Bet_Noire/iStock via Getty Images

As commodity prices plummeted and economies came to a screeching halt in 2020, a cyclical rotation into growth and tech companies decimated shares of energy companies. The plunge in oil prices caused energy companies to write down asset values or, in some cases, declare bankruptcy. The vanishing demand for oil & gas put the energy sector on the defensive while a counter-cyclical movement emerged as defense sectors shined. Companies made capital investments to accommodate remote work infrastructures while individuals upgraded technology, stocked up on consumer staples, and streamed content on their devices. The back half of 2020 was a glorious time for growth investors as SPACs were bringing companies public left and right while the growth sector couldn’t miss.

Fast forward to Q1 of 2021, which became the beginning of oil’s endless bid. WTI Crude, which had a negative price per barrel for a brief period at the height of the pandemic, went from $48.52 on 1/1/21 to $76.08 a year later, increasing by 56.80%. With the combination of supply and demand constraints and the ramifications of the war in Ukraine, WTI continued its ascent as prices reached $123.70 on 3/8/22. With WTI prices still over $100 per barrel, the energy trade has become an unmissable event despite the war on fossil fuels. The bigger picture has been overlooked as oil & gas are embedded in our footprint no matter how green someone tries to become. The saddest part is that it took the war in Ukraine for leaders of the free world to recognize how important energy security is, and in 2022 it’s not possible for a nation to exist solely on renewable energy.

Make no mistake; there are still political leaders waging war on oil & gas with an agenda of achieving 100% clean energy. While the supermajors have rebounded, much of the energy sector is chasing their pre-pandemic highs. President Biden recently criticized big oil for its record profits, and I believe exploration & production companies will continue to face scrutiny. The reality is that oil & gas will play an integral role in society for decades to come, and I believe there is still a profitable investment in energy infrastructure companies. The restraints on new energy infrastructure projects, from government approvals to environmental studies, have made existing energy infrastructure more important than ever. Unlike technology, where a team of individuals can build a new software platform or SaaS product and disrupt the industry, you can’t just build pipelines, processing plants, or exporting facilities. Thanks to capital-intensive investments and governmental red tape, a powerful moat has been created to alleviate competitive threats due to excessive entry barriers. The InfraCap MLP ETF (NYSEARCA:AMZA) is a hybrid energy infrastructure fund positioned to deliver large amounts of income through an actively managed strategy. I believe energy infrastructure companies will continue to rebound as the demand for fossil fuels increases.

The InfraCap MLP ETF

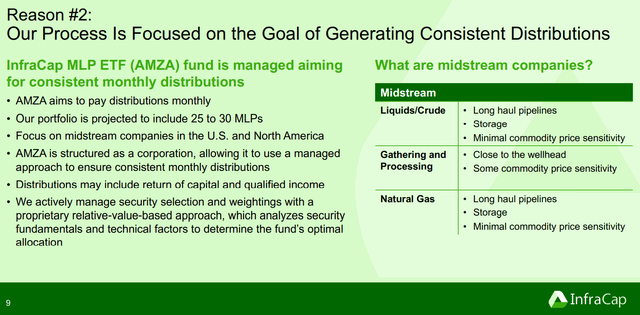

Energy infrastructure companies have been synonymous with income investing. The large yields have been considerably more attractive than the average yield found in the S&P 500. Energy infrastructure is critical to society, yet there is still a war being waged against fossil fuels. Nonetheless, I still believe many energy infrastructure companies are undervalued and present an interesting opportunity for capital appreciation and income generation. AMZA is an actively managed fund that’s focused on generating income for its investors while providing exposure to an underappreciated growth opportunity. AMZA has an investment focus on energy infrastructure, primarily the midstream sector in the form of MLPs. While many of AMZA’s holdings are master limited partnerships (MLPs) such as Energy Transfer (ET), AMZA also allocates capital toward limited liability companies taxed as partnerships.

AMZA’s primary allocation revolves around investing at least 80% of its net assets in energy infrastructure companies. AMZA is a leveraged fund and may borrow up to 33.33% of its total assets from banks for investment purposes. Due to its active strategy, AMZA doesn’t seek to replicate or exceed the performance of a specific index. Instead, the active investment strategy seeks to meet its investment objective of generating income. In addition to investing in individual equities, AMZA utilizes an options overlay strategy with the objective of increasing distributable income while limiting the risk of incurring losses.

