jetcityimage/iStock Editorial via Getty Images

Angi (NASDAQ:ANGI) which is a business formed by IAC Inc (IAC) as a merger between HomeAdvisors and Angie’s List, and operates those two directories/marketplaces for home service professionals to offer their services. There should be some sign of cyclicality in at least the rate of growth, although the trajectory of the business’ growth is likely to produce growth regardless. There’s some declines in marginality, both on the gross margin and operating margin level on the side of the business that isn’t doing intermediation and platform economics, but since the business is characterized by demand side economics, margin compression is a small sacrifice in the pursuit of scale. Moreover, based on some comps with other businesses, less profitable ones at that, that work on demand side economics, we think Angi’s looks cheap. Naturally, volatility could come as expectations may be attacked and revised with the oncoming recession, but overall the company appears to becoming cheap.

Quick Q2 Look

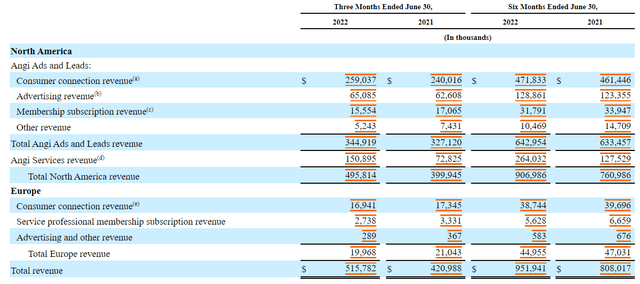

The breakdown on the 10-Q looks a little like this:

Segment Revenues (10-Q Q2 2022)

The Angi’s ads and leads revenue which comes from selling ad space as well as matching businesses on the directory with customers grew nicely at about 10% on a three-month basis YoY. The growth was similar in absolute terms but less in percentage terms for the six months. 2021 was a strong year in terms of home improvement activity, so especially tough comps are important to consider for the growth rate. Also we note a fall in membership subscription revenues. Being a member is most economical for those with plans to do a lot of home improvement because it gives savings on a per engagement basis in exchange for offering up a fixed cash flow stream. These declines signal the declines in consumer confidence, while Angi is still able to collect new customers with the current rate of marketing efforts.

The real push has come from Angi services revenue, which comes from business that customers buy directly from Angi, not the affiliates in the directory. 6% of overall revenue comes from the roofing business and this would fall under this part of the revenue mix. On balance, this has grown by more than 2x, and this growth in the mix also has been a driver of the much higher COGS and lower gross margins, since these businesses generate COGS in the form of materials costs and are not part of the intermediation business. Apparently the company also is pricing aggressively and a little irrationally in this segment to win share. Weird thing to do given it affects its affiliates negatively, and also when materials costs are such a problem. But the need to achieve scale to make the platform more valuable does justify it to some degree, although we think sticking to intermediation would be better especially with how fragmented home services markets are as it is.

European revenue is pretty marginal, and it declined slightly, but still the overall revenue picture was mostly toward to 25% in YoY growth in revenues. Net losses declined about 20% and of course net margins improved to -5% as of now. On a six-month basis the effects were the opposite direction, with losses doubling due to higher COGS in particular, which almost doubled, but also higher SG&A. The gross margin declines were driven in part by higher costs for contracting, which should have been offset by higher pricing to the end consumer, so the majority of the gross margin declines are likely coming from Angi’s direct roofing business, which accounts for about 6% of the company’s total revenue. Loss in scale there as well as higher material costs were likely a substantial pressure.

Macro Considerations

The issue is the ads market in general. It’s definitely decelerating – we’re even seeing it with Google (GOOG) (GOOGL), which we actually predicted some months ago. The Angi ads and leads are sold on a less generalized basis, i.e. only to businesses and individuals in the industry of home service, but the same issues apply coming from macroeconomic slowdown. Home services in particular are seeing strong comps as it is, with home improvement having been a fervid market in 2021 as people looked toward their homes. Those revenues are decelerating a bit, and if it wasn’t for the launch of new products and services directed at Angi customers the revenue growth would have been more alarming.

We believe growth will still be maintained, but there will be pressure as demand destruction and higher rates pass through the economy. Angi is likely to reach profitability past Q4 of this year, and management reiterated that expectation in the last earnings call despite the growing chorus of analysts questioning the market for generating leads and business.

Cyclicality is going to be more pronounced in the roofing business, which generates about 6% of overall revenue on a run-rate basis. Some of this revenue is in renovation, but without actual leaks this is still a discretionary business. Pressures on scale and pricing in an environment where raw material costs are high is not such a great thing, and we don’t like that Angi is affecting the value of its platform by becoming (possibly privileged) competition to its affiliates.

Bottom Line

There are going to be pressures on Angi just like any other business, but Angi isn’t currently at valuations that necessarily imply such high growth expectations. Angi trades at a 0.63x P/S ratio which is rather low given firstly the growth rates and secondly the demand side economics of the business. Harsher macro conditions impact the returns to demand side economics, but network effects are probably the most valuable lever any business can have. The more affiliated home service businesses on the platform, the more beneficial to the consumer, and therefore the better the value proposition and the more consumer contact for home service businesses paying for intermediation. Other platform-based businesses like Udemy (UDMY) trade at a 2x P/S. About 30% of the revenue is not in intermediation and platform economics type businesses, but even giving that proportion a 0x multiple, the Angi multiple seems to be undervaluing the part that does benefit from network effects. Angi looks attractive at these levels even considering that slowdowns are coming. The 70% YTD declines seem to account for that.

Be the first to comment