Chinnapong/iStock via Getty Images

Investment summary

From the Portfolio Manager’s desk

With more clarity around the pace of inflation providing a subtle calmness to broad equities, the question on how to position in speculative medtech is once again relevant to equity investors. There’s evidence to suggest growth will catch a bid before the end of the market cycle. There’s been evidence of multiple relief rallies as well, and there’s still numerous selective opportunities for managers to harvest alpha on the tactical side. Hence, we’ve begun to revisit our thesis on unprofitable medtech to understand our directional focus for the segment. Net-net, our posture remains unchanged in that we’re still looking to position against strong bottom-line fundamentals versus top-line growth [as had been the market’s trade for FY18-FY21].

With that, I’ve decided against reallocating any of our equity risk towards AngioDynamics, Inc. (NASDAQ:ANGO) with the view it will only add to equity beta and increase drawdown in the equity bucket. Valuations are unsupportive and when stripping back the company’s performance metrics, there’s a lack of tangible asset value we are buying in the name. With this, coupled with the points raised in this report, plus the remaining data pulled from my previous analysis on ANGO here, I reiterate the hold rating on ANGO.

Rates driven story

With the Fed [and central banks globally] committed to curbing the path of inflation, it remains a rates driven story in the unprofitable end of the medtech universe. With uptick in policy rates yields at the long end of the curve have curled up with force and are now at multi-year highs. The jump increases the discount rate and cost of capital, also increasing the WACC hurdle for most leveraged companies. In turn, the valuations for equities are compressed and this has seen a substantial de-rating of multiples in 2022.

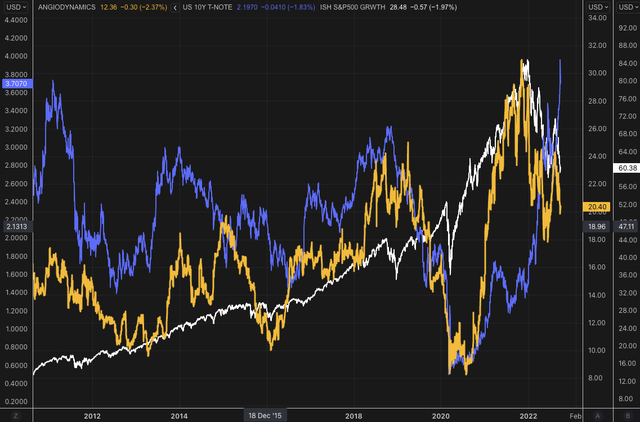

This is particularly important in the ANGO investment debate, most specifically the company’s inclusion in equity portfolios. Investors are ideally winding back equity duration in portfolios [and therefore sensitivity/exposure to rates]. This is counter-intuitive to allocating or sizing towards speculative growth like ANGO. Curiously, in the FY12-FY19 period, both ANGO and the 10-yr yield [what I’d benchmark as the discount rate used to calculate the equity risk premium] displayed a tight directional relationship, with high correlation and narrow dispersion, as seen in Exhibit 1.

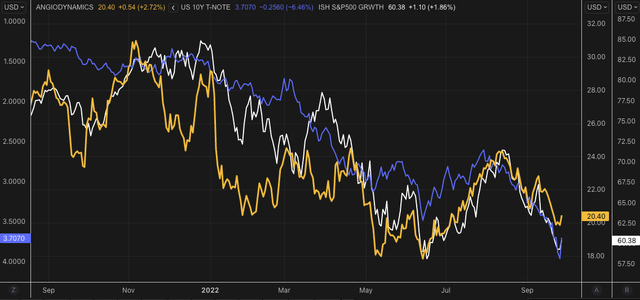

During the pandemic ‘era’, however [FY20-FY21], the inverse was true alongside the entire growth spectrum in equities, with the surge in yields to multi-year highs holding an ongoing causal relationship with the rating of the ANGO share price, as seen in Exhibit 2, where the 10-yr yield is inverted to illustrate the correlation effect. Note, it remains a rates driven story as mentioned, and until there is clarity on the path of the treasury yield curve and all of its derivatives, a rapid turnaround for ANGO seems path-dependant on the direction of US yields.

Exhibit 1. Long-term directional relationship between ANGO share price and US 10-yr yield from FY12-FY19 = tight, narrow dispersion

- This is one piece of data to suggest there was uncorrelated alpha to be obtained in ANGO over this period.

- There is an argument therefore that once policy & treasury rates normalize a factor rotation back toward growth in medtech.

Note: ANGO share price in YELLOW; US 10-yr Yield in PURPLE; SDPR SP500 Growth ETF in WHITE. (Data: HB Insights, Refinitiv Eikon)

Exhibit 2. Correlation in benchmark yields [inverted for visual effect] to ANGO share price [12-months to date].

- Supportive of the inverse covariance structure of growth-yields.

- This continues to drive the numbers for ANGO looking ahead.

Note: ANGO share price in YELLOW; US 10-yr Yield in PURPLE; SDPR SP500 Growth ETF in WHITE. (Data: HB Insights, Refinitiv Eikon)

This does, however, create an interesting debate looking ahead. Presuming one expects normalization of rates policy and therefore a wind-back in treasury yields, there is a strong case for a re-rating of the ANGO share price back to the upside. Shares are trading back at pre-pandemic levels, and are in-line with 5-year ranges, therefore the question of price targets is central to the debate looking ahead.

Deflationary tailwinds

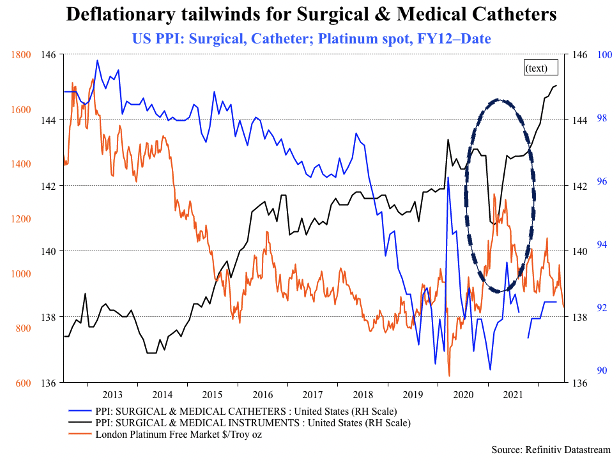

One key factor I believe has helped weigh in to preventing heavy downside for ANGO is the pricing impacts of platinum and iridium – 2 key raw materials used for manufacturing in the surgical and medical catheters segment. The two are combined as an alloy for its conductive and malleable properties, making it ideal for use in the electrophysical (“EP”) study domain.

However, as seen in Exhibit 3, platinum spot has continued its sharp descent of highs of US$1,302 since February FY21′. Tracking this price decompression has been the producer price index (“PPI”) for the surgical & medical catheters sector, which I believe to be partly driven by the wind-back in platinum spot prices. I noted this in my previous analysis on ANGO, and mentioned the following:

“A macro divergence has therefore emerged between these two instruments and the wider US surgical & medical instruments index since that time. Whereas cost-inputs for the wider segment ratchet up for the surgical/medical catheters section and platinum has bifurcated to the downside.”

With forex and cost inflation headwinds plaguing gross-net margins for companies this year, any idiosyncratic premia like this is worth paying attention to. The key numbers to watch will be the company’s margins from gross-net and see any change in working capital, operating cash flow and free cash flow.

Exhibit 3. Macro divergence in platinum, surgical catheters PPI, to medical devices inflation

- Deflationary tailwinds to gross-net margins.

- Question becomes what this means for ANGO in terms of FCF, return on invested capital and earnings.

Data: HB Insights [ANGO 12/07/2021], Refinitiv Datastream

Valuation and conclusion

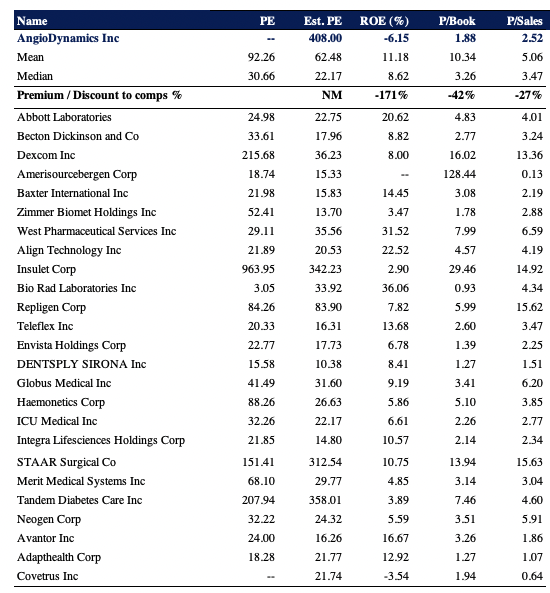

It then becomes a question of valuation for ANGO, and after careful examination, there’s a lack of compelling value on offer in my estimation. With a lack of earnings [historical, expected] to bite into, I’d look to free cash flow and return on capital as a deeper guide.

Yet, we’ve none of this on offer in ANGO. Despite the fact that shares trade at 1.88x book value – a 42% discount to peers – I’d also note that of the company’s balance sheet is heavily tilted toward intangible sources of value. Of its $552.75mm in total assets, 63.9% is comprised of goodwill and intangibles [36% from goodwill alone]. As such, 35.8% and 47.3% of ANGO’s book value is comprised of intangible assets and goodwill, respectively. Therefore, on a negative TTM ROE of 6.15% and 83% of book value sourced to non-tangible assets, trading at 1.8x book value suddenly looks far less appealing.

Exhibit 4. Multiples and comps – Whilst the 42% discount to book value vs. peers might seem attractive there’s less to like with more than 83% of shareholder equity from non-tangible value.

Data: HB Insights, Refinitiv Datastream

Net-net, I continue to believe ANGO is a hold and retain this recommendation from my previous analysis. Whilst there are idiosyncratic tailwinds beneficial to the company in its exposure to platinum [with price evolution of the metal continuing in a downtrend since Feb FY21′] this does not outweigh the lack of earnings quality and return on capital required to mitigate the impeding macroeconomic headwinds. With these points in mind, ANGO is a hold.

Be the first to comment