adamdodd/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am constantly looking for additional opportunities to supplement my dividend income. In the financial sector, I own stock in banks, insurers, wealth managers, and credit cards. I own shares in Visa (V) for close to a decade, and shares have appreciated significantly since I have done so.

In this article, I will take a deeper dive into another credit card company, American Express (NYSE:AXP). This credit card company is a historical investment of Berkshire Hathaway (BRK.A)(BRK.B). The company owns almost 20% of this credit card issuer, and following the last 20% dividend increase, I decided to take a further look into the company.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alphas’ company overview, American Express Company provides charge and credit payment card products, and travel-related services worldwide. Its products and services include payment and financing products, network services, accounts payable expense management products and services, and travel and lifestyle services.

Wikipedia

Fundamentals

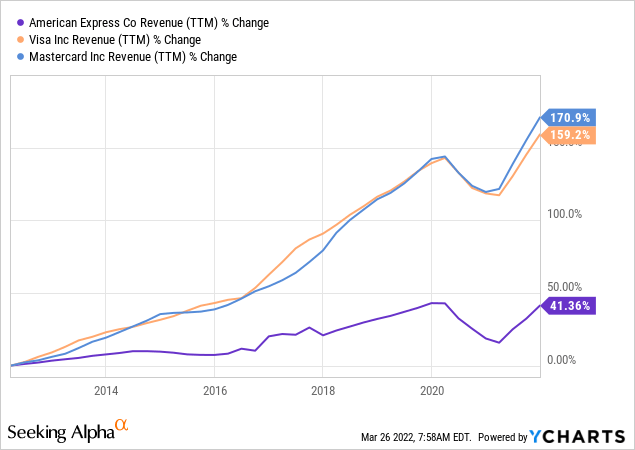

Over the last decade, the sales of American Express have increased by 41%, which translates into less than 4% annual growth. This is not a very impressive figure, as other credit card issuers such as Mastercard (MA) and Visa enjoyed much more impressive growth. American Express has higher revenues, as it doesn’t only offer a network, but offers financial services including loans directly. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects American Express to keep growing sales at an annual rate of ~15% in the medium term.

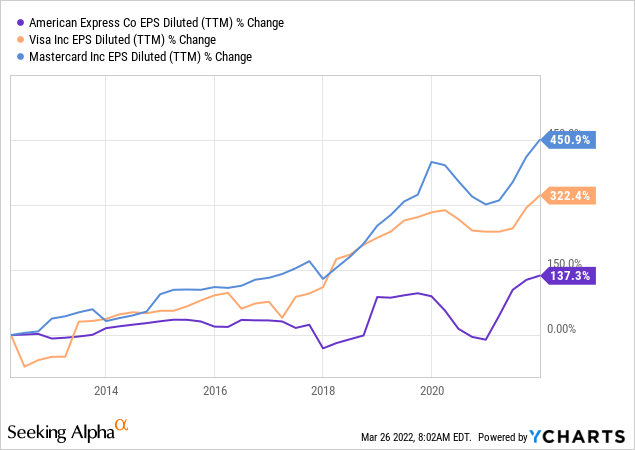

When it comes to EPS (earnings per share), the figures are more impressive. The company has grown its EPS by roughly 10% annually over the last year. However, again this is not a very impressive figure compared to its competitors. Both Mastercard and Visa focus on the network, which is a much more scalable business as more transactions have a tiny marginal cost, while American Express offers services like loans that require more significant investment both in capital and in employees. The company’s EPS growth was fueled by sales growth and significant buybacks. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects American Express to keep growing EPS at an annual rate of ~10% in the medium term

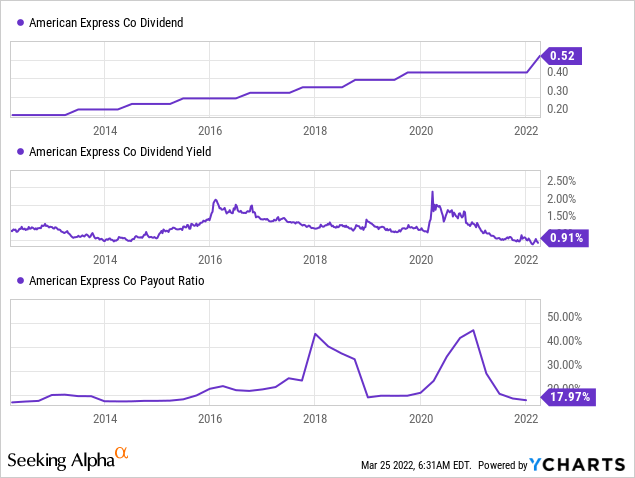

The company’s dividend yield is in line with its peers. American Express pays less than 20% of its earnings in dividends. It results in a dividend yield of less than 1%, which is of course extremely safe. The company has a long track record of dividend increases which stopped during the pandemic as the company froze the payment. It has increased it last month by 20% to make up for that lost year. Therefore, it may not be a dividend aristocrat, but it is clear that it is a dividend growth company.

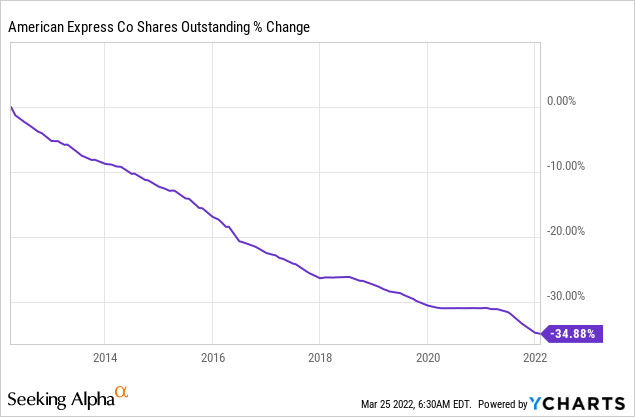

The company is also returning capital to shareholders in the form of buybacks, which come in addition to the dividends. Over the last decade, the company has bought back more than one-third of its shares. It has significantly contributed to the company’s EPS. The buybacks took advantage of the company’s lower valuation compared to its peers. A combination of a safe dividend with consistent buybacks is my sweet spot as a dividend growth investor.

Valuation

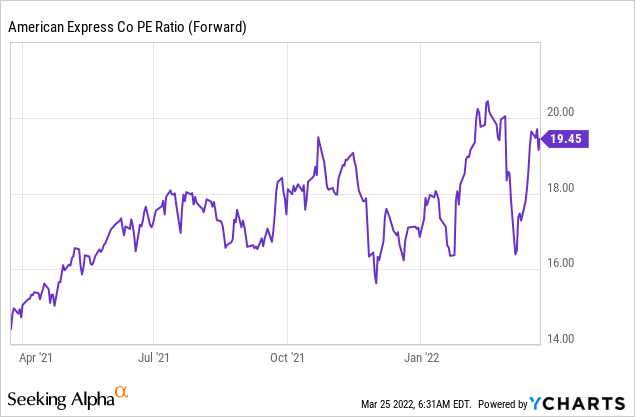

