suwichaw/iStock via Getty Images

It is rare when we write follow-ups so close to the previous article but this is an unusual case. When we last covered AGNC Investment Corp. (NASDAQ:AGNC) we went over why we stayed out.

If you are expecting a truly epic blow up in rates, then this is not the REIT for you. AGNC stands more exposed on rates thanks to its lower hedges and that is why we have avoided this one.

Source: We Continue To Stay Out

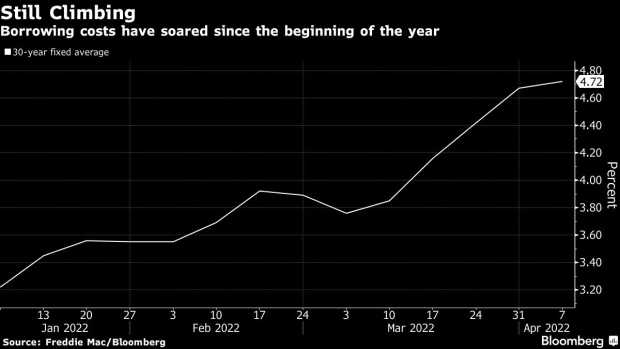

One of the notable events since then has been that bond bulls have been taken to the woodshed. The 30-year mortgage rates have soared another 70 basis points in 3 weeks!

Mortgage Rates (Bloomberg)

This has coupled with the Federal Reserve essentially telling everyone that they are actually far behind the curve. These facts, alongside some of the discussion points we saw in the last article, necessitated a follow-up.

Is Book Value Actually Important?

Book value reported under GAAP has a different degree of importance for equity and mortgage REITs. On the equity REIT side, book value is about the most useless metric one can find. Depreciation does not equal destruction of property value. If an analyst quotes GAAP book value for equity REITs, you know they skipped REIT 101. You should run as far as possible from whatever is presented alongside that analysis. In the case of mortgage REITs, book value is extremely critical. An extension of that, tangible book value is very close to the liquidation value today. So yes it is extremely important and we would not trust any view that says otherwise.

Why Is Book Value Important If I Am Still Getting My Dividends?

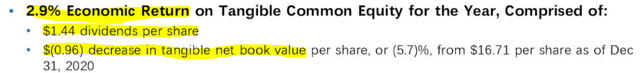

There are quite a few reasons for this. The first is that the mortgage REITs themselves measure their performance as a sum of dividends and the change in tangible book value.

AGNC 2021 Economic Return (AGNC Q4-2021)

If they consider it a true measure of return, why do you believe you know different?

The second is that their tangible book value is what backs their credit facilities, secured loans, warehouse facilities or whichever way they acquire debt. It is their real collateral in the long run regardless of how things are structured in the short run. An extension of this is what happens to AGNC’s leverage ratios as tangible book value declines. Based on the last presentation we saw, AGNC was running a 7.7X tangible book value leverage.

So if we start at the year end 2021 with tangible book value of $15.75, we get that AGNC had 7.7X “at risk” assets or $121.28 of assets per share. Now come April end, assume we see a tangible book value of $11.75. AGNC could maintain the same level of assets only if it was ready to dial up leverage to 10.32X. This is why the idea that one can ignore declines in tangible book value is laughable. AGNC will liquidate assets and that will impact the ability to generate the dividends in the long run.

This brings us to the third reason. Declines in book value of this speed create chaos. AGNC needs to liquidate its assets into the market that is rapidly declining and this is true for every mortgage REIT. Let’s all add to that the Fed needs to liquidate as per their announced quantitative tightening. Every big player is liquidating, so who is buying? Note that the mortgage REITs don’t have a choice unless they want to lever themselves to the hilt and risk blowing their equity to smithereens. This process is marked by a lot of slippage as hedges are unwound and spreads widen. Losses can be more than what you might think.

Finally, AGNC has to continue to hedge its portfolio against risk. Buying option protection when things are calm is one thing. Buying option protection after such a chaotic event will be different and extremely expensive. This will compress net margins.

Verdict

The dividend is safe for now as AGNC still has a good buffer for now between what it is generating and what it is paying. After the next round of rebalancing and asset liquidation we will reassess. True economic return for the first quarter will be dreadful as drop in tangible book value dwarfs income generated. While a bounce can certainly happen, it is unlikely that AGNC will repurchase recently liquidated assets. Some losses will be actual permanent losses. We strongly urge investors to assess if this is the outcome you are happy with.

