georgeclerk

Q2 results better than feared

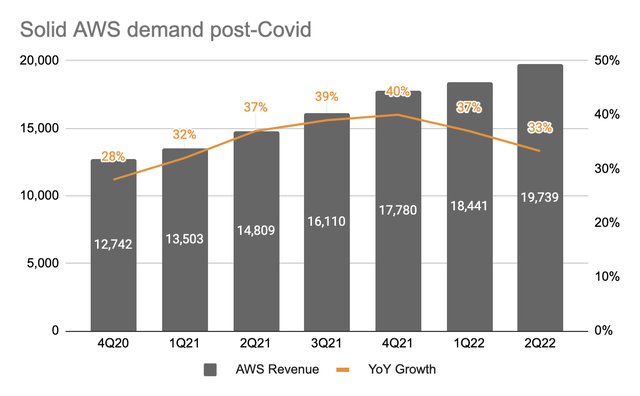

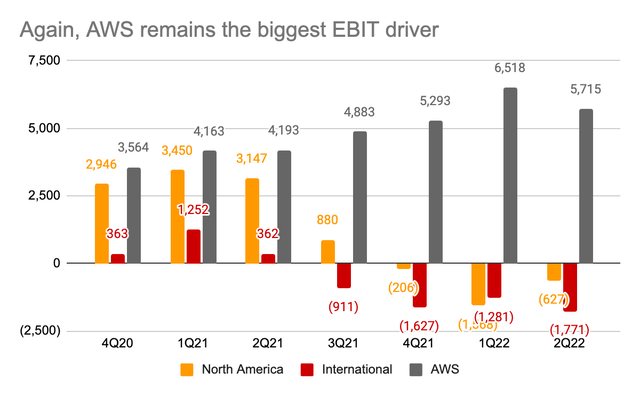

Amazon.com, Inc. (NASDAQ:AMZN) reported 2Q22 results where revenue of $121 billion (+7% YoY/+10% ex-FX) beat the Street’s $119 billion forecast. North America revenue of $74.4 billion (+10% YoY) came in 5.2% above consensus, but international revenue of $27 billion (-12% YoY/-1% ex-FX) missed estimates by 7.8%. AWS revenue of $19.7 billion (+33% YoY) was marginally above expectations by 1%.

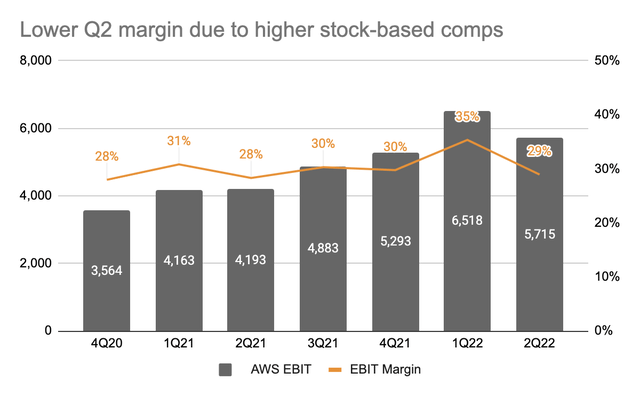

Operating margin also came in above expectations. Recall that on 1Q22 call, management guided 2Q22 operating income of $0 to $3.5 billion or EBIT margin of 1.5% at the midpoint. For Q2, Amazon reported operating income of $3.3 billion (above Street’s $1.75 billion) and EBIT margin of 2.7% vs. 1.5% consensus, driven primarily by strength in AWS.

For Q2, Amazon posted a net loss of $2 billion with a $3.9 billion pretax valuation loss from its investment in Rivian (RIVN). Adjusted EPS came in at $0.1 vs. $0.13 consensus. Despite the bottom line miss, investors were relieved to see better-than-feared results. While top-line growth was nowhere near the level seen during the pandemic (+27% in 2Q21), markets were comfortable enough to send share prices up following earnings.

AWS remains a bright spot

AWS was again the largest value driver with 33% top-line growth and a 29% EBIT margin in Q2. Note that Q2 margin was lower than Q1’s 35% due to a seasonal increase in stock-based compensation. Demand remains strong as AWS has reached an annual revenue run rate of $79 billion, with a backlog up 65% YoY / 13% QoQ to reach ~$100 billion and an average remaining client commitment of 3.9 years. New customers include Delta Air Lines, Riot Games and Jefferies.

Company data, Albert Lin Company data, Albert Lin Company data, Albert Lin

AWS is now available in 84 zones in 26 regions and will be adding 24 more zone across 8 regions. In May, Amazon announced that the new Graviton3 CPU chip will power all new EC2 (Amazon Elastic Compute Cloud) C7g instances. To break down the name C7g: the “C” means compute-intensive workloads; the “7” stands for the 7th generation for this instance family; and the “g” means it is based on the AWS-designed Graviton chip. Graviton3 offers 25% better performance over Graviton2 and uses up to 60% less energy.

