oatawa

A Quick Take On 1stDibs

1stDibs.com (NASDAQ:DIBS) went public in June 2021, raising approximately $115 million in gross proceeds from an IPO that priced at $20.00 per share.

The firm operates a website and marketplace that enables makers and sellers of premium home decor, art, jewelry and fashion items to sell to consumers.

DIBS faces revenue decline conditions along with significant operating cost structures likely resulting in more losses ahead.

Until management can reignite topline growth and reduce operating losses to make serious progress toward operating breakeven, I’m on Hold for DIBS.

1stDibs Overview

New York, NY-based 1stDibs was founded to create a platform of vetted sellers of art, jewelry, furnishings and accessories for the home.

Management is headed by Chairperson and CEO David Rosenblatt, who has been with the firm since November 2011 and was previously President, Global Display Advertising at Google.

The firm focuses on creating relationships with high quality, vetted sellers which in turn attracts well-heeled buyers.

According to a 2020 market research report by Bain & Company Luxury Goods Worldwide Market Study (Spring Update), the global market for luxury goods fell by an estimated 25% in Q1 2020.

The report said ‘there will be a recovery for the luxury market but the industry will be profoundly transformed…The coronavirus crisis will force the industry to think more creatively and innovate even faster to meet a host of new consumer demands and channel constraints.’

Also, the report estimated that ‘recovery to 2019 levels will not occur until 2022 or 2023,’ with growth resuming only gradually and depending on the major ‘luxury player’s strategic responses to the current crisis and their ability to transform the industry on behalf of the customer.’

Major competitive or other industry participants include:

1stDibs’s Recent Financial Performance

-

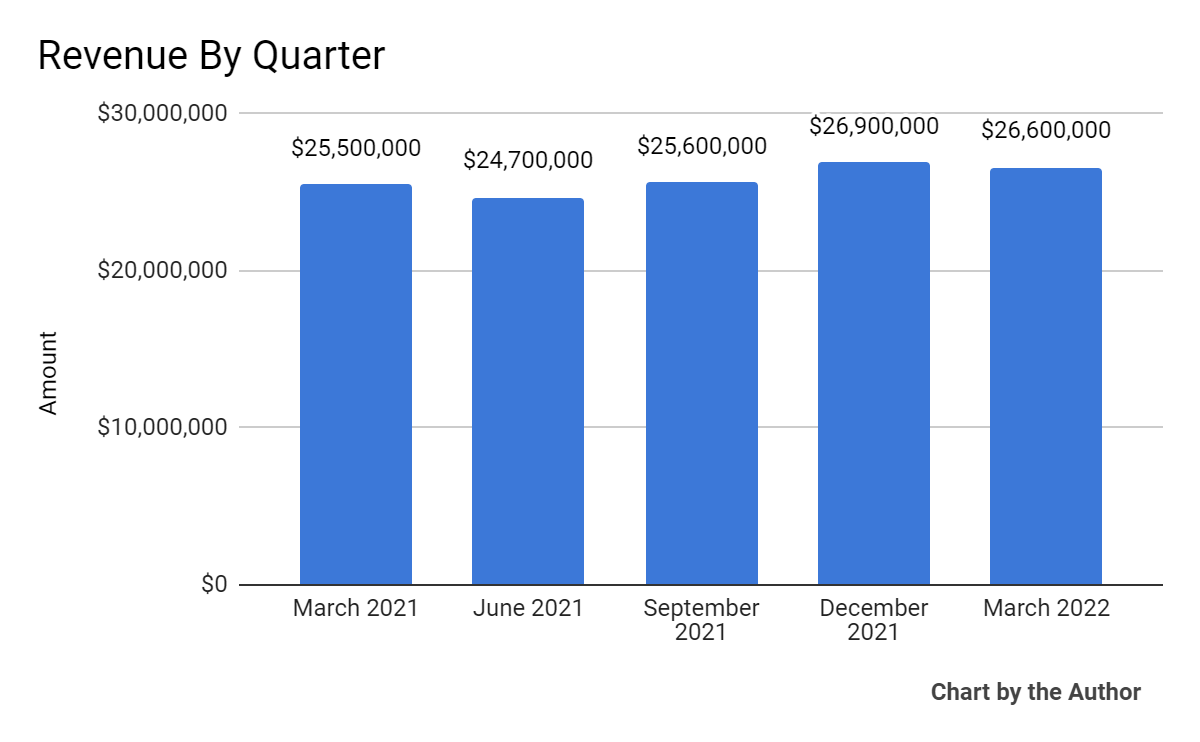

Total revenue by quarter has risen moderately over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

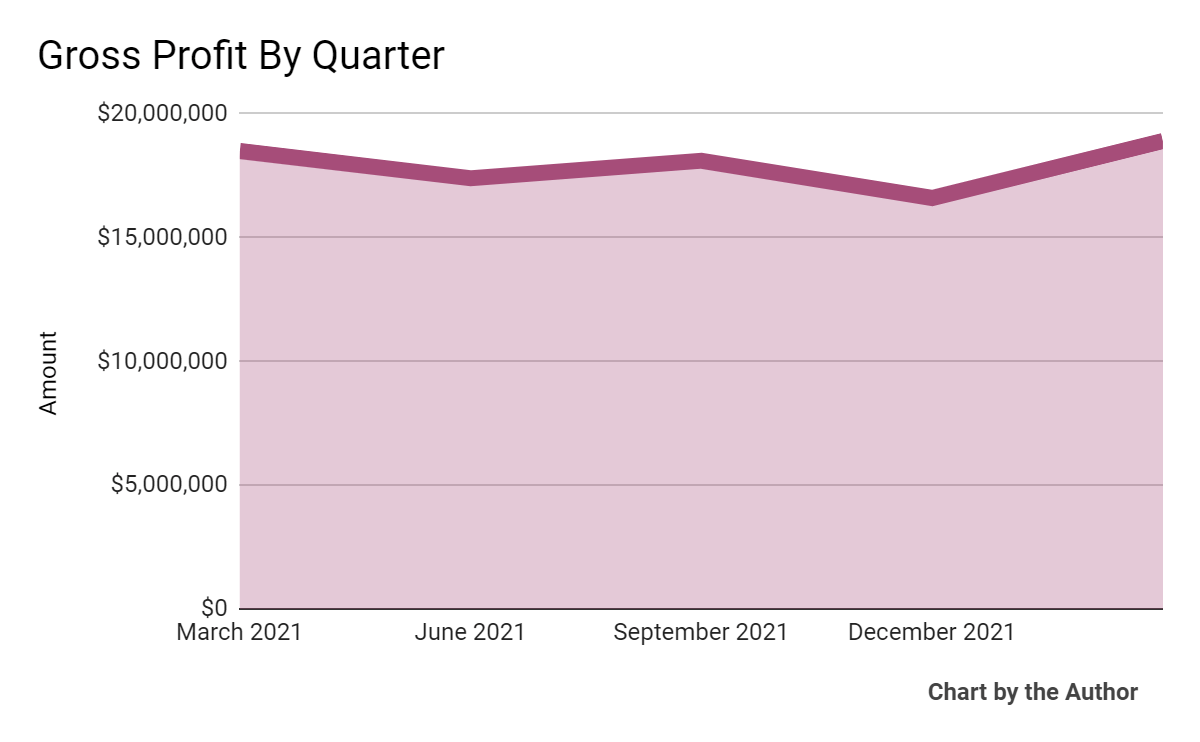

Gross profit by quarter has essentially plateaued:

5 Quarter Gross Profit (Seeking Alpha)

-

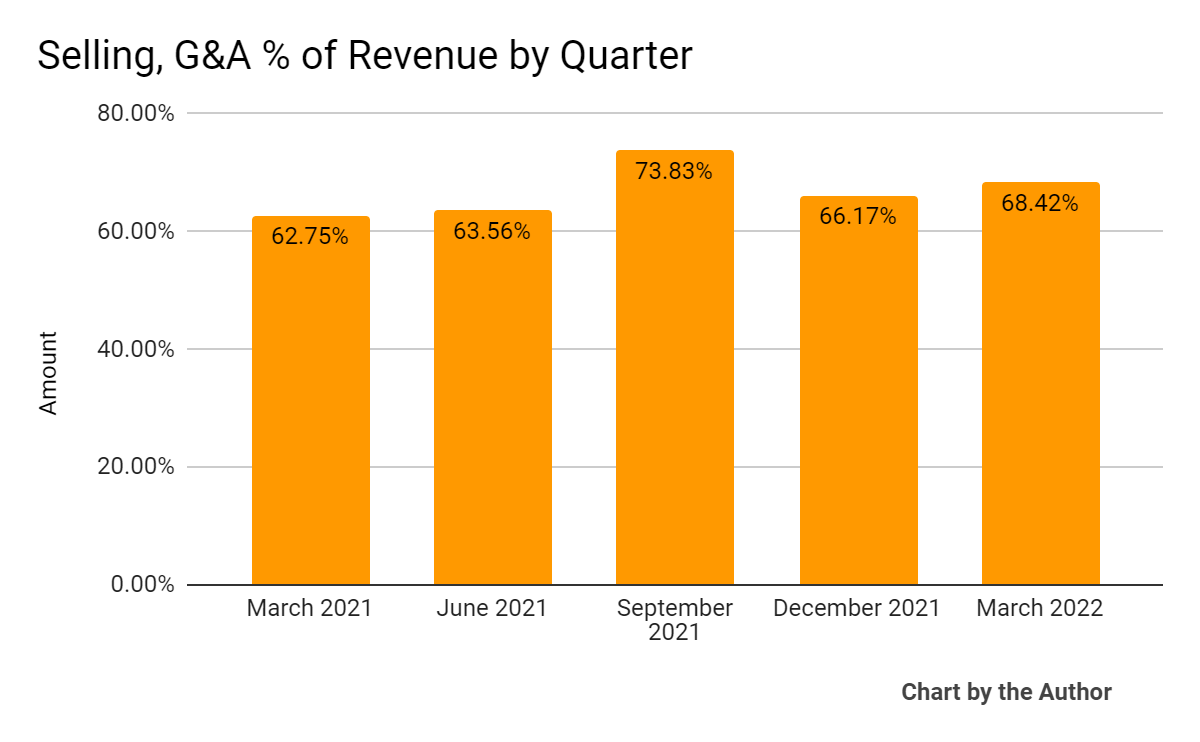

Selling, G&A expenses as a percentage of total revenue by quarter have remained well into the 60’s:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

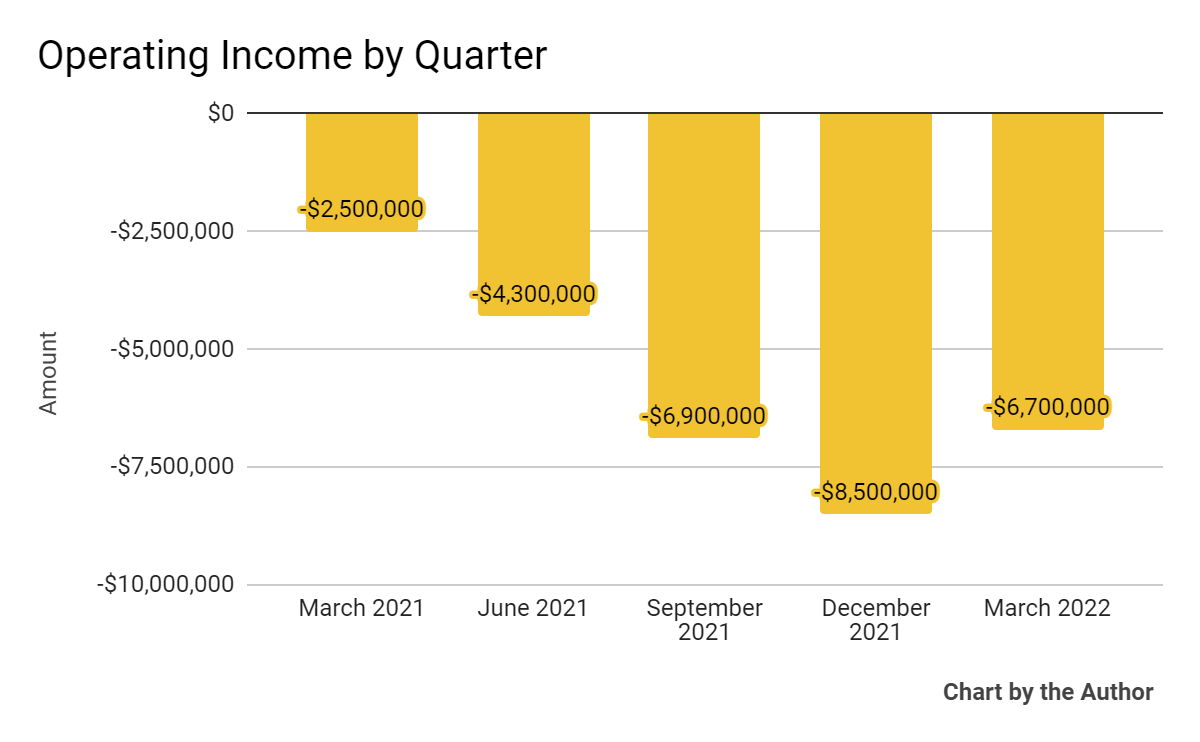

Operating losses by quarter have remained elevated with no path to breakeven:

5 Quarter Operating Income (Seeking Alpha)

-

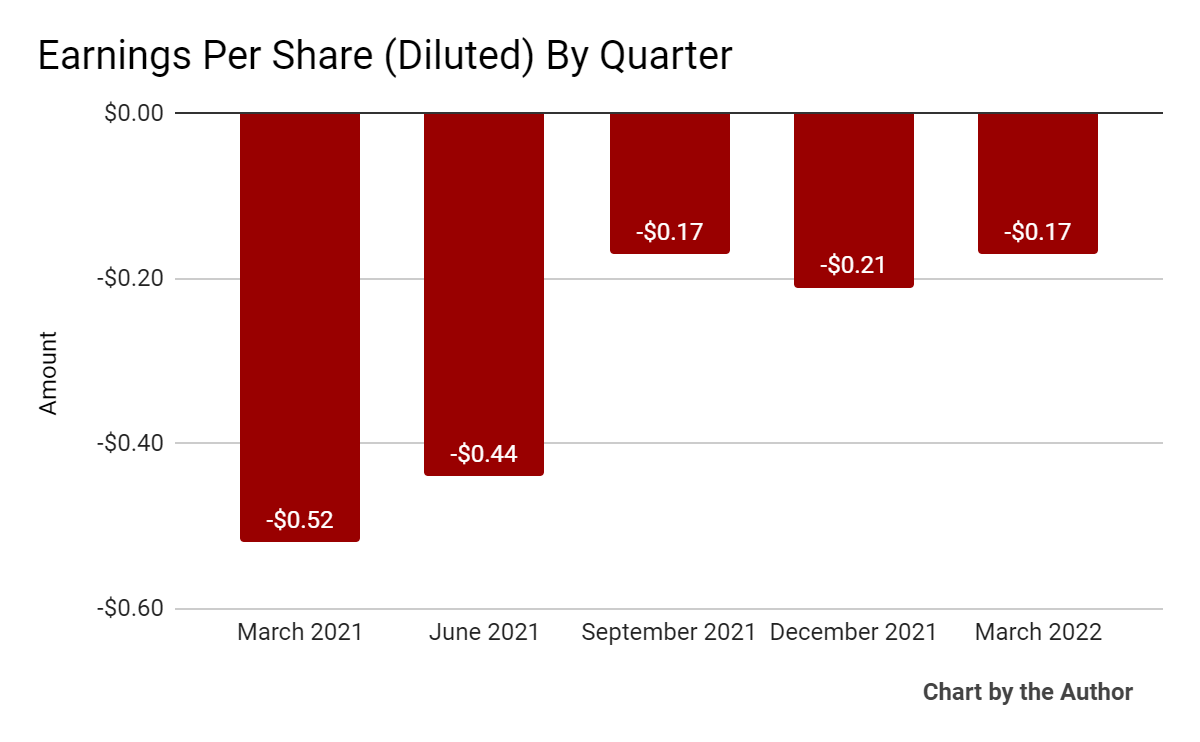

Earnings per share (Diluted) have remained negative with little serious progress toward profitability:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

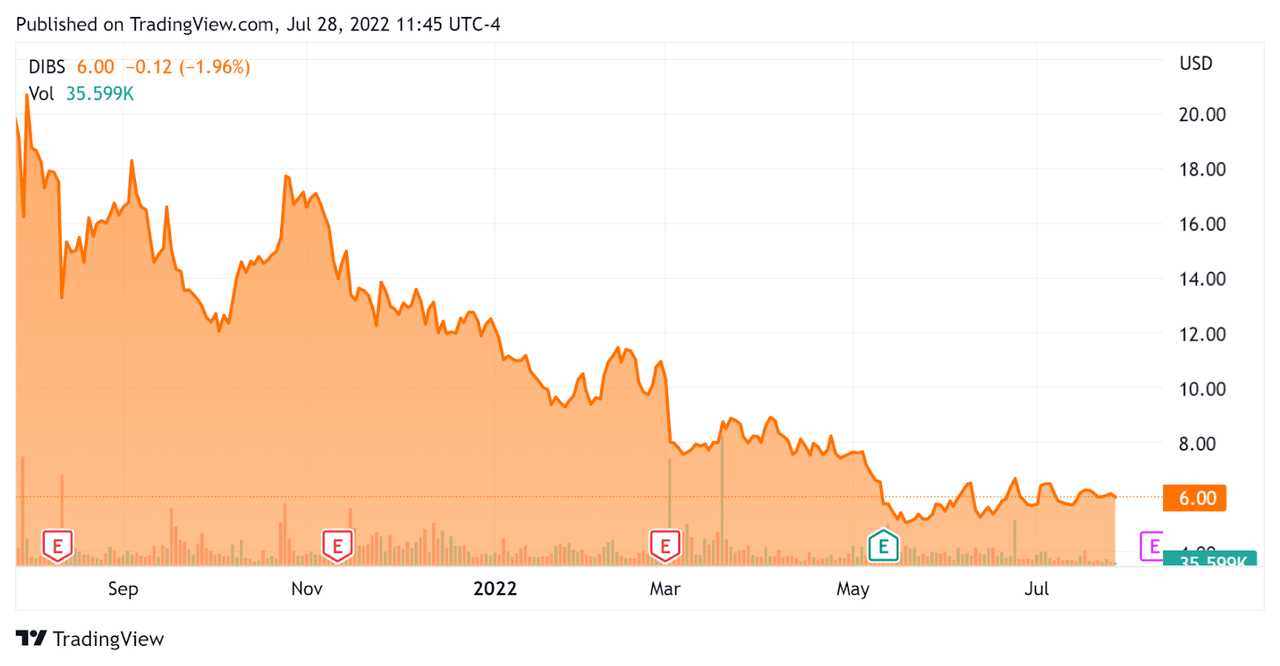

In the past 12 months, DIBS’ stock price has fallen 70.2 percent vs. the U.S. S&P 500 index’s fall of around 7.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For 1stDibs

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$98,890,000 |

|

Market Capitalization |

$233,730,000 |

|

Enterprise Value / Sales [TTM] |

0.95 |

|

Price / Sales [TTM] |

1.93 |

|

Revenue Growth Rate [TTM] |

15.97% |

|

Operating Cash Flow [TTM] |

-$16,770,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.99 |

(Source – Seeking Alpha)

Although the firm is not strictly a ‘software’ company, the Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

DIBS’ most recent GAAP Rule of 40 calculation was negative (9%) as of Q1 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

16% |

|

GAAP EBITDA % |

-25% |

|

Total |

-9% |

(Source – Seeking Alpha)

Commentary On 1stDibs

In its last earnings call, covering Q1 2022’s results, management highlighted the growth in its trade business but challenges in its consumer GMV (Gross Merchandise Volume) ‘due to lower new buyer conversion, a trend that’s continued into the second quarter.’

Management is seeing negative online consumer buying trends due to a shift back to in-person buying and substitution spending more on travel and restaurants.

Also, the broad economic slowdown, which has now turned into a recession with two consecutive quarters of negative GDP growth in the U.S., is reducing discretionary spending by consumers.

Notably, CEO Rosenblatt said that while new user registrations have remained strong, getting them to convert to buyers has been a challenge, likely due to the aforementioned trends, which he believes are ‘temporary.’

The company is focused on increasing supply growth, as ‘supply begets demand.’ It is testing new supplier subscription options and is seeking to commercialize an auctions functionality, which could appeal to more ‘price-sensitive consumers.’

As to its financial results, total revenue grew by only 4% year-over-year, while gross profit rose by 2%.

Sales and marketing expenses increased by 2%, with the firm spending somewhat less on performance marketing due to unfavorable changes in mobile advertising IDFA policy changes which reduce advertising ROI.

Technology development grew by 46% driven by the need to develop its localized sites for France and Germany.

For the balance sheet, the firm finished the quarter with cash and equivalents of $161 million and a trailing twelve month use of cash in operations of ($16.8 million).

Looking ahead, management guided to continued revenue decline with GMV flat year-over-year.

Regarding valuation, the market is valuing DIBS at an EV/Sales multiple of around 0.95x.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow consumer discretionary spending. Also the shift by consumers away from online spending on the firm’s product categories may continue.

Additionally, its choice to launch new localized sites in France and Germany, which are likely in worse economic conditions than the U.S., was not exactly prescient.

A potential upside catalyst to the stock could include a short and shallow recession.

However, the firm faces revenue decline conditions along with significant operating cost structures resulting in more losses ahead.

Until management can reignite topline growth and reduce operating losses, I’m on Hold for DIBS.

Be the first to comment