Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Amazon.com, Inc. (AMZN) and MercadoLibre, Inc. (MELI) stocks significantly underperformed the market in 2021. It followed a phenomenal year in 2020 as both companies rode the pandemic tailwinds. However, the year also quickly turned into headwinds as 2021 unfolded, exacerbated by the supply chain disruptions and cost inflation. Therefore, we were not surprised that investors chose to reduce exposure in both stocks as they changed their focus towards the “brick-and-mortar” plays last year.

There are certainly some companies whose businesses have been significantly and permanently impacted by the reopening headwinds. However, we believe both Amazon and MercadoLibre are strong secular plays that have already been riding on their e-commerce tailwinds before the onset of the pandemic.

Although the pandemic accelerated the digital transformation towards m-commerce and e-commerce, we believe these secular tailwinds remain intact. Moreover, recent mobile statistics from App Annie show that mobile commerce will continue to be a key driver for consumers moving forward. Notably, MELI and AMZN are among the leading players who will benefit tremendously from the secular digitization trend.

Nevertheless, while both companies are massive e-commerce leaders, their underlying drivers are also quite different. We discuss what we think will be the key catalysts for both companies as they finally lap challenging comps from CY20.

AMZN and MELI Stock Performance

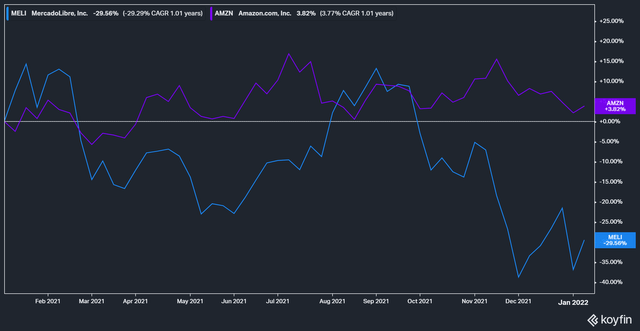

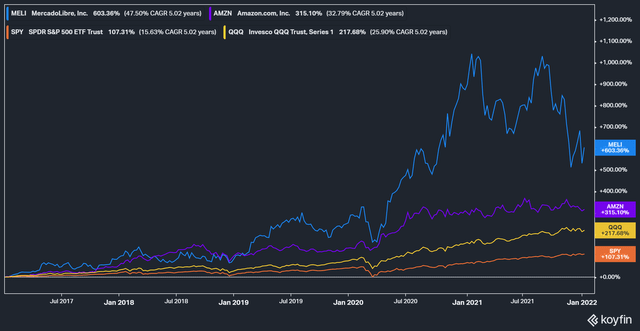

AMZN and MELI stock 1Y performance (as of 12 Jan’ 22). koyfin AMZN and MELI stock 5Y performance (as of 12 Jan’ 22). koyfin

Both stocks had an underwhelming 2021 for investors, with MELI taking the brunt of the selling pressure with a disappointing 1Y return of -29.6%. However, as mentioned, both stocks have been huge long-term winners before the pandemic struck. While MELI stock has been more volatile, it has also outperformed AMZN stock over the last five years. In addition, both stocks also easily outperformed the broad market, delivering superior returns for their investors over time.

Why MELI Stock’s Volatility is Likely to Continue

MELI and AMZN stock beta trend (against SPY ETF). koyfin

We can observe from the above chart that MELI stock has a current beta of 1.46, which is also significantly higher than AMZN stock’s 0.79. Moreover, MELI stock’s beta has also been trending higher compared to AMZN stock over the last year. As a result, investors who are not comfortable with volatility must have felt a certain amount of angst over MELI’s stock performance. But, investors must understand that MercadoLibre’s primary operations are in the LatAm region. The region’s political and economic environment has much more flux than in the US, where Amazon is headquartered at.

The business environment in LatAm, especially in Brazil has also been undergoing tremendous stress recently. Since Brazil is MercadoLibre’s most important market, investors must continue paying close attention to Brazil’s economy.

We covered in our previous article that MercadoLibre reported robust business performances throughout FY21. Nevertheless, its stock performance has been overshadowed by the failure of Brazil’s central bank to bring inflation under control. Like the US, Brazil’s economy has also been significantly impacted by supply chain disruptions, exacerbated by record-high commodity prices, that drove up inflation tremendously. Bloomberg also reported that “a severe drought also pushed electricity bills up. Complicating matters, the real failed to strengthen despite an increase in exports as investors weighed the country’s fiscal woes.”

