South_agency/iStock Unreleased via Getty Images

Investment Thesis

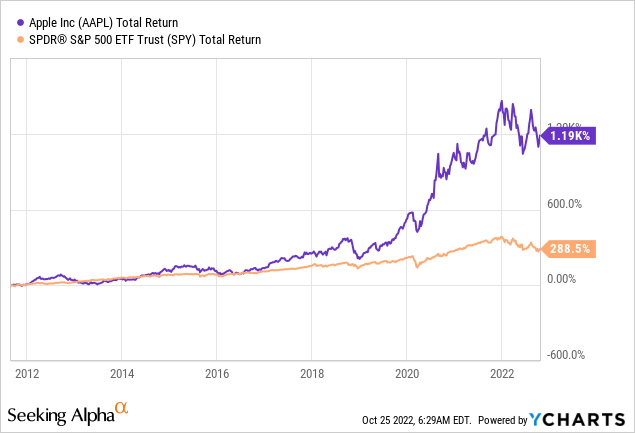

Apple (NASDAQ:AAPL) has absolutely dominated the smartphone market over the past decade, particularly in the western world, and in doing so it has created a formidable ecosystem that competitors are finding tough to crack. The design prowess of Steve Jobs laid the foundations for the current ecosystem of hardware and software created by Tim Cook’s Apple, and investors have enjoyed great returns since he took the helm in August 2011.

There is no doubt that Apple is a once-in-a-generation business of the highest quality, and the iPhone in particular has changed the way we live our lives.

Yet, when a company becomes as large as Apple, there are always bound to be some problems that crop up. Not only are there macroeconomic issues facing all businesses right now, but Apple also faces geopolitical issues between the US and China (with the impact to Apple outlined in the following Seeking Alpha article), as well as regulatory risks such as the EU Digital Markets Act or the recent US senate panel bill that was approved in February 2022 with the aim of reining in app stores’ monopolistic powers.

Some investors are now wondering if Apple’s best days are behind it, or if this behemoth of a business will remain a fantastic investment for years to come?

Looking ahead, the iPhone 14 was released in mid-September, and we should get an indication in Apple’s Q4 results about the appetite for its latest smartphone – but early indications are showing some worrying signs, so what should investors be watching out for when Apple reports its results later this week?

Latest Expectations

Apple is set to report its Q4’22 earnings on Thursday, October 27, after the market closes, and there are several key items that investors should keep their eyes on.

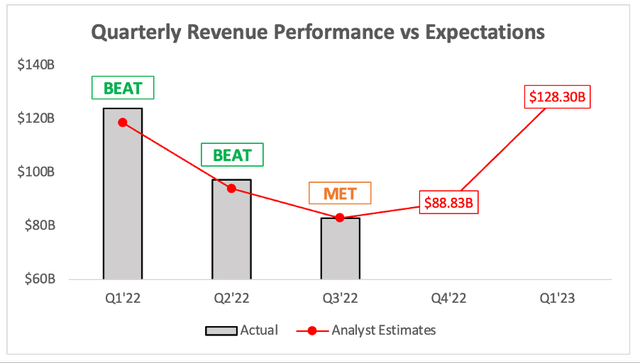

Starting with the headline numbers; analysts are expecting Q4 revenue of $88.83B, representing YoY growth of 6.6%. Apple has had a fairly strong year so far when it comes to beating analysts’ revenue estimates, which is even more impressive considering the company has faced a number of headwinds including supply constraints, a strong US Dollar, and the impact of its business in Russia.

Seeking Alpha/Apple/Author’s Work

In fact, according to Tim Cook on Apple’s Q3 earnings call, the total impact on sales from supply constraints was ~$4 billion. The company isn’t out of the woods yet, however, as Cook went on to list some of the headwinds Apple faces this coming quarter:

Overall, we believe our year-over-year revenue growth will accelerate during the September quarter compared to the June quarter despite approximately 600 basis points of negative year-over-year impact from foreign exchange. On the product side, we expect supply constraints to be lower than what we experienced during the June quarter. Specifically related to Services, we expect revenue to grow but decelerate from the June quarter due to macroeconomic factors and foreign exchange.

Whilst there is a decent amount of negativity in there, investors should be pleased to see that the impact of supply constraints will be lower than the ~$4B hit to sales that was seen in Q3.

It’s also worth pointing out the Q1’23 spike in the above graph, as this represents the final three months of 2022 where holiday shopping should boost Apple’s top line, as well as the impact of a full quarter of its iPhone 14 being launched.

