perfectlab/iStock via Getty Images

Introduction

It’s time for me to cover the Scotts Miracle-Gro Company (NYSE:SMG) again. My most recent article was written in September of 2021. Back then, I considered the stock to be attractive. Unfortunately, the stock fell 25%, which makes it one of the worst dividend growth performers on my watchlist. In this article, I will explain what went wrong and why I believe that SMG investors are in a good spot, even the ones who bought at (much) higher prices. What we are dealing with here is a stock that investors have ignored due to inconsistent free cash flow growth and expectations that housing and consumption growth will slow significantly. While that is the case, we’ve reached deep dividend growth value – even in a scenario where the company misses very reasonable analyst expectations going forward, which I do not expect to happen.

Let’s look at the details.

SMG Is Very Cheap

The Scotts Miracle-Gro Company has a perfect business model for long-term dividend (growth) investors for a number of reasons. It operates in an industry that is not prone to significant innovation risks – like a company competing in the smartphone segment. The company sells lawn and garden care products as well as indoor and hydroponic growing products. The company is not impacted by competition between big store chains as it sells its products in all major stores like Home Depot (HD) and Lowe’s (LOW). The company’s main competition risks come from smaller private labels that have regional exposure.

The company has done an incredible job growing its company and positioning itself for (secular) growth. The company has cannabis covered via Hawthorne and, as a supplier, it once again avoids being left behind in a competitive industry. Bear in mind, that although cannabis is a very hot growth market, entry barriers are low. Growing cannabis is not rocket science. Doing it on a bigger scale with sufficient supply chains is a different story, but in general, it’s why I have never bought a cannabis producer. SMG is looking to target major commercial growers with its solutions, which once again takes away competition risk. In general, strong cannabis demand means higher demand for SMG products.

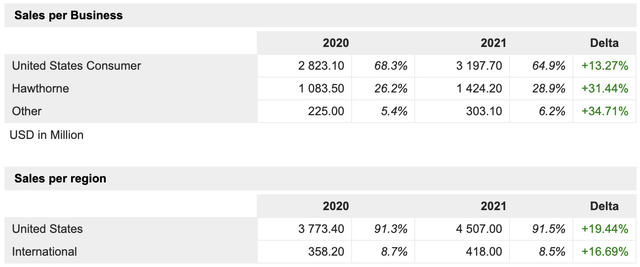

In its FY2021, Hawthorne sales consisted of a broad variety of supplies needed to efficiently grow cannabis. This includes lighting (32%), nutrients (22%), full-scale growing environments (19%), as well as other related operations.

In 2025, Hawthorne’s net sales were less than $100 million. In 2022, sales are expected to be $1.1 billion. Only $100 million is expected to come from M&A – $1.0 billion is expected to be organic.

The same goes for the entire SMG company. In 2022, the company is expected to do $4.7 billion in sales. It’s slightly down from $4.9 billion in 2021, which benefited from lockdowns but well above pre-pandemic levels. And even better, new investments, minor (expected) M&A, and secular growth are expected to boost net sales to $5.4 billion.

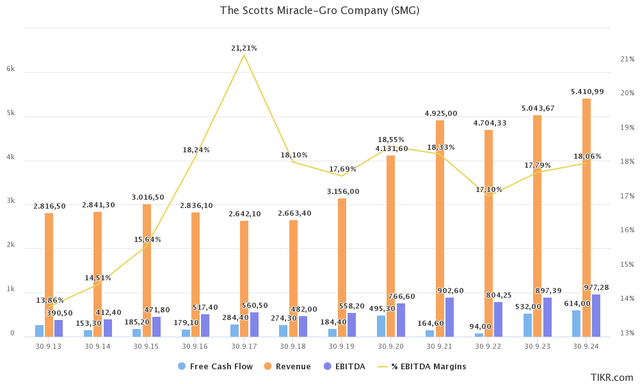

Between 2018 and 2022E, consolidated net sales are expected to grow by 15% per year, on average. The problem, however, is that free cash flow suffered. Free cash flow is basically net income adjusted for non-cash operating items and capital expenditures. Its cash a company can spend on dividends, buybacks, and debt reduction. It’s the cornerstone of any successful dividend growth stock.

Free cash flow was $164 million in the 2021 fiscal year. It’s expected to be lower in the 2020 fiscal year. Note that this is not due to bad management which fails to turn higher sales into higher cash generation, but based on strategic investments. The company has increased capital expenditures, which is pressuring free cash flow for the time being. In 2018, CapEx was just $68 million. In 2021 it was $107 million and in 2022, it is expected to be $165 million.

