Claude Laprise/iStock via Getty Images

It’s been a rough year thus far for investors in the Gold Miners Index (GDX), with the ETF suffering a more than 30% drawdown, extending its bear market decline to 52% from Q3 2020. It’s declines of this magnitude that open up the best buying opportunities for patient investors, but the key is to focus on quality. This means buying the best businesses at the cheapest price possible, not simply looking for those with the most upside that also carry the highest risk. The latter strategy can lead to massive drawdowns in one’s portfolio during relatively shallow bear markets for gold, with names like Pure Gold Mining (OTCPK:LRTNF), Argonaut Gold (OTCPK:ARNGF), and Great Panther (OTC:GPLDF) being huge disappointments for shareholders.

The good news is that the combination of technical damage and the duration of this bear market in gold miners has pushed sentiment to the worst levels I’ve seen since 2015, with true bear markets requiring adequate time and price to eradicate bullish sentiment. The other good news is that the indiscriminate selling has left some of the best companies on the sale rack, and Agnico Eagle (NYSE:AEM) is one clear example, trading at just ~8.3x FY2022 cash flow estimates and less than 1.0x P/NAV. Based on what I believe to be a fair value of US$70.00+ per share [18-month price target], I would view any weakness in the stock as a buying opportunity.

Agnico Eagle Underground Operations (Company Presentation)

Q3 Production & Sales

Agnico Eagle released its Q3 results this week, reporting quarterly production of ~816,800 ounces, a significant increase from the year-ago period following its merger of equals. This has pushed year-to-date production to ~2.48 million ounces (1.58 million ounces in the year-ago period), representing 57% growth year-over-year. Not surprisingly, this has led to a sharp increase in revenue, with revenue increasing to ~$1.45 billion in Q3 2022 and $4.36 billion year-to-date. However, the production statistics are just one highlight, with several others worth discussing. Let’s take a closer look below:

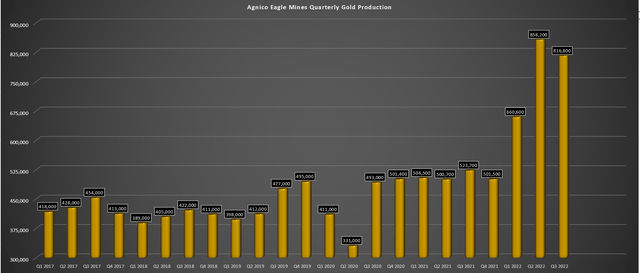

Agnico Eagle – Quarterly Gold Production (Company Filings, Author’s Chart)

As shown in the chart above, Agnico Eagle has continued to see steady growth in gold production and gold production per share, with the most recent leg higher in production helped by a merger of equals with Kirkland Lake Gold completed earlier this year. The company’s strong performance in the first nine months of the year despite a challenging environment (labor tightness, supply chain headwinds) has placed it well on track to meet its annual guidance of 3.2 to 3.4 million ounces, and more importantly, the company has maintained its cost guidance, a testament to its cost controls and the benefit of merger synergies plus a weaker Canadian Dollar, with most other miners having to revise their cost guidance higher due to inflationary pressures.

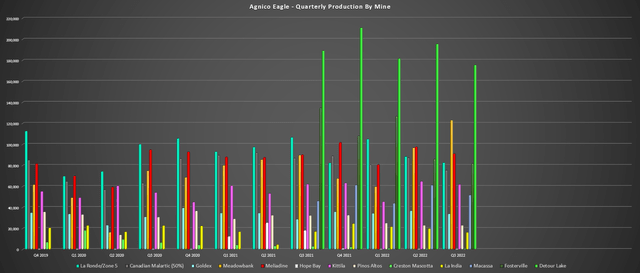

Agnico Eagle – Quarterly Production by Mine (Company Filings, Author’s Chart)

Digging into the mine-by-mine performance, Meadowbank was the star performer in Q3, producing ~123,000 ounces of gold as commercial production was declared at Amaruq Underground on schedule and budget on August 1st, 2022. This provided a significant lift in head grades to 4.11 grams per tonne of gold, and combined with higher throughput; we saw a 33,000+ ounce increase in production year-over-year. Notably, Agnico enjoyed another quarter of positive grade reconciliation from Amaruq in the IVR and Whale Tail open pits (we saw grade outperformance in these deposits in Q2 as well), providing some upside to the production profile. Notably, this performance was achieved despite extended commissions of the high-pressure grinding rolls, with higher throughput expected in Q4.

