Olivier Le Moal/iStock via Getty Images

It has been quite a roller coaster ride since the beginning of this year. Last month when we wrote this series, volatility was on a fast rise. The market sentiment has improved somewhat during the last week or so, and volatility has come down a bit. That said, a lot of the conditions that existed a few weeks back are still with us. The war in eastern Europe is still raging, inflation & energy prices are still on the rise, and Fed is set on the path to increase the interest rates six or seven times this year. So, nothing much has changed, but the market has come to terms with all of these underlying issues, and the fact that the economy is still in good shape is helping improve the market sentiment.

With regards to Options income, higher volatility certainly provides us better premium or higher income, so it’s definitely a plus. But at the same time, it increases the risk of trade going against us. So, we need to be sure of our planning in case a stock is assigned to us in case of selling a PUT or a buy-write CALL. For writing call options on stocks that we already own, the conditions may be a bit favorable as the chances of those shares being called away are lower. Even then, we should not be tempted to sell strike prices that are too close to the current price. However, as always, we will urge extra caution and due diligence. Don’t take the risk that you cannot afford, and always keep an extra margin of safety.

There are many types of options strategies. However, the options strategies discussed in this monthly series are limited to selling (or writing) the Covered Call options and cash-covered PUT options. The primary purpose of these option strategies is to generate income. As such, there are two sides to options. There’s an option buyer for every seller of an option. When you sell an option, you earn an immediate premium, and you get to keep that premium irrespective of the outcome of the option. However, when you buy an option, you pay the premium upfront and basically buy the right to buy (or sell) the underlying security at a pre-set price (called the strike price). As an option buyer, you’re essentially looking for a high gain, but your entire investment (the amount of premium paid) is at risk if the option expires worthless, which, by the way, happens the majority of the time. We believe the strategy to sell options (opposite of buying options) to generate income is the safer strategy. It’s more akin to acting like an insurance provider, where you earn the premium upfront, and if you act conservatively, 80%-90% of options should expire worthless, thereby limiting your risk.

However, we do not intend to convey an impression, especially to the folks who are new to options, that there’s no risk in selling options. In fact, there’s plenty, especially if we are not careful. But there are ways we can minimize the risk to a large extent by following certain time-tested principles.

- The first rule is that we should not use the margin (or borrowed) money to write or sell options. That should be a big ‘no’ for most investors. We only recommend using cash-covered PUTs and covered CALL options.

- Second, the stocks that we choose to write PUT options should be the ones that we would not mind holding for the long term. If a trade was to go against us and we’re assigned the shares while the share price has dropped significantly, we could just hold the stock until the price recovers close to our buying cost.

- Next, we should preferably use only dividend-paying and dividend-growing stocks for options. If we were forced to hold shares for the medium to long term, not only would we be paid for waiting, but the dividend growth stocks would have a much better chance of recovering quickly.

- Lastly, but not least, we should not chase very high premium rates to avoid risk, as they’re high for a reason. We should keep our expectations in check and aim to earn an average of 10% to 20% premium (annualized) on dividend stocks.

Author’s Note: This article is part of our periodic series that attempts to present three lists of stocks that could be suitable for writing options to generate safe income. Certain parts of the introduction, definitions and the section describing the selection process may have some commonality and repetitiveness with our other articles in the series. This is unavoidable as well as intentional to keep the entire series consistent and easy to follow for the new readers. Regular readers who follow the series from month to month could skip such sections.

All tables in this article have been created by the author (unless explicitly specified). Most of the data in this article are sourced from Fidelity, Yahoo Finance, DripInvesting, and Barchart.com.

Options Income Strategy 101

Note: This section is for readers who do not have much prior exposure or experience with options. Other readers could skip this section.

You’re basically acting as an insurance company and providing insurance to the buyer of the option for stock at a certain stock price for a limited period of time. There are obviously two types of options that you can sell (or write) to generate premium.

- You already hold a stock (of at least 100 shares), or you buy 100 shares of a company. Then you turn around and sell (or write) a call option to guarantee the counterparty that you would sell your shares at a certain maximum price (called Strike-Price) until the expiry of a certain period (called expiration period). This type of call option is also called the covered call option since you already hold those shares. If the price of the underlying security goes above the strike price, the buyer of your call has the right to exercise the option and buy your shares at the strike price. If the share price of the underlying security does not go above the strike price, the buyer of the call would not have any incentive to exercise the call. There’s one caveat here. If the stock has a dividend-ex date falling before the expiry date, the buyer could exercise the option even if the stock price is slightly below the strike price just to capture the dividend. So, prior to selling a call option, we need to be aware of ex-dividend dates so that we’re not surprised later. Also, we should consider if the premium is good enough for this period.

- You do not hold the stock. You sell (or write) a cash-covered put option on 100 shares of the stock (or one put option contract) at a certain price (called the strike price) for a certain period of time (called the expiry period) at a certain option premium. In other words, you agree to buy 100 shares of the stock at the strike price until the expiry date. You also provide your broker with enough cash reserve for the value of this contract. As long as the share price remains above the strike price until the expiry date, you would not be “put” the shares, and the option will expire worthlessly. But you will keep the premium that you earned at the time of selling the option. However, if the price falls below the strike price on or before the expiration date, the buyer of your option has the right to “put” the shares to you at the strike price. That means you will be required to buy those 100 shares (assuming one contract) at the strike price. Since you already had reserved the cash with your broker, you are covered for the purchase. So, now you own 100 shares of the underlying stock.

Can it be a Sustainable and Repeatable Income Strategy?

We definitely think so. Any strategy that cannot be repeated with reasonable success on a consistent basis would not be much useful. However, we believe the strategy to write options on dividend stocks is both repeatable and sustainable. In fact, if you act conservatively and limit this strategy to only certain kinds of stocks, you can safely generate 10%-12% average income and up to 12%-15% CAGR (Compound Annual Growth Rate). Sure, as with any strategy, there are a few downsides. The strategy needs some work on a regular basis, though depending upon the number of positions, just a few hours a month should be enough. You have to be very careful with the selection of stocks. As stated earlier, the first and most important rule is that the stocks that you choose are the ones that you do not mind holding for the long term. The second rule is consistency that we follow the discipline and follow the process as per the pre-determined rules.

Selection Strategy for Underlying Stocks

One of the most important aspects of writing or selling options is to select the right kind of stocks and to use the right kind of options strategy. What kind of stocks will be suitable will depend on the investor’s goals and risk profile? In this monthly series, we will present three lists of 10 stocks, each with different characteristics. Please note that some stocks may appear in multiple lists. We will scan the complete universe of stocks and apply some broad-based filtering criteria to make our list smaller.

- Market cap of the company larger than $10 Billion

- Daily volume for the underlying stock to be > 100,000

- Dividend yield preferably > 1.20% (at least higher than the S&P 500 yield); however, we make exceptions for well-established dividend stocks (for example, stocks like Apple, Microsoft, and many others)

By applying the above criteria, we get roughly 600 stocks.

Since our goal is to look for companies that we do NOT mind owning for at least in the short to medium term, we will filter out the companies that have less than five years of dividend growth history. This filter leaves us roughly 270 companies that have a consistent record of paying growing dividends for at least five years, preferably longer.

Now, we will import financial data for each company in our list. We want to see the dividend safety of each company at least on a relative basis. So, we import the following data elements:

- No of years of dividend growth history

- Dividend growth during the last one year, three years, and five years

- Dividend Payout Ratio (preferably based on cash-flow basis rather than EPS)

- Debt/Capital

- Return on Capital – ROC

- Sales Growth during the last five years

- Credit Rating (from S&P)

We will combine these factors and calculate a dividend safety score for each company. Sure, a high safety score would not guarantee absolute safety because business conditions can change over time, new competition can emerge, or the management can make some bad decisions destroying shareholder value. But it will at least provide a reasonable level of assurance that the company has the financial capability to continue making its dividend payments.

We also will import the data on price movements related to 1 week, 4-weeks, and 12-week price performance for the selected stocks.

We’re going to use our proprietary formulas (as detailed below) to calculate the optimal strike prices for CALL and PUT options. However, there are many other ways to determine the appropriate strike prices. The readers are encouraged to try several methods before determining what works best for them. There are many other ways to determine the appropriate strike prices. Your brokerage provider may provide more information on variables like delta, gamma, theta, etc., and how they can be relevant to options.

