Fahroni

Thesis highlight

I believe Polestar Automotive Holding (NASDAQ:PSNY) is undervalued as of today. Two major factors are driving a shift in the automobile industry: a customer preference for value-based companies and their products and a rise in the adoption of electric vehicles. Any vehicle manufacturer that taps into these two advancements will enjoy a large market share. With a focus on low environmental impact, PSNY has won the hearts of environmental enthusiasts and penetrated the electric vehicle industry.

Company overview

PSNY is a premium electric car brand that was established by Volvo (OTCPK:VOLAF) Cars and Geely (OTCPK:GELYF) in 2017. It is based in Sweden, and it designs and manufactures products that are meant to excite consumers and at the same time drive change.

Investment merits

Fundamental change in the automotive industry benefits PSNY

An increase in customer awareness about the environment, technological improvements, and a shift in customer preference toward premium luxury vehicles are driving a global car industry transformation. This makes the premium luxury electric vehicle segment one of the fastest-growing segments in the automobile industry. I believe that the move by organizations and governments to implement strict environmental regulations, as well as the ever-expanding charging infrastructure, both drive the adoption of electric vehicles, with premium luxury electric vehicles expected to outpace the growth of other premium vehicles.

Among the top strategies employed by PSNY is expanding internationally. From its inception, PSNY went global with a target to penetrate 30 markets by the end of 2023. PSNY intends to achieve this by expanding its presence in Asia Pacific and the Middle East, which are both rapidly growing markets. To further strengthen the global expansion strategy, PSNY’s direct-to-consumer [DTC] approach is digital, allowing potential customers to browse PSNY’s products, configure a vehicle to their own preferences, and also place their order online. In order to wrap both the offline and online worlds together, PSNY uses an omni-channel approach to allow customers who want to have a feel of the physical product and go for a test drive to visit one of PSNY’s locations.

In terms of environmental issues, PSNY targets mitigating the environmental impacts of their products by developing technologies that lessen the impact. An example is their Polestar 0 project, which aims to develop a climate-neutral car by the year 2030. To achieve this, their research and development activities will include developing new interior materials and structural components with low environmental impact, thereby lowering PSNY’s environmental impact.

PSNY’s mass production capability is a big differentiator

According to PSNY F-4, PSNY and Tesla (TSLA) enjoy the monopoly of being the only global pure play premium electrical vehicle manufacturers at scale. For new entrants to match their capabilities, they have to develop core competencies to match their technologies to PSNY’s, access vehicle design and manufacturing capabilities, and develop a sales and service infrastructure similar to what PSNY receives from Volvo Cars and Geely. This is itself a giant barrier to entry.

Asset-light model enables PSNY to scale rapidly

PSNY employs a scalable, asset-light business model that enables it to transfer noncore assets and liabilities (technology, manufacturing footprint, logistical infrastructure, and information technology systems) to Volvo Cars and Geely, allowing them to increase their strength, focus on scaling production to meet demand, and globally launch their brand. Viewed from a capital intensity standpoint, this model requires less capital to produce vehicles and revenue as compared to traditional and other electric vehicle companies. This is because PSNY gains access to an already operational ecosystem.

PSNY’s go-to-market strategy is effective

Through PSNY’s mobile application or other digital platforms, a customer is able to:

- Discover PSNY’s products,

- Configure and personalized PSNY’s products,

- Choose a financing option, and

- Purchase PSNY’s products.

This gives the customer a smooth experience and makes PSNY more efficient by getting rid of different kinds of distribution. Customers can also have a feel for the physical product and do a test drive at any of PSNY’s locations before making a purchase. This sales and distribution model delivers a seamless, high-quality customer experience.