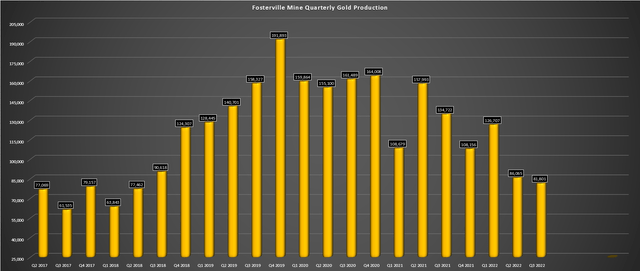

Moving to Macassa and Fosterville, these high-grade mines combined for a total production of ~133,600 ounces. Macassa produced ~51,800 ounces and benefited from higher productivity with the improved ventilation related to the #4 Shaft connection lowering temperatures in the mine and allowing for increased usage of diesel trucks to supplement the battery electric fleet. During the quarter, Macassa processed ~75,000 tonnes at 21.9 grams per tonne of gold, up from ~76,600 tonnes at 19.1 grams per tonne of gold in the year-ago period. At Fosterville, production was down sharply, but this was largely expected due to very difficult comps due to the significant grade outperformance in Q3 2021. Still, despite much lower production, the mine enjoyed industry-leading cash costs of $435/oz.

Fosterville Quarterly Production (Company Filings, Author’s Chart)

Looking at LaRonde and Canadian Malartic, these two large Canadian assets combined for production of ~157,900 ounces, a sharp decline from the year-ago period (~193,500 ounces). This was to be expected with planned lower throughput at Canadian Malartic (51,500 tonnes per day) to optimize cash flows as the asset transitions to processing ore from underground before returning the mill to full capacity of 60,000 tonnes per day in H2 2024. At LaRonde, the mine was up against very difficult year-over-year comps, with the operation having its best quarter since Q4 2019 in Q3 2021 due to higher gold grades. During Q3 2022, we saw lower grades and throughput due to a change in the mining sequencing and a delay in lateral development (additional ground control requirements at East Mine and revised seismic protocols).

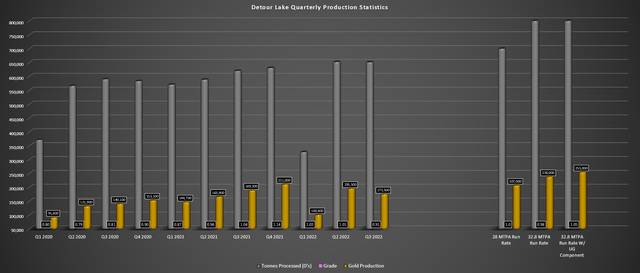

Finally, moving over to Agnico’s largest operation, Detour Lake, the mine had another phenomenal quarter. During Q3, we saw a throughput of ~6.51 million tonnes at an average grade of 0.91 grams per tonne of gold, resulting in ~175,500 ounces being produced. While this was down on a year-over-year basis, this was solely due to difficult year-over-year comps related to higher grades processed in Q3 2021 (1.04 grams per tonne of gold). Notably, despite the inflationary pressures, especially from a fuel standpoint from this massive operation, cash costs came in at industry-leading levels of $691/oz, or $650/oz year-to-date, representing a cash margin of $1,100/oz at a $1,750/oz gold price.

Detour Gold – Quarterly Production Statistics & Future Potential (Company Filings, Author’s Chart)

While the production results were solid, with year-to-date production at this asset of ~552,800 ounces, the progress on key projects is also worth noting. In the prepared remarks, Agnico noted that it’s seeing continued progress on its path to increasing throughput to 28 million tonnes per annum, with the screen before the secondary crusher (line two) completed in August, resulting in average daily throughput of 3,515 tonnes per hour or the equivalent of 28 million tonnes for September. The line one screen installation is set to be complete in Q4, and “the focus will be on maximizing daily throughput levels”.

Previously, the outlook was that Detour Lake would be able to ramp up to 28 million tonnes per annum (85% of permitted capacity) by 2025 with several initiatives, but Agnico now believes that a mill throughput of 28.0 million tonnes per annum could be reached before 2025, and there’s the potential to see a further increase above this level. This is a big deal, as the above chart highlights, with ~28.0 million tonnes per annum pushing production closer to 830,000 ounces per year at a 1.0 gram per tonne head grade. Also noteworthy is that an upgrade of the 230kV main substation is planned for 2024 to improve the site for potential future power expansion, including looking at trolley-assist mine haulage to help reduce diesel fuel usage by substituting for electricity during the most demanding portion of the truck work cycle.