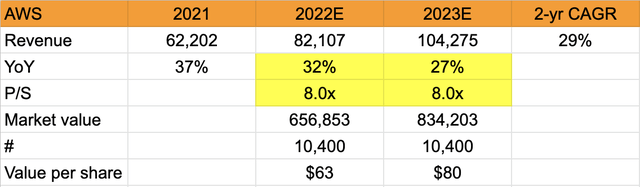

In 1H22, AWS delivered revenue of $38 billion, up 35% YoY from 1H21. For full year 2022, the Street is looking for revenue of ~$82 billion, implying 32% YoY growth. Per IDC, the combined public cloud IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) market is estimated to grow at a 29% CAGR from 2021 to 2025 to reach $400 billion. Suppose AWS is to grow with the industry at 32% in 2022 and 27% in 2023 at a 2-year CAGR of 29%, it is on track to become a $100+ billion business by 2023. At 8x 2023 revenue (in line with Microsoft), AWS should have a fair value of $80 a share, representing ~60% of the current share price of $135.

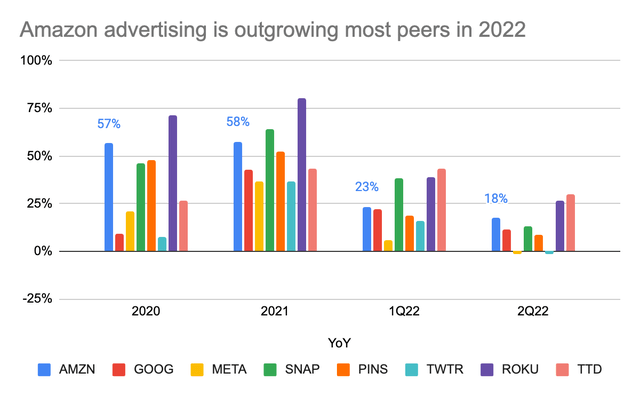

Advertising is outperforming most peers

Amazon’s advertising segment saw another solid quarter following a strong 1Q22 with 23% YoY growth. In Q2, advertising services revenue saw 18% YoY growth to reach $8.76 billion. This compares positively against search giant Google (GOOG, GOOGL) which saw its advertising revenue (search+YouTube+network) grew 12% in the second quarter.

In the social media space, Meta Platforms (META) had a muted 2Q22 with revenue down 1% YoY following a 6% growth in Q1, while smaller peers like Snap (SNAP), Twitter (TWTR) and Pinterest (PINS) all experienced a sharp revenue deceleration in Q2. CTV (connected TV) beneficiaries like Roku (ROKU) and The Trade Desk (TTD) are doing better, and note that Amazon does have exposure to this space with assets like Twitch and FireTV. Evidently, Amazon’s down-funnel advertising is favorably positioned to weather a slowing economy where advertisers will likely focus on conversions over impressions. Further, iOS privacy policy has no impact on ad campaigns run on amazon.com.

Better cost control in the retail business

In 1Q22, Amazon noted approximately $6 billion of higher costs resulting from inflation pressures (higher shipping cost and wages), lower labor productivity from over-hiring when Omicron hit, and deleveraging as a result of warehouse overcapacity. In 2Q22, management highlighted an improvement as these incremental costs were reduced to $4 billion over a year ago. This is reflected in a 99,000 QoQ reduction in headcount.

While inflation pressures is expected to persist into Q3, Amazon has slowed 2022 and 2023 expansion plans to right-size the business. Oil prices have dropped 22% from $122 in June to $96 today. Should this downward trend continue in 2H22, North America operating margin is likely to return to positive territory in light of solid top-line growth in Q3 (Prime Day) and Q4.

In Q2, Amazon’s 1P online store revenue growth ex-FX was essentially flat, but 3P seller services increased 13% ex-FX YoY and 3P accounted for a record 57% of total units sold. In my view, higher 3P penetration should help drive Amazon’s advertising business, which is an important margin driver with an estimated gross margin of 80%.

Q3 outlook better than expected

For 3Q22, Amazon guided revenue of between $125 and $130 billion (+15% YoY / +19% ex-FX at midpoint) vs. $126.5 consensus. Note that Prime Day (7/12 and 7/13) took place in the current quarter vs. in Q2 last year so some of the revenue upside is driven by this event. In 2Q21, Prime Day contributed 4% of YoY revenue growth. On the other hand, operating income is expected to come in between $0 and $3.5 billion for an operating margin of 1.4% at midpoint. Management noted a $1.5 billion cost improvement from fulfillment and productivity in Q3, but this is more than offset by investments in AWS. Further, new content for Prime Video such as The Lord of the Rings: The Rings of Power and Thursday Night Football also do not come cheap.

Final thoughts

On 5/4, I published an article arguing that Amazon could be a buying opportunity at $100 ($2,000 pre-split) given investors would be paying a fair price for AWS and Advertising while getting the retail business virtually for free. I subsequently picked up some shares at an average price of $108 and have taken some chips off the table after the strong price reaction after Q2 earnings. While it’s encouraging to see AMZN revenue returning to double-digit growth in Q3, the muted profit outlook could be a concern for some investors as higher AWS margins are offset by the lower-margin retail business. Conservatively speaking, I believe it’s worth taking some profits now and monitor Amazon stock’s price actions for the next buying opportunity.

Be the first to comment