bjdlzx

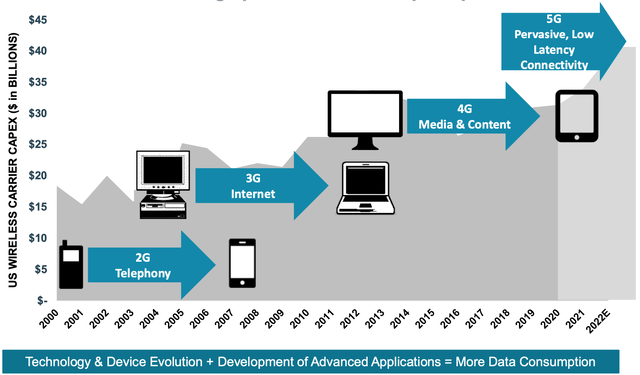

Since the year 2000, mobile data usage has expanded exponentially and this trend is set to continue. According to one study by Ericsson, the average mobile data usage per person is 11.4GB and this is forecasted to increase by nearly 5X to 53GB per phone by 2027. The real interesting part is 5G networks are expected to carry over 62% of global smartphone traffic by 2027. Thus, it’s no surprise that the global 5G infrastructure market is forecasted to grow at a blistering 56.7% compounded annual growth rate [CAGR] between 2022 and 2026. American Tower (NYSE:AMT) is poised to become the backbone of the 5G network across the US and internationally. This behemoth of the telecommunications industry has a solid growth strategy, smart efficiency tactics and pays a consistent dividend. In this post, I’m going to break down the company’s business model, financials and valuation for the juicy details, let’s dive in.

5G Network (Investor Presentation)

Business Model

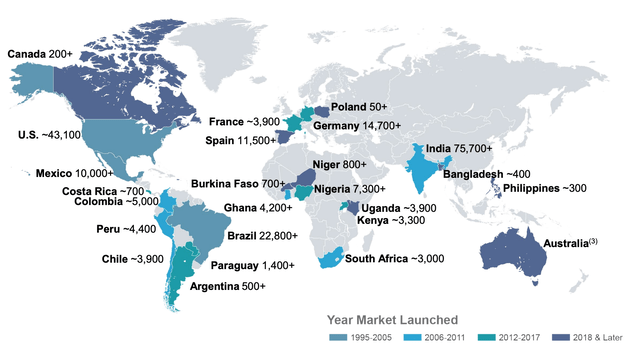

American Tower is a global provider of wireless communications infrastructure. The company has a vast portfolio of over 170,000 sites across 25 countries. American Tower constructs or acquires cell tower sites and then leases them to major telecoms carriers such as AT&T (T) and Verizon (VZ). Verizon is particularly interesting given the company has recently entered into a long-term lease deal to secure 5G network deployment in the US. This is a major deal and effectively guarantees solid income over a multi-year period.

American Tower Sites (created by author Ben at Motivation 2 Invest)

The company also has over 30,000 sites in Europe, with strong positions in Germany and Spain. American Tower operates a strong acquisition strategy. For instance, the company acquired CoreSite for $10.1 billion in Q4, 2021. In addition, the company acquired Telefónica’s (TEF) tower business, Telxius Towers, for about $9.4 billion in Q1,21. This growth by acquisition strategy enables the company to gain an edge when it comes to the “land grab” opportunities internationally. This also offers a faster time to value than construction, as that can take significant periods of time.

