sx70

Technology stocks, the Nasdaq Composite Index (COMP.IND), and The Nasdaq 100/Invesco (Nasdaq 100) ETF (QQQ) have performed exceptionally well in recent weeks. Since the mid-June “bottom,” the Nasdaq 100 and similar market averages have surged by nearly 25%, and many individual stocks have appreciated much more. Many market participants are discussing the possibility of a new bull market, and many investors are chasing their stocks.

However, the bearish trend may not be over, and the bear market may still have more room to run. After all, the Fed is raising interest rates. Quantitative tightening (“QT”) should continue to unfold. Inflation is at multi-decade highs, the economy is in an “official recession,” corporate earnings could continue to slide, and no one knows precisely how long the downfall will last or how deep the current recession will run. Therefore, it may be early for a victory lap, the countertrend rally could fade, and another leg of the bear market could materialize as markets advance into the fall.

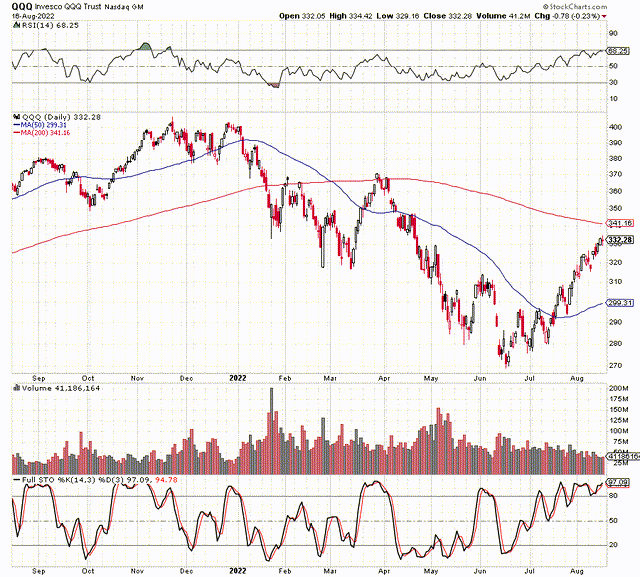

QQQ

QQQ is the closest thing we have to a widely traded Nasdaq 100 exchange-traded fund (“ETF”). Since the mid-June reversal, we’ve seen massive gains in QQQ and in many individual tech companies. QQQ has surged nearly 25% since the June low and is now approaching highly oversold technical levels. We’re nearing the relatively high 70 level on the RSI, and there is substantial 200-day MA resistance at around $340. There is also a general heavy resistance level around the $340-350 resistance zone, which could represent the near-term ceiling for now. $340 represents a 26% move off the lows, and the $350 point stands at 30% off the recent bottom. We may see the countertrend rally end in this range, and the market could trade down in the fall.

The ETF’s top five holdings account for a remarkably high 43% of the ETF’s weight. Moreover, these same five holdings represent a significant portion of the S&P 500’s (SP500) weight now (approximately 22%). QQQ’s top holdings include Apple Inc. (AAPL) 13.3% weight, Microsoft Corporation (MSFT) 10.6% weight, Alphabet Inc. (GOOG, GOOGL) 7.2% weight, Amazon.com, Inc. (AMZN) 6.9% weight, and Tesla (TSLA) 4.7% weight.

Now, I am not against technology companies. My top investments over the last twenty years have been technology-stock related. Additionally, I’ve recently owned several of the big names and still hold Google in my portfolio. Nevertheless, it is problematic that a few mega-cap technology-related companies command massive portions of major benchmark averages. Moreover, several mega caps appear overbought again and are at risk of further declines, which could torpedo QQQ and the general stock market in the coming months.

1. Apple

Let’s begin with the most prominent company of all, Apple. Apple should report EPS of approximately $6.10 this year, putting its forward P/E ratio at about 28. The company’s earnings growth projections are for only around 5-9% EPS growth in the coming years. The company’s revenue growth projections are for about 4-7% in the coming years. Yes, I realize that Apple could surpass consensus estimates. However, there is also increased uncertainty about the Fed/interest rates, inflation, and the economy in general, and there is a risk that the company could miss estimates as well. Therefore, a 28 forward P/E ratio now seems very rich, while there is likely limited growth ahead in the coming years. Additionally, the stock has skyrocketed by a whopping 37% from its mid-June low.

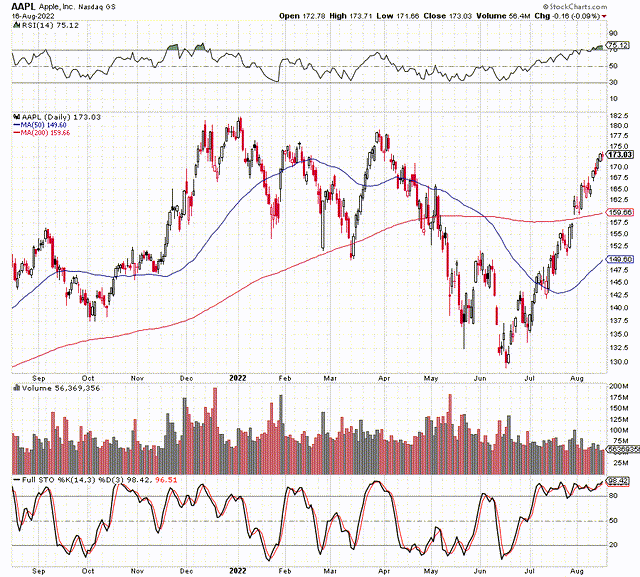

AAPL

The RSI is at 75 here now, highly extended. We have not seen such overbought conditions in a very long time, and the technicals are even more overheated now than they were during the market top around the end of last year. It isn’t easy to imagine Apple moving on to new ATHs in the current environment, and another selloff appears increasingly likely. Therefore, I would consider taking some quick profits in Apple shares and possibly revisiting this stock around the $150-140 range or lower this fall.

2. Microsoft

Now, let’s look at Microsoft objectively. Like Apple, Microsoft is also trading at a relatively high P/E multiple. Microsoft should report approximately $10.20 in EPS this year (fiscal 2023), placing its forward P/E ratio above 28. The company’s growth outlook is more promising than Apple’s. Consensus estimates are for approximately 10-20% EPS growth and 10-15% revenue growth in the coming years. However, I must emphasize that these are estimates and provided the increased uncertainty surrounding the economy. These projections appear quite bullish in my eyes. Therefore, I am skeptical that investors should pay more than 28 times forward earnings estimates to pick up Microsoft’s shares.

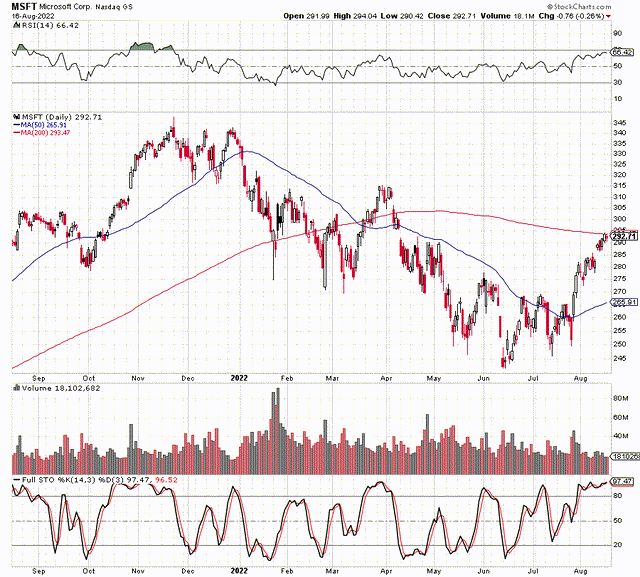

MSFT

Microsoft is not quite as overbought as Apple, but it has had a substantial 23% move off its mid-June bottom. The RSI is approaching 70, and there is significant technical resistance at the $295-310 zone. Microsoft may also head lower in the fall, and I would look to repurchase shares in the $270-250 range or lower in the coming months.