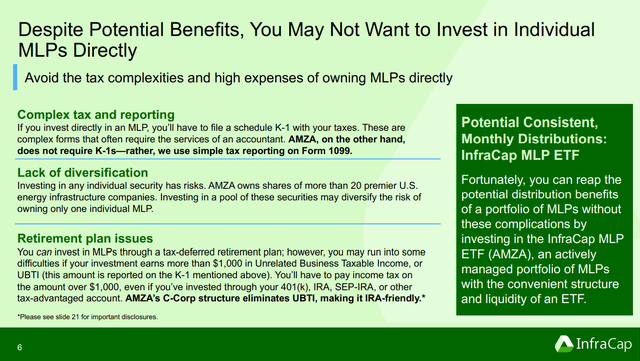

Due to tax implications, there has been an ongoing debate about what type of account to hold an MLP in. Many investors are discouraged by the infamous K-1 package, and the difficulties exceeding $1,000 in Unrelated Business Taxable Income (UBTI) can present during tax season. Investing in AMZA makes these headaches disappear as it provides exposure to an array of MLPs without dealing with these complex forms since AMZA is structured as a C-Corp. This eliminates any concerns around accumulating $1,000+ of UBTI or having to file K-1 packages as AMZA issues a Form 1099, simplifying the reporting process of its monthly distributions.

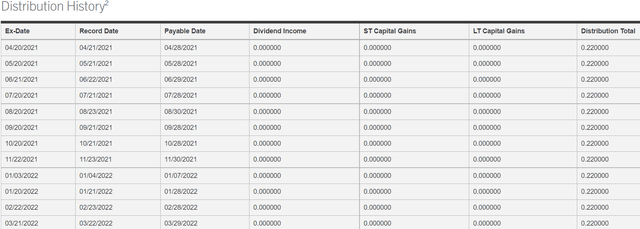

There are many aspects of AMZA that appeal to me. Unlike exploration & production companies, where much of their share price and momentum are dependent on commodity prices, midstream companies are not dependent on daily or monthly pricing fluctuations. Many midstream operators enter take-or-pay and/or fee-based contracts with upstream producers. Take-or-pay eliminates commodity price risk and eliminates volume risk. An upstream producer such as Exxon Mobil (XOM) would be contracted for a certain amount of capacity per day for the life of the contract. Whether XOM utilizes the contracted capacity is irrelevant as it is obligated to pay for 100% of the contracted volume as it is reserving the space through the pipeline system through a take-or-pay contract. Fee-based contracts also mitigate commodity price risk as a pipeline company such as ET would charge a set fee for the shipped volumes. AMZA has a stable distribution of $0.22 per month, which is a forward annual yield of 8.7% based on the closing price of $30.35 per share. AMZA’s portfolio is intriguing to me as I am invested in 5 of its 25 equity holdings, and I am a fan of its options overlay strategy.

AMZA’s monthly distributions are solid and outpace inflation

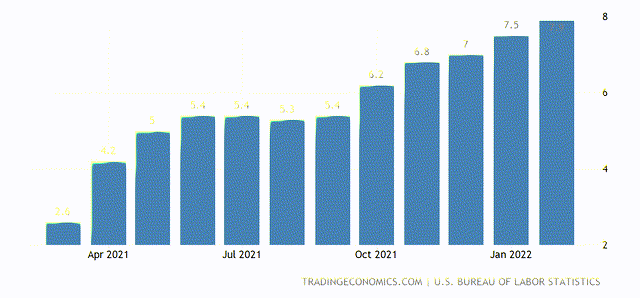

Some investors are worried about generating a stream of income from their assets that outpace inflation. Over the previous year, inflation has run rampant and reached levels the United States hasn’t witnessed since the early 80s. Currently, there aren’t many high-yield options to outpace inflation, as it reached a 7.87% rate in February.