Hence, after the 2022 fiscal year, we’re looking at lower CapEx again as well as higher sales, resulting in accelerating free cash flow.

If we assume that the company can do $532 million in FY2023 free cash flow, it implies a free cash flow yield of 8.2% using the company’s $6.5 billion market cap. That’s ridiculous and way too high. After all, if the company were to spend all of its expected 2023 FCF on dividends, that’s the yield investors would get.

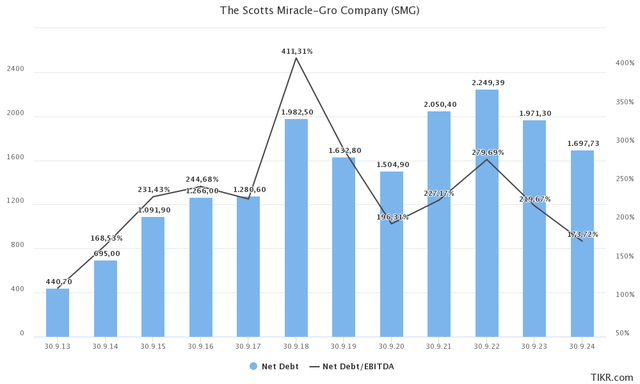

One reason why companies sometimes have a high free cash flow yield is that the debt load is high. That implies that a company cannot use FCF to pay dividends or engage in buybacks because it needs to reduce debt. In the case of SMG, the company is set to lower net debt to roughly $2.0 billion in its 2023 fiscal year. That’s close to 2.2x EBITDA. That’s sustainable.

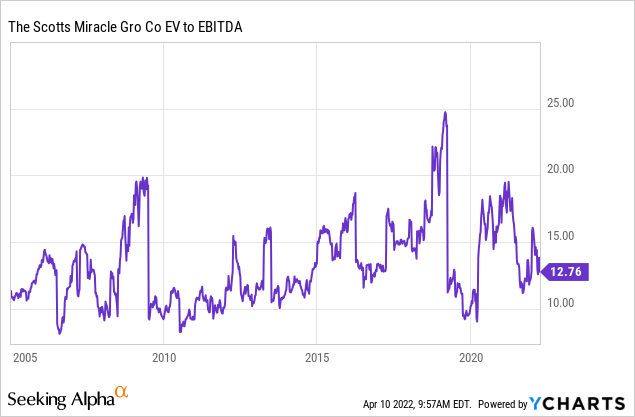

In this case, an 8.2% implied free cash flow yield is one major part of the valuation. However, we can also look at the (expected) EBITDA multiple. In this case, we need the company’s $6.5 billion market cap and the aforementioned $2.0 billion in (expected) net debt. This gives us an enterprise value of $8.5 billion. This is 9.4x expected 2023 EBITDA of $900 million. In 2024, the company is expected to do close to a billion in EBITDA. However, for now, I’m sticking to the 2023 numbers.

9.4x EBITDA is way too cheap. We’re not just dealing with an implied FCF yield close to 10%, but also an implied EBITDA multiple way below prior-year levels.

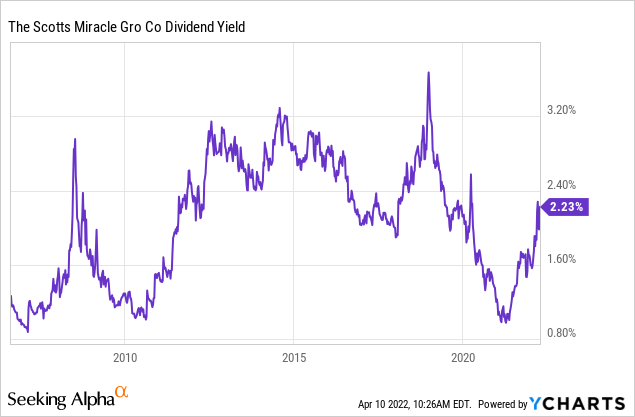

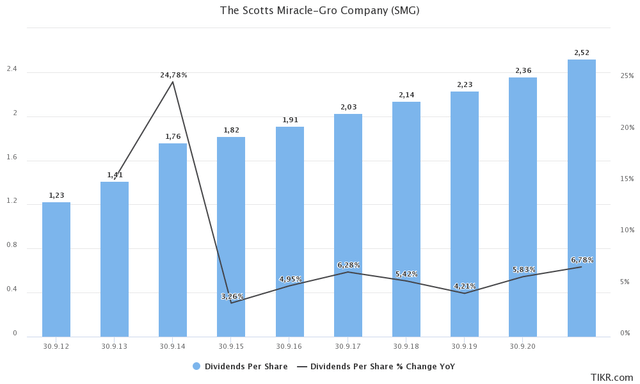

Another part of the valuation is dividend growth and the dividend yield, which is all that matters for a lot of investors.

