JHVEPhoto

Elevator Pitch

My investment rating assigned to Citigroup Inc.’s (NYSE:C) stock is a Buy.

I have previously raised my rating for Citigroup’s shares from a Hold to a Buy as part of my Q1 2022 earnings preview article for C written on April 12, 2022. Citigroup’s share price performance (-17.8%) has largely tracked that of the broader market (-18.6% decline for the S&P 500) since my earlier update for Citigroup was published.

I preview Citigroup’s upcoming earnings for the third quarter of 2022 with this article. My analysis suggests that C might disappoint the market with an earning miss for Q3 2022. But Citigroup is already trading close to historical trough valuations, and this should limit the potential decline in C’s stock price in the event of an earnings miss.

Instead, investors should focus more on the potential for a substantial re-rating of Citigroup’s valuations in the mid-term when it achieves its Return on Average Tangible Common Shareholders’ Equity or RoTCE target. I have confidence in C’s ability to achieve its RoTCE goal for the medium-term, and this explains why I have assigned a Buy rating to C.

C Stock Key Metrics

It is worth taking a look at C’s most recent Q2 2022 metrics before assessing how Citigroup might have performed in Q3 2022.

There were two key positive takeaways from Citigroup’s second quarter financial results.

Firstly, Citigroup’s Q2 2022 EPS grew +8% QoQ and beat the Wall Street analysts’ consensus projection by +31%. The key growth driver for C was the company’s Markets unit which saw its segment revenue rise from $4.3 billion in Q2 2021 to $5.3 billion for the recent quarter, as disclosed in its earnings presentation.

Citigroup explained at the Q2 2022 earnings briefing that its Markets unit benefited from “market volatility” which led “corporate clients, in particular, to be more active in risk management.”

Secondly, C kept its intermediate-term CET1 (Common Equity Tier 1) target unchanged at 11.5%-12.0%. Earlier, there were concerns that Citigroup will have to raise its CET1 target for the medium term. Instead, Citigroup’s unchanged mid-term CET1 goal is an indication that C expects capital requirements to decline in the next couple of years.

At the company’s second-quarter investor call, Citigroup shared that it is confident in achieving “a mix towards more sustainable, predictable earnings” going forward, which will help the company to achieve its intermediate-term CET1 target. Specifically, C sees a positive change in its future earnings mix thanks to growing contributions from businesses like securities services and treasury & trade solutions.

In the subsequent section, I evaluate the odds of a Q3 earnings miss (or beat) for Citigroup.

Is Citigroup Expected To Beat Earnings?

Citigroup will report the company’s Q3 2022 earnings on October 14, 2022, before the market opens, as disclosed in an announcement issued in late September.

I take the view that Citigroup’s third-quarter EPS will come in below the sell-side analysts’ expectations due to two key factors.

One factor is that the downward revisions to the market’s consensus Q3 2022 financial projections for C in recent months have been relatively modest.

In the past three months, Citigroup’s Q3 consensus topline estimate was reduced marginally by -0.1%, while C’s third-quarter consensus EPS forecast was cut by -7.6%. More significantly, four of the 24 analysts covering Citigroup’s shares even had higher Q3 EPS projections than they did three months ago. Also, 15 analysts kept their third-quarter EPS estimates for C unchanged in the last three months.

This suggests that the market’s expectations for Citigroup’s Q3 2022 financial performance aren’t sufficiently low, and there could be negative surprises.

Another factor is that Citigroup’s cost should remain elevated in the third quarter this year, and this increases the probability of a Q3 earnings miss.

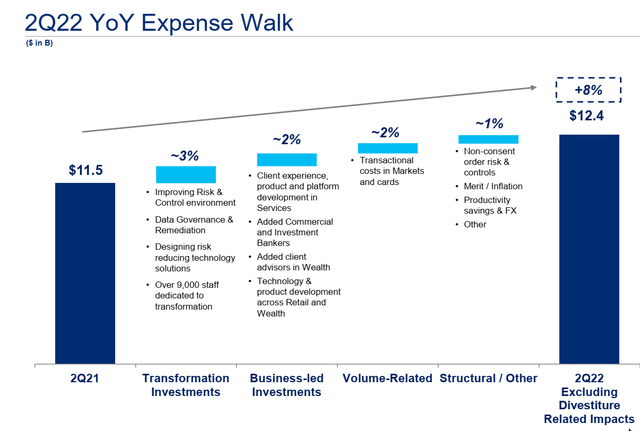

Drivers Of The Increase In Citigroup’s Q2 2022 Expenses

C’s Q2 2022 Earnings Presentation

As highlighted in the chart presented above, Citigroup’s expenses rose by +8% YoY in the second quarter of 2022. It is noteworthy that “transformation investments” and “business-led investments” in aggregate accounted for around 500 basis points of the +8% increase in costs. These represent investments for the long run and the associated expenses won’t vary with revenue in the short term. As such, these costs are expected to be “sticky”, which translates into meaningful downside risks for C’s Q3 2022 EPS.

In a nutshell, my prediction is that Citigroup’s third-quarter bottom line will fall short of investors’ expectations. However, C’s valuations are already very depressed, so I don’t expect the market to react negatively to the bank’s earnings miss in a big way assuming that it materializes. More importantly, Citigroup’s current valuations offer a very attractive entry point for investors with a long-term investment horizon, as I will discuss in the subsequent sections of the article.

Is Citigroup Stock Now Undervalued Or Overvalued?

Citigroup’s stock is now undervalued.

The market currently values C at a trailing price-to-tangible book value or P/TBV valuation multiple of 0.51 times. This is just slightly above Citigroup’s 10-year historical P/TBV through multiple of 0.50 times as per S&P Capital IQ’s valuation data. In contrast, C’s 10-year mean P/TBV multiple was 0.90 times. Mean reversion will be a powerful force in re-rating Citigroup’s share price and valuations in the intermediate-to-long term.

Also, Citigroup’s RoTCE was a modest 10.8% for the first half of 2022. In comparison, the mid-point of C’s mid-term RoTCE goal is 11.5% as outlined at the bank’s Investor Day in March 2022. If Citigroup can drive its RoTCE higher in the coming years, it is reasonable for C’s shares to command a higher P/TBV valuation multiple closer to the long-term average in time to come.

What Is Citigroup’s Long-Term Outlook?

Citigroup’s long-term outlook should be bright, if management’s expectations of the bank’s future RoTCE are any indication.

At Barclays’ (BCS) Global Financial Services Conference in mid-September 2022, Citigroup’s CFO Mark Mason noted that C “will see upside to this 11% to 12%” intermediate-term RoTCE target in the long run.

I share C’s optimism in relation to its outlook for the long term. As I mentioned earlier in this article, Citigroup is investing to grow its capital-light, services-focused businesses such as securities services and treasury & trade solutions. These businesses also offer more recurring revenue, and this increases the predictability of Citigroup’s future earnings streams. At its 2022 Investor Day in March, C emphasized that treasury & trade solutions and securities services “generate incredibly sticky relationships with strong fee-based return.”

Looking ahead. I see this favorable shift in revenue and earnings mix to be supportive of a higher RoTCE for C in the future.

Is C Stock A Buy, Sell, Or Hold?

C’s stock is rated as a Buy. Citigroup is a Buy before upcoming earnings. C’s actual Q3 2022 financial performance might come in below expectations due to higher-than-expected expenses. Nevertheless, Citigroup still warrants a Buy investment rating, considering the mismatch between its current valuations and the long-term RoTCE expectations.

Be the first to comment