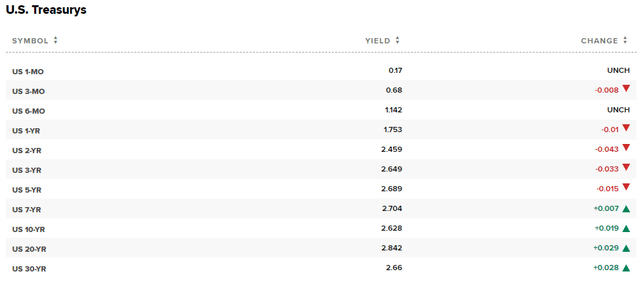

I have never been a fan of U.S. Treasury Bonds, and looking at the yields today, allocating capital to anything other than the 2-year makes little sense. Why on earth would anyone lock up their capital on a 10-year note at a 2.638% yield when they can take the 2-year note at 2.459%? Less than half of a percent separates the yield throughout every note from the 2-year to the 30-year. Unless you’re investing large sums of capital, the yields generated by treasuries aren’t enticing.

This is where investments such as AMZA come in. Over the past year, AMZA has appreciated from $24.47 to $30.05, generating $5.58 (22.80%) of capital appreciation while producing reliable monthly income. Like clockwork, AMZA has delivered a $0.22 distribution at the end of every month over the past year. As investors benefited from an appreciating investment while the 2020 market darlings fell off a cliff, AMZA’s yield continuously outpaced inflation. While inflation rose from 2.6% to 7.87% over the past year, AMZA’s yield declined from 10.95% to 8.92%, as its ETF appreciated. AMZA is still outpacing inflation by 1.05%, and if the Fed’s aggressive rate hikes counteract the current levels, the spread between AMZA’s yield and inflation will only get wider.

For investors who are looking for predictable income in an environment where inflation has risen, and high-yielding investments have been scarce, AMZA is an interesting option. Its holdings are essential and required for our country and economy to operate. As the country and the world continues to reopen and the population grows, more energy will be required, and companies such as ET and Kinder Morgan (KMI) will continue to deliver distributable cash flow (DCF) quarter after quarter to their investors.

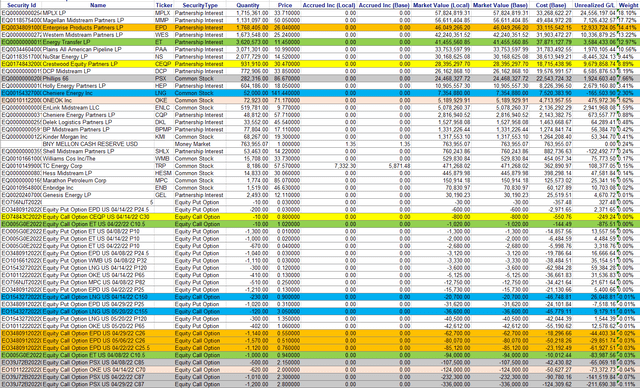

AMZA’s options overlay strategy

AMZA’s actively managed strategy includes an options overlay component as management engages in selling call and put options. I color-coded the covered calls that AMZA has sold against its positions in the chart image below. AMZA sells short time duration covered calls on a small portion of some of the fund’s positions to generate additional income for the fund. AMZA generated $1.18 million in income from its covered call positions based on the number of current contracts sold. Take ET, for instance; AMZA has sold 1,010 contracts against its position in ET at a $10.5 strike price. AMZA holds 3.62 million shares of ET, and these contracts only represent 2.8% of AMZA’s overall position in ET. I personally sell covered calls against many of my income investments to juice the yield. The beauty about a large fund such as AMZA is it can generate significant amounts of income only utilizing a small percentage of its equity positions.

In addition to covered calls, the management team at AMZA sells equity put options as part of the options overlay strategy. This is where a portion of AMZA’s leverage comes into play because it affords management the ability to sell cash-backed puts. AMZA effectively has a modified option wheel strategy occurring within its fund, and to me, it’s beautiful. Sticking with ET, AMZA has sold 2,970 cash-backed puts at a $10 strike price which expire from 4/8 through 4/22, generating an additional $5,980 in income. You may be thinking that $5,980 in income doesn’t sound like much, but here is the crux of the equation. If ET closes above $10, the put options expire worthless, AMZA retains the $5,980 of income generated and can repeat the process. If ET closes under $10 when these puts expire, AMZA will be assigned the shares, but since its current average price per share on ET is $11.45, it will basically get paid to dollar cost average into a position. Overall, AMZA has generated $164,967 from the equity puts sold in the portfolio.