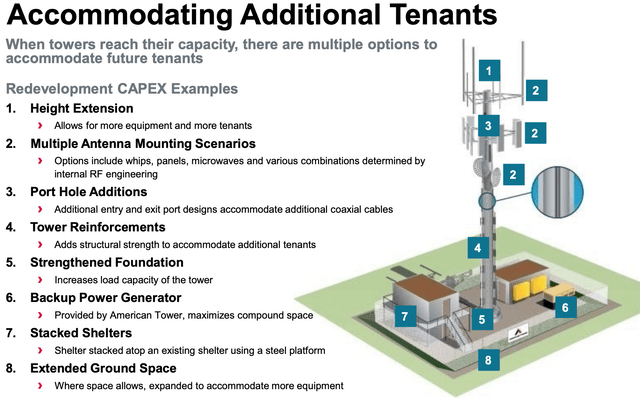

American Tower also executes an exceptional strategy of “growing vertically”. This basically means the company can add new sections to its towers to effectively accommodate more tenants. In addition, the company leverages the space around its towers to rent out to additional tenants. Overall, these smart strategies help to increase the efficiency and Net Operating Income of each site.

American Tower More Tenants (Investor Presentation 2022)

Alternative investment firm Stonepeak has recently announced to have acquired a 29% stake in American Towers US data center business for ~$2.5 billion. This investment from Stonepeak should help its data center segment to grow and more multi-tenant sites to be rolled out.

The company’s contracts with tenants are typically “non-cancellable” and include an initial term of between 5 and 10 years. This offers significant consistency to the cash flow and thus safety of the dividend.

Growing Financials

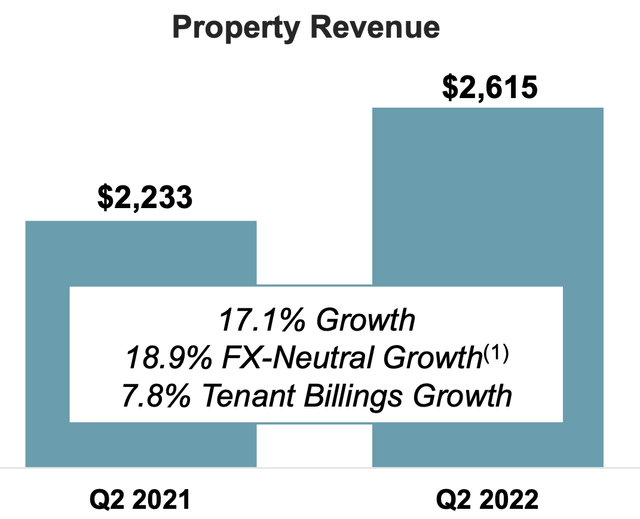

American Tower generated strong financial results for the second quarter of 2022. Total revenue increased by a rapid 16.3% to $2.67 billion. Property revenue popped by 17.1% to $2.62 billion. This growth was driven by strong international revenue growth, which increased by 19% year over year or 23% on a constant currency basis. Strong performance from the newly acquired Telxius assets contributed to approximately 12% of this growth. In North America, property revenue was pretty much flat to negative effects from telecoms provider Sprint and its churn due to the merger with T mobile. The US data center business generated nearly $190 million of growth in the quarter, which was driven by continued 4G and 5G rollouts, which acted as a secular tailwind.

Property Revenue (American Tower)

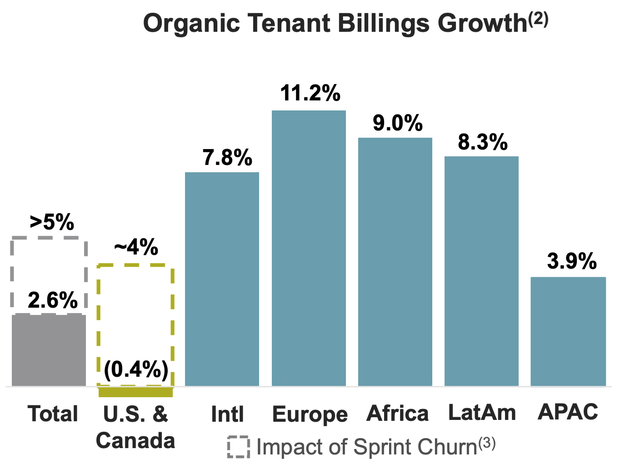

Organic tenant billings growth was 2.6% on a consolidated basis. North American organic growth turned slightly negative at 0.4% which was mainly driven by the timing of fees with a greater portion expected in Q3 and Q4 and 2022. European billings saw strong growth of 11.2%, which was mainly driven by contributions for the recently acquired Telxius portfolio. Excluding this, European Organic tenant billings still popped by ~6%, year over year.

Africa was a shining light and generated strong organic tenant billings growth of 9%, which includes 8% in gross organic new business. This was driven by 400 new sites in Q2 and strong growth in 4G. Latin America also generated strong organic growth of 8.3%. Emerging markets are a strong growth area for American Tower and I forecast these to continue to perform well. Many of these nations, such as in Africa, often skip a generation when it comes to telecommunications technology. For example, many parts of Africa skipped hard phone lines and went straight to mobile. I forecast a similar trend in regions where 3G or 4G is still lagging, 5G may accelerate.

The Asia Pacific Region also achieved steady growth of 3.9%, driven by strong building activity of nearly 1,000 sites.

Organic Tenant Billings Growth (Investor Presentation Q2)

A key metric to watch when analyzing REITs is rent escalations, ideally you want to see the REIT consistently raising rents in order to keep up with the target inflation rate (at least 2%). Although inflation is much higher at the moment, it would be unrealistic to raise rents by over 8% as it would put too much pressure on tenants. In this case, American Tower executed a solid rent escalator of 2.8% and expects 3% for the rest of the year, which aligns with historic levels.

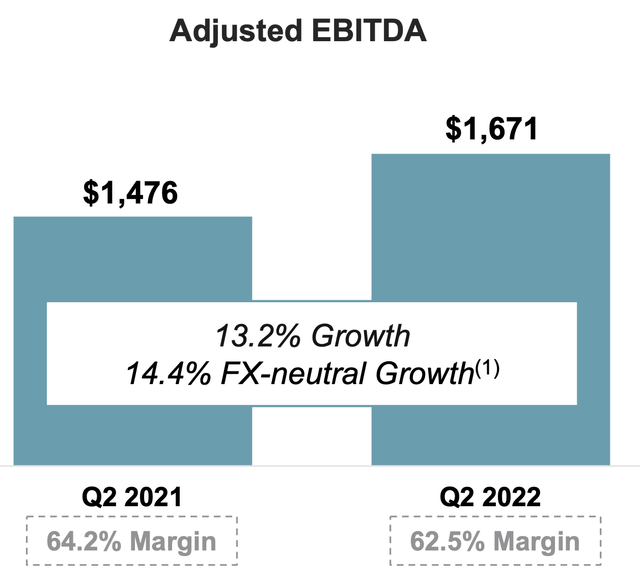

Adjusted EBITDA margin was squeezed by 170 basis points to 62.5%. This was driven by the lower margin profile of newly acquired assets.

Adjusted EBITDA (Q2 Earning Presentation)

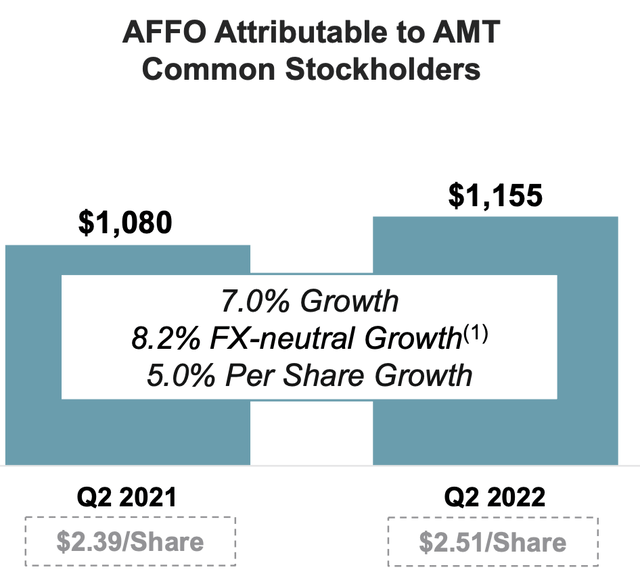

The main metric investors should care about when analysing REITs is the Attributable Adjusted Funds from Operations [AFFO], which increased by 7% year over year and 5% on a per-share basis. The Sprint churn and the timing of “cash taxes” did impact this substantially by ~7%.

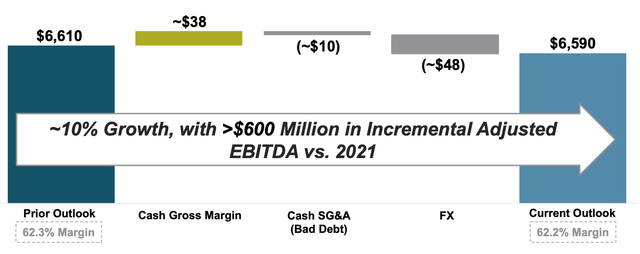

Moving forward, management has raised its AFFO per share guidance for the year, which is a positive. However, the business has lowered the outlook midpoint range by ~$20 million due to FX headwinds and bad debt reversal expectations. The good news is I believe the majority of these issues are short term headwinds and management raised its organic growth expectations in Latin America and Africa, which is a positive.

Outlook (Q2 Earnings Presentation)

Consistent Dividend

American Tower pays a forward dividend of 2.19%. This is not the highest in the REIT but is definitely one of the most consistent with an A rating on Seeking Alpha for Dividend consistency. In addition, it has a 5-year growth rate of over 18.27% which is fantastic.

AMT Stock’s Valuation?

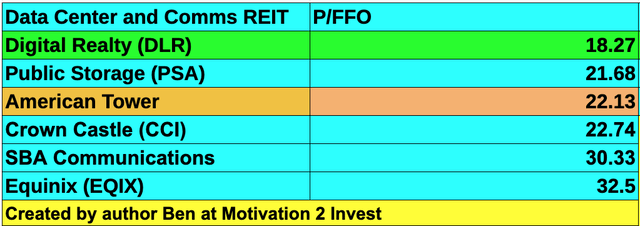

In order to value American Tower, I will analyze two common valuation metrics for REITs, P/FFO and P/AFFO. American Tower trades at a Price to Funds from Operations [P/FFO] forward of 22.13 which is 53% more expensive than its 5-year average of 14.42. A similar pattern is true for the adjusted FFO, with P/AFFO = 26 which is 60% more expensive than its 5-year average. As an extra data point, I have compared American Tower to other telecoms and data center REITs. In this case, we can see American Tower trades mid-range in the table, but it is slightly cheaper than Crown Castle (CCI) which is a very similar company. The main difference is Crown Castle is focusing on US 5G investment, while American Tower is focusing more on its international strategy.

Data Center and Telecoms REIT (created by author Ben at Motivation 2 Invest)

Risks

High Valuation

As shown above, American Tower isn’t exactly cheap relative to historic multiples, but it does trade at mid-range relative to the sector. Digital Realty (DLR) is an interesting data center REIT that trades at a very cheap valuation, P/FFO = 18.3. I have previously written a full report on this stock if you want to find out more.

Recession/Spending Slow Down

We are also seeing inflation in material and labor prices, thus many analysts are forecasting a recession. This may cause a temporary slowdown in the rollout of 5G, especially given immense geopolitical uncertainty from factors such as the Russia-Ukraine war.

Final Thoughts

American Tower is a global telecoms REIT that is poised to ride growth trends in 5G across both US and International markets. The company has generated steady growth despite temporary headwinds. The stock price isn’t exactly cheap right now, but it is cheaper than a close competitor and offers immense stability. Therefore, I will label the stock as a “Buy”, but investors may also wish to look at the other opportunities I have highlighted in cheaper Data Center REITs.

Be the first to comment