3. Alphabet

Google is facing an unprecedented EPS decline this year. Consensus estimates are for $5.27, a 6% drop relative to last year. Still, with a 23 forward P/E ratio, it’s difficult to call the stock cheap. Next year’s consensus EPS figures are around $6, and roughly 20 times next year’s earnings multiple looks better than many companies. Also, Google should provide double-digit revenue and EPS growth in the coming years, making it one of the most attractive tech stocks right now. However, Google is highly dependent on ad revenues, which are declining due to the economic slowdown. Therefore, it’s perceived as riskier than Microsoft and Apple, thus the lower P/E multiple.

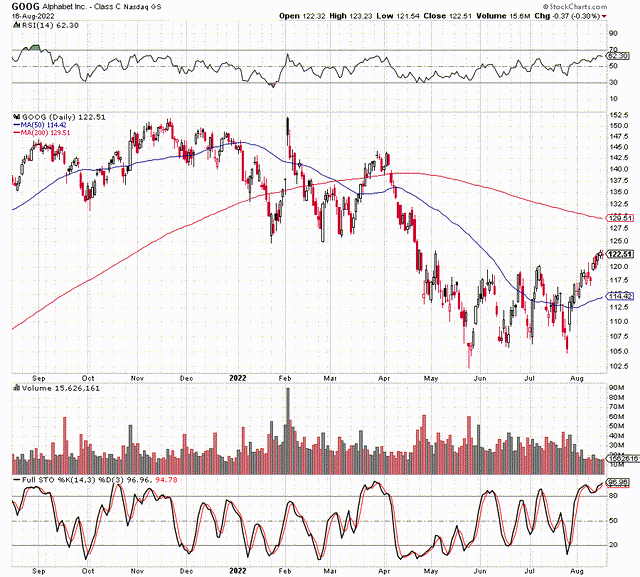

GOOG

Google has also enjoyed a robust rebound off the lows, and the stock is up by approximately 20% from mid-June. However, Google’s rebound has been less prevalent than Apple’s and Microsoft’s, and the stock does not appear significantly overbought yet. Nevertheless, Google will probably go for the ride if the market reverses and heads lower. While I am long Google now, I will look to add to my position in the $110-100 range or lower if the stock corrects that deep in the fall.

4. Amazon

Amazon is a great company, but analysts’ estimates imply that the company will show almost no earnings this year. When Amazon gets its earnings picture back on track, it could deliver about $2.37 in EPS next year and $3.82 in EPS in 2024, respectively. These estimates put the company’s forward P/E ratios at around 61 and 38 for next year and 2024. Therefore, we see that Amazon’s stock is relatively pricy again. Nevertheless, Amazon should continue delivering robust revenue and EPS growth in the coming years, creating long-term opportunities for shareholders.

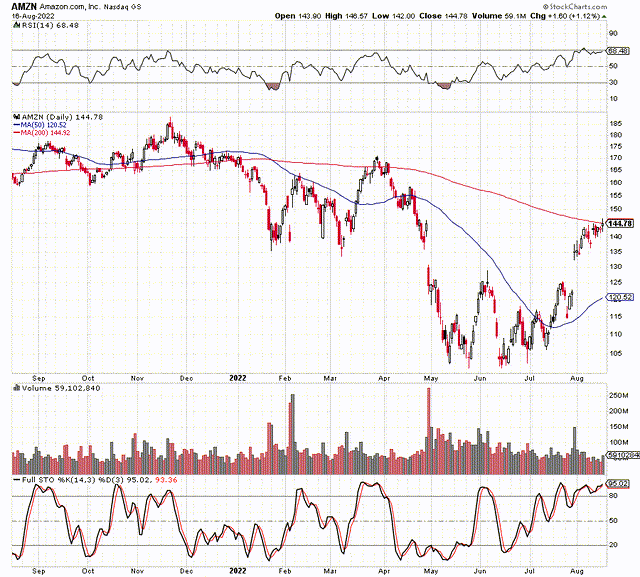

AMZN

Amazon crashed nearly 50% from its November top and became grossly oversold and undervalued. I purchased the stock around the $100-105 support range and recently exited at about $140. Amazon had a significant 40% surge off June’s bottom, but the stock is getting overbought again. Moreover, Amazon is approaching critical resistance in the $150-160 range. There is also a significant gap at about the $120-125 level. I like Amazon as a long-term play, but I will look to reenter shares in the $120-100.