The majority of AMZA’s options have a staggered expiration throughout April, with only 4 sets of option chains expiring in May. The longest duration is roughly a month and a half from today, with 3 sets expiring on 5/22. AMZA is sacrificing a small amount of upside potential through its covered calls to generate additional income, which is its primary objective. As an actively managed fund, I would rather pay .80% on the expense ratio for a management team to deploy an options strategy that I agree with around its core holdings than 0.6% to a management team to build a portfolio. There is a level of risk that comes with leverage and utilizing leverage to deploy an overlay option strategy. I am very familiar with this industry, the positions within AMZA, the options strategy management is using, and this fund fits within my personal risk profile. If you’re not risk-averse, you may want to reconsider AMZA, but if you believe in management’s track record, AMZA could be a great income-generating machine for your portfolio.

AMZA’s holdings are best in class

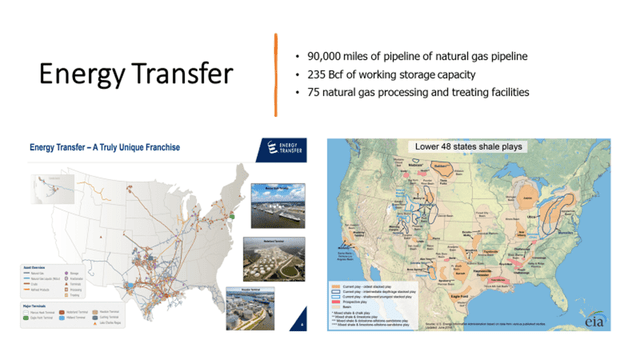

From crude to natural gas and natural gas liquids to liquefied natural gas, AMZA invests in every major energy infrastructure company encompassing gathering, transporting, processing, storing, refining, distributing, and exporting the energy society depends on. When I look at a hybrid energy infrastructure fund, if the holdings don’t include the combination of ET, Enterprise Products Partners (EPD), Kinder Morgan, and Enbridge (ENB), it’s an immediate pass for me. In my opinion, these are the big 4 in the sector as the combination covers more than 300,000 miles or pipeline to move crude, natural gas, refined products, and NGLs, terminaling services, fractionation, storage, marketing services, and exporting capabilities for crude, LNG, and NGLs. Here are some interesting facts about ET, EPD, KMI, and ENB:

- ET

- Nearly 120,000 miles of pipeline

- 90,000 miles of natural gas pipeline

- 235 Bcf of working natural gas storage capacity

- More than 75 natural gas processing and treating facilities

- 11,315 miles of crude oil trunk and gathering pipeline

- Crude oil terminals with storage capacity of approximately 66 million barrels

- 5,500 miles of NGL pipelines transportation capacity of approximately 3 million barrels per day

- Nederland Terminal

- 6 ship docks and 4 barge docks

- 700,000 bbls/d of combined LPG, ethane, and natural gas export capabilities

- 600,000 bbls/d of crude export capacity

- Houston Terminal

- 5 ship docks and 7 barge docks

- 500,000 bbls/d of crude export capacity

- Marcus Hook Terminal

- 4 export docks

- 400,000 bbls/d of combined LPG and ethane export capacity

- Lake Charles Terminal

- Developing a large scale LNG export facility

- Signed a 20-year agreement with ENN Natural Gas to supply 1.8 million tpa of LNG to ENN Natural Gas, and 900,000 tpa to ENN Energy, on a free-on-board basis

- Liquefaction capacity when complete of 16.45 million tpa

- EPD

- Over 50,000 miles of natural gas, NGL, crude, refined products, and petrochemical pipelines

- 260 million barrels of NGL, refined products and crude storage

- 14 Bcf of natural gas storage

- 23 natural gas processing plants

- 25 NGL and propylene fractionators

- 7 deep-water ship docks on the Houston Ship Channel

- 4-deep water docks at the Beaumont location

- 5-deep water docks at the Seaway Texas City and Freeport locations

- 2-deep water docks at Morgan’s Point

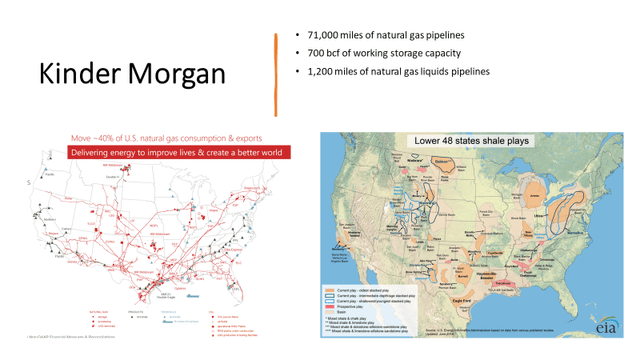

- KMI

- 83,000 miles of pipelines and 143 terminals

- 70,000 miles of natural gas pipelines

- Transports approximately 40 percent of the natural gas consumed in the United States