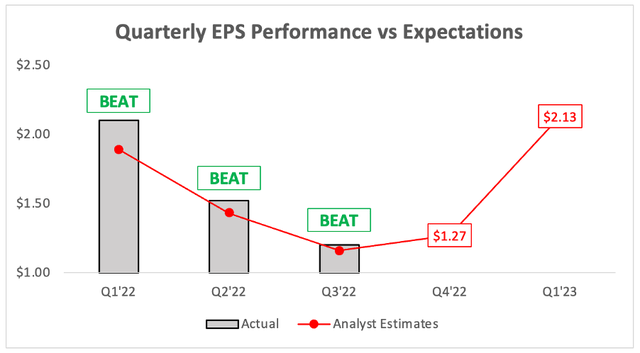

Moving down to the bottom line, analysts are expecting Apple to report EPS of $1.27 in Q4, a small increase from the $1.24 Apple reported back in Q4’21. Once again, the company has had a stellar track record over a difficult 2022 when it comes to beating Wall Street’s expectations on earnings.

Seeking Alpha/Apple/Author’s Work

It’s worth highlighting that analysts are expecting to see earnings grow at a slower pace than revenue; this is not what investors want to see in a company that should be getting more efficient over time, but it is also not a surprise. Many companies saw record margins in a booming 2021 economy, and these margins have been dragged back down to earth by supply chain issues, inflation, and a strong US Dollar – even a company such as Apple is not immune.

Outside of the headline figures, what should investors be watching when Apple reports its results? Well, no prizes for guessing what I’ll be looking at…

All Eyes On iPhone 14 Sales

Apple rolled out its iPhone 14 in the US on Friday, September 16, and launched the iPhone 14 Plus on Friday, October 7. Given that Apple’s fourth quarter ends on September 25, investors should not expect to see any material impact on the financials from the iPhone 14 launch.

The market, however, will be listening very closely to any commentary and guidance offered up by management on the Q4 earnings call that could indicate whether the launch has been a success or a disappointment.

Whilst Apple has become so much more than just the iPhone, investors cannot forget that this brilliant device remains the centerpiece of Apple’s ecosystem. Even though there are now longer replacement cycles for smartphones, faltering iPhone sales could spell trouble for Apple if it is more than just a blip – and unfortunately, the early indications are that Apple’s iPhone 14 launch might not be going smoothly.

A recent article by The Information reported that Apple actually cut production of its iPhone 14 Plus model less than two weeks after it debuted. According to a summation by Seeking Alpha:

The news outlet, citing two people in Apple’s (AAPL) supply chain, reported that Apple (AAPL) was reevaluating demand for the product and told a Chinese manufacturer to “immediately halt production” of iPhone 14 plus components.

Two Apple (AAPL) suppliers cut their production on the iPhone 14 Plus by 70% and 90% respectively, the person added.

The thought of suppliers cutting their production by 70% or 90% is quite staggering. Clearly, investors don’t have the full picture at this stage, but it’s certainly not a great early indication.

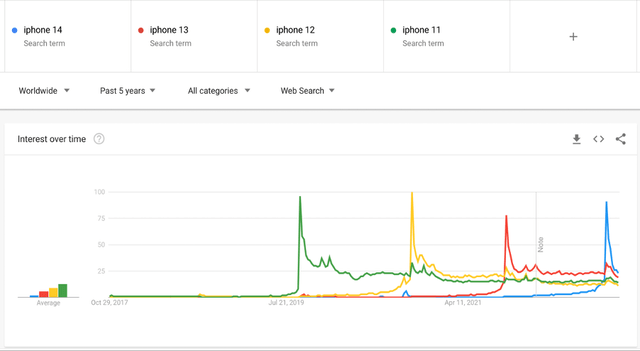

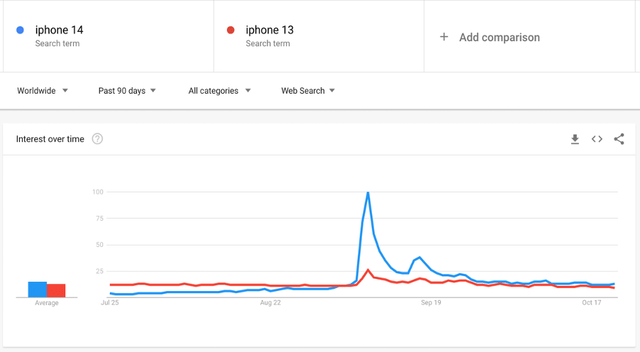

In trying to gauge the demand for the iPhone 14, I’ve turned to Google Trends to simply see how many people are searching for this iPhone compared to the last few. It would appear to be seeing more popularity than the iPhone 13, but perhaps it is less popular than the iPhone 11 and 12.

