Getty Images/Getty Images News

Investment Thesis

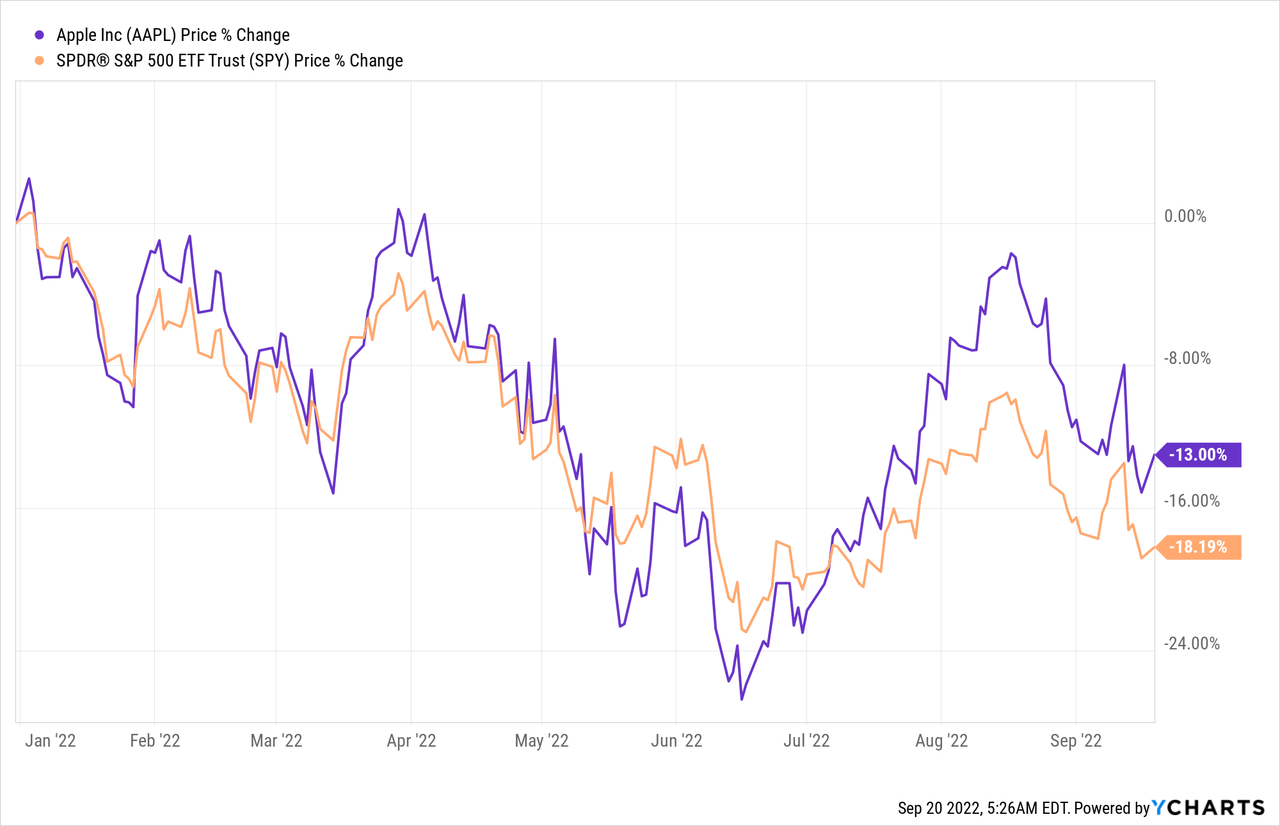

Despite the gloomy macroeconomic outlook and the ongoing bear market, Apple Inc. (NASDAQ:AAPL) has remained relatively flat YTD, proving its resiliency in the market. The hotter-than-expected inflation, with more aggressive rate hikes, has created widespread pessimism in the stock market. Even though some analysts predict relatively flat sales expectations and steady margins, AAPL is a solid stock with an attractive valuation to weather the storm, earning the buy rating.

iPhone Launch Event Overview

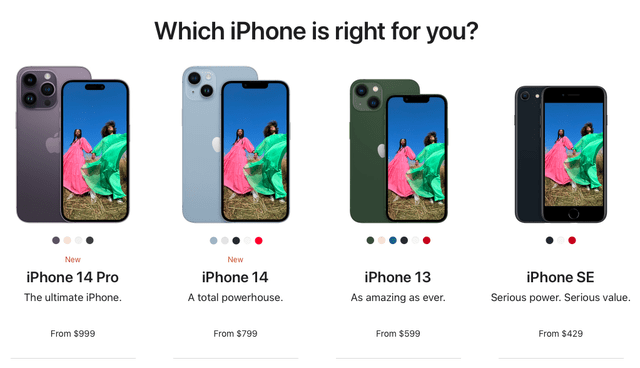

Two weeks ago, Apple held its iPhone 14 event, unveiling updates to its iPhone, AirPods, and Apple Watch product lines. The most anticipated releases were the iPhone 14 and iPhone 14 Pro, which, besides an improved camera system, safety features, and the Dynamic Island, are more or less identical to the iPhone 13 series. However, Apple said the new iPhone 14 Plus would have the longest battery life of any iPhone. Surprisingly, Apple’s Emergency SOS via Satellite function, which allows iPhone users to contact for assistance if they are in a distant region not served by a 5G signal, is a unique feature not seen in any smartphone, offering a competitive edge.

The company decided to keep the prices unchanged in the United States amidst rough macro-conditions. As a result, the base model of the iPhone 14 will cost $799, the same as last year’s iPhone 13. The most expensive iPhone 14 Pro Max costs $1,099, the same as the iPhone 13 Pro Max. Even though the market was expecting some price increases due to inflationary pressures, that was the right thing to do, considering the uncertain global landscape, suggesting flat profit margins.

CEO Tim Cook also announced a new model of Apple’s AirPods Pro, wireless earbuds with noise-cancellation. The AirPods Pro 2, which will be available for $249 on September 23rd, is the first upgrade to Apple’s most popular headphone series and includes numerous new features such as a speaker on the case to assist customers in locating the item, longer battery life, and Apple Watch charging functionality.

The Apple Watch Ultra, the company’s first real Garmin rival, piqued the viewers’ interest. The Apple Watch Ultra is an exciting play from Apple; not in the same league as Garmin in some respects, but it has several standout features, including a much stronger case, 36 hours of battery life, a night mode, and a unique band, is designed for outdoor sports with enhanced GPS and water resistance features that could persuade serious athletes to embrace this device. The price is set at $799, while Garmin’s highest-end watch costs $1,500-$2,500. Apple understands that higher-income consumers have seen less pressure from inflation and considering its unique brand and superior features, the new product is expected to perform well.

Not surprisingly, the company also kept prices unchanged for the new Apple Watch Series 8 lineup as the Series 7, and it also reduced the price of the new Apple Watch SE model. The new Apple Watch SE is available for $249 with GPS and $299 with cellular, while the Apple Watch Series 8 is available for $399 with GPS and $499 with cellular.

Steady Prices – A Positive Catalyst

Pricing was the key watch-point going into the launch, more so for the wearables than iPhones, as wearables are considered more discretionary purchases by consumers in a tough macro-environment comprising inflationary pressures and a pullback in consumer spending. The executives acknowledged earlier this summer that economic headwinds influenced the company’s wearables business. They seemed to recognize those dynamics when they revealed the company’s latest Apple Watch lineup on Wednesday.

Nevertheless, it is reasonable to expect an improved iPhone product mix, as analysts predict iPhone 14 Pro to account for 60%-65% of total iPhone shipments in 2H22, higher than initially anticipated. As a result, as more customers opt-in for Pro models, the average selling price (ASP) will expand, increasing the overall margins and profitability.

Apple’s decision to hold pricing steady for iPhones is a positive for the company as it will allow the tech giant to pick up market share in the smartphone space and position the iPhone well in an economic environment where inflation has pressured consumers’ discretionary spending.