- 700 Bcf of gas storage capacity

- 9,500 miles of product pipelines

- Transports 2.4 million barrels per day

- 65 liquids terminals

- 143 terminals

- 16 Jones Act product tankers

- ENB

- 76,546 miles on natural gas pipeline

- Transport 21 Bcf/d

- 161.7 Bcf of storage

- 17,809 miles of crude pipelines

- Delivered 4 billion + barrels of crude and other liquids in 2021

- Enbridge Gas Inc. (Utility Company) serves approximately 75% of Ontario residents

- distribute about 4.9 Bcf/d of natural gas

- Renewable Energy

- Capacity to generate 5,179 megawatts

- 23 wind farms

- 17 solar energy operations

- 76,546 miles on natural gas pipeline

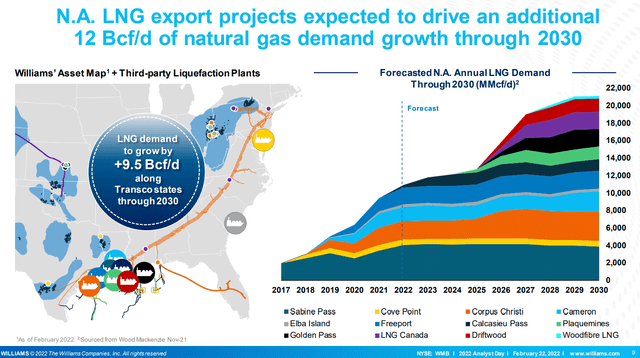

In addition to my favorite positions, AMZA is positioned to capitalize on the growing energy demand. Cheniere Energy (LNG) is the dominant force in LNG exporting. I went through the data from FERC and identified every investible company for LNG export facilities. Of the existing 12.85 Bcf/d of LNG export capacity, Cheniere Energy operates 6.95 Bcf/d or 54.09% of America’s LNG exporting capacity. Cheniere Energy also has an additional 1.86 Bcf/d of capacity approved from FERC, which is not yet under construction.

Overall, AMZA’s holdings are critical to the transportation, processing, and exporting of critical energy sources that make global economies operate. AMZA’s holdings cover the entire gamut, and if energy is being transported within the U.S. or exported abroad, it’s likely that one of the companies within AMZA’s portfolio is facilitating all of the backend services. Within the portfolio, you will find industry giants such as MPLX LP (MPLX), Phillips 66 (PSX), Magellan Midstream (MMP), and NuStar Energy (NS). Energy infrastructure hasn’t been an exciting space for many investors, but that’s about to change.

The short version of why energy infrastructure companies could become an unforeseen growth play

Unfortunately, it took a war in Ukraine for the leaders of the free world to acknowledge the current dependence on fossil fuels, in particular natural gas. Prior to the war, President Biden’s top official on climate change, John Kerry, told business leaders he could fathom keeping natural gas in a cleaner energy mix as a “bridge fuel” from traditional fossil fuels to a renewables-heavy future. Mr. Kerry indicated that natural gas could become a bridge fuel to help nations on their path to net-zero emissions.

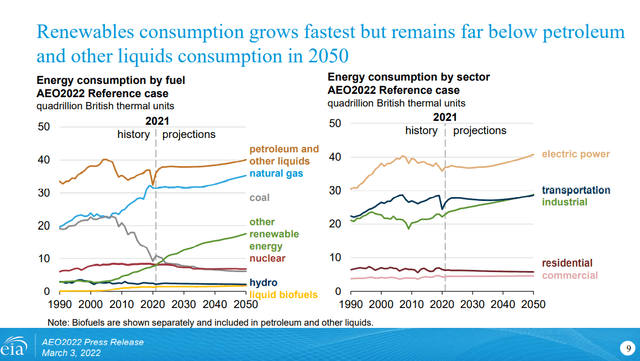

In the 3/3/22 Annual Energy Outlook 2022 report, the EIA projected that in 2050 the USA would be dominated by fossil fuels. Coal is expected to decline while oil climbs back to its previous highs of the early 2000s and natural gas continues to increase. Both see increased demand over the next 3 decades. Renewables will experience the fastest rate of adoption and growth on a percentage basis, but from a consumption standpoint, they will remain a fraction of natural gas or petroleum’s consumption.