Yet the most worrying for investors would be taking a look at the past three months. There is a clear spike in searches for the iPhone 14 following its release, but by the end of September, there have been a very similar number of global searches for the iPhone 13 as there have been for the iPhone 14.

This is by no means perfect information, but I am limited in the amount of industry data I’m able to access – so, it’ll have to do. Whilst I’m not basing any sort of investment decisions on the Google Trends data, it does seem to corroborate earlier reports that Apple might be seeing lower iPhone 14 demand, combined with the fact that smartphones in general are being replaced less frequently.

Given the negative backdrop, I’m going into Apple’s Q4 earnings eagerly anticipating any news on the iPhone 14 sales; in particular, whether or not these indicators of lower demand have any truth to them. There are always plenty of items to look for when a company of Apple’s size reports, but investors should pay extremely close attention to any guidance given by management on the iPhone 14, since early indications are not painting a pretty picture.

AAPL Stock Valuation Is Not Enticing

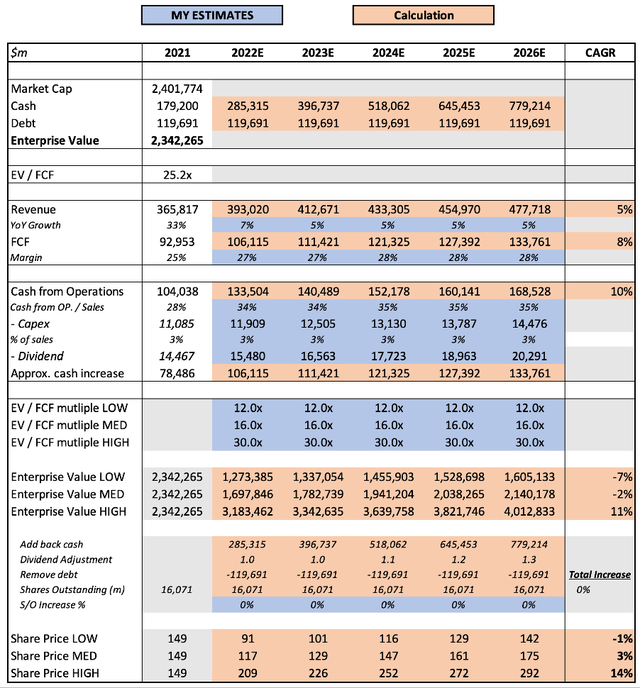

I normally look to invest in high growth, disruptive companies where valuation is tough. At least with Apple, I feel like I have something a bit more stable and predictable – so, a bit of a treat for me. When a company is more stable like Apple, I do think valuation is substantially more important than it is for a high-growth disruptor. With that said, onto my valuation model:

I have kept my assumptions very similar to the model used in my previous article, with a slight lowering of revenue growth rates reflecting analysts’ latest expectations. There are very few changes, so I believe the rationale for these assumptions in my previous article remains appropriate.

Put all this together, and I can see Apple shares achieving a 3% CAGR through to 2026 in my mid-range scenario. There may be some bullish Apple investors out there who laugh at this outcome, and that’s fair – investing would be boring if we all had the same opinion! Yet many of my assumptions used above are in line with analysts’ expectations for Apple; it may prove to be a great investment once again, but for me, the share price right now is just not attractive enough.

Bottom Line

Apple is a once-in-a-generation company that has taken the world by storm over the past decades. It now boasts the world’s most valuable brand, and it has built out an ecosystem with seemingly impenetrable moats.

But, I have my concerns. I personally don’t like investing in large companies – generally, I go for businesses with market caps below $50 billion – and Apple is no different. Personal preferences aside, there are also several risks that I’ve outlined which make me cautious about investing in Apple, combined with the fact that I think the growth story for this company is slowing down.

According to my valuation model, shares themselves are currently not priced too attractively, especially when investors consider the risks that Apple faces right now.

When it comes to Q4 earnings, investors should certainly keep a close eye on management’s iPhone 14 comments on the earnings call. There’s no telling exactly what the environment is, but I’ve seen enough small indicators to give me cause for concern.

Given all this, I will reiterate my previous ‘Hold’ rating on Apple.

Be the first to comment