PM Images

Andvari Adds Adobe, Subtracts Visa and Liberty Broadband

“Watching the tape or watching the wheel – what is the difference morally?” 1912 illustration by Will Crawford.

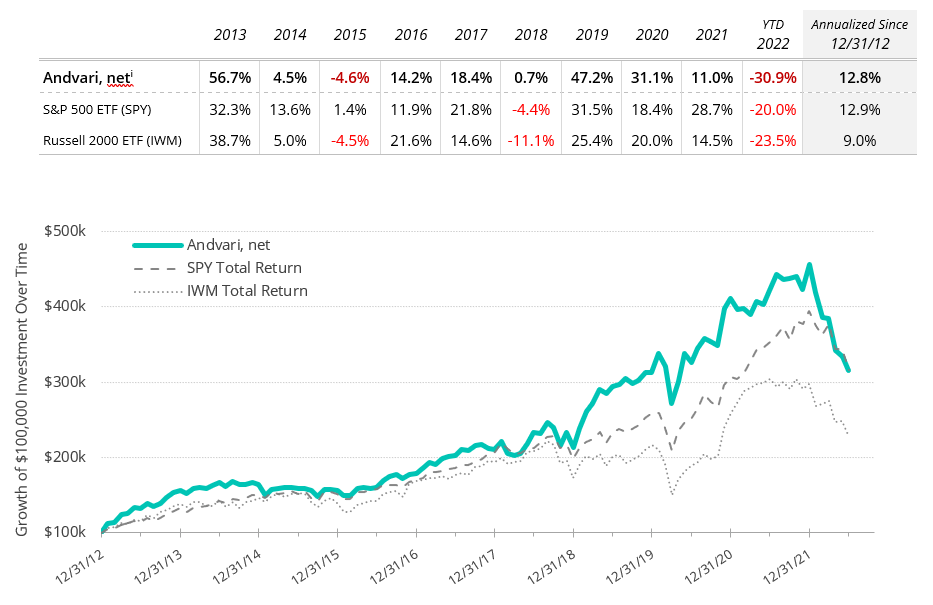

For the first six months of 2022 Andvari was down 30.9% net of fees while the SPDR S&P 500 ETF was down 20.0%.*

The table below shows Andvari’s composite performance against two benchmarks while the chart shows the cumulative gains of $100,000 investments.

ANDVARI HOLDINGS

Activity within accounts managed by Andvari was higher than normal this quarter. We sold out of Visa (V) and Liberty Broadband (LBRDK). We sold Visa because the combined position of Visa and Mastercard (MA) had become quite significant. Given the large combined investment, and our preference for Mastercard, we reduced exposure to the card networks by selling Visa.

Regarding Liberty Broadband, Andvari has owned it for the last 7+ years primarily because of its large stake in cable company Charter Communications (CHTR). Given that Liberty also traded at a wide discount to its own net asset value, Andvari saw this as an even cheaper way to own Charter. We sold Liberty because we saw (too slowly) a violation of one of the core parts to our investment thesis: pricing power at Charter was not as great as we imagined. Charter has not been able to raise prices in line with inflation. To add insult to injury, the trade association for the U.S. cable industry started proudly advertising about how internet price increases have remained far behind the rate of inflation.

We added to our positions in other current holdings and we also started a new position in a company we have known for decades: Adobe Inc.

ADOBE

Adobe is a software company that has been around for nearly 40 years. We are intimately familiar with the company. Andvari’s own founder and Chief Investment Officer started using Adobe products over 25 years ago. Adobe is also one of several companies featured in an Andvari white paper about business lessons learned from the evolution of the desktop publishing software industry.

There are many reasons why Adobe is a high quality company, but let’s first outline what the company does. The company divides its offerings into two groups: Digital Media and Digital Experience. The Digital Media segment contains the products with which most people are familiar, such as Photoshop for photo editing, Illustrator for digital illustrators, and Acrobat for creation, editing and signing of documents in Adobe’s own ubiquitous PDF file format.

