Andrei Metelev/iStock via Getty Images

Most of you may not have heard of LCNC or Low-code No-code. This is about developing software without going through the intricacies of hundreds of lines of code. Now, this novel technique in the way software is developed is not only resulting in more mobile apps hitting the market, but also allows for a reduction in development costs.

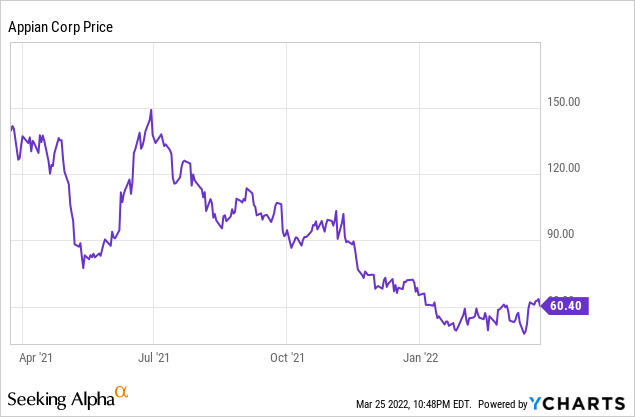

In this respect, any means to reduce costs in a period of rising inflation need to be objectively analyzed, and for this purpose, I look at Appian’s (NASDAQ: NASDAQ:APPN), whose stock has been volatile during the last year as it has lost over 60% of its value since the end-of-June peak.

I start by providing an overview of the low-code (“LC”) aspect of LCNC while stressing its attractiveness at a time when a talent shortage in tech is leading to high competition for developer expertise, surging salaries, and higher turnover rates.

The need for Low-code

LC, which is more commonly provided by suppliers compared to No-code, where not a single line of code is used, makes it possible to create applications or to automate corporate business processes without mastering the programming steps that are normally taught as part of IT courses. In this respect, templates guide beginners, including the use of powerful AI tools in the background, as well as visual interfaces which hide the lines of codes.

These tools are intended for “citizen developers”, or those with little or no development experience who come from the marketing, HR, or finance departments, but need IT applications for their daily tasks. The idea is to have the users themselves create mostly workflow-based applications by circumventing the IT department, which is normally entrusted with these tasks.

In this respect, with the acceleration of the digital transformation trend as from mid-2020, the demand for IT jobs has surged with CIOs either not being able to access developer talent pools or seeing software development budgets stretched because of wage inflation. While it is true that some companies like Cognizant (NASDAQ:CTSH), a multinational IT business consultancy have access to cheaper developer skills in India, this is not the case for the average SMB (small to medium-sized business). Now, for those that have chosen the LC path, the table below shows the market potential as well as some key statistics pertaining to adoption, time-to-market, and the ability to compensate for the lack of IT developers.

| Feature | Details | |

| 1 | Adoption of low-code worldwide and market size. |

Low-code market growing at a CAGR of 31.1% from 2019 to 2030 and to reach $187 billion. |

| 2 | Acceleration of time to market and decrease in development time. |

Decrease in development time by 90%. |

| 3 | Compensate for the lack of developers on the market |

Improvement in the organization’s backlog of web and mobile development projects by 46%. |

| 4 | Uncertainties in the adoption of low-code. |

Not suitable for complex use cases where some level of technical expertise is still required. The adaptability of employees. How to cater for cybersecurity in the new business paradigm. |

Benefits like reduced development time and the ability to do away with developer skills are appealing from the cost reduction perspective in a period characterized by the “Great Resignation” whereby many are not willing to go back to their office after having worked for extended hours from their homes during the pandemic. Furthermore, LC adoption is transforming the way businesses operate by facilitating the switch from Capex-intensive software development to a flexible pay-as-you-scale SaaS subscription model.

However, with LC still being an emerging technology, it is important to also consider the uncertainties, labeled in red in the table above. Consequently, my next step is thus to realistically assess how these have been tackled by Appian with its cloud-based platform.

Appian’s Low-code platform

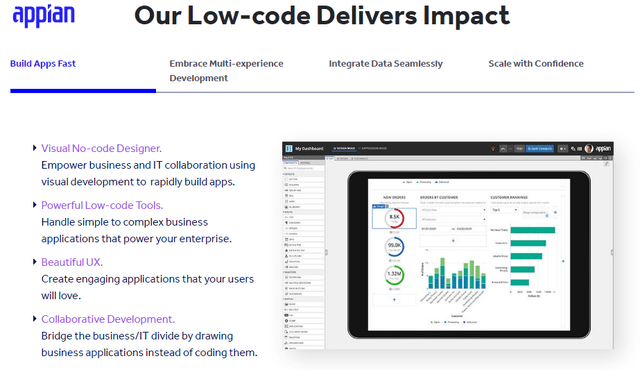

Here, the aim is to use visual development and “rapidly draw” applications instead of painfully writing lines of codes ranging from simple to complex business ones with enticing user interfaces. Another objective is to bridge the business and IT divide, a factor that can lead to IT project failure because developers and business owners can find it hard to interact to identify the requirements. Hence, with business owners or delegates crafting the application themselves, the probability of achieving success is higher.

I also noted there is also a focus on IT security and adhering to standards for compliance and data privacy, which means that LC uncertainties are being addressed. Exploring further, pre-built connections to popular business apps and the ability to access the platform either from a laptop or your smartphone provides for a good user experience. These help to get the buy-in of the tech-savvy GenZ (those born from mid-to-late 1990s to the early 2010s), which now comprises an increasing percentage of the workforce.