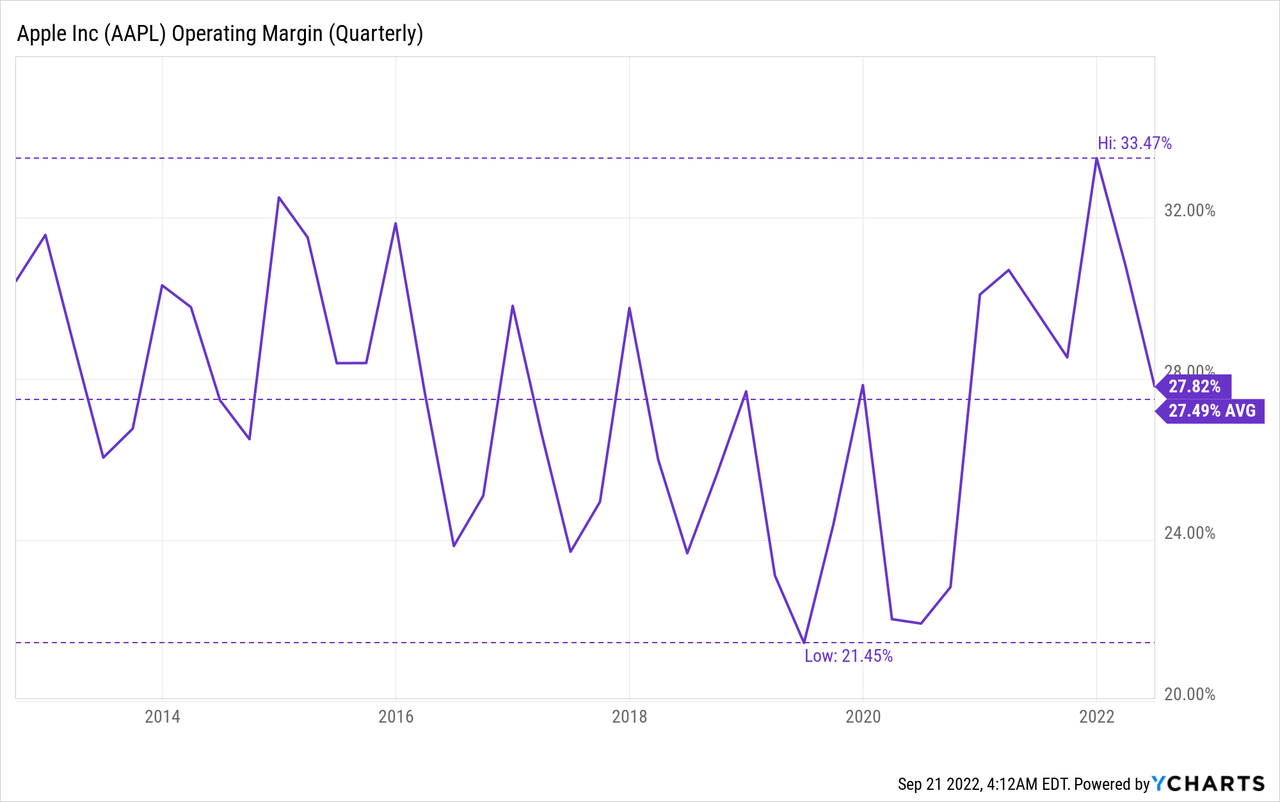

Lastly, Apple’s ability to shift its revenue mix to services could be the most critical long-term sales and margin expansion driver. Services that account for 20% of sales have gross profitability twice that of products, and the greater emphasis here could help lift operating margins above 30% in the short to medium term.

iPhone Sales To Remain Flat In 2023

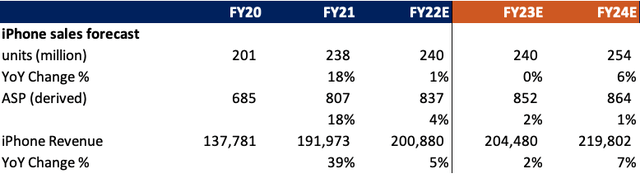

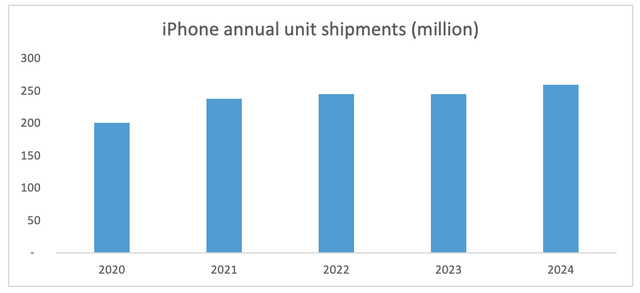

I don’t expect the new version of Apple’s phone to have a noticeable financial impact as the new iPhone products lack meaningful updates, and the macro-outlook remains dim. Based on this, I see a potential for flat unit shipments in fiscal 2023 compared with 2022. However, the ASP per unit is expected to increase as Apple raises prices in key markets, including the U.K., Japan, and Germany, despite keeping steady pricing in the U.S. Therefore, the increase in ASP has led me to come up with total iPhone sales growth of 2% in 2023.

Author’s calculation (counterpointresearch.com)

iPhone 15 Likely To Be A Bigger Upgrade

The 2023 version of the iPhone will likely be a bigger growth catalyst. It could push the unit shipment growth in fiscal 2024 closer to 5-6%, or 260 million units, as Apple gains some share from Android, especially in emerging markets. Coupled with a modest ASP increase, I expect iPhone sales growth of 7-8% in 2024.

iPhone Unit Shipments (counterpointresearch.com)

China Dependency Risk

Apple’s overexposure to China for manufacturing is a major concern, and any disruptions due to either parts shortages or geopolitical issues could seriously hinder its ability to fulfill demand. Suppose US-China tensions escalate to the point of sanctions. In that case, our analysis suggests that Apple would be one of the most affected companies in terms of sales and manufacturing among the leading tech companies.

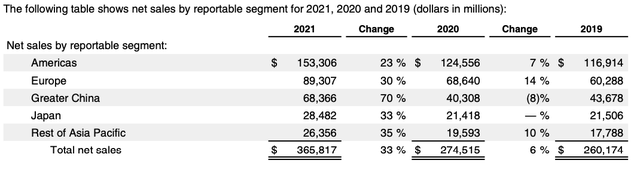

Europe & China’s Economic Troubles

A global economic slowdown, especially in China and Europe, is another reason for the expectation of no iPhone unit growth next year. These two regions combined account for 43% of Apple’s total sales and are already seeing signs of ebbing economic activity. Though overall revenue in China will likely increase around 8-10% in 2022, I expect a low-single-digit increase next year. For Europe, I don’t anticipate any growth next year compared with a 4-6% gain in 2022. As a result, the Americas may be the only geography that may see a modest increase in sales growth.

iPhone 14 Pro Max Vs. Samsung Galaxy S22 Ultra Comparison

- Camera: Regarding camera capabilities, the Samsung Galaxy S22 Ultra is more versatile since it has additional secondary sensors, such as a periscopic 10MP lens with a whopping 10x optical zoom. It even has a 40MP front camera capable of recording 4K films at 60 frames per second. The camera on the iPhone 14 Pro also offers a lot of upgrades over the previous series, with a 48MP primary camera, a 12MP ultrawide camera, and a 12MP telephoto camera. The front-facing camera system has also been upgraded with a dual-lens 12MP camera.

- The iPhone’s image processing is superior and produces color-accurate photographs with far more details owing to the new 48MP sensor, pixel-binning, and Photonic Engine. When it comes to video recording capabilities, iPhones generally perform better, and the iPhone 14 Pro should outperform the S22+. However, the iPhone 14 Pro still lacks 8K recording despite the upgraded hardware. If 8K video recordings are an essential feature to customers, then the camera on the S22+ will be more useful for those users. If not, the iPhone 14 Pro is the better option.

- Performance: Even though the Samsung Galaxy S22 Ultra hardware profile appears superior on paper, the iPhone 14 Pro Max outperforms it due to the iOS operating system. The Samsung is powered by either a Samsung Exynos 2200 or a Qualcomm Snapdragon 8 Gen 1, with up to 12 GB of RAM and up to 1 TB of native storage. The iPhone 14 Pro Max has the new Apple A16 Bionic proprietary processor with a maximum frequency of 3.46 GHz, 6 GB of RAM, and up to 1 TB of native storage.

It would not be wrong to say that Samsungs 8 Gen 1 is no match for the new 4nm A16 Bionic in the iPhone 14 Pro. In regular usage, you might not notice any major differences in performance, but the A16 Bionic will perform better if users go heavy. The iPhone 14 Pro is available with capacities of 128GB, 256GB, 512GB, and 1TB. The Galaxy S22+ only has 128GB and 256GB of storage space. Although 256GB of storage is sufficient, the absence of larger storage choices makes the S22+ a bad choice for anyone who needs extra local storage. Nevertheless, the Galaxy S23 is just around the corner, and its upcoming 200MP camera might offer a leading competitive edge. However, it remains to be seen in actual camera testing which is the winner.

All in all, both phones have their unique value propositions with pros and cons. The Samsung Galaxy S22 Ultra has a bigger battery, faster charging, and a periscopic camera, while the iPhone offers better performance and unmatchable image processing capabilities to produce high-quality pictures and videos.

Concluding Thoughts

Undoubtedly, Apple has built a unique brand name and ecosystem, possessing a unique place in consumers’ minds, supporting its solid branding moat that is hard to compete with. Despite the recession fears, and muted growth expectations, AAPL has entered my buying zone, and I plan to start building a position in my model portfolio throughout the bear market. However, I wouldn’t overweight a position yet, unless it falls to ridiculously cheap levels.

Be the first to comment