Jean-Luc Ichard

Microsoft Corporation (NASDAQ:MSFT) software is considered a gold standard and is one of the most widely held technology stocks in our coverage universe. While Microsoft has one of the best software franchises in the world, the company is NOT immune to market meltdowns. Like most companies in our coverage universe, Microsoft has benefited from the pandemic. Now the pandemic benefits are beginning to unwind. In addition, we expect impending consumer weakness to impact the windows franchise, as PC shipments will likely continue to decline into C2023.

While PC shipments were elevated during the pandemic’s work-from-home environment, we now see shipments decline, impacting the highly profitable Windows franchise. Both Dell and HP noted weaknesses in PC shipments. In addition, we expect the consumer will likely remain weak in 2H 2022 and into 1H2023, driven by inflationary pressures and higher interest rates. We believe demand for Microsoft Windows and PCs will decline post-pandemic and amid inflationary pressures as fewer people buy PCs or upgrade them in the near term. In addition, we expect cloud demand to slow down as most companies are not looking to make significant infrastructure changes under the current macroeconomic environment. Combined with elevated multiple, we believe Microsoft stock is at risk of a pullback from these levels due to multiple compression. Therefore, we recommend investors wait for a better entry point on the stock. Accordingly, we are hold-rated on the stock.

Over the past few years, Microsoft enjoyed massive multiple expansion leading as it became a consensus long across the world. We believe the company will likely face mean reversion due to multiple compression as the era of easy money ends over the next few months. Microsoft stock is down by around 28% YTD. We believe Microsoft’s YTD decline is the result of macroeconomic weakness. We don’t believe the company is out of the woods yet and see potential weakness affecting the stock towards the end of the year and possibly into the following year. We believe investors should wait for a better entry point on the stock, as there is more downside than upside from the current levels.

Weakness likely to spill into Windows and cloud

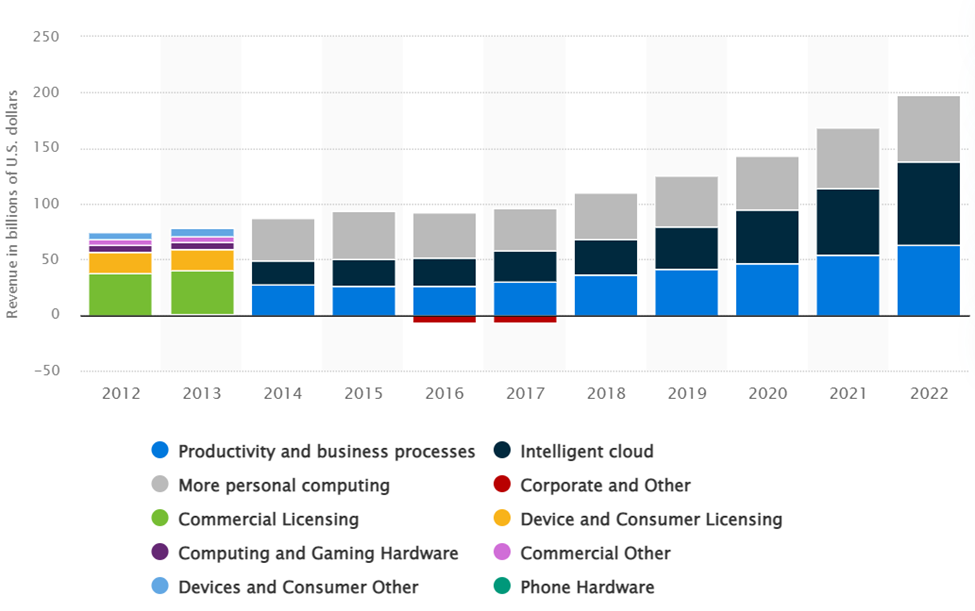

Microsoft reports revenue through three main segments: Intelligent Cloud, Productivity and Business Processes, and More Personal Computing. We expect consumer weakness to impact demand for PCs, impacting Microsoft’s Windows franchise.

Statista

We believe the company is losing the pandemic benefits once enjoyed due to the work-from-home environment. We also expect weakness in its cloud business as customers push out any new migrations in the near term. The following outlines our expectations for each segment:

Intelligent Cloud

Weakening consumer and enterprise spending has lowered PC demand, and we expect weakness to catch up to Cloud. Azure and other cloud services, Microsoft’s fastest-growing segment, provides computing, analytics, networking, and storage services. We expect demand for computing and storage services to slow compared to the lowered PC and server demand. Moving to Azure Cloud is also expensive in the near term, given the challenges to re-platform enterprise applications.

Hence, we believe fewer enterprises will be investing in cloud services towards the end of the year. In addition, Azure services are NOT cheap. Even after accounting for costs associated with reduced headcount, third-party cloud services are 20-30% more expensive than hosting the applications on-prem. However, we believe Microsoft Azure is much more resilient in the near term due to its lower exposure to startups.

