SAND555

The interim report had recently come out, and it was about time to cover Anglo American (OTCQX:NGLOY)(OTCQX:AAUKF) again. YTD declines have been fairly limited, as while declines in commodity prices have been pervasive, major concerns surrounding iron had already taken its toll on the price prior to the turn of the year. Anglo American continues to be positively exposed to some megatrends, and, income investors may continue to consider it, also on the mitigating factor that trading activity has it being volatility exposed.

Q2 Review

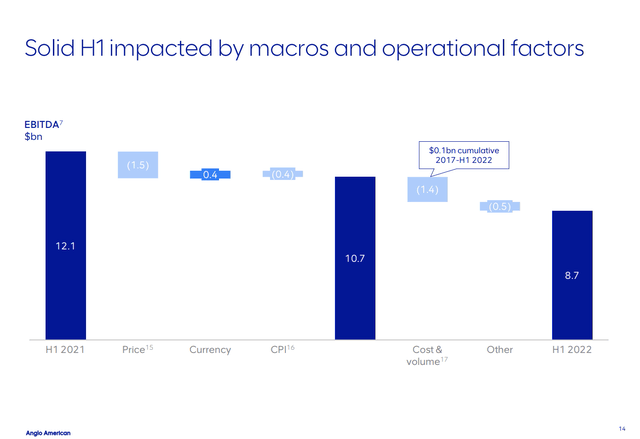

It all comes down to the following chart.

EBITDA Waterfall (Q2 2022 Pres)

EBITDA declines were close to 30% and about half can be put on commodity price effects, while the other half can be chalked up to general CPI effects, which is another way of saying labour inflation. Indeed, with our coverage on Anglo American Platinum (OTCPK:ANGPY), we saw that as part of the implicit windfall tax that would need to be paid to a government like South Africa’s for its commodity fortunes, labor concessions were very substantial. Fuel and steel procurement was also another source of inflation on the company’s production.

Declines in volume of around 10% due to operational problems also drove up unit costs. Hopefully those will reverse in H2 and help drive down per unit costs.

Remarks

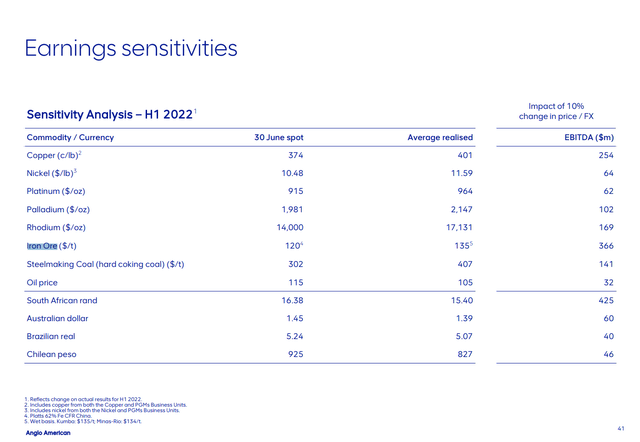

Comp effects had a lot to do with this quarter’s performance. Prices in H1 2021 were some of the highest they’d been across Anglo’s mining portfolio. Even copper, which is supported by powerful secular tailwinds, saw meaningful declines. PGMs were a little more resilient, but iron ore also dropped the ball (almost 50% declines YoY), perhaps more enduringly, because of issues in the Chinese property and infrastructure markets. Copper and iron ore declines really matter for Anglo; it’s where they’re most sensitive.

Sensitivity Analysis (Q2 2022 Pres)

In other words, Anglo’s been hit where it really hurts over the last 12 months.

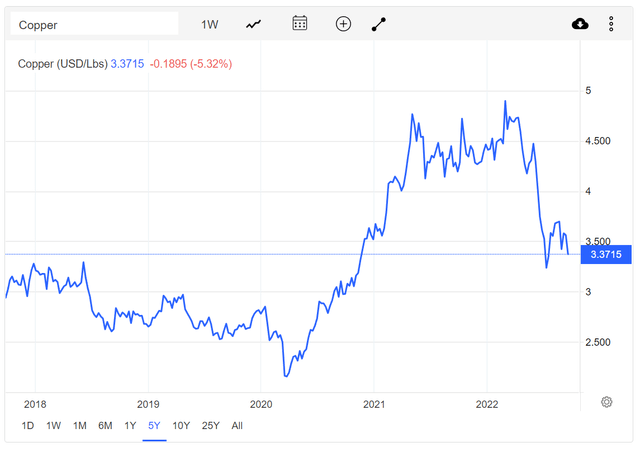

Where does that leave Anglo American investors? Copper was a big culprit in the declines, and all it takes is a look at the chart to see how powerfully its sensitivity was leveraged.

Copper Price (Tradingeconomics.com)

Declines were over 20% since 2021 levels. Copper accounts for a lot of Anglo’s EBITDA, about 20% of Anglo’s EBITDA, and we think that the copper markets will continue to trend upwards as the renewable agenda in Europe doesn’t seem to let up, being now pitched as an energy security solution as opposed to fossil fuels. Massive amounts of funds are being earmarked for electrification, and copper is intensively used in all aspects of the electrification supply-chain. Every type of renewable energy installation, with hydropower to a lesser extent, is using copper intensively. Its demand should continue as European utilities, but US utilities too, continue to grow renewable capacity undaunted by the economic environment. Indeed, while many blame the renewable agenda in Europe for the reliance on Russian supplies which may be shut off come winter, its economics still improve throughout this energy shortage, and the attractiveness of renewable energy investments are there, even without the extensive government support.

Likewise, the PGM division of Anglo, which accounts for another 25% of EBITDA or so, is also levered to the green agenda. Already in its current application in cars’ catalytic converters, but also in the potential future of hydrogen energy, PGMs are essential.

Finally, Anglo American does do commodity trading, and this division, while not separately reported, does benefit from commodity volatility which is likely to continue both on the up and downside as access issues to strategic materials and questions around the economy swirl. This provides some resilience too.

With a low trailing P/E of about 5.6x, and a yield at around 7.3%, Anglo Americans may consider to hold, especially if they believe that the geopolitical issues lengthen what might otherwise look like a late-cycle moment in commodity markets. That would render late-cycle multiples overly pessimistic, and an entry now attractive. With a reversion of the mean in volumes likely to help drive down unit costs, despite sticky-downward effects with labor forces that are protected in some of Anglo’s mining geographies in Africa, there is a case here for the company.

Be the first to comment