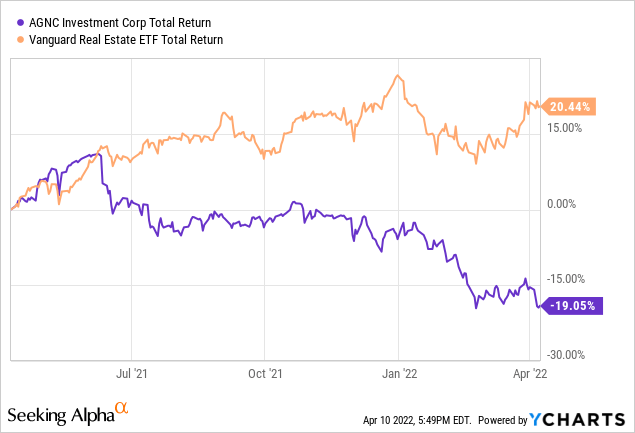

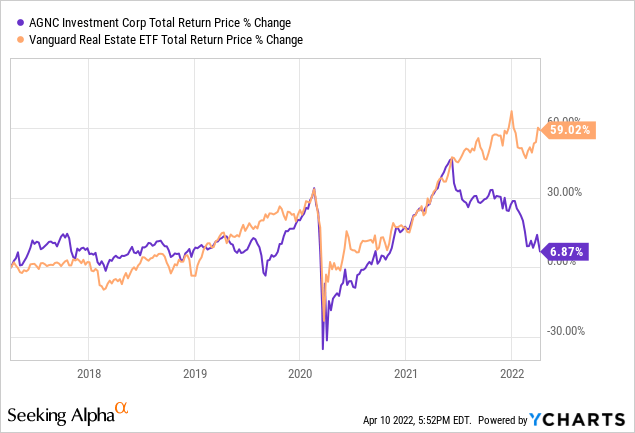

1 Year total return including dividends vs. Vanguard Real Estate ETF (VNQ).

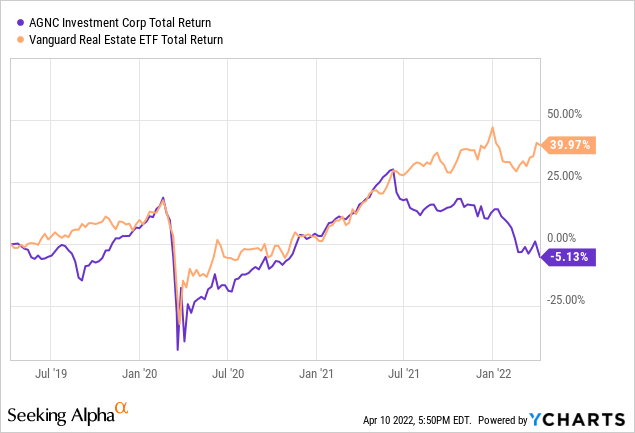

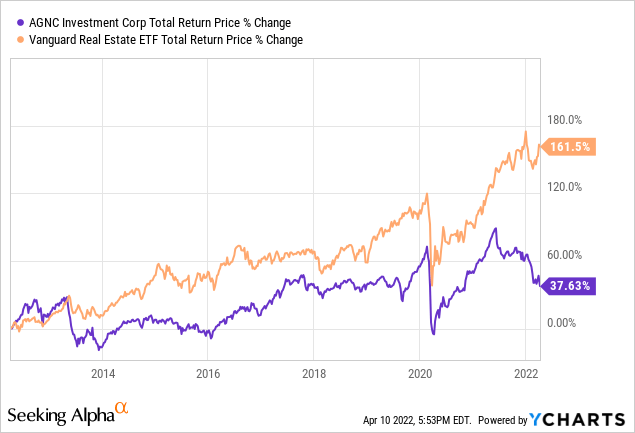

3 Year total return including dividends vs VNQ.

5 Year total return including dividends vs VNQ.

10 Year total return including dividends vs VNQ.

We like the sector for trades and yes occasionally it sets up quite nicely. But it is easily one of the worst sectors for buy and hold.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment