Wendy Townrow/iStock via Getty Images

What Are Marketing Exclusivity Sales and Why Is Amyris Able to Sell Exclusive Marketing Rights for a Specific Use At Such a High Value vs. Selling Complete Ownership of the Molecule?

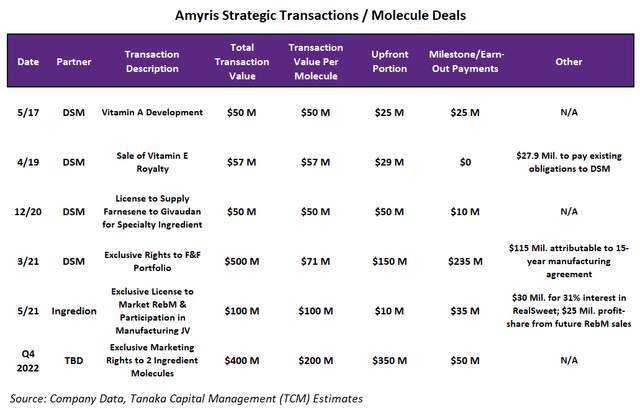

In 2021, Amyris (NASDAQ:AMRS) sold “marketing exclusivity” for its portfolio of 7 Flavor and Fragrance molecules to DSM for $500 million with $150 million upfront. Amyris also sold to Ingredion marketing exclusivity for its RebM sweetener and a minority share of a manufacturing JV for $100 million with $10 million upfront.

These were not outright molecule sales like the sale of Vitamin A in 2017 and Vitamin E in 2019. They are instead the sale of exclusive marketing rights to a trusted partner that Amyris determines can better access the consumer end markets faster than Amyris could on its own. For example, CFO Han Kieftenbeld explained Amyris tried to get food and beverage companies to use Amyris’ Reb M no calorie sweetener in their products but only had 2 sales reps vs. the 1500 reps Ingredion can use to approach Coke, Pepsi etc. It made sense to sell the exclusive marketing rights for RebM to Ingredion while maintaining the rights to use RebM in Amyris’ own PureCane sweetener brand.

In selling only the exclusive marketing rights, Amyris still retains the ownership of the IP and the manufacturing of the ingredients at a gross margin we estimate to be about 20-30% going forward at Barra Bonita with 2/3 lower costs than by using CMOs as explained in our August 8, 2022 Seeking Alpha “Amyris’ Vertically-Integrated Business Model Transitioning From Investment Mode To Payoff Mode.

There would also typically be royalty type earn-outs that Amyris would receive as the exclusivity partner reaches certain volume levels. We believe that earn-outs for an average exclusivity deal could add about 2000 basis points on a net basis to the 30% gross margins that Barra Bonita-produced molecules would have had without an exclusivity deal. This boosts that molecule’s ingredient gross margin to close to 50% which is quite outstanding for the ingredients or specialty chemicals industries.

The industry partner, in this case Ingredion, would have the right to be the exclusive buyer of the Amyris RebM off its production lines, allowing Ingredion to have total control over marketing and distribution of the Amyris RebM. In essence, Ingredion becomes the only marketer of the Amyris fermented and processed RebM to the thousands of food and beverage companies globally, including Pepsi or Coke.

Being the only supplier can be enormously profitable if the product becomes in great demand as DSM has seen with vanillin in the last 12 months. We understand that vanillin volumes have gone through the roof which is one reason that Amyris is expecting higher earn-outs from DSM and improved cash flow in 2022.

Why Did Amyris Start Selling Marketing Exclusivity for its Ingredients Only a Couple of Years Ago and Not In Prior Years?

Early this year I asked CEO Melo why Amyris was able to negotiate deals to in effect sell marketing exclusivity and deliver its bio-produced molecules to one and only one industry partner at a premium price and receive such large payments. He said that a couple years ago they realized that some of its industry partners would prefer to become the sole purchaser of Amyris’ Hero Ingredients and would pay a premium for this privilege.

CEO Melo went on to explain that they realized these exclusivity deals could be made easier by no longer selling its ingredients to all customers under multi-year contracts. If approached by a single market leading industrial customer who would pay a premium to become the exclusive distributor or user, Amyris would not be encumbered by pre-existing long term supply agreements with its existing customers.

Two years later, Amyris is now in a position to be able to sell exclusivity for more of its ingredients at a higher price, thank you. We are just now realizing that this is developing into a significant and increasingly more frequent profit-enhancing feature of the Amyris business model which we did not fully appreciate when we published our last Seeking Alpha article.

It Starts With The Best Engineered Organisms, Precision Fermentation and Downstream Processing to Produce the Most Pure Molecules at the Lowest Cost

The “Bio-manufacturing Industry” is new to many and has been evolving rapidly after a slow start 10-15 years ago due to the demise of biofuels from the last oil price collapse. (I prefer to use the term “bio-manufacturing” rather than “synthetic biology” which implies the products are synthetic. The term derives from the synthetic engineering of new strains of organisms that produce the molecules that are exactly identical with those found in nature. The molecules are not synthetic, the organisms that produce them are. The term “SynBio” also does little to reflect the importance of the other half of the manufacturing process, precision fermentation and downstream processing required for bio-manufacturing.)

The ability to offer exclusivity at a materially higher price exists because Amyris is the only company in the industry able to design organisms and actually bio-manufacture through fermentation and downstream processing molecules reliably at scale — and at superior purity and lower costs. Each molecule is uniquely produced in a process proprietary to Amyris. We will become more anxious if we see a competitor emerge that can produce the same molecule efficiently at scale, but we don’t see any on the horizon. In fact, we believe that bio-manufacturing competitors will most likely avoid competing directly with Amyris which is now well known to have the lowest cost manufacturing and will likely chose to produce some of the other 10,000s of known molecules.

Why Are We Just Learning Now About This Profit Enhancing Marketing Exclusivity Strategy?

The industry is so new and changing so quickly that its participants are having to adjust strategies “on the fly” much like during the Digital Revolution. In the meantime, investors should be glad to know that Amyris is developing innovative business strategies along with its great science to maximize returns shareholders and partners.

For us, the lightbulb moment was being shocked by management responses to questions on the 2022 Q2 conference call on August 9, 2022 about the progress of the ongoing H2 2022 $400 million two molecule exclusivity sale. CEO Melo responded “we’ve already been approached for another molecule in our portfolio that we expect to … end up doing some time in 2023 … we’re by no means done … We monetize the marketing rights because we can’t market to everybody all the time.”

This clearly suggested more frequent molecule exclusivity sales in the future. As for justification, CEO Melo went on to clearly suggest that Amyris will continue to focus on Consumer end markets: “We need to focus our own direct capability on the Consumer and let our partners focus on the B2B sales.”

We believe that the rising level of interest in buying exclusivity on the part of its industry partners may have even caught Amyris by surprise. After all, the first exclusivity deal was only signed in March of last year with DSM and then with Ingredion in May of 2021. These first two “exclusivity sales” followed more traditional molecule asset sales in 2017, 2019 and 2020 where Amyris sold the ownership of the intellectual property (engineered yeast strains, enzymes, etc.) and rights to produce those molecules:

Amyris company data and Tanaka Capital Management Estimates

Note: All tables were prepared by my partner Benjamin Bratt, CFA

Reasons Why We Expect Marketing Exclusivity Deals to Become More Common for Amyris, Likely to Happen Every Year and Should Therefore Be Incorporated in Earnings Models:

- We thought Amyris was fortunate to have interest in two exclusivity deals signed in 2021 at large premium prices ($500 million from DSM and $100 million from Ingredion). Then Amyris announced two large molecule exclusivity deals expected to close in 2022 for a total of “about $350 million upfront cash and around $400 million of total value” as mentioned on the Q2 2022 conference call on August 9, 2022. We understand that there is interest from multiple buyers, suggesting increasing industry awareness of the value of exclusive supply of a molecule from Amyris’ fermentation lines.

- Surprise early interest in a molecule for 2023 mentioned in the August 9, 2022 conference call. We believe it could be for a cannabinoid CBD, CBG or for squalene which could be category-specific for cosmetic use or for use as a vaccine adjuvant as mentioned in our September 30, 2020 Seeking Alpha article “R&D Surprises Offer Amyris Unbounded Upside”. Our November 19, 2021 Seeking Alpha piece “Amyris Buying Opportunity Created by Q3 Miss, Mega Convert and Potential Revolutionary COVID Vaccine” further discusses the use of the Amyris squalene adjuvant in the ImmunityBio/Amyris/AAHI 2nd Gen COVID vaccine human trials currently underway in South Africa and Botswana.

- The visible physical presence of a massive state-of-the-art 6-fermentation tank facility in June 2022 that is already brewing tons of vanillin per day as well as RebM and farnesene and will be producing 16-20 molecules by the end of the year is proof positive that Amyris can deliver volume for a new partner very quickly.

- Vanillin and Reb M exclusivity deals (DSM and Ingredion, respectively) are producing in volume and are apparently becoming great success stories for Amyris’ two industry partners. We believe “success sells itself” and will inform other potential partners what new exclusivity deals could deliver to them.

- A large evergreen R&D pipeline of 25 molecules under development will deliver 5-6 new molecules every year to feed into the exclusivity candidate pool that Amyris can market to industry partners, old and new. We are assuming only one new exclusivity candidate per year the next few years which could be conservative.

- CEO Melo has pointed out to me it is important to realize that Amyris has added much more valuable molecule candidates to its R&D pipeline. We believe that this could result in more valuable molecules with larger upfront exclusivity fees and possibly better upside in earn-outs in future years.

- It appears that cycle times are shortening between the production of a new molecule, delivery of samples and negotiations to sign exclusivity deals to a few months from 1-2 years in the past. This suggests that prior successes seem to be advertising the value of the exclusivity model to new partners.

- Amyris knows it doesn’t have the bandwidth to address each new vertical as the bio-manufacturing revolution proliferates broadly to more new industries. As fermentation becomes more accepted and recognized as a viable source of pure ingredients at a lower cost, Amyris could become the go-to provider or foundry for many new industry verticals as TSMC has done for the semiconductor industry.

- By collecting large upfront payments for selling exclusivity to individual partners, Amyris can re-liquify its balance sheet faster than many believe. In addition, by selling exclusivity at a premium price, we estimate Amyris might boost prices and margins by about 20% which all goes to the pretax bottom line for these ingredients. Importantly, these exclusivity price premiums should shorten Amyris’ path to profitability as we believe that it will be able to sign exclusivity deals each year in the next few years and that analysts will have to include these earn-out premiums in their earnings models as we have done below.

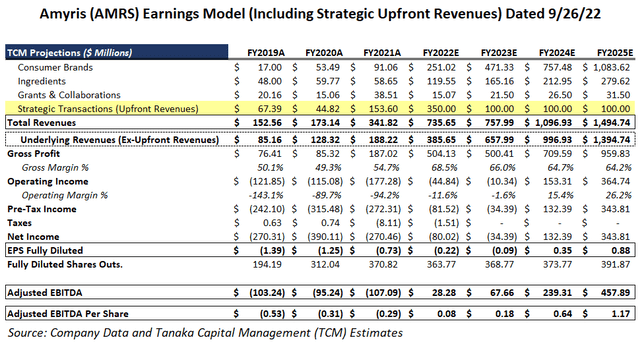

Below, my partner Ben Bratt is now incorporating Exclusivity Upfronts and annual earn-outs in our 2022-2025 Amyris earnings and cash flow model.

Near term, adding $350 million of upfront revenues and pretax profits by year end makes Q4 2022 profitable at $0.85/share of GAAP profit. Assuming an additional $100 million per year of upfronts for one molecule marketing exclusivity deal per year for each of the next 3 years would add about $0.25/share to pretax EPS in 2023, 2024 and 2025. This would bring 2023 close to profitable at a loss of ($0.09/share) and make 2024 solidly profitable at $0.35/share of earnings increasing to $0.88/share in 2025.

Closing the two molecule exclusivity sales announced for 2022 would make our 2022 full year cash flow estimate a positive $0.08/share of Adjusted EBITDA. We estimate one exclusivity sale per year with $100 million upfront would help generate estimated positive EBITDA of $0.18/share in 2023, $0.64/share in 2024 and $1.17/share in 2025:

Amyris Earnings Estimates Model Including Strategic Upfront Revenues to 2025 (Amyris company data and Tanaka Capital Management Estimates)

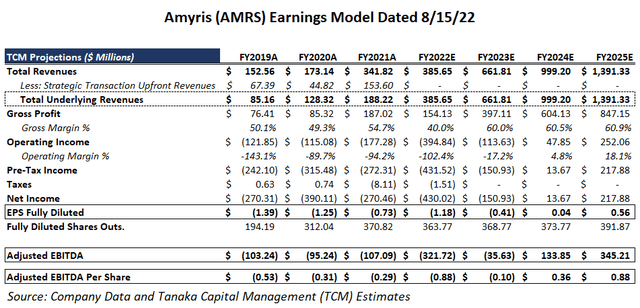

For comparison purposes, below is our post-Q2 Earnings Model prior to including ongoing marketing exclusivity sales:

Prior Amyris Earnings Model dated 8/15/22 (Amyris company data and Tanaka Capital Management estimates)

How Long Will this Window of Opportunity Last?

While it is probably obvious that this ability to charge premium prices for marketing exclusivity exists because no other company is currently able to do so, we are confident that Amyris will be able to maintain its lead in volume, efficiency and cost for the foreseeable future as its current lead might be about 5 years.

Intel maintained its 2-5 year lead in microprocessor performance/cost for 3 decades and while a tall order, we believe that Amyris has a similar multi-year head start given its very large patent pool in yeast design, enzymes, fermentation and downstream processing as well as unpublished know-how advantages and future advances and economies of scale which we discussed in our previous analysis.

We Have Validated The Thesis That Exclusivity Deals Could Potentially Enhance Ingredient Profit Margins by 20% and Provide $100 million of Upfront Fees Per Molecule

After bouncing our theories on the potential financial benefits of Amyris’s unique new Exclusivity Premium addition strategy off of management, we are now comfortable assuming that Amyris will likely be able to sign at least one deal per year going forward and that deal sizes could be estimated to average $100 million or more of upfront fees and enhance Ingredient pricing and margins by about 20% points. We will discuss how the Ingredient Exclusivity deals combine with the new Barra Bonita plant’s 2/3 reduction in Cost Of Goods Sold (COGS) for Ingredients in our next article to highlight its significant potential to accelerate Amyris’ path to sustainable profitability.

While new strategies have to be born out in practice over repeated cycles, we are encouraged by the track record of the two Marketing Exclusivity deals signed in 2021, the two large deals nearing completion in Q4 in 2022 and the early interest in a deal for 2023.

Risks:

- Natural disasters which could disrupt the stable supply of sugar cane to the Barra Bonita fermentation plant in Brazil.

- A rebound in COVID could disrupt ingredient production and delay the timing of exclusivity earn-outs.

- Delays in closing or changes in terms on additional Marketing Exclusivity sales.

- Disruptions in the ongoing Barra Bonita plant startup, but at least three of the five lines have reportedly been brought up and running since June.

- Appearance of competition earlier than expected for any of the existing ingredient molecules at competitive pricing and purity but we are not aware of any fermentation facilities with similar capabilities.

Timing Is Important

We recognize that achieving profitability was delayed 2 years by Amyris’ management decision to accelerate investments and spending on launching 8 new Consumer Brands and making several acquisitions in addition to building new downstream plants to bolster its own supply chain. These investments burned cash and delayed our investment time horizon but strengthened Amyris by making its business model much more complete.

Following this 2-year hiatus, we feel it is even more important for us to describe this new strategic Ingredient Marketing Exclusivity catalyst that we believe can actually accelerate Amyris reaching profitability and it will be in our lifetime.

We note that we still firmly believe that Amyris could be the next Tesla (TSLA) for all the reasons we pointed out in our first Seeking Alpha article back on May 29, 2020 “Why Amyris Could Be the Next Tesla”.

We would be remiss if we didn’t point out that Tesla’s stock tripled in the first 4 months and has appreciated 17 times since reporting its first profitable quarter for Q3 2019, and Amyris could be reporting its first profitable quarter very soon.

We will present our other financial models in the next Seeking Alpha article which will also discuss why Amyris should deserve a premium valuation (similar to Tesla and Apple (AAPL)). Our last Seeking Alpha article described the unique Amyris business model including its proprietary science, know-how, ability to scale precision fermentation and downstream processing, the value of Consumer Brands generating 100 times the revenue per milliliter of product and 60-70% gross margins, a state of the art fermentation facility reducing Ingredient COGS by 2/3 and now the ability to layer in marketing exclusivity rights to potentially boost Ingredient gross margins by 20% to the 50% level. This opens up a multi-lane super highway to new markets for the emerging Bio-manufacturing Industrial Revolution to travel in the years ahead.

Be the first to comment