Productivity and Business Processes

Microsoft’s Productivity and Business Process is driven by Office 365 Commercial (Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, and Microsoft Viva) and LinkedIn. We expect consumer weakness to affect Office commercial demand towards 1H23. With current inflationary pressures, and rising interest rates, we believe fewer individuals and small businesses will be spending to expand their business.

More Personal Computing

Weakness has already been spotted in Microsoft’s Personal Computing segment, which only grew 2% YoY. More Personal Computing encompasses Windows, devices (surface and PC accessories), Xbox content, and search and news advertising. Gartner reported a 12.6% decline in quarterly global PC shipments. Microsoft announced that $300M in Windows income from device makers was lost due to manufacturing closures in China in April and May and the deteriorating PC market. We believe the company will likely see more downside in the post-pandemic environment as weakening consumer spending and inflationary pressures persist.

Cloud remains a solid growth driver in the long term

While we don’t expect Microsoft stock to work meaningfully in the near term, we remain bullish on the company’s Intelligent Cloud segment for the long term and the overall position of the company in the industry. The cloud market is predicted to grow at a CAGR of 19.9% between 2022-2029. Over the next few months, we expect Azure growth to slow as business spending slows down. Moving business and enterprise data and applications to the Cloud is expensive. We don’t believe businesses will be investing as heavily as in the past in changing their infrastructure due to the current wave of inflation and rising interest rates.

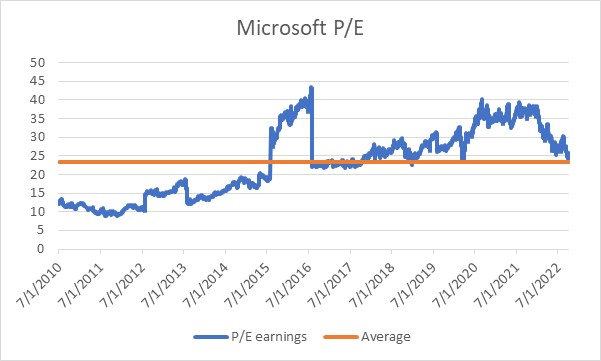

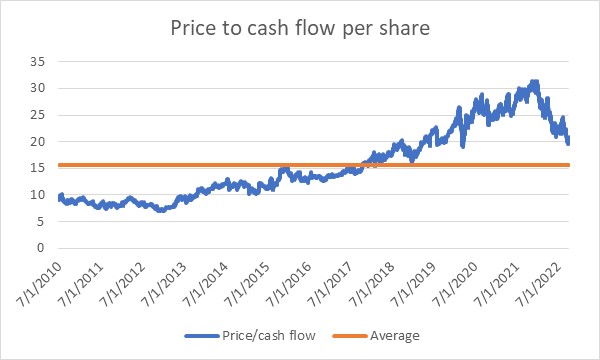

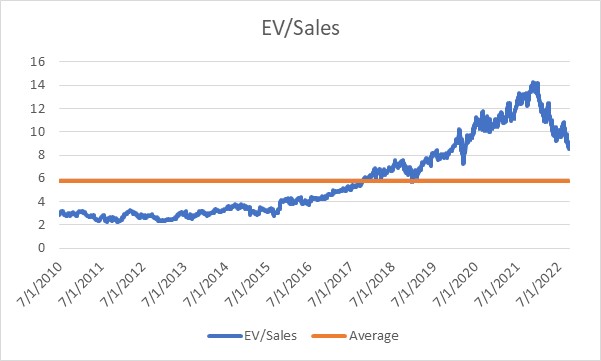

Risks of mean reversion – multiples remain elevated

We believe Microsoft multiples are at risk of mean reversion and recommend investors wait to buy the pullback. We don’t believe consumer and enterprise weakness is fully priced into the stock yet. We believe estimates remain high, and there is a risk of downward estimate revision over the next few months. Microsoft has been under pressure in the post-pandemic environment, contributing to its underperforming S&P index. We believe Microsoft is exposed to inflationary pressures, weakening consumer spending, and supply chain issues.

Microsoft’s multiples saw rapid expansion over the last twelve years. On a P/CF basis, Microsoft trades at 21x versus the historical mean of 15.6x. On an EV/Sales basis, Microsoft trades at 9.2x versus a historical mean of 5.8x. Finally, on a P/E basis, Microsoft trades at 26x while the last twelve-year average is about 23x. While P/E is now heading towards the historical average, P/CF and EV/Sales are still elevated and are above the mean. We believe Microsoft’s multiples will likely revert to mean over the next few months, and we recommend that investors remain patient for a better entry point. The following graphs outline Microsoft’s historical P/E, P/CFO, and EV/Sales multiples.

