Drazen_/E+ via Getty Images

Amwell (NYSE:AMWL) investors continue to learn the hard lesson of how a hot sector doesn’t always led to big profits. The telehealth sector boomed during covid, but some companies still don’t have the business models in place to benefit from the growing demand for digital care delivery. My investment thesis is more Bearish on the stock after the rally back towards $5 while the stock market and economy have weakened in the last few months.

More Weak Quarters

Back in Q1, Amwell reported revenues that missed estimates by $0.74 million and only grew 11.5% YoY. The company guided to 2022 revenues of $280 million, roughly in line with consensus estimates despite the Q1 miss.

The problem here is that Amwell continues to forecast massive annual adjusted EBITDA losses of up to $200 million. The virtual healthcare platform doesn’t have the growth or the revenue base to come anywhere close to eliminating the losses in the years ahead.

The numbers reported by Amwell continue to highlight the issue with a company creating a modern platform solving problems while not being able to charge the fees commensurate with the benefits. Whether due to competing platforms or the lack of perceived benefits, the company isn’t able to generate anywhere near the revenues to match the costs to develop the platform.

The key Q1 subscription revenues were still stuck below $30 million. Amwell is busy migrating customers to the Converge platform, but the company is constantly spending more money on R&D at $37.8 million in the quarter than the telehealth platform generates on subscription revenue at just $28.7 million or total gross profits of a similar $27.5 million.

When stripping out one-time and non-cash charges, Amwell had a Q1’22 adjusted EBITDA loss of $47.1 million on revenue of only $64.2 million. The company doesn’t forecast much of an improvement on the bottom line for the rest of the year.

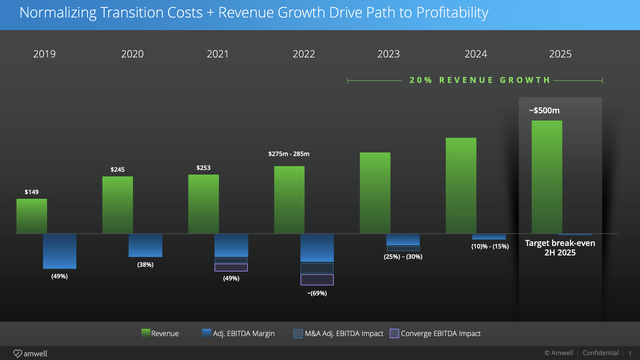

Amwell forecasts massive cuts to the EBITDA losses by next year due to revenue growth and normalized costs. The problem here is that the telehealth company still forecasts only reaching breakeven in 2025 with revenues reaching $500 million.

Source: Path to Profitability presentation

The Converge platform drove an increase in providers on the platform to over 100K, up an impressive 11K providers in just one quarter. Regardless, Amwell still forecasts an EBITDA loss in 2024 of at least 10%. The market won’t get behind this stock with these large EBITDA losses in future years.

Competitive Threat

The healthcare sector is massive, but the aggressive entry of Amazon (AMZN) into the space doesn’t help any industry player. The tech giant already has Amazon Care available virtually nationwide and now the company has agreed to acquire One Medical (ONEM) to expand into membership-based primary care focused on digital solutions.

Amazon agreed to pay $3.9 billion for the business that forecasts generating $1.075 billion in 2022 revenues. One has to wonder how much the tech giant will cut into the growth of Amwell with an expanding primary care virtual platform.

Remember, the telehealth provider just missed Q1’22 targets and Amazon could make it far more difficult to hit future targets. Amwell has no measure of safety here unlike profitable companies that can handle competitive impacts in the short term.

Amwell still has $675 million in cash to fight off competitors. The company has to cut the ongoing losses to attract investors to the beaten down stock. More importantly though, the telehealth provider has to figure out a business model where customers look to the telehealth platform as a valued technology provider and not one to save costs for the healthcare sector.

The company reports Q2’22 results on August 4 after the market closes with the consensus estimates for a repeat of the weak Q1 results. Amwell must maintain guidance for 2022 which would lead to substantial growth in the 2H of the year and hit those numbers before the stock becomes appealing. Any signs of elevated sales cycles and customer delays on migrating to the Converge platform would bury the stock for a long time.

Takeaway

The key investor takeaway is that Amwell isn’t exactly expensive with a market cap at $1.3 billion, but the stock isn’t appealing with mounting losses set to burn the large cash balance. Until Amwell proves the business model can hit financial targets despite the growing influence of Amazon and a tough sales cycle with a looming recession, the stock just isn’t touchable. The recent rally isn’t likely to hold.

Be the first to comment