Emphasis on sustainability should attract more attention from ESG investors

PSNY aims to attract and engage environmentally conscious customers. To do this, they aim to produce environmentally sustainable products using Scandinavian avant-garde design and high-tech minimalism. I believe this is a dual-pronged strategy, as it will also attract customers who cherish its design aesthetic. As PSNY focuses on electric vehicle manufacturing, sustainability is their core principle. They aim to reduce the impact of their products and every aspect of their business on the environment, and they also actively target climate neutral manufacturing processes and materials by using tools such as Life Cycle Analysis to ascertain the impact of their vehicles and to also identify new opportunities. This information is transparently shared with PSNY’s customers for them to make an informed purchasing decision and also track PSNY’s progress.

While this doesn’t reflect directly in the profit and loss statement of PSNY, it creates an avenue for PSNY to source capital from ESG investors.

Strong internal culture to ensure long-term success

PSNY has drawn employees with the right creative and analytical skills to its ranks. Its designer-led, visionary, and sustainability-focused corporate culture is rich in experience in the automobile industry.

The Chief Executive Officer of PSNY, Thomas Ingenlath, is a former senior vice president of design at Volvo Cars and was a key player behind Volvo Car’s recent award-winning design renaissance. The Chief Financial Officer, Johan Malmqvist, is vastly experienced across multiple sectors in the United States and other publicly listed companies. The Chief Operating Officer, Dennis Nobelius, is the former Chief Executive Officer of Zenuity, an assisted and autonomous driving software company. PSNY intends to use Zenuity’s technology in future vehicles, beginning with Polestar 3.

Valuation

Price target

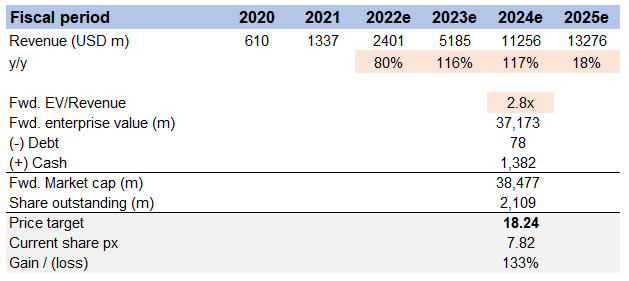

My model suggests a price target of $18.24 in FY24. This assumes that revenue will continue its strong growth momentum until FY24 and then slow down in FY25, and the forward EV/EBITDA multiple will be 2.8x in FY24e.

Own estimates

For FY22e, I used FY22 guidance, and for FY23e and beyond, I used consensus estimates. I mean, frankly, the growth momentum is incredible, and I have little confidence in my ability to precisely forecast the growth rate. Hence, using a consensus estimate would be a good yardstick.

As for how much PSNY is worth, it trades at 2.8x forward EBITDA right now, and I assumed that the multiples wouldn’t change.

Risks

Core competitive advantage relies on Volvo and Geely

PSNY’s strategy of relying heavily on its strategic partners, Volvo and Geely, is a huge risk. If PSNY can’t maintain these strategic partnerships and agreements or enter new agreements and partnerships, their ability to operate as a standalone business to produce vehicles and meet development and production targets will be negatively affected. Without these partnerships, PSNY can’t focus on its core areas of differentiation.

Legacy automotive industry has high barriers to entry

The high initial investment to gain entry into the automobile industry poses a challenge to PSNY. By focusing on electric vehicles, PSNY faces challenges that a traditional automobile manufacturer won’t face, for example, developing and producing an electric power train with comparable performance to a traditional gasoline engine, having little experience servicing electric vehicles, and abiding by regulations on the transport of batteries. If PSNY does not overcome these obstacles, its business will suffer.

Exposure to China

Relying on manufacturing facilities based in China is a risky venture considering the volatility of the Chinese government. PSNY uses the factories of contract partners like Volvo, Geely, and others, as well as its own factories in China, to make its vehicles.

Conclusion

PSNY is undervalued. With an ever-increasing market for these electric vehicles and the high barriers to entry for potential competitors, PSNY stands a good chance of winning a large share of the market. By partnering with Volvo and Geely, PSNY can tap into the already functional manufacturing and sales ecosystems owned by these two huge companies. This also presents an advantage for PSNY to scale its profits further by focusing on manufacturing only.

Be the first to comment