SolStock

Investment Thesis

American Woodmark Corporation (NASDAQ:AMWD) has outperformed the broader markets since my last bullish article as my thesis around improving margins has played out well and the company reported good results. However, the business has started experiencing softness in demand due to macroeconomic uncertainty and changes in consumer behavior. The company’s order rates are expected to moderate and the elevated backlog levels are expected to return to normal by the end of the calendar year 2022. After improving meaningfully over the past few quarters, the company’s adjusted EBITDA margin is expected to remain in the low double digits in the second half of FY23.

While the company is moving ahead with its five-year strategy for long-term growth focusing on digital transformation and platform design, the challenging near-term outlook should continue to weigh on the stock. The valuations are cheap but I don’t see a catalyst that can drive the stock higher in the near term. Hence, I am moving to a neutral rating on the stock.

AMWD Q2 FY23 Earnings

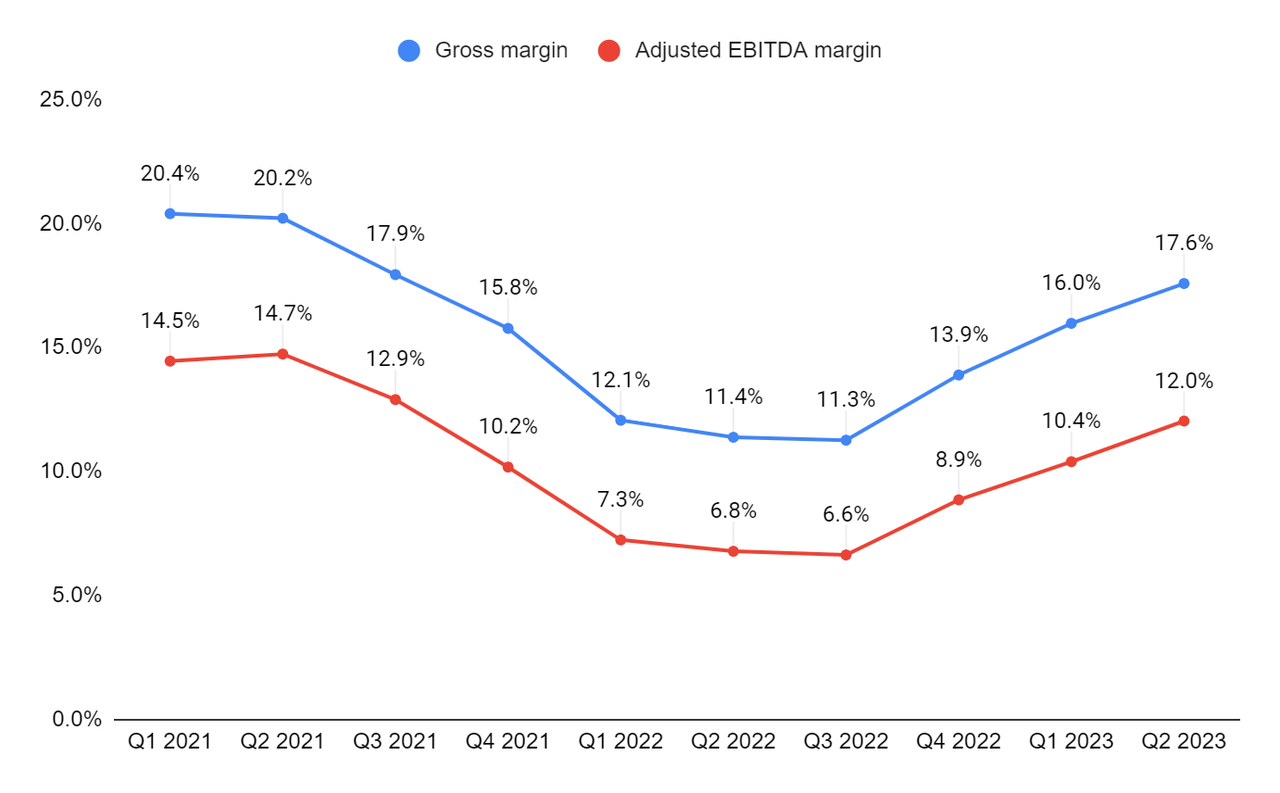

AMWD recently reported better-than-expected second-quarter FY23 financial results. The net sales in the quarter grew 24% Y/Y to $561.5 mn (vs. the consensus estimate of $553.67 mn). The net sales growth was driven by growth in the new construction and repair & remodel (R&R) businesses. The adjusted EPS was up from $0.62 in Q2 FY22 to $2.24 in Q2 FY23 (vs. the consensus estimate of $1.92). The bottom-line growth was driven by higher sales and an improvement in the adjusted EBITDA margin. The adjusted EBITDA margin in the quarter increased from 520 bps Y/Y to 12% due to higher price realization and improved efficiencies in the manufacturing platforms.

Revenue

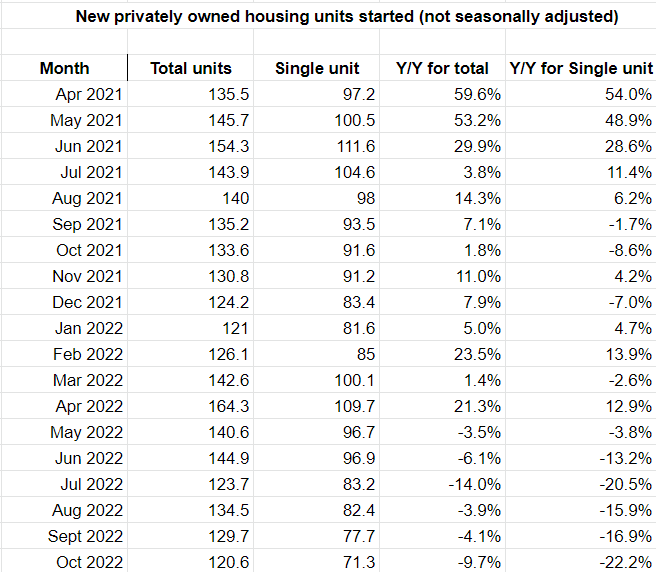

In Q2 FY23, the new construction business grew 33.3% Y/Y with growth in the Timberlake business. Notably, the overall market starts for single-family homes were down 15.8% Y/Y in the quarter; however, the completions were up 7% Y/Y. The company’s sales outperformed the end market meaningfully as it is converting its elevated backlog to sales faster given the easing supply chain constraints. The backlog levels are expected to return to normal levels by the end of the calendar year 2022. While most of the homebuilders are seeing a significant decline in new orders, the incoming orders for AMWD are still healthy as homebuilders are completing the homes in their backlog. The R&R business, which includes home centers and independent dealer and distributor businesses, grew 17.5% Y/Y. The home center business was up 10.3% Y/Y while the dealer/distributor business was up 46.2% Y/Y.

US Housing Starts (Census.gov, GS Analytics Research)

The made-to-order (MTO) frame backlog, decreased in the quarter as production levels exceeded the incoming order rate. AMWD is experiencing a slowdown in incoming order rates in the home center business around the MTO platform. The Professional Cabinet Solutions (PCS) frameless business remains strong as unit shipments and order rates remain healthy.

The stock platform is stabilizing as overall demand returns to normal levels. MTO and PCS units were up in the quarter and contributed to the sales growth along with higher price realization. However, the stock platform units were down.

Consumer behavior is shifting due to housing affordability, and macro uncertainty and rising interest rates are impacting single-family new construction starts and R&R demand. Due to these headwinds, management expects a low double-digit growth rate for FY23 with negative sales comps in Q4 FY23.

Despite near-term headwinds, the company is working on its five-year strategy, which is based on three pillars: growth, digital transformation, and platform design. Growth should come from the launch of new products, including four new finishes and several new door styles that are continuing to perform well. The digital transformation includes planning efforts for the next implementation area of ERP. After a comprehensive review of its platform, AMWD plans to add new capacity for its stock kitchen and bath cabinetry product lines. In October, the company announced an investment worth $65 mn to expand capacity in Monterrey, Mexico, and Hamlet, North Carolina. With the addition of the fourth facility in Mexico and expansion at the Hamlet location, AMWD should strengthen its overall supply chain and increase capacity in both categories on the East Coast, which is one of the largest R&R and new construction markets. The capital investment in FY23 is expected to be in the range of 3% to 3.5% of net sales. The additional capacity is expected to come online by Q4 FY24 or Q1 FY25 and would be utilized to drive incremental sales growth. In the longer run, AMWD should also benefit from the lower housing inventory, higher home-equity levels, and demographic trends.

Margins

In Q2 FY23, the gross margin improved by 620 basis points to 17.6%, and adjusted EBITDA margins improved by 520 bps to 12% due to the pricing actions taken by the company and operational improvements, partially offset by inflation and input costs. The company is seeing some relief on the cost of hardwood lumber, however, the costs of certain commodities, such as plywood, particleboard, and other inputs, continue to remain elevated.

AMWD’s gross margin and adjusted EBITDA margin (Company data, GS Analytics Research)

AMWD plans to rightsize its inventory levels and tightly manage its SG&A spending in the back half of FY23. The company plans to just-in-time inventory as the supply chain improves. The price increases implemented by the company over the last few quarters are in effect across all its sales channels. However, there will be some deleverage, especially in the Q4 of this fiscal year as, according to management, revenue is likely to decline Y/Y in the fourth quarter. Management has guided for the adjusted EBITDA margin to be in the low double digits in the back half of FY23 and for the full year 2023. Given, the company was already at a 12% adjusted EBITDA margin in Q2, I don’t expect much improvement from these levels.

Valuation & Conclusion

The stock is currently trading at a P/E of 7.73x FY23 consensus EPS estimate of $7.34 and a P/E of 9.50x FY24 consensus EPS estimate of $5.97 which is a significant discount versus its historical levels. While I like the company’s long-term prospects, the near-term prospects look bleak. I shared my bullish thesis on the stock in September where my main argument was improving margins will drive earnings growth. The stock has outperformed the broader markets since then gaining 11.80% versus the S&P 500’s (SPY) 2.97% gains. I believe the thesis around margin recovery has already played out and with no further margin expansion expected in the near term, I don’t see a catalyst that can drive stock upward. Near-term revenue outlook is also not good with a decline expected in Q4 of this fiscal year and the next fiscal year. Hence, I believe it is prudent to wait on the sidelines at least for the next few quarters. So, I have a neutral rating on the stock.

Be the first to comment