5. Tesla

Tesla is the most volatile stock out of the top mega-cap “tech stocks.” Tesla is also the most expensive company on our list, but it is also arguably the one with the most potential. Currently, Tesla trades at approximately 11 times this year’s sales estimates and commands a forward (2022) P/E ratio of 74. Tesla should continue growing revenue and EPS quickly in the coming years to its credit. Thus, Tesla should grow into its valuation. Still, in the near term, the stock could head lower on valuation and other concerns associated with slowing economic growth, higher interest rates, and Fed tightening.

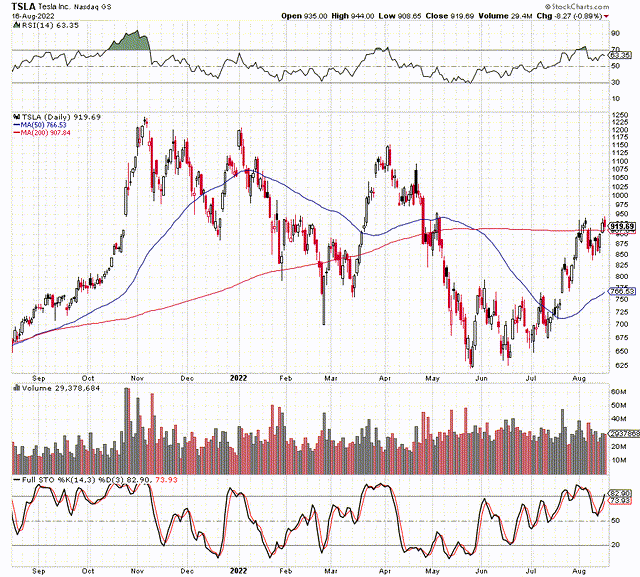

TSLA

Tesla had the steepest drop of the mega-cap names and the quickest rebound since. The stock declined by approximately 50% during the initial bear market phase. Yet, its rebound has been around 53% from the lows. However, we see technically overbought conditions, and critical resistance is coming around the $950-1,000 level. The stock may be around another double top, and there is a risk of more volatility. I released my Tesla stake in yesterday’s (Tuesday’s 8/16/22) session, and I plan to reenter the stock in the $650-750 range, roughly 20-30% lower from here.

The Bottom Line: Contemplating Our next Move

I am not saying sell everything here. However, I am advocating a more cautious approach now that we’ve seen significant gains off the “bottom.” It is unclear if the June low is a sustainable low, if the market will retest it, or if it will tumble to new lows in a bearish-case scenario. There are too many unknowns now. The Fed will continue tightening monetary conditions, will introduce more interest rate increases, and should proceed with QT. Inflation remains at unprecedently high levels, and the economic slowdown is real. The consumer could experience more pressure, and corporate profits are not immune from further declines. The economy is already in a recession, and it is unclear how long the downturn will last or how deep it will be.

Yet, the biggest “tech firms” still have relatively high valuations and appear overbought. Moreover, these tech giants account for an abnormally high percentage of the weight in significant averages, with the top five companies accounting for more than 40% of the Nasdaq 100’s total weight. We will probably see further downside in the mega-cap titans, and they should lead major market averages lower this fall.

I Plan To:

- Increase my cash (dry powder) position

- Decrease “riskier” high multiple holdings

- Rotate to safer sectors (i.e., staples, healthcare, other)

- Diversify into precious metals and specific bond instruments

- Hedge (covered call, collar, put options, other)

- Reenter high-quality stocks at lower levels

Be the first to comment