Ivan-balvan/iStock via Getty Images

After a wild earnings week in mega tech companies, Apple (NASDAQ:AAPL) reported a decent quarter in relation to fears. The landmines hit by other FAANG stocks led the stock to rally 8% on a strong relief rally in the stock market. My investment thesis remains Bearish on Apple as the decent quarter in comparison to weaker results elsewhere wasn’t enough to warrant a higher stock price.

Solid Quarter Considering

Apple reported FQ4’22 revenues grew by a solid 8.1% to $90.1 billion. The tech giant beat analyst revenue estimates by $1.4 billion in the quarter.

The company reported the following YoY revenue growth in each unit compared to FQ4’21:

-

Products – $70.96B vs. $65.08B, up 9%.

-

iPhone – $42.63B vs. $38.87B, up 10%.

-

Mac – $11.51B vs. $9.18B, up 25%.

-

iPad – $7.17B vs. $8.25B, down 13%.

-

Wearables, home and accessories – $9.65B vs. $8.79B, up 10%.

-

Services – $19.19B vs. $18.27B, up 5%.

Remember, Apple benefitted from supply chain disruptions holding back revenues in the prior quarter by up to $4 billion, with the issues mostly resolving themselves during the quarter. In addition, the company was hit by a foreign exchange headwinds similar to other tech companies. The amounts appear to nearly offset each other during the September quarter.

Most telling about the results is that Apple wanted to temper expectations for the key holiday quarter. The tech giant faces a more lagging impact from global recession fears as compared to the tech giants tied to e-commerce and digital advertising.

On the FQ4’22 earnings call, the CFO highlighted a very challenging quarter ahead:

Overall, we believe total company year-over-year revenue performance will decelerate during the December quarter as compared to the September quarter for a number of reasons.

While Apple does face a tough currency hit, the view is very negative compared to the 8% surge in the stock price following the release of FQ4 earnings. The company expects to take a big hit on Mac revenues along with further weakness on Services where the recurring revenues were supposed to warrant the higher valuation multiple for the stock.

The market was probably excited about where sales growth could be without a foreign exchange hit, but the company is also benefitting from lower commodity prices in areas such as memory. Mainly though, the big benefit in the last couple of quarters of catching up on supply constraints disappears in the current quarter.

Services Demise

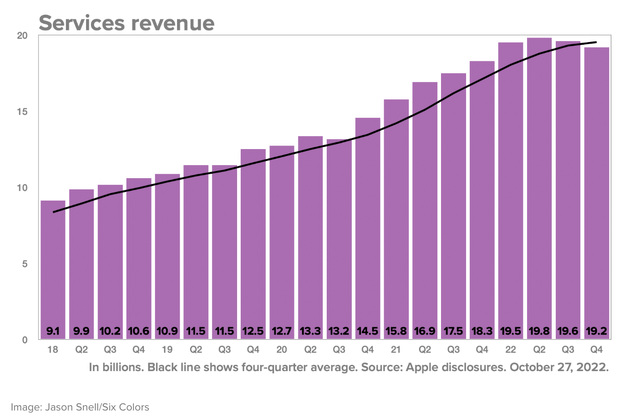

Only a few quarters ago, the Services group was the future of the business. Now, Services is struggling to even grow with FQ4 revenues only up a meager 5%

The division had the slowest growth rate since the numbers have been counted with some views that Apple would grow this recurring revenue category at 20% annual clips The quarterly numbers are now falling sequentially after peaking at $19.8 billion in FQ2’22.

Apple just announced price hikes for a lot of Services in a sign the company is struggling to generate any traction in the group. The company made the following price hikes due to higher licensing fees:

Apple Music

- Individual: $10.99 per month (from $9.99)

- Family: $16.99 per month (from $14.99)

- Individual Annual: $109 per year (from $99)

Apple TV+

- Monthly: $6.99 per month (from $4.99)

- Annual: $69 per year (from $49.99)

Apple One

- Individual: $16.95 per month (from $14.95)

- Family: $22.95 per month (from $19.95)

- Premier: $32.95 per month (from $29.95)

The average service is ~$1 higher, but the Apple TV+ service jumped $2 per month, or what amounts to 40%. The streaming service is one of the cheapest options on the market, but viewers are increasingly pressured to subscribe to all of the different services at higher prices.

The results continue to suggest Apple customers are possibly saturated with all of the different Services. Not to mention, a Service like Apple Music isn’t necessarily a market leader like hardware Products. CNET ranks Spotify (SPOT) as the best streaming music service with Apple Music as only the best alternative option in certain scenarios.

Slipping EPS Estimates

The weak Services growth is another feather in the cap questioning why investors are so willing to pay a premium price for the stock. As highlighted and reinforced by the limited FQ4 EPS beat and growth rate, the current analyst estimates are solid, if not actually too high.

The FY24 EPS target started the year at $6.88 and the current estimate is down to just $6.80. The stock already trades at 23x FY24 EPS targets, which are only ~10% above the actual EPS for the just ended fiscal year. Apple is only forecasted to grow at an ~5% annualized clip.

All the numbers continue to reinforce Apple has limited growth going forward. The stock is still priced for fast growth and the reaction to FQ4 earnings reinforces the investor group is off-base with the valuation of the tech giant.

Takeaway

The key investor takeaway is that Apple rallied following a decent FQ4 considering the environment, but the quarterly results weren’t anywhere close to good enough to justify the current valuation. Investors should again use the irrational rallies in the stock to unload shares.

Be the first to comment