shaunl

Dear readers/followers,

This won’t be my first time writing about or following smaller shipping companies like AMSC ASA (OTCQX:ASCJF). I’ve invested somewhat successfully, though not always, in businesses like Ocean Yield (no ticker). These business models and operations require understanding before investing because on paper they often look “too good” to be true. Indeed, I was one investor who went into Ocean Yield a fair bit too early and as a result, saw some red before selling.

Let’s approach this business with care – but let’s approach it nonetheless to see what it has to offer investors.

AMSC ASA – 11 vessels yielding 10%+

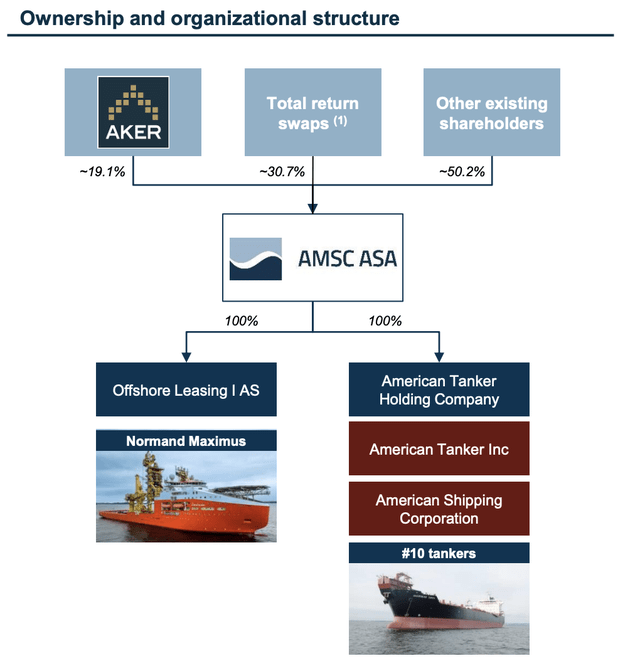

The AMSC ASA is a ship financing company.

This means that in a typical way for this sort of business, it owns bareboat charters for maritime assets – various vessels – and leases them to various companies around the globe.

This is a small company. Miniscule, in fact. It was established back in -05 and is traded under the ticker AMSC natively in Oslo. It does have large, good shareholders in the form of Aker ASA (OTCPK:AKAAF), but this shouldn’t be misinterpreted as any sort of guarantee that the company is “safe” because of a 19% ownership – it’s not because of that at least.

It has a market cap of around $300M, and works with the Jones Act to lease company assets to various counterparties. The company works with fixed-rate bareboat contracts, generating stable and predictable cash flows – at least for as long as the various counterparties continue earning money, and as long as the contracts are extended and there isn’t much “outage”.

So what does the company own exactly?

- Nine product tankers.

- One shuttle tanker

- One international subsea construction Vessel.

This is where these vessels are currently found – which by the way you can follow in real-time on the company’s homepage.

The company’s entire fleet caters to the crude oil and petroleum logistics portion of industries. Major oil companies and refiners, as well as offshore construction and subsea operation businesses, are the customers here.

Currently, all vessels are deployed on long-term bareboat charters.

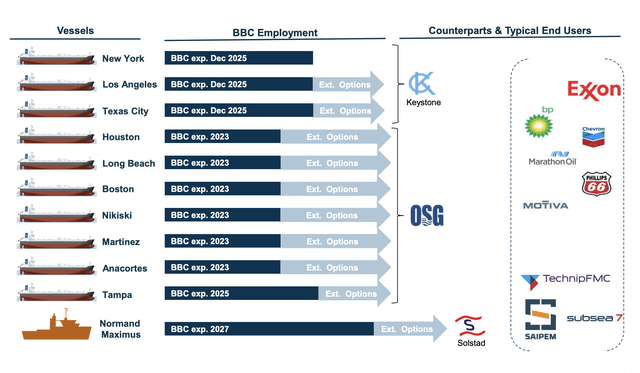

The company has leased out its vessels to a total of three companies at this time. The Keystone Shipping Company (No Symbol), The Overseas Shipholding Group, or OSG (OSG), and the subsea construction vessel Normand Maximus is leased to Solstad.

Here are the contract terms and extension options.

Right away, we see a bit of a problem, don’t we? Nearly all of the OSG vessel contracts expire next year. Pay only slight attention to the extension options, as those are not in any way fixed in stone. They are just that – options.

The company counterparties aren’t the problem. As you can see, end users are solid, the question is how likely OSG is to re-lease basically their entire fleet of tankers beginning next year.

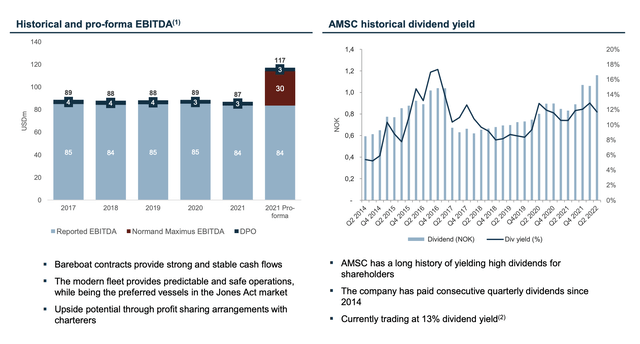

The company’s historical dividend yield and EBITDA are solid. This is no surprise, because the company has traditionally, since inception, had only limited counterparty risk, though as you can see, there have been some ups and downs to the dividend.

To say that I have been somewhat burned in a similar situation would be understating my experience in this sort of business. But my learning experience with Ocean Yield was just that – a really excellent learning experience.

AMSC business is at its heart attractive, especially going into the current market environment. Their counterparties do not want to take on financing and rate risks in this market environment by taking on their own shipping ownership.

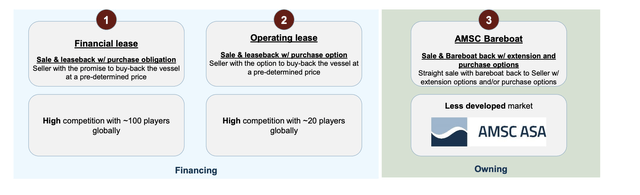

AMSC offers up to 100% financing, with long-term operation control of assets with historically limited balance sheet impact. The higher risk/reward of the company is because AMSC remains commercially exposed to the markets through contractual profit share mechanisms on purchase options. Like Ocean Yield, its competition is very limited – because alternative capital providers are far more risk-averse and tend to focus on straight financing without profit-sharing clauses.

Because AMSC does the latter, it has, and I want to emphasize this, a higher amount of risk that you’re taking on, by investing in this business.

The latest example of the Normand Maximus M&A is a good one. The company bought the vessel back in early 2022, and it’s the first company to purchase outside the protected Jones Act. The transaction was fully funded through acquisition financing using shipping back, cash, and proceeds from private placings.

The ship has, with extensions, a 15-year potential contract with Solstad, which is a subsidiary of Solstad offshore, which adds $150M of backlog for the contract, and up to nearly half a billion if options are exercised.

The likelihood of Solstad actually going for the options prematurely is very low – the company itself says that it’s likely to operate the Maximus on a short-term lease.

So what is this Jones act I keep mentioning? it’s been around since 1920, and it restricts the maritime transportation of cargo and passengers between certain points in the US to vessels that meet the criteria of either being US-Built, Registered under the US Flag, manned by US crew, and at least 75% controlled by US Citizens. The company’s presence in this market is made possible by the lease finance exception and is a bit of a protection for the company in the US waters. The fact is also, the Jones act is driving demand, and driving interest for company ships.

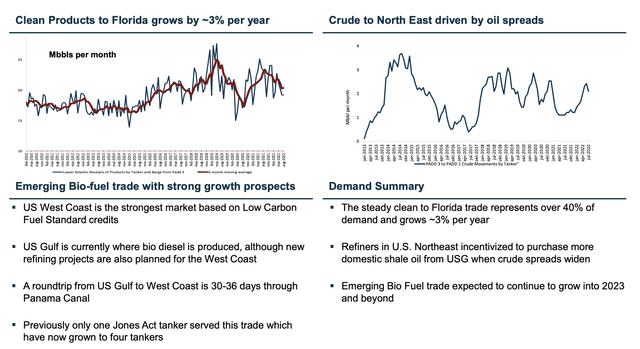

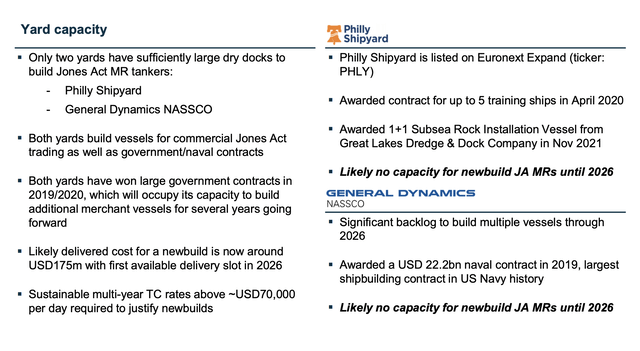

The market is in fact in a tight spot. For the past few years, we’ve seen increased scrapping of tankers and vessels due to advanced age – many of them over 50 years old, which has led to a negative growth in overall fleet capacity. For the past years, we’ve been looking at negative 1% to negative 7% growth in Kbbls capacity in terms of product.

Yard capacity for replacements meanwhile, is close to nil, and the costs for such replacements are very high. There are, simply put, very few new slots for new vessels available as things stand.

This company is very much “In the now”, and in compliance with the Jones act, meaning crew is compensated better, vessels have a higher economic life, they tend to be more modernized in terms of fuel consumption, and they’re in trend with the local movement as opposed to the international movement of fuels and crude. The voyage from EU to Florida is close to 2 weeks. The voyage from Texas/Louisiana to Florida is as little as 1-3 days in comparison.

It’s clear that the crude market and offshore market, in today’s economy, has been recovering. How long will we see these positive trends? That much is unclear at the moment. But recent company results are very solid.

We have 3Q22, and profits here were $5M net, with a normalized EBITDA of $22.6. The company is declaring quarterly dividends of $0.12 which are fully covered by the company’s free cash flow.

The big question mark remains the upcoming expirations of no less than over 50% of its entire fleet. While the current markets would suggest that these charters will likely be extended, it does present a risk.

The current fleet is fully leased, and together they bring in daily short-term charter rates of around $65,000 on a daily basis, but as I said, six of these vessels have contracts that currently expire in December of 2023. There is no guidance or information regarding extension or how the companies will act here.

Let’s look at valuation.

AMSC Valuation

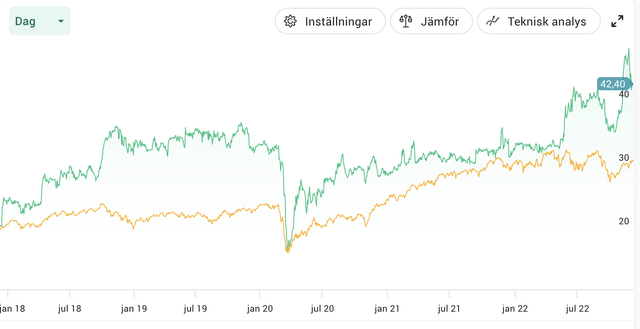

The company’s valuation is not an attractive one. The combination of the positive market and the company’s results have driven this company up to levels we have not seen in 10 years.

The relative yield is now just below 11% for the company, and the company has a 5-year RoR of 113%+, making it a better performer than most indices.

In the end, this is a very risk-oriented play. What goes up will once again come down. We do actually have analysts following this minuscule business – 3 of them in fact, and they give the company an average rating of 48 NOK/share, implying an upside of nearly 17% here.

I consider that to be far too exuberant for a company like this. For the past 10 years, the company has traded at an average of around 7-8x P/E. The current multiple is close to 10x P/E. The same sort of multiple-implied overvaluation can be found in other metrics, like EBITDA, EBIT, and sales multiples. The company, according to the market, warrants a sales multiple of close to 2.75x, which I just can’t agree with.

When we look at analyst outlooks, we can see that analysts expect the 2023 bareboat charter contracts to either be renewed or extended in some fashion – because the impact on earnings and dividends is at this time expected to be essentially zero – it’ll keep growing.

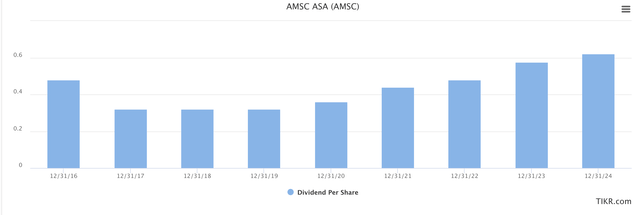

AMSC dividend forecast (TIKR.com/S&P Global)

On the surface, things look quite excellent for a company like AMSC here. And I can’t really go on record saying that I expect the company to have massive issues at this time extending their charters. The markets, the yards and production, and the scrapping/new vessel balance coupled with rates and costs are too tight for that.

But at the same time, I won’t be putting cash to work at these multiples even if it is in a company that could be considered attractive. I want cheap – and I can get cheaper yield, even if it’s somewhat lower, elsewhere.

Because it’s also safer – and safety is one thing I treasure highly at this time.

So here are my targets for AMSC ASA.

Thesis

- AMSC is an interesting company in the shipping sector with a solid portfolio of 11 modern vessels leased to relatively safe counterparties. The company sports a double-digit yield and attractive financials but is a small business with a decent amount of risk if contracts should expire. Currently, 6 out of 11 contracts are set to expire in about a year, which could cause uncertainty for the company.

- For that reason, I’m careful here. I wouldn’t buy the company at today’s valuation but would wait, if interested, for a bit of a drop.

- My PT for the company comes closer to the historical norm of 30 NOK/share, which is where I initiate coverage here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 2 out of my 5 criteria, making it a “HOLD” here.

Be the first to comment