Agnico Eagle Operations (Company Presentation)

Overall, from a production standpoint, Agnico’s operating performance in Q3 was solid, and the company is in a comfortable position to come in near the mid-point of its guidance at ~3.30 million ounces in 2022. However, as noted previously, it’s the progress across the board that is the most exciting, and the production results alone don’t do enough justice to the exceptional performance of the company and all its team members across all facets in the challenging environment.

Exploration & Development

Beginning with exploration, there were several highlights worth pointing out:

Detour Lake: Wide mineralized zones continue to be intersected adjacent to the current open pit in the West Pit extension, with more high-grade intercepts over 1,900 meters west of the pit. This points to significant resource growth and underground potential, which could help to augment head grades later this decade.

Odyssey (Canadian Malartic): Odyssey South continues to deliver high-grade intercepts, and drilling in the core of East Gouldie is also yielding very high-grade results. Finally, step-out drilling filling in the gap between East Gouldie and Norrie continues to be successful, with 12.8 meters of 4.2 grams per tonne of gold following up on the previous thick intercept of 1.8+ grams per tonne of gold over 63 meters gold west of East Gouldie. This also points to further resource expansion and a mine life that will likely extend into the 2050s, even if the CM Partnership chooses to sink a second shaft to pull ounces forward.

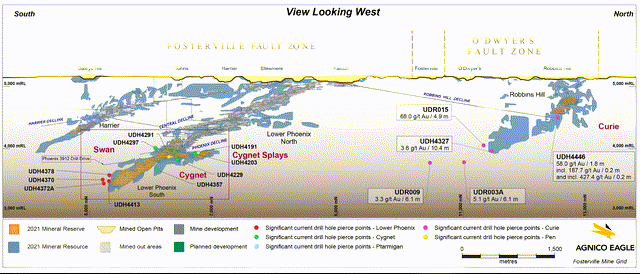

Fosterville: Step-out drilling hit 1.1 meters at 365.5 grams per tonne of gold and 1.4 meters at 226.2 grams per tonne of gold in the Cardinal Fault, which is a hanging wall splay of the Lower Phoenix mineralization. In addition, Agnico intersected 10.6 meters at 14.6 grams per tonne of gold and 21.9 meters at 5.5 grams per tonne of gold 150 meters down-plunge from Lower Phoenix reserves. Finally, step-out drilling at Robbins Hill hit sulfide-hosted gold mineralization 2.5 kilometers down plunge from Curie mineral reserves with 3.8 meters at 5.6 grams per tonne of gold. These results are encouraging, suggesting the potential for continued resource and reserve growth at Fosterville at 10.0+ gram per tonne grades.

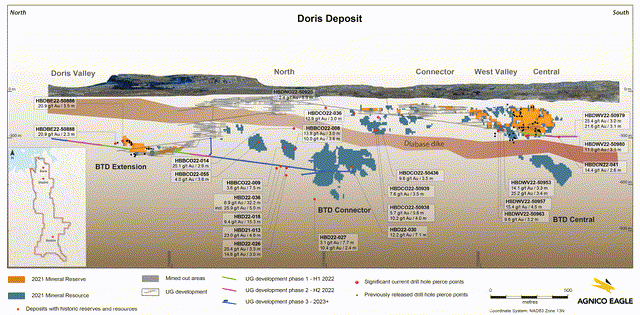

Hope Bay: Recent results continue to confirm and extend mineralization at depth, with the team hitting thick intercepts of 15.8 meters at 7.3 grams per tonne of gold (west of BTD Connector Area) and 4.5 meters at 19.6 grams per tonne of gold. At Boston, camp refurbishment is complete, setting up this high-grade deposit for drilling in 2023. Overall, I see continued exploration success at Hope Bay as positive, with a high likelihood that Agnico will restart this operation and add 300,000 ounces to its production profile later this decade at a permitted operation with existing infrastructure.

Fosterville Mine & Robbins Hill (Company Presentation) Hope Bay – Doris Deposit (Company Presentation)

From a development standpoint, Odyssey remains on schedule, with shaft sinking set to begin in early 2023 and the initial production from Odyssey South expected in March next year. At Macassa, the commissioning of the #4 Shaft is expected in December 2022, and the exploration ramp into the AK deposit was completed this quarter with the potential for ore from AK to be fed to the Macassa mill in 2024. Meanwhile, Agnico continues to work on engineering for an exploration shaft at Upper Beaver and is looking at the potential to leverage existing infrastructure in the Kirkland Lake Camp to reduce capital expenditures for Upper Beaver.