Techstockpros & Refinitiv Techstockpros & Refinitiv Refinitiv & Techstockpros

We are bullish on Microsoft’s long-term growth, specifically within the cloud industry, but recommend investors wait for weakness to be priced in before buying the stock.

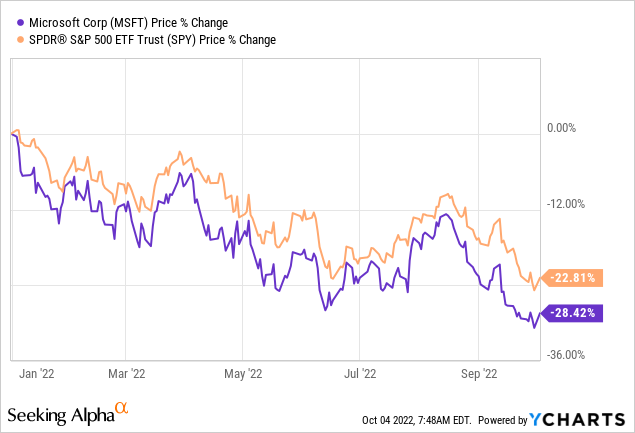

Stock Performance

Microsoft grew an impressive 217% over the past five years. However, the company has taken a hit over the past year, dropping 15%. YTD, the stock is down around 28%, underperforming the S&P 500 index, which dropped 23% during the same period. The stock is trading at $249, closer to its 52-week-low of $234. While Microsoft did outperform the competition, we believe the stock will likely have more downside ahead.

The following chart shows YTD Microsoft stock performance.

Ycharts

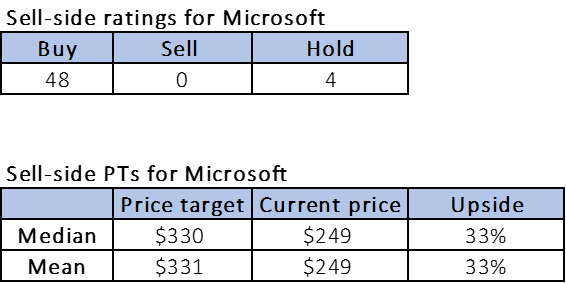

Valuation

Microsoft is not cheap, and we believe the stock is further downside. On a P/E basis, Microsoft is currently trading at 22.5x C2023 EPS of $11.00 compared to the peer group trading at 21.5x. On an EV/Sales, Microsoft is trading 7.7x C2023 sales versus the peer group average of 4.5x. We believe Microsoft is at risk of consumer weakness spilling into the enterprise over the next few months. We also believe the multiple is likely to compress from the current levels, leading to a stock sell-off.

The following chart illustrates MSFT’s valuation relative to the peer group valuation.

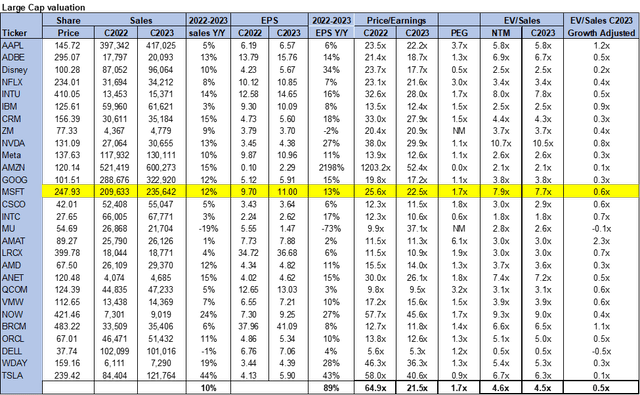

Word on Wall Street

Microsoft is a gold standard in software and is a consensus long. Of the 52 analysts covering the stock, 48 are buy-rated, and four are hold-rated. Microsoft is currently trading at around $249.The median price target is $330, and the mean price target is $331, with a potential upside of 33%. The following chart indicates MSFT stock’s sell-side ratings and price targets.

Techstockpros & Refinitiv

What to do with the stock

We are hold-rated on the stock. We expect revenue and EPS to be affected by the weakening consumer and enterprise spending. We believe the company does not yet provide a favorable risk-reward profile at the current valuation. Microsoft’s multiple is at risk of compression and will likely revert to historical levels over the next few months.

Nevertheless, we remain bullish on Microsoft’s position in the industry and its prospects in the longer term. We believe the company is well-positioned within multiple segments across enterprise and Cloud. We believe there is more weakness to be factored into the stock price and recommend investors stay on the sidelines for now.

It is possible Microsoft stock can dip below $225 quickly and possibly hit about $200 over the next few months. There is no need to hurry and buy shares at the current levels. We look for more clarity about the demand for its products and services and the spending intentions of its customers when the company reports results in a few weeks.

Be the first to comment