HJBC/iStock Editorial via Getty Images

France-based asset manager Amundi S.A. (OTCPK:AMDUF) delivered a surprisingly resilient set of results this quarter, highlighting its relative defensiveness against secular headwinds in the asset management industry. While the company benefited from positive mix effects and operational leverage this time around, the key question will be the sustainability of these results from here. In particular, the current quarter’s volume-linked benefit from non-linear structuring and administration fees is unlikely to recur in the coming quarters. This ultimately leaves Amundi’s ability to manage cost inflation headwinds as the key P&L driver going forward, alongside the pace of revenue and fund flow momentum headwinds.

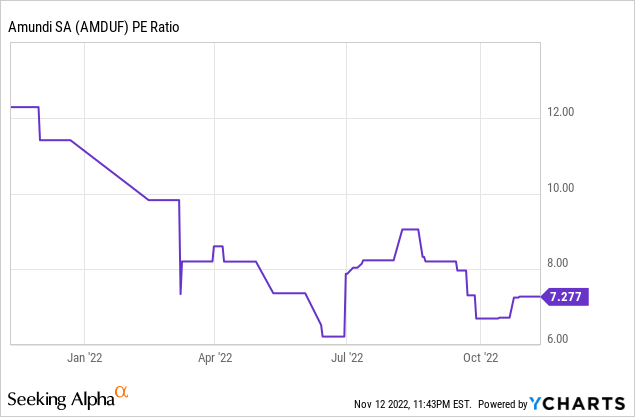

The stock trades at a relatively discounted ~7x PE, but given the many company-specific headwinds, including near-term cost-income ratio pressures from the Lyxor integration and tech investments, as well as a sustained shift in fund flow to retail bonds amid higher rates, I remain neutral.

A Resilient Quarterly Result

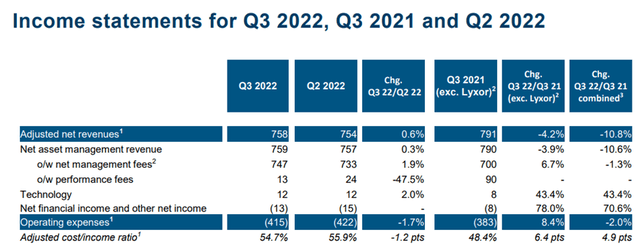

Amundi posted a surprisingly solid adj revenue of EUR758m for the quarter, coming in ahead of consensus estimates on the back of a favorable mix shift as well as FX gains and other non-recurring items. The implied management fee margin was also positive at 18.7bps, although half of the ~EUR14m delta from the last quarter was down to one-offs. Still, the vast majority of fee commissions continue to be driven by assets under management, with the rising rate environment helping allay some of the pressure on management fee margins in fixed-income products.

Where the Amundi really shone was on the expense side, however, which saw a ~2% decline YoY (on a like-for-like basis), as the initial cost synergies from the Lyxor integration flowed through to the P&L. Also helping was increased cost discipline, which should continue to be a theme through the coming quarters. As a result, adj pre-tax profits outpaced consensus numbers at EUR366m; even though profitability continues to decline ~20% YoY, the pace was slower than expected. Going forward, revenue generation will be challenging given the uncertain market environment, which likely means more diligence on the cost management front. In line with this view, management reiterated its mid-term cost targets, which should help to stem the pace of future profit declines.

Outflows Continue, but Favorable Mix Shift Helps

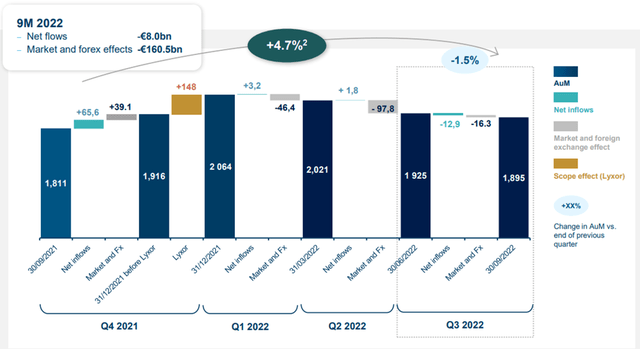

At a group level, assets under management ex-JVs (AUM) were in line at EUR1.9tn, reflecting better than expected medium/long-term (MLT) flows and offsetting any headwinds from treasury outflows (ex-JVs) across the corporate and institutional client base. Still, the source of the higher-margin MLT funds was concerning, coming mainly from client de-risking and insurance outflows, with the remainder from the maturity of funds from the Chinese wealth management subsidiary. The pace of outflows from institutional and third-party distributor de-risking was also a net negative, with significant outflows across multi-asset and passive management.

The biggest surprise this quarter was the outperformance in active management, which saw positive flows of EUR1.1bn, led by active equities at +EUR2bn and active bonds at +EUR3.4bn. Most of this comes from retail activity, which has been positive across the board, even as JV contribution fell short at ~EUR1.3bn of total net outflows (mainly from treasury products and channel business). The sustainability of this trend is far from certain, though the positive mix benefit from a rebalancing toward active equity, fixed income, and real assets should help to offset outflows in passive and mandate-driven alternatives for now.

Completed Lyxor Integration Frees Up M&A Capacity

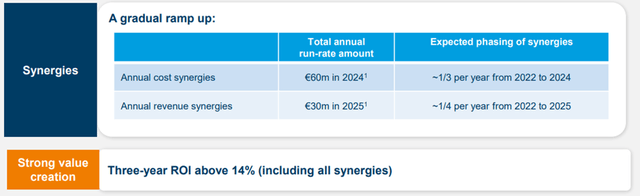

On a positive note, the operational integration of recently acquired Lyxor Asset Management has been completed as of Q3. No changes to the synergies run-rate, though, with estimates still in line with previous guidance for ~EUR60m of pre-tax cost synergies in 2024 and full-year revenue synergies of ~EUR30m in 2025 remaining intact.

The initial benefits from the cost synergies have already been recorded thus far, but most of the effects are only expected to flow through in Q4 and in 2023, so expect a near-term P&L tailwind. As things stand, the return on investment is projected to exceed 14% in 2024, including all synergies. Perhaps more importantly, the acquisition frees up capacity for more industry consolidation. Amundi’s acquisition criteria remain subject to valuations and strategic alignment, but given the de-rating across the industry, new deals should not be hard to come by.

A Resilient Quarter but Headwinds Remain

Overall, this was a reassuring set of results from Amundi, highlighting its defensiveness through volatile market conditions. Going forward, the cost-income ratio will be key, particularly with the current market-driven AuM headwinds likely to continue for some time yet. Supporting this view are the company’s peer-leading operating margins and the prospect of further margin gains from the Lyxor integration. These should support a more resilient earnings growth trajectory into 2023, in my view.

That said, there are clear headwinds ahead for Amundi, including its planned investment cycle related to tech and commercial initiatives, ongoing outflows from older general strategies, as well as a continued rebalancing toward retail bonds amid the ongoing rate hikes. So while the current valuation seems undemanding at first glance, the high-single-digit fwd P/E seems warranted, all things considered.

Be the first to comment