Leonidovich/iStock via Getty Images

AppHarvest (NASDAQ:APPH) had very ambitious dreams when it went public early last year and announced its plans to build one of the largest controlled environment agriculture facilities in the United States. The 60-acre Morehead, Kentucky greenhouse is growing 45 million pounds of tomatoes a year and is the first of many facilities planned. It was meant to enable AppHarvest to reach its goal of $25 million in net revenue for 2021, growing to $59 million in 2022. The hype was tangible and at a press event to commemorate Morehead’s opening, CEO Jonathan Webb announced how AppHarvest was “here to shock the world”. I last covered AppHarvest at the end of 2021, where I try to go over the core reasons AppHarvest’s approach to agriculture is better than the status quo.

Investors rightly got swept up in the dream of changing US farming for the better. Indeed, the benefit of controlled environment agriculture then as it is now is clear; grow more food with fewer resources and do it closer to where the food is consumed.

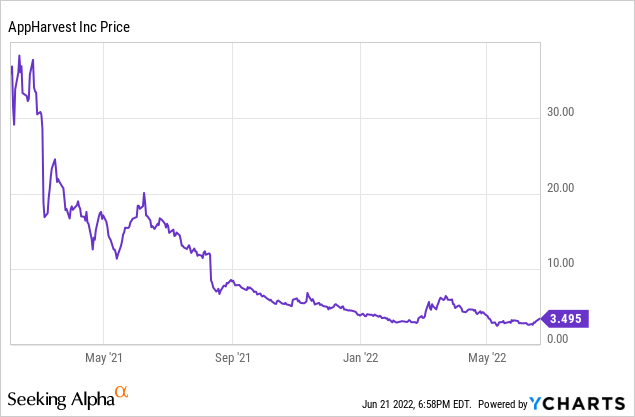

Now more than a year since the company went public, its common shares are struggling having collapsed more than 90% from highs of $35. Further, with total revenues for its fiscal 2021 eventually coming in less than 50% lower than guidance and current fiscal 2022 revenue also tracking lower on a quarterly basis, AppHarvest’s revolution seems to have been thrown into doubt.

This comes against rapidly rising commodity prices as Russia’s war against Ukraine has set off global supply chain disruption and multi-decade inflation highs. This has injected even more uncertainty into a food system that is still recovering from the pandemic.

Here To Shock America And The World

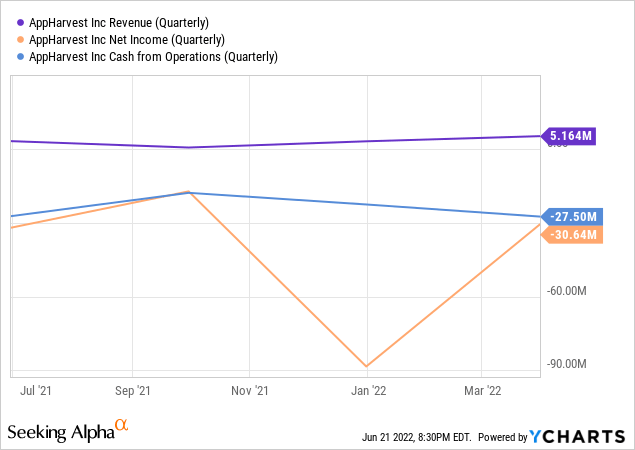

The company’s struggling share price and dwindling liquidity have come as a shock to long-term investors chasing the promise held by growing food indoors. With initially provided guidance all but gone, AppHarvest’s last released earnings for its fiscal 2022 first quarter saw revenue come in at $5.2 million. This was a 126.1% year-over-year increase but a miss by $200,000 on consensus estimates. Growth was driven by an 82% year-over-year increase in yield from 3.8 million lbs to 6.9 million lbs. The net selling price per lb also increased by 23% to $0.75.

Net loss was high at $27.5 million with cash loss from operations at $30.64 million. The company expects to be able to produce leafy greens and berries in the near future with three new facilities planned for 2022. This will also see the addition of another 60 acres tomato grow facility in Richmond, Kentucky.

AppHarvest reaffirmed its new fiscal 2022 net revenue guidance of $24 million to $32 million. This should be more than double 2021’s net revenue. However, losses are still expected to be high with non-GAAP adjusted EBITDA expected to be in the range of $70 million to $80 million. The company is also expected to maintain Capex at its high range to complete the build out of its new growth facilities. This was at $39 million during its last reported quarter against cash and equivalents that had declined to reach $97.6 million from $150.8 million in the preceding quarter. Fundamentally, the resiliency of AppHarvest is being challenged and raising money in the current climate might prove difficult and more expensive than it would have otherwise been. I don’t think AppHarvest faces a going concern problem as it held approximately $58 million in untapped credit facilities and also established a $100 million committed equity facility. But a protracted dearth of financing options on the back of a collapsed stock market and a global recession could lead to job cuts and prioritisation of planned Capex.

It’s Time To Grow

The current crash of AppHarvest shares does not mean that demand for tomatoes from domestic sources has suddenly disappeared. The previous valuation, like many other companies that went public via SPAC at the time, was driven by excess liquidity conditions and unfettered investor euphoria. AppHarvest continues to remain at the vanguard of the shift towards a more sustainable method of farming. A necessity in a world facing significant population growth rates whilst beset by the uncertainties of climate change.

The fragile US food system was highlighted by the pandemic as globalized supply chains buckled under pressure and national governments prioritized their own populations. Hence, the critical need for a domestic supply chain has never been clearer. This situation has been exacerbated by the current geopolitical climate.

When people work together great things happen. And AppHarvest is a great thing and an important company chasing a market that will be critical in a more unstable and unstructured world likely to be beset by consecutive unprecedented issues. So beyond a need to grow more food with fewer resources, AppHarvest opens a very needed orthodoxy of self-reliance and food security. In this the Appalachian agricultural revolution soldiers on. The stock is a buy on more clarity on management on long-term financing against their current facility build-out plan and cash burn.

Be the first to comment