We will also calculate the following ratios and factors:

Distance-Ratio = (52-WK-HIGH – 52-WK-LOW)/((52-WK-HIGH + 52-WK-LOW)/2)

Distance-Ratio % = Distance-Ratio x 100

- Strike-Price Safe Distance

Strike-Price-Safe-Distance % = [(Distance-Ratio %) x STPR-factor (STRIKE-PRICE-factor)] / 10

Whereas STPRC-factor = 1.2 (can vary from 1.0 to 1.5)

- CALL Option Strike-price = Close-price + (Close-price x Strike-Price-Safe-Distance)

This price may need to be rounded to the lowest dollar or half-dollar amount depending upon what strike prices are prevailing for the underlying stock for the specific strike date.

- PUT Option Strike-price = Close-price – (Close-price x Strike-Price-Safe-Distance)

This price may need to be rounded up to the nearest dollar or half-dollar amount depending upon what strike prices are prevailing for the underlying stock for the specific strike date.

Below, we present two lists of 10 stocks each, one for writing PUT options and the other one for writing CALL options. The second list is presented with two different options – the first one with stocks that you may want to own (or already own), whereas the second one is using the same stocks for the purpose of earning a high rate of income but possibly avoiding owning them. Please note that some stocks may appear in multiple lists as they may satisfy the criteria for more than one category.

10 Option Stocks Suitable for PUT Options:

For PUT options with the primary objective of generating income, we would want to see them expire worthless. So, we will analyze the 1-week, 4-week, and 12-week price performance and try to see if it’s a rising trend or downward trend. For writing (or selling) PUT Options, we want to select stocks that have a rising trend. These are the stocks that generally would have high relative strength or momentum. That will help ensure that, more than likely, the PUT option will expire worthless. In the reverse situation, if the option was assigned and we were put the shares, the rising trend will help that we are able to write CALL option immediately with a good premium.

In our list, we are careful not to put too many names from the same industry segment. We generally limit to two or three names from the same sector for the sake of avoiding too much concentration in one sector.

One important caveat for selling PUT options: Do not start a PUT option on a stock that you do not see yourself holding for an extended period of time.

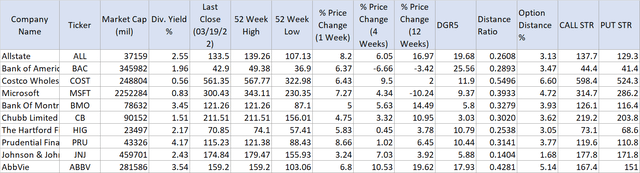

Here are the top 10 large-cap stocks for PUT options:

(ALL), (BAC), (COST), (MSFT), (BMO), (CB), (HIG), (PRU), (JNJ), (ABBV)

Table 1:

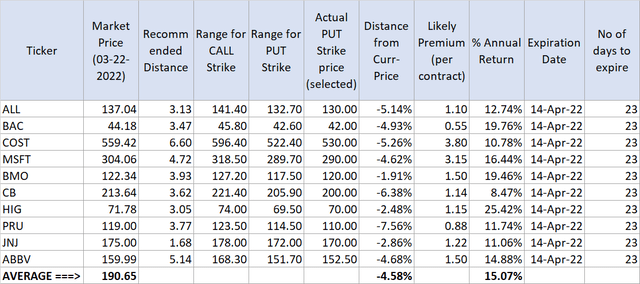

Below, we present the current PUT Options trades and current premiums that we can expect for the above ten stocks.

Table 1A:

10 Option Stocks with Safe Dividends (PART-A):

In this category (part-A), we’re assuming that you already own these stocks (or you will be happy to own them at the right price). So, we’re aiming for an average of 2% dividend and 8% to 10% income by writing call options.

In this category, we will list ten large-cap stocks that are perceived to have very safe dividends. There’s nothing that we can claim to be absolutely safe in the investing world – the same can be said about dividends. But based on various financial metrics, we can shortlist companies that have low payout ratios, low debt, high credit ratings, positive top-line growth, and have been consistently growing their dividends. We present ten such companies below:

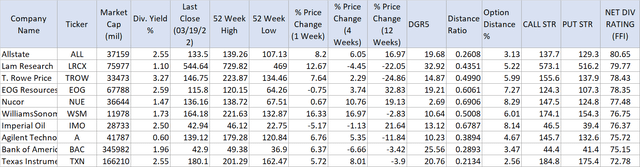

Our Top 10 Stocks with Very Safe Dividends for (BUY-WRITE) CALL options:

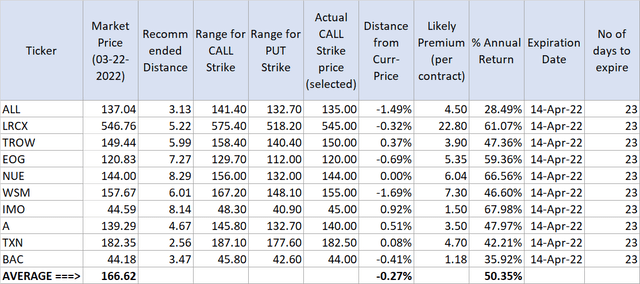

(ALL), (LRCX), (TROW), (EOG), (NUE), (WSM), (IMO), (A), (BAC), (TXN)

Table 2:

Note: The “Net Dividend Rating” (the last column above) is based on recent past parameters like 5-year dividend growth, number of years of dividend growth, Payout Ratio based on cash-flow, ROC, Sales-growth, and Debt/capital.

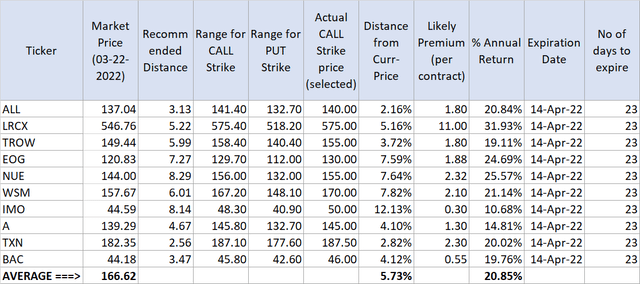

Below, we present the current CALL Option trades and current premiums that we can expect for the above ten stocks.

Table 2A:

10 Option Stocks with Safe Dividends (PART-B):

In this part, we are assuming that you do not own these stocks to start with, and your goal is not to own these companies but simply to earn a high income (> 20% annualized rate). Even then, there is always a chance that we end up owning these companies, so we want to make sure that their dividends are safe.

To achieve this, we will use the buy-write CALL option (for one contract, buy 100 shares and sell one call-option contract at the same time). Since the goal is simply to earn a high income, we will sell call-option with a strike price that is slightly above the current market price or, at times, even below the current price. In normal circumstances, odds will be very high that the shares will get called away, and we will earn a high premium. It’s also possible in some cases that the shares are not called away as the price may fall substantially. In such a case, our cost basis will be much lower (roughly 3%-5% lower than the current price due to the premium already earned), and we can write another set of call-option.

However, there’s one caveat here, and it’s an important one. In case you write such call options on a large number of stocks (10 different stocks in our example below), and if the market was to take a deep dive during the option period (which is always a possibility but more so in the current environment), the majority of our shares would NOT get called away, and you will end up owning all these stocks, albeit at much-reduced cost basis. So, it’s important to know how much capital you’re willing to commit and if you can really afford to allocate. Secondly, you always want to use this strategy with stocks that you do not mind owning and holding for an extended period of time.

This list of stocks is the same as in Part-A:

(ALL), (TROW), (NUE), (UNH), (EOG), (LHX), (MFC), (AEM), (CNI), (TXN)

Table 3:

Conclusion

We have presented two lists with ten stocks each and the second list with two possible action strategies. We think these lists could be great selections for writing/selling PUT or CALL options. We have tried to put relatively safe stocks in all the groups; however, the stocks listed in the second list (part A and B) for call options (or buy-write call options) have been specifically filtered based on the safety of the dividend.

We expect 70% to 80% of our options to expire worthless, earning us the upfront premium. But there will be times when we are assigned a stock. Usually, it should not be a problem, as we can turn around and write a covered call option. But at times, during high volatility periods like now, the stock price may drop much below our strike price. In such cases, we will have to sell CALL options far out of money, earning us very little premium but still earning the dividends. This will reduce the overall premium yields by 2%-3% in the long term, but this can be easily offset by the capital gains we may earn from time to time. So, overall, it may be quite reasonable and realistic for us to expect 10% to 12% income on a consistent basis, as long as we play it wisely and conservatively.

As stated earlier, we usually target an average of 10%-12% annualized premium. In the current environment, meeting that target is not a problem, but we need to be extra diligent on what stocks we choose. We have used our proprietary formulas to calculate the optimal strike prices. That said, there are many other ways to determine the appropriate strike prices.

In order to have a conservative strategy, we have limited our choices of stocks that are large-cap (cap above $10 billion), offer respectable yields, have at least five years of dividend growth history, and generate enough cash to cover their dividends.

Be the first to comment