From a synergy standpoint, corporate G&A synergies were realized at a higher and brisker pace than previously anticipated, with the $50 million in annual savings mostly realized for 2022. Agnico expects corporate synergies of ~$225 million in the first five years and $425 million over the first ten years post-merger and expects that it could see operational synergies of $1.1 billion in the first ten years. These synergies and the amalgamation of Agnico and Kirkland make it stand out in the sector, given that it can claw back some of its lost margins due to inflationary pressures through these realized synergies vs. peers struggling to find ways to reduce costs meaningfully. Finally, the company is working on improved budgeting and costing, hoping to deliver $30 million in operating savings per year by 2026.

Financial Results

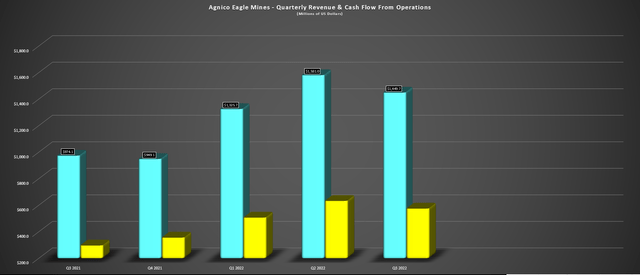

Moving to the financial results, Agnico Eagle reported revenue of ~$1.45 billion in the quarter, up from $983.8 million in the year-ago period. The sharp increase in revenue was driven by higher sales volume (ounces of gold sold) but partially offset by a lower average realized gold price of $1,726/oz in Q3 2022. Meanwhile, cash flow from operations came in at $575.4 million and $1.72 billion year-to-date, up from $1.08 billion in the first nine months of 2021. Given the inflationary pressures that the company called out on fuel, steel, and cyanide, among other things, the financial performance was solid, and I would expect better performance next year with all-in-sustaining costs likely to dip below $1,025/oz, down from a range of $1,000 to $1,050/oz this year.

Agnico Eagle – Quarterly Revenue & Cash Flow From Operations (Company Filings, Author’s Chart)

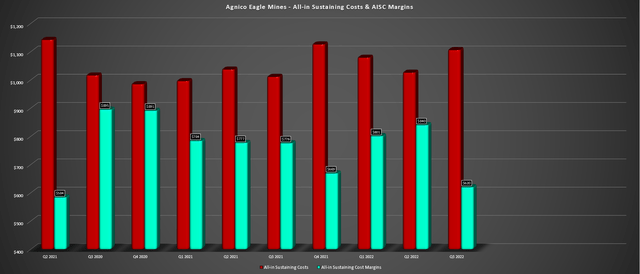

Looking at Agnico’s costs and margins, we saw cash costs up less than 1% year-over-year to $784/oz (Q3 2021: $779/oz), while all-in-sustaining costs came in at $1,106/oz, but is sitting much lower at just $1,067/oz year-to-date. The higher all-in-sustaining costs [AISC] in Q3 and year-to-date were related to lower by-product revenue, higher sustaining capital expenditures, and inflationary pressures. However, Agnico has maintained its original guidance but guided towards the top end (unlike some of its peers that had to pull cost guidance substantially higher), evidence of the company continuing to be conservative and delivering on promises even in unprecedentedly challenging environments.

Despite the lower gold price ($1,726/oz) and higher costs, Agnico reported a very respectable AISC margin figure of $620/oz and should report AISC margins of $730/oz, assuming an average realized gold price of $1,780/oz for FY2022. This would represent industry-leading AISC margins of ~41%, with the potential to hold the line on these margins in FY2023, even with a slightly lower gold price assumption of $1,760/oz due to a decline in costs year-over-year (more favorable exchange rates, some moderation in inflationary pressures). That said, Agnico did note that it’s seeing positive signs related to supply chain and fuel prices; pressures could persist into Q4 and 2023.