Right now, the stock is yielding 2.3% based on a $0.66 quarterly dividend and a $117 stock price. The most recent dividend hike took place on July 30, 2021, when the company hiked by 6.5%. Over the past 10 years, dividend growth has averaged 8.5% per year, which isn’t bad.

As a result of dividend growth and a lower stock price, the dividend yield is now back at pre-pandemic levels, which I believe will attract buyers at current levels.

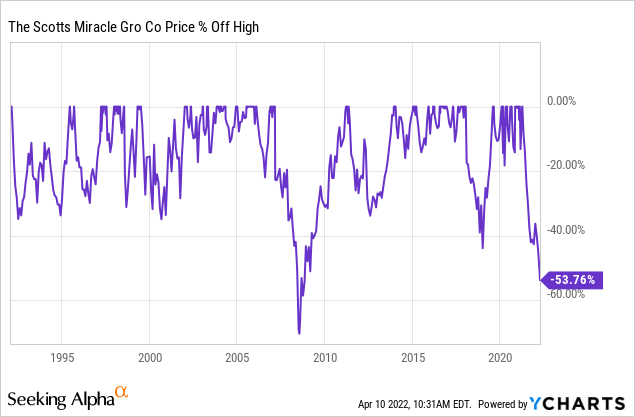

So far, the valuation looks very good but buyers aren’t buying as the stock is now 54% below its all-time high.

Why is that?

(Not So) Hidden Risks

There are a number of risks that are contributing to a lower SMG share price. One of them was revealed on March 8, 2022, when the company cut full-year sales guidance for its Hawthorne segment based on an oversupply in the cannabis industry.

CFO Cory Miller said the company now expects Hawthorne sales will decline 15%-25%, including the benefit of acquisitions, after several months of an oversupply of cannabis, which is leading to a slowdown in both indoor and outdoor cultivation.

Moreover,

The company also said it no longer expects to make a significant acquisition in FY 2022, after actively pursuing such an opportunity over the past year.

This flushed out the crowd that had bought SMG just to benefit from the boom in cannabis without considering that cannabis is a long-term idea due to the risks of short-term oversupply. This happens all the time in hot new trends. It happened in 3D printing, it happened in shale oil growth prior to 2015, it is happening now in cannabis, and it will happen in a different segment in the future. However, this does not scare me at all as the stock is far from a pure-cannabis play and a supplier of many companies. Oversupply will fade and SMG will benefit from long-term growth in the industry. And, as I already showed, the stock is trading at ridiculous levels. SMG is not a growth stock.

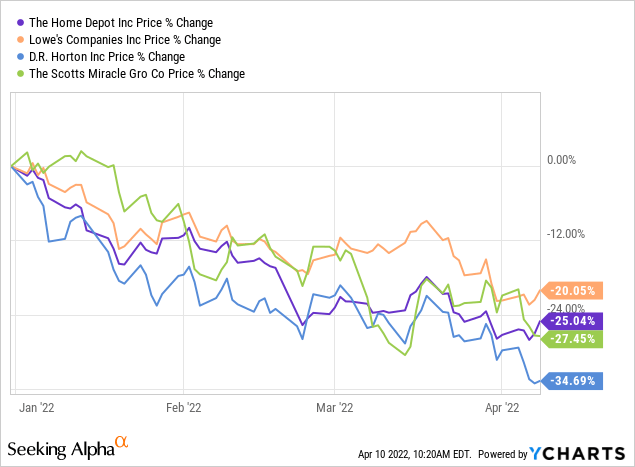

Then there’s another problem. One of the tailwinds SMG has enjoyed is a strong housing market. Millennials made up the largest segment of homebuyers in 2021. According to SMG, only 50% of the group are homeowners. This segment has high trust in SMG brands, which is why SMG expects that this trend will come with significant long-term growth.

In general, it’s fair to say that a strong housing market is the main driver. The same goes for Lowe’s or Home Depot – and others. A strong housing market means people have home equity they use to improve their homes, new homes are sold, and people engage in more DYI projects. This includes gardening, in a way.

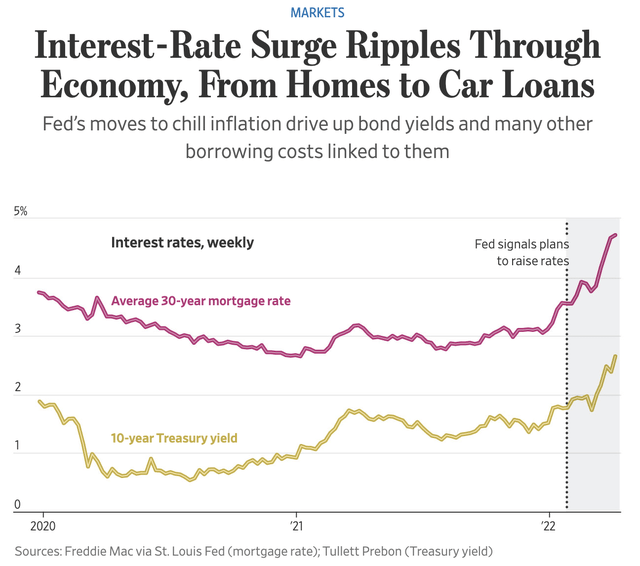

So, what’s the problem? It’s the housing market. As the Wall Street Journal headline below shows, rates are rapidly rising.

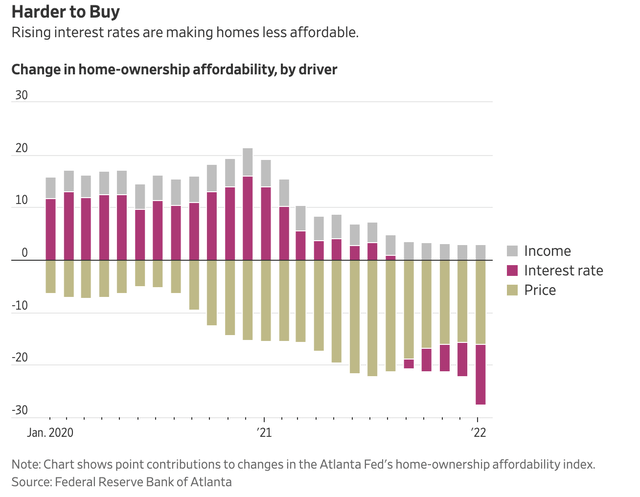

The following graph was used in that article, which shows that housing affordability is lower than at any point after the pandemic. In this case not because of high prices, but because of interest rates – on top of high prices, that is.

This is likely to continue for a while as Joseph Wang explains in a recent article on Intelligence Quarterly. He makes the case that yields will have to rise further as the Federal Reserve starts quantitative tightening:

Going forward the supply of duration in the market will be historically high at a time when rates are still historically low. This will occur amidst multi-decade high inflation, vanishing Treasury market liquidity, and binding balance sheet constraints. Commercial banks, a significant marginal buyer last year, appear to have stepped back from the market this year. Foreign buyers, another marginal buyer, are facing steeply increasing FX hedging costs from rate hikes. In this context, much higher yields will be needed to draw in new investors.

As a result, investors are de-risking, sending housing and related stocks lower.

After all, even higher rates on top of high inflation, supply chain issues, low consumer sentiment, and other problems could severely weaken economic growth.

Takeaway

I’ve liked SMG for a while. The company has a very conservative business model that allows it to generate steadily growing sales, earnings, and free cash flow. It also allows the company to benefit from secular growth like increasing indoor farming demand and (related) cannabis growth.

However, the company is selling off like a worthless tech stock. The stock is down another 25% since my 2021 article when I considered the stock already attractive. What is happening is that investors are selling SMG because of slower than expected growth in cannabis and because consumer/housing demand is expected to fall off a cliff.

While all of this is true, there is good news. First of all, despite cannabis and related headwinds, free cash flow is expected to soar after 2022. In addition to a low EV/EBITDA multiple and a relatively high yield, we’re dealing with a very attractive valuation.

I believe that SMG is a terrific long-term dividend growth stock. The 2.3% yield is attractive, dividend growth is expected to remain close to 8% and its business model will protect it against severe economic stress. It also helps that the stock is more than 50% below its all-time high, which means a lot has been priced in.

While I don’t know if the stock is bottoming or if we’re in for a bit more downside *if* the market tanks, I think it’s a good spot for people to initiate a position or lower their average in case they bought at higher prices.

(Dis)agree? Let me know in the comments!

Be the first to comment