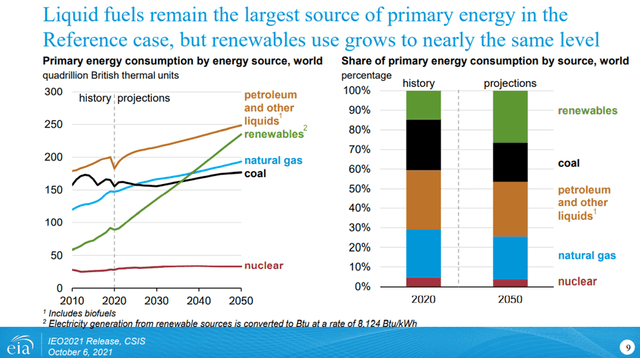

The EIA released its international energy outlook on 10/6/21. In their baseline case, the global energy demand would increase by 50%, growing from 600 quadrillion BTUs in 2020 to 900 quadrillion BTUs in 2050. In a low economic growth environment, there would be a 25% increase to 750 quadrillion BTUs, and in a high economic growth rate scenario, the global energy demand would increase to 1,100 quadrillion BTUs (83.33%). The EIA is also projecting that liquid fuels will remain the largest source of primary energy by 2050. Renewables will experience the most growth and increase their share of primary energy consumption by source, but petroleum and other liquids and natural gas will remain the largest source of primary energy.

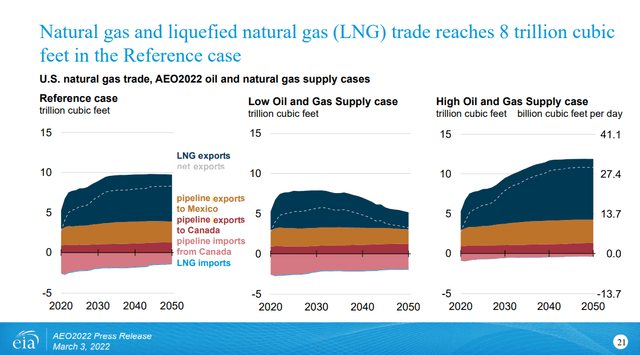

The U.S. is the largest producer of natural gas, and natural gas is projected to increase on a utilization basis over the next 3 decades. The EIA is projecting that the U.S. natural gas and LNG trade will reach 8 trillion cubic feet in 2050 as our exporting capability will more than double. Looking at the chart from the EIA, pipeline exports to Mexico and Canada slightly increase, while our LNG exports experience significant growth. In 2021, the U.S. averaged 9.7 Bcf/d of LNG exports, equivalent to 3.54 Tcf. LNG exports increase to roughly 5 Tcf in the reference case on the left, and in the high oil and gas reference case on the right, LNG exports increase to roughly 8 Tcf. These projections were created prior to the new stance on the U.S. helping the EU secure their natural gas supply as they move away from Russian exports. These numbers could be looked at as conservative as Germany is making sizable investments in LNG import terminals.

Conclusion

The oil patch is heating up and transitioning from a trade to an investment. The once demonized sector is becoming relevant again as the reality sets in that renewables can’t replace fossil fuels anytime soon. The global economy and society is tied to oil & gas, and securing reliable sources of these fuels is critical to a nation’s survival. Energy infrastructure has an almost impenetrable moat, as starting a pipeline company in 2022 is next to impossible. AMZA is an interesting ETF that I have recently invested in. AMZA makes tax season easy as it eliminates many of the frustrations from MLPs while generating reliable income that is still outpacing the rate of inflation. I believe that the lack of new competition and increased demand for American energy domestically and abroad will create additional value for the companies within AMZA’s portfolio. If you’re looking for large yields and want to avoid K-1 packages and UBTI, AMZA should be at the top of the list.

Be the first to comment