Chip Somodevilla/Getty Images News

The TJX Companies, Inc. (NYSE:TJX), is one of the leading off-price apparel and home fashions retailer in the U.S. and worldwide. In June, 2022, we published an article on Seeking Alpha, titled: “TJX: Could benefit from declining consumer confidence, but be aware of other headwinds”. In that article, we gave TJX’s stock a “hold” rating. The main pros and cons of investing in the company’s stock at that time were the following:

Pros:

- Potential benefit from declining consumer confidence

- Strong track record of returning value to shareholders in the form of dividend payments and share buybacks

Cons:

- Unattractive valuation

- Elevated commodity prices causing increased freight costs and eventually margin contractions

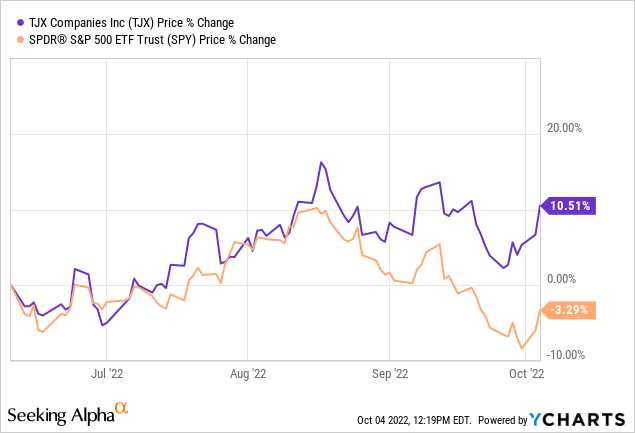

Since our last writing, the stock has outperformed the broader market, by gaining as much as 10% in contrast to the 3% decline of the broader market.

Today, we will revisit TJX and provide an updated view on the firm, taking the newest developments around the firm and the sector into account. We will look at the firm’s latest quarterly earnings report and provide our view on certain items.

Q2 earnings

Sales

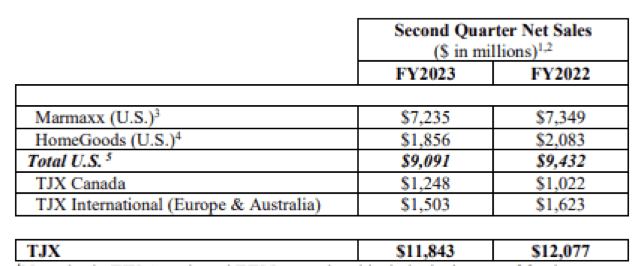

Net sales for the second quarter of Fiscal 2023 were $11.8 billion, representing a decline of 2% year-over-year. For the first half of Fiscal 2023, however, net sales reached $23.2 billion, representing an increase of 5% YoY.

Net sales (TJX)

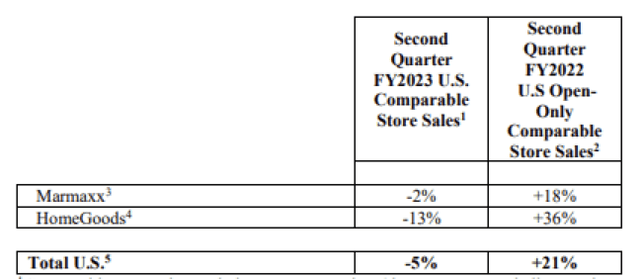

U.S. comp store sales also decreased by as much as 5% compared to the same quarter a year ago. Comparing the first 6-months of FY2023, to the year ago 6-months U.S. comp store sales decreased by 2%.

U.S. comp store sales (TJX)

The lower than expected sales figures can be, at least partially, attributed to the impacts of low consumer confidence. In our previous article, we stated that the low consumer confidence may be beneficial for TJX’s business as the consumers are likely to spend less on discretionary and durable goods, and therefore are likely to switch to more affordable, lower cost alternatives. As TJX is an off-price retailer, we expected that they are well-positioned to offer these lower cost alternatives to the consumers. In reality, the demand for their products has also fallen. As we do not expect the sentiment to dramatically improve in the near term, in our view, the demand is likely to remain soft in the upcoming quarters.

Margins

Despite the decline in net sales and comp store sales, the firm has exceeded its pretax profit margin projections. Q2 FY23 pretax profit margin came in at 9.2%.

Previously, we have highlighted that the elevated commodity prices are likely to lead to increased freight costs and a downward pressure on the margin. In fact, in the second quarter, merchandise margin was down due to 2.4 percentage points of incremental freight pressure. Incremental wage costs, further negatively impacted the pretax profit margin by 0.8%. These negative impacts were however, partially offset by the combination of strong mark-ups and the company’s pricing initiative.

We believe that the elevated commodity prices are likely to keep negatively impacting the firm’s financial performance for the rest of 2022. While commodity prices have come down substantially in Q3 from their peaks, they remain elevated compared to 2021 price levels.

WTI price (Tradinngeconomics.com)

Due to the margin contraction and the sales decline, Q2 FY23 diluted earnings per share have totaled $0.69. While this figure is at the high-end of the company’s forecasts, it represents a decline compared to the year ago quarter.

Foreign exchange headwinds

Additionally to our previously stated risks, we now have to mention the FX related headwinds as well. While a significant portion of the firm’s sales is being generated in the United States, about 23% of net sales is coming from Canada, Europe and Australasia. The strong USD in the second quarter has been having a substantial negative impact on many firms, which are operating internationally. TJX has also not been an exception from this.

The movement in foreign currency exchange rates had a two percentage point negative impact on the Company’s net sales growth in the second quarter of Fiscal 2023 versus the prior year. The overall net impact of foreign currency exchange rates had a $.03 negative impact on second quarter Fiscal 2023 earnings per share.

We believe the unfavorable FX environment is likely to continue in the near future, which is likely to negatively impact TJX’s financial performance, along with its stock price, potentially.

Inventory

Inventories have increased by as much as 33% year over year.

Total inventories as of July 30, 2022 were $7.1 billion, compared with $5.1 billion at the end of the second quarter of Fiscal 2022. […] The Company is comfortable with its inventory levels and well positioned to take advantage of the off-price buying opportunities it is seeing in the marketplace. Overall availability of quality, branded merchandise is outstanding and the Company is set up well to flow exciting selections and values to its stores and e-commerce sites throughout the fall and holiday selling season.

On one hand, we like that TJX is actively taking advantage of the off-price buying opportunities. Such actions could have positive impacts on the firm’s margins going forward. These buying opportunities exist in the market because other large retailers have been struggling with inventory management, including Walmart (WMT) and Target (TGT). Those firm’s had to use excessive discounting to reduce their excess/ obsolete inventory.

On the other hand, we have to ask ourselves, will TJX be able to sell these products without substantial discounting? According to analysts, also large off-price retailers may be forced to use significant discounting, which could offset the positive impact of the previously mentioned buying opportunities.

To sum up

All in all, we believe that the macroeconomic headwinds are having a more pronounced impact on TJX’s business than we first thought. Declining demand and sales, combined with the contracting margins and the unfavorable FX environment have resulted in a per share earnings decline year over year.

While the management considers the current inventory levels as healthy, our view is slightly more conservative. In our opinion, we have to take the potential risks into account, which are associated with the potential need of using significant discounting to reduce the inventory levels later on.

Due to these factors and headwinds, the firm has also adjusted its full year guidance downwards.

At this point, based on the performance during a single quarter, however, we do not see the necessity to sell the stock. We believe, despite the worse than expected Q2, TJX may be a good place to hide, during the current, uncertain market environment.

Be the first to comment