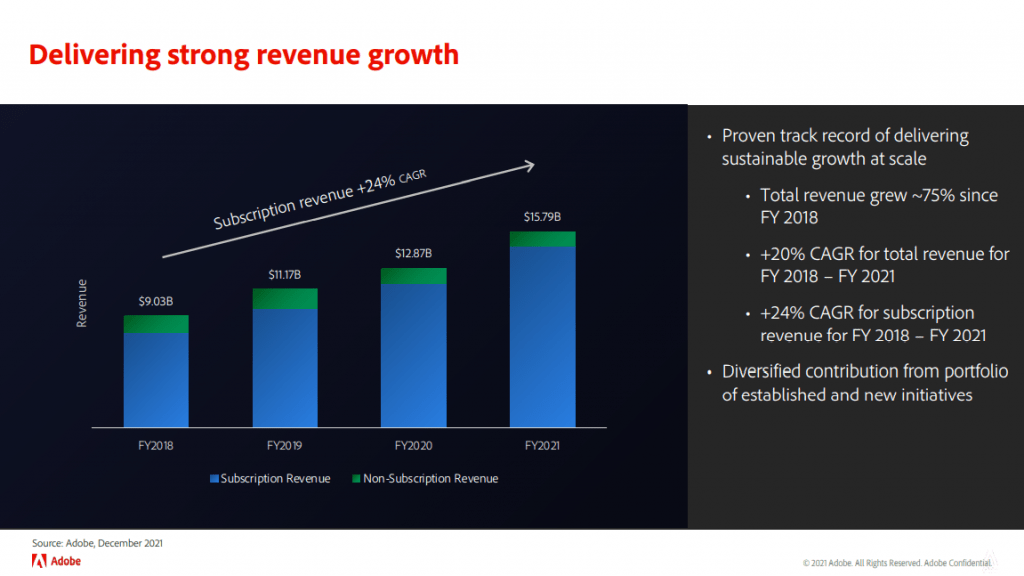

Source: Adobe

Adobe’s Digital Experience segment is the smaller of the two and thus the one with greater potential. Digital Experience offers software applications that enable large enterprises to manage, execute, measure, monetize and optimize customer experiences across different sales channels and different devices. Companies like BMW, Nike, Prada, Verizon and Walgreens are Digital Experience customers.

Andvari admires how most of Adobe’s tools in Digital Media have market shares exceeding 90%. The content creation industry has standardized on Adobe products and thus the cost to switch to a competing product is extremely high. Content creators have spent their entire careers using Adobe products. The time to learn the ins and outs of another piece of software, and the loss in productivity that would result in doing so, prohibits the creative professional from switching. On the Digital Experience side, we believe Adobe has dominant and growing share when it comes mid-sized and large enterprises. Switching costs are also high.