Consequently, Brazil’s inflation rate continued to shoot up throughout 2021, as it ended the year at 10.06% in December. In November, it also reached an 18-year high as inflation shot up to 10.74%. Notably, it’s also well above the central bank’s target of 3.75%. Even though the central bank raised rates aggressively throughout the year, it has failed to anchor inflation expectations while also pushing the economy into a recession, with the potential threat of stagflation hanging over the horizon. Furthermore, the central bank recently emphasized that it will miss its 2022 inflation target. It also highlighted that it will continue its “significantly restrictive” cycle of rate hikes moving forward.

Therefore, investors should continue to expect MELI stock’s volatility to continue. Given that MELI is a growth stock, unexpected interest rate hikes will adversely raise its discount rate, reducing the present value of its future cash flows. Consequently, it would impinge on MELI stock’s valuation as investors scramble to account for interest rate risks appropriately. Given the flux going on in the Brazilian economy, MercadoLibre investors must continue to monitor the developments closely. Furthermore, we expect the high volatility in MELI stock to continue until the central bank can demonstrate credibility in its ability to bring inflation under control.

Amazon Needs AWS To Continue Driving Leverage As E-Commerce Headwinds Persist

We believe that the global supply chain headwinds are temporary. However, Amazon’s massive e-commerce footprint has also not been spared. We highlighted in a previous article that the company invested $4B in trying to overcome the logistical setbacks to maintain the quality of its fulfillment capability. Recent checks also suggest that the supply chain headwinds could be normalizing. For example, Citigroup highlighted in a recent note that “the supply-chain pressures leading to longer delivery times and rising prices may be easing.”

Nonetheless, these pressures are likely to persist in the near term but may ease from H2’22. Hence, we believe that AMZN stock may continue to trade in a tight trading range in the near term until its quarterly results start to show improvement. Notably, the critical aspect of its business that may catalyze its stock price could potentially be its AWS cloud business.

Keen Amazon investors know the critical importance of AWS to its profitability. Even though Microsoft (MSFT) Azure has been gaining share rapidly, AWS is still the #1 hyperscaler. Furthermore, the massive scale of the AWS cloud has been instrumental in attracting key enterprise customers. Monness Crespi Hardt also weighed as it articulated the advantages of AWS. It added (edited):

AWS is now available in 84 zones, 26 different geographic regions and has more than 200 fully-featured services with “millions of customers.” Over the years, AWS expanded its reach well beyond the regions and availability zones of its core public cloud, with solutions that support on-premises, IoT, rugged edge, and the next frontier (e.g., AWS Ground Station for taking satellite data into AWS) workloads. (Seeking Alpha)

We believe that some investors don’t afford sufficient credit to AWS’s massive footprint. AWS offers a critical competitive advantage for Amazon as its primary profitability driver. Therefore, we believe that if AWS can continue to scale up by leveraging opportunities in edge computing, cybersecurity, and Cloud SaaS, it could continue to drive further growth.

Moreover, Atlassian (TEAM) was attracted to Amazon’s massive global footprint as Insider reported (edited):

Atlassian was also drawn to Amazon’s catalog of homegrown cloud services, including those around reliability, security, and data processing. It was also drawn to Amazon’s global footprint, with cloud data centers around the world. (Insider)

Its keen competitors Microsoft and Google Cloud (GOOGL) (GOOG) have also been leveraging on the multi-cloud theme to encourage customers to diversify their cloud workloads away from AWS. Moreover, the recent outages suffered by AWS have also renewed concerns on companies reliant on just a single cloud.

Nevertheless, Atlassian CTO Sri Viswanath is not unduly concerned. He emphasized that a multi-cloud model “would add complexity and make it harder for Atlassian to ensure reliability. Atlassian’s goal is to focus on the speed of innovation.’ ((So)), it doesn’t make sense to add complexity.”

Notably, AWS has also raised the ante to compete more aggressively against Cloudflare (NET) in edge computing. VentureBeat reported that edge computing would continue to be a key driver for companies in 2022. As more workloads move to the cloud, companies are looking for ways to optimize costs, efficiency, and speed. VentureBeat highlighted:

The move is driven by physics and economics. Even when data travels at the speed of light, the time it takes to send packets halfway around the world to one central location is noticeable by users whose minds start to wander in just a few milliseconds. The price of data transmission is often surprising, and many CIOs have learned to make sure to include the cost of data exfiltration alongside the price of servers and disk drives. (VentureBeat)

In addition, we also believe that AWS is targeting to further expand its security infrastructure and offerings in 2022. Threatpost reported recently that “cyberattacks increased 50 percent YoY in 2021 and peaked in December due to a frenzy of Log4j exploits. ((It also)) reached an all-time high of 925 cyberattacks a week per organization, globally.” Therefore, we think it makes sense and imperative that AWS leverages the opportunities from such momentum. We believe it will be a crucial part of AWS’s business in 2022 as Amazon recently promoted AWS CISO Stephen Schmidt to its S-team, reporting directly to Amazon CEO Andy Jassy. Therefore, “Amazon is centralizing its cybersecurity operations.”

Are Both Stocks a Buy Now Despite the Supply Chain Headwinds?

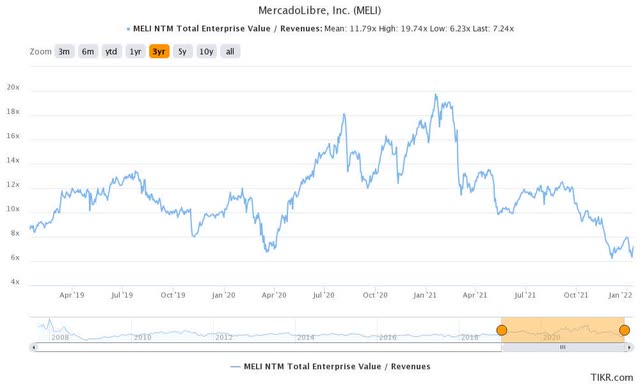

Brazil inflation rate trend. tradingeconomics MELI stock EV/NTM Revenue 3Y mean. TIKR

There’s little doubt that Brazil’s inflation rate has spooked investors who are investing in companies with significant exposure to its economy, such as MercadoLibre. But, if you think that its central bank can eventually bring inflation under control moving forward, we believe that MELI stock seems undervalued now. It’s also trading near valuations last seen at the COVID-19 bear market bottom. For us, we think that Brazil’s peak inflation rate would normalize eventually. Consequently, it could be a critical catalyst in lifting MELI’s stock valuation if it can continue its run of robust business performances.

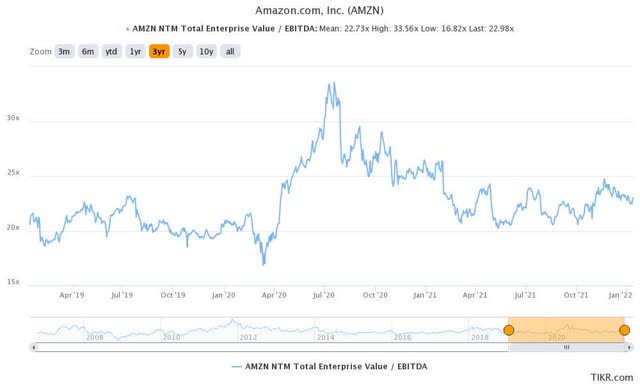

AMZN stock EV/NTM EBITDA 3Y mean. TIKR

AMZN stock is trading at an EV/NTM EBITDA of 23x, in line with its 3Y mean of 22.7x. Moreover, it has also moved off its peak valuations in July’20. AMZN continues to improve its operating leverage despite its topline growth deceleration due to the supply chain headwinds. Notably, AWS has been a critical driver of its operating leverage, and we believe that the market will eventually notice that AMZN stock is now discernibly undervalued.

Therefore, we believe that investors could benefit by holding these two e-commerce behemoths in their portfolios, given their respective geographical exposure. Moreover, we believe that the headwinds that impact their stock performance could normalize soon. Consequently, we believe they could be re-rated by the market after their headwinds normalize and resume their undisputed long-term uptrend.

As such, we reiterate our Buy rating on MELI stock and AMZN stock.

Be the first to comment