Agnico Eagle – All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

Finally, from a balance sheet standpoint, Agnico repaid $100 million on its 4.87% senior notes with cash to reduce its net debt to ~$520 million and repurchased ~1.0 million shares for $42.6 million in the quarter. Since announcing its NCIB, the company has repurchased $65 million in shares at an average cost of ~$44.70 and has room to repurchase another 21+ million shares or over 4% of its float based on its current buyback program. Given the significant undervaluation in the share price, I would have preferred to see more share buybacks, but this is to be used opportunistically, and I can understand the choice to balance capital between paying down debt and share repurchases.

Valuation

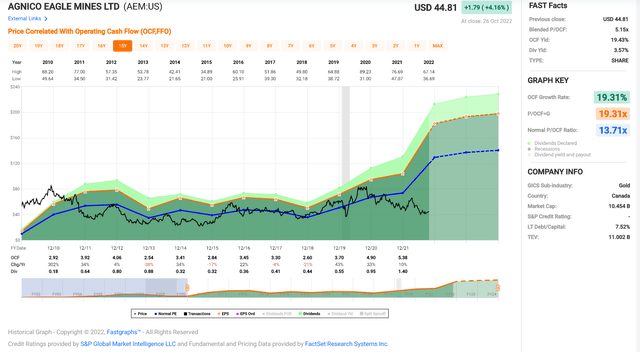

Looking at the chart below, we can see that Agnico Eagle has historically traded at ~13.7x cash flow (15-year average), with a slightly higher average cash flow multiple of 13.9x over the past five years. Given that the company has grown in scale, added three world-class mines (Detour, Fosterville, Macassa) and seen improved diversification, and improved its cost/jurisdictional profile with its merger, I think it can easily command this premium multiple and multiple expansion and I would argue that a cash flow multiple of 14.0x is not unreasonable at all. However, to be conservative in a turbulent market environment, I believe it’s best to use a fair multiple of 13.0x, representing a 5% discount to its 5-year average.

Agnico Eagle Mines – Historical Multiple (FASTGraphs.com)

Based on FY2022 cash flow per share estimates of $5.40 and a fair multiple of 13.0x, Agnico Eagle’s fair value comes in at US$70.20, representing a 58% upside from current levels. This price target (US$70.00+) is corroborated on a P/NAV basis, with an estimated net asset value of $23.2 billion and a P/NAV multiple of 1.50x, translating to a fair value of US$76.60. So, no matter how you slice it, Agnico Eagle remains very undervalued even after its recent rally, and I see a 63% upside to fair value on a blended basis (60% weight to price target based on cash flow estimates, 40% to net asset value price target), resulting in a price target of US$72.75. This return is higher on a total return basis, with Agnico returning ~5.0% to shareholders from dividends (3.6% yield) and opportunistic share buybacks.

Summary

Occasionally there are significant disconnects between the fundamentals of a business and where it trades in the market, and this couldn’t be more true for Agnico Eagle today. However, while a valuation disconnect can be an opportunity, the most important consideration for purchasing a stock for an investment is not just how cheap it is but the quality of this business. In Agnico’s case, this is a company that stands head and shoulders above its peers from a production growth per share standpoint and operates some of the best mines globally at ~40% AISC margins in the safest jurisdictions with a glowing safety record for its workers. In fact, Q3 2022 was the best quarter from a safety standpoint in the company’s 60-year history.

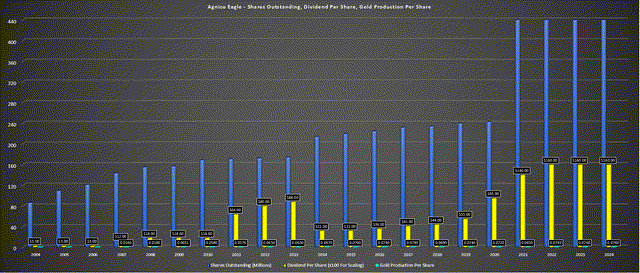

Agnico Eagle – Production Growth Per Share, Dividend Per Share, Shares Outstanding (Company Filings, Author’s Chart)

This quality business model is further evidenced by the above chart, highlighting that not only has Agnico Eagle steadily grown production per share (which is the only type of production growth that matters), but it’s also seen its annual dividend increase at a 24% compound annual growth rate (2004-2022) – an incredible feat for a stock in a cyclical sector. In fact, this growth rate is in line with Apple (AAPL) and Starbucks (SBUX). So, while gold producers may not make great investments historically, I see Agnico Eagle as a clear outlier and a name that can be accumulated cheaply and tucked away in one’s portfolio to provide diversification. I am overweight AEM currently, but if we were to see a pullback, I would strongly consider adding to my position.

Be the first to comment