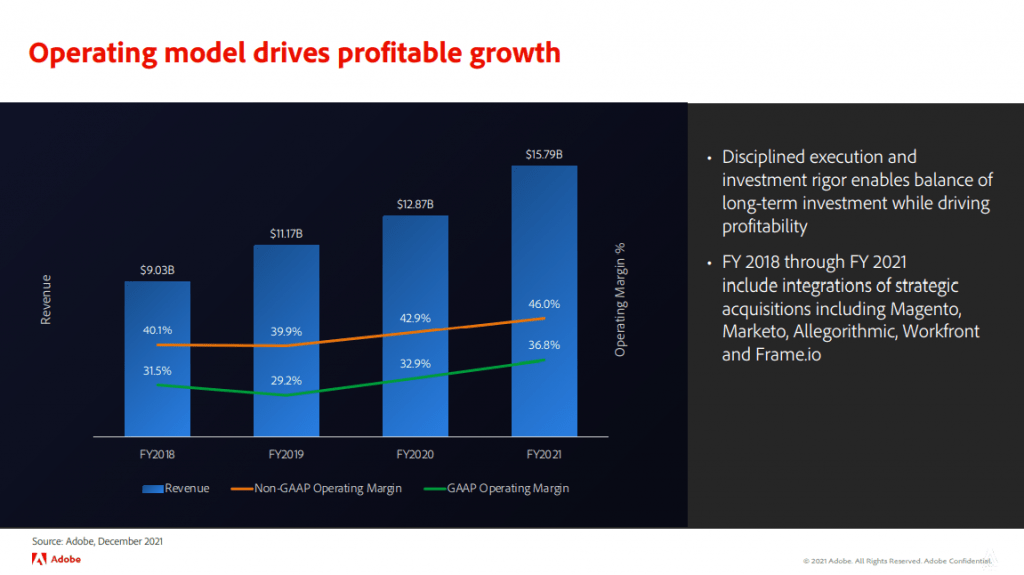

Source: Adobe

Adobe has even more attractive attributes. There is little to no customer concentration. This contributes to Adobe’s ability to raise prices and maintain high margins because there is no customer large enough to negotiate significantly on pricing. Next, regulatory risk is decidedly less compared to our former investment in Liberty Broadband. The cable and telecom industry has always faced extraordinary scrutiny from the Federal Communications Commission, Justice Department, and Congress. To our knowledge, no executive at Adobe has been hauled in front of a Congressional committee to be grilled about charging excessive prices for Photoshop.

Finally, Adobe’s financial profile is outstanding. Total annual revenues will be ~$17.7 billion this year and subscription-based revenues make up 90%+ of that. Revenues have been growing at mid-teens in recent years and will likely continue at low double-digit rates. Margins are high, working capital is negative, and annual capital expenditures are very low at 2%–3% of revenues. Free cash flows are copious and Adobe has returned 57%–68% of them to shareholders in the form of share repurchases over the last three fiscal years.

ANDVARI TAKEAWAY

“I won’t argue that it wasn’t a no-holds-barred adrenaline-fueled thrill-ride, but there’s no way that you could perpetrate that amount of carnage and mayhem and not incur a considerable amount of paperwork.”

– Nicholas Angel (played by Simon Pegg) in the film Hot Fuzz after watching the film Point Break

“How can you tell if you’re drunk if you’re never sober?”

– Andrew Knightley (played by Nick Frost) in The World’s End

If an investor wasn’t already a fan of Simon Pegg and Edgar Wright, they’d probably think the above quotes aptly refer to fiscal and monetary policy since the Great Financial Crisis of 2008. Perhaps even more apt descriptions of just the past two and half years. Congress and the Federal Reserve have enabled a “no-holds-barred adrenaline-fueled thrill ride” by providing huge amounts of stimulus for an extended period of time. Thus, it is perfectly understandable why some investors might have believed high inflation (and high interest rates) to be a thing of the past. Perhaps even more understandable why young investors may have believed inflation to be a mythical creature inhabiting a tale told by the “olds” and the “boomers.”

It only took a confluence of events—many related to COVID and then Russia’s invasion of Ukraine—to remind us all that inflation is not a mythical creature, but indeed a real beast that can ravage the economy. With inflation rates reaching heights not seen since the early 1980s, there is now a “considerable amount” of work needed to remedy the situation. Most notably, the Federal Reserve this year started raising short-term interest rates from zero to now 1.25%, which could then go towards 4% by year-end. This is why so many fast-growing companies have declined 40% or more from their recent all-time highs. This is why we’re either already in a recession or why we’re likely heading into a recession.

All this said, we remind you that Andvari’s expertise is in analyzing and investing in individual businesses. We are unskilled at analyzing the economy and its multitude of data points (constantly changing) and how those in turn might (or might not) impact current and potential investments. Our goal is to invest in quality companies with long runways to invest their cash flows at rates well above their cost of capital. Attempts to scry the future by reading economic tea leaves is beyond Andvari’s ken.

Instead, we believe it is much better to allow the beneficial effects of compounding to endure for as long as possible by following the advice of investing legends Peter Lynch and Charlie Munger. We remain fully invested (to the extent clients allow us) and do our best to sit and do nothing with the fine companies in which we have invested. This is the best way Andvari knows of that will allow us to grow money for decades at rates exceeding the market average.

Finally, Andvari believes that during times of inflation, one of the best types of assets to own are businesses that can grow their revenues in line with or above the rate of inflation. It’s even better if these businesses don’t have to replace fixed assets at continually rising prices! We think that each of the companies in our current portfolio has these characteristics.

With the short-term hit to performance our holdings have taken so far this year, we believe the odds are now even more in our favor that their long-term performance will outpace the market average.

As always, I love to hear from clients and interested parties about anything on your mind. Please contact me with your thoughts, comments, or questions.

Sincerely,

Douglas E. Ott, II

Footnotes

* Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment