GaryPhoto

Introduction

Stocks that are inflation prone have been falling in price over the past few months. And loan and credit card companies are part of this group. Discover Financial (NYSE:DFS) has seen over a 20% price decline this year, so does the price match the risk-reward? Well, Discover has seen the credit metrics slightly increase, and the company is now increasing reserves. But even with the high inflation this year, Discover is still showing great operational results. That being said, I don’t think the company offers the best risk-reward over 1.5x price to book value per share.

This Year So Far

Performance

Over the past six months, Discover has seen net investment income grow by 10%. Much of this was due to the net interest margin growing by 17 basis points, in tandem with Fed rate increases. But Discover has started to increase provision for losses now and has recorded $703 million so far this year for a 405% increase from last year. This is now in normal territory rather than the drawdown of reserves that happened after the pandemic. For comparables though, this increased provision for losses made net income decline by 29% to $2.352 billion. The allowance ratio is now at 6.8%, and the current economic outlook with most likely keep increasing.

Credit Metrics

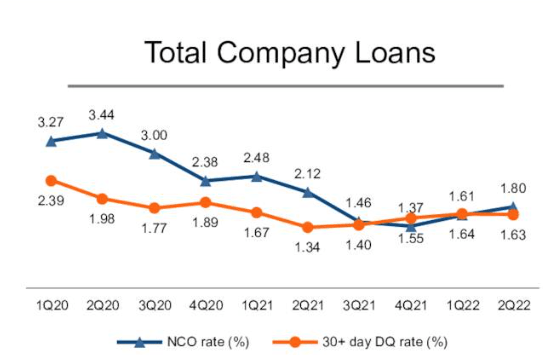

Discover Financial Credit Metrics (Discover Quarterly Presentation)

Looking at the credit metrics show a continued trend of low charge-offs and delinquencies. As can be seen in the above chart, the trend has slowly reserved, but the numbers are still very low compared to prior years. This shows a healthy consumer in the face of inflation so far. During the half year, credit card charge-off and delinquency rates have declined 70 basis points and increased 10 basis points to 1.93% and 1.76% each. Private student loans saw a 35 and 11 basis point increase in charge-off and delinquency rates, and sit at 0.88% and 1.66%. Private loans saw a 113 and 6 basis point decline for rates of 1.17% and 0.63, respectively. Overall, the trend has slowly changed, but the strong metrics are still evident.

Outlook

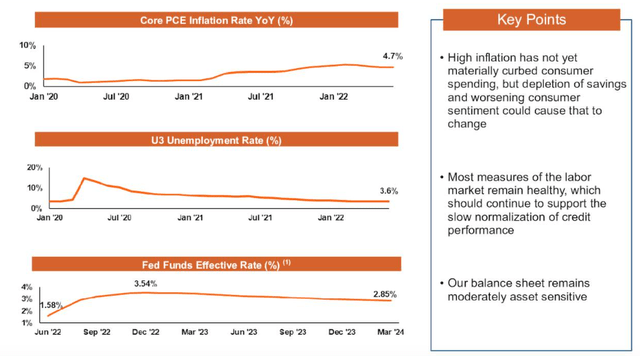

Discover Economic Outlook (Discover Quarterly Presentation)

Many are concerned about the economic and inflationary outlook regarding Discover’s business. While these will definitely cause pressure on credit metrics and the customers’ ability to pay their loans, it seems to be happening very slowly. As seen above, credit metrics are holding low and steady, with small upticks each quarter, but nothing to break the bank. And this has been in a very high inflationary period already. The graphic above shows this high increase in the inflation rate paired with the Fed rate increases, but what seems to be holding everything together is the fact that people are still working, and jobs have yet to be lost in the economic environment. Now, I do believe this will eventually happen, barring all trends staying the same. And when they do, Discover will be hit, but I don’t think this will be a quick event, and the economic environment may change for the better over this time.

Valuation

As of writing, Discover trades around the $92 price level and has seen an over 20% decline in price this year. So is the company a buy at this price level when factoring in the risk profile? Well, at this price, Discover is at a forward P/E of 5.94x and a P/BV of 1.88x, which I think is fairly valued. That being said, I would want P/BV closer to 1.5x with the economic risks involved.

Conclusion

While Discover has performed very well through the current high inflation, persistent inflation in the future will put pressure on the business. I think this may take a while to happen if it does, but this factor changes the risk-reward profile. Because of this, I am not a buyer while the price is over 1.5x P/BV.

Be the first to comment