wildpixel/iStock via Getty Images

The off-calendar reporting cycle for AngioDynamics (NASDAQ:ANGO) gives investors a bit of a peek at what’s coming in the med-tech space, and it looks as though the sector-wide challenges from omicron have been manageable and that the market is on the way back to normalization. Of course, supply pressures are still very much a factor and it doesn’t look like there will be much relief in the near-term.

These shares have risen about 8% since my last update, with the post-earnings jump taking the share price performance above the average for the med-tech sector over that time. I find the improvement in AngioDynamics’ growth businesses to be encouraging, and I think the company’s focus on large markets that are still up for grabs can drive better and more consistent growth than what the company has managed in the past. Given momentum in the business and credible growth opportunities, I think this name is worth a closer look now.

Mixed Results, With Input Costs Still Taking A Bite

There were some positive takeaways from AngioDynamics’ fiscal third quarter, but the overall results were mixed and management basically held the line on guidance.

Revenue rose 4% year over year and fell 5% quarter over quarter, with the omicron variant once again leading to procedure deferrals at hospitals. Relative to expectations, AngioDynamics came in slightly below expectations (3%), but I would argue this is generally positive result for the larger med-tech space going into this earnings cycle. While I’m sure there will be some notable under/outperformances, on the whole I think the impact from omicron will be proven to be pretty well dialed-in by management and sell-side analysts.

AngioDynamics reported 29% growth in its faster-growing “Medical Technology” business (which made up 26% of revenue), while the Medical Device businesses declined about 3%.

Gross margin declined 190bp year over year and improved 40bp quarter over quarter, missing by about a point. In contrast to the revenue situation, this underlines my concern going into the quarter that the market may still be underestimating the impact of ongoing supply chain inflation – a situation that I think will linger longer than most sell-side models would suggest (I’m speaking on a sector-wide basis here, not ANGO-specific).

Adjusted EBITDA rose 24% year over year, while adjusted operating loss shrunk slightly from the year-ago period to $2.9M (I don’t exclude intangibles amortization as some analysts do). Comparisons of operating income to sell-side estimates are complicated by varying treatment of amortization and other items, but I can say that AngioDynamics underspent on R&D and SG&A relative to expectations.

The R&D undershoot could be down to the timing of clinical trial starts/enrollment. For SG&A, I don’t want to “under-credit” management for efficiency efforts, but I won’t dismiss the possibility that this cost line came in a little low as a by-product of the omicron surge.

Interesting Product Trends, With Good Growth From Important Growth Drivers

As I said above, the growth-oriented Medical Technology businesses grew 29% yoy this quarter, but also grew 4% qoq, which I find encouraging given the operating circumstances of the quarter.

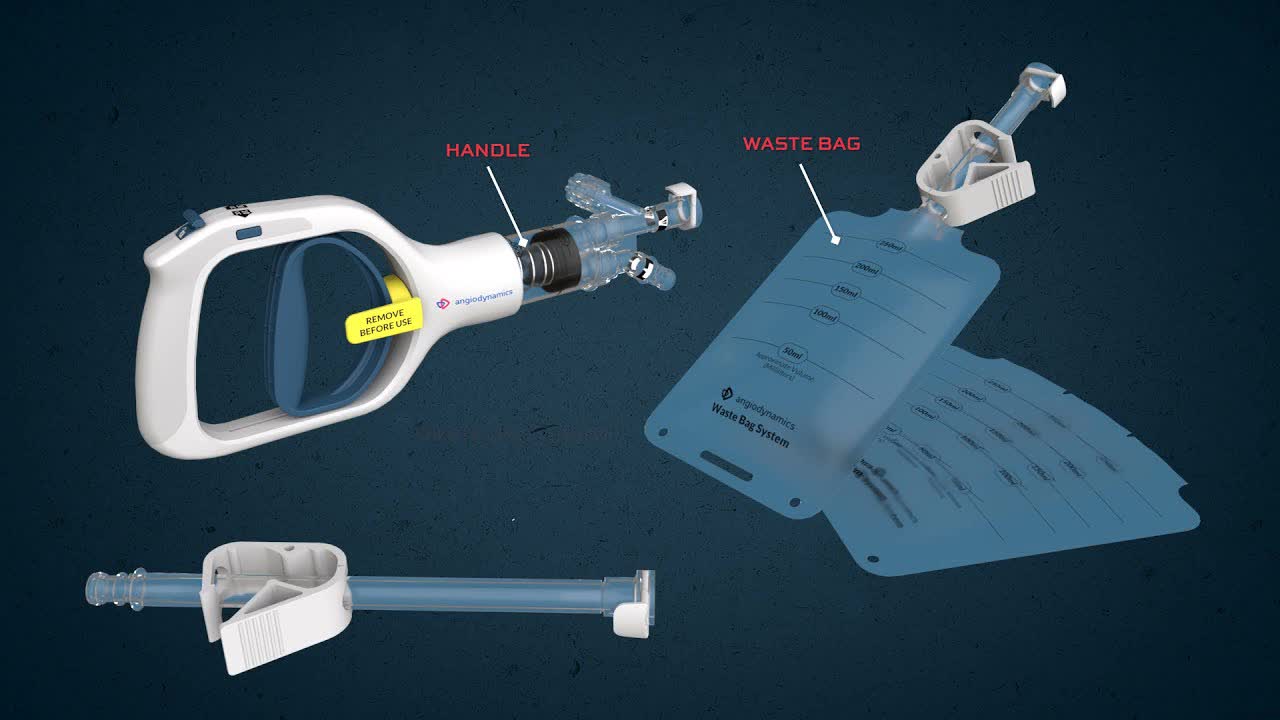

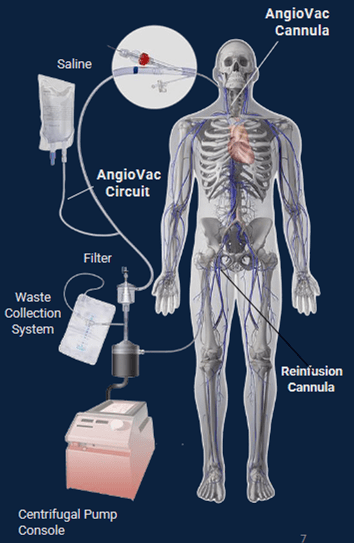

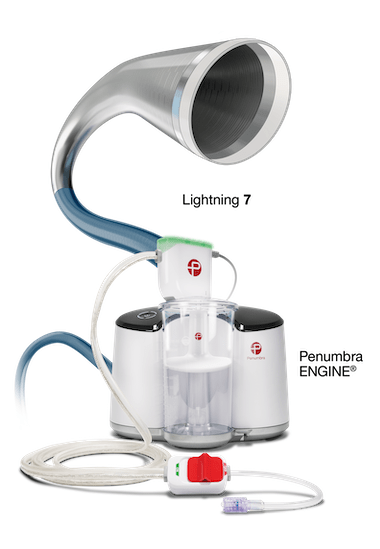

Mechanical thrombectomy (AngioVac and AlphaVac) were up 14% after 29% yoy growth in the prior quarter. That’s solid relative to the 31% growth in the vascular business at Penumbra (PEN), particularly given more limited FDA clearance for ANGO’s platform (not approved for pulmonary embolism, for instance).

AlphaVac (AngioDynamics)

AngioVac (AngioDynamics)

Penumbra

While this space is getting more competitive, including relatively recent market entries via M&A for Abbott (ABT) and Boston Scientific (BSX), this remains an attractive market with long-term addressable annual revenue in excess of $4 billion. I also note that the company got approval from the FDA to begin its IDE study of AlphaVac F18 in pulmonary embolism (APEX-AV), and the company expects to being enrollment in the second half of calendar 2022.

I was also impressed by the 117% yoy and 16% qoq growth in the Auryon business (laser atherectomy). Market growth is challenging to assess given the fact that many peripheral atherectomy businesses are buried within larger med-tech companies (including Medtronic (MDT) and Philips (PHG)), but based on my research across the space, Auryon appears to be growing well ahead of the low-double-digit industry growth rate and taking share. Management has been cagey about revenue/procedure breakouts, but it sounds as though in-stent restenosis has been a particularly good market for them.

NanoKnife had a more mixed performance, with capital sales down 32%, but probes (which are driven by procedure volumes) up 11%. If you have to pick one or the other, probe growth is what you’d prefer to see. As a reminder, future adoption/growth of this business is largely gated by clinical trials that are underway, including studies in pancreatic and prostate cancer.

One negative item worth watching was the weak performance (down almost 6%) of the Access business, including double-digit declines in midlines and dialysis and flat performance in PICCs. This too is difficult to corroborate with other competitors, as it’s a part of much larger businesses at Becton Dickinson (BDX) and Teleflex (TFX), but it is worth monitoring as it is still a meaningful business for AngioDynamics and was weaker than I’d expected.

The Outlook

Given the performance this quarter and management’s maintenance of guidance, there shouldn’t be significant changes to the outlook. I don’t think the lower opex will necessarily be repeatable, and I was already lower than the Street on gross margin given my more conservative outlook on cost pressures in 2022. That said, I’m becoming more bullish on the prospects for their growth businesses, particularly Auryon and AngioVac/AlphaVac. These are large addressable markets and while there are large players in the atherectomy space, and large players entering thrombectomy, nobody has yet developed a solution good enough to close the door on competitive entries.

I’ve increased my revenue expectations on the basis of those growth drivers. It’s not a major change, but it does lift my three-year revenue growth rate to almost 8% and my 10-year growth rate to 6%. My margin assumptions improve slightly given improved scale/leverage from that higher revenue base, though I do believe the company will need to continue to spend to support their growth platforms.

The Bottom Line

With a higher revenue growth rate and good results from the growth-driving businesses, I think a 4x forward revenue multiple is reasonable now, and that supports a fair value of close to $33 based on my 12-month revenue estimate.

That’s not a trivial jump from my prior estimate of $29 (on a 3.5x multiple), and there is certainly a risk that the company won’t live up to my growth expectations (and/or that the market won’t reward that growth with the multiple I expect). Still, given management’s ability to deliver on these growth opportunities so far, this name is becoming more interesting to me as an underrated and under-followed med-tech turnaround/growth story.

Be the first to comment