Appian Low-Code platform (appian.com)

Furthermore, based on customer reviews, the company has been ranked first by the Gartner Peer Insights survey compared to its top competitors, with these rankings also being confirmed by TrustRadius. One of the reasons for this superiority is bundling of low-code with RPA (Robotic Process Automation) so that enterprises can automate low-level processes faster.

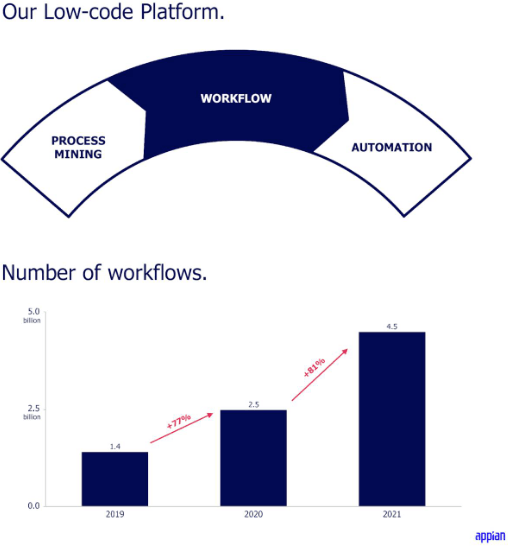

Ultimately, Appian’s platform should benefit from more revenues as LC gradually results in more workflows being created in 2022. For this matter, there were 4.5 billion workflows on Appian Cloud in 2021 or an increase of 81% over 2020.

Coming back to LC uncertainties, Appian has addressed these through its cloud platform, but it is equally important to assess how it is commercialized.

End-to-end solution for differentiation

The company, which already proposes task automation and business process management services, has added LC workflow functionality in such a way that employees can rapidly create simple applications like data collection forms. As they gain experience, they can move on to more complex tasks.

Moreover, through cross-selling to its existing customer base, the company stands a better chance than pureplay low-code providers like Outsystems or Quickbase, in actually profiting from this novel way of developing apps. Scanning the industry, there are other much bigger competitors too, like ServiceNow (NASDAQ: NOW) with App Engine, Microsoft’s (NASDAQ:MSFT) with Power Apps, and SalesForce’s (NASDAQ: CRM) platform.

Out of these, it is Appian that appears to have put in more effort to achieve an end-to-end platform that facilitates the customer journey from discovery, design to automating processes (including the analytics part), as shown in the slide below.

Slides for Appian Low Code platform and workflows (seekingalpha.com)

The Process Mining addition as shown above was achieved through the acquisition of Lana Labs for $30.7 million in August 2021. Process mining is about obtaining actionable insights from items like company records or making the most out of existing data. Moreover, Appian’s executives emphasized the end-to-end aspect of their platform as a key differentiator against the competition during the fourth-quarter 2021 earnings call in February. Thinking aloud, having an extended platform generating more sales makes sense from the topline standpoint, with Appian’s solutions gaining traction for enterprises whose annual revenue exceeded $1 billion.

For investors, one way to gauge LC usage will be to observe the progression in the number of workflows that are created on Appian’s platform during 2022, with the above figure showing the figures till 2021. On the other hand, Appian’s higher investments have resulted in lower profit margins compared to ServiceNow.

Valuations and key takeaways

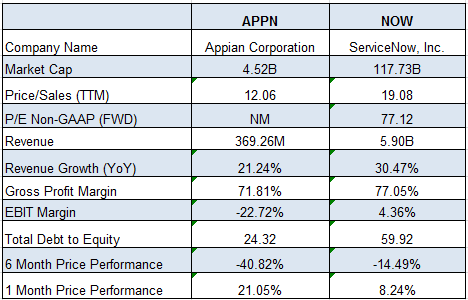

As seen in the table below, with a market cap of $117.7 billion and annual revenues of $5.9 billion, ServiceNow’s scale of operations is much higher than Appian’s. Its higher gross margins are synonymous with fewer manhours of work on its platform. Also, with EBIT margins of 4.36%, it is a profitable company.

This profitability also explains its better 6-month price performance relative to Appian during a period characterized by higher volatility for non-profitable tech stocks as the value strategy gained the upper hand.

Comparison with peers (seekingalpha.com)

Looking at a shorter one-month time frame, it is Appian who has delivered better performance, and this seems to indicate that the growth strategy is back on the agenda given that the market has already priced in the Fed rate hikes. Along the same lines, the smaller company’s outperformance could also be due to its lower debt-to-equity ratio (above table) as investors focus more on borrowing costs in a rising interest rates environment.

Looking ahead, in addition to the LC market growing to $187 billion by 2030 (from $10.3 billion in 2019), the process mining market should scale from $627 million in 2021 to $10.4 billion in 2028. Integration of LC and process mining permits synergistic growth for Appian as the company provides a one-stop-shop service to enterprises that are currently shifting to the more data-driven phase of the digital transformation trend, which is now also pressured by rising manpower costs.

In addition to low-code, the business process and workflow management market in which Appian currently operates is expected to reach $55.35 billion by 2028, after growing by 30.6% CAGR from 2021. Thus, with the potential to improve sales figures in a considerably expanded market size, Appian looks undervalued with its trailing P/S multiple of 12x. However, for value investors, the company is rated poorly by SA on profitability and cash from operations grounds.

On the other hand, for growth investors, with the economy still growing and Appian’s cloud subscription business expected to grow between 33% and 35% on a year-over-year basis during the first quarter of 2022, there is potential for an LC-driven revenue beat when results are announced in the final week of May. In this respect, the company has produced positive surprises during the last eight quarters and is, therefore, a buy at $60-61.

Finally, there were cash and equivalents of $168 million as of December 31, 2021, with $444 million to $446 million of sales expected for 2022, or 20%-21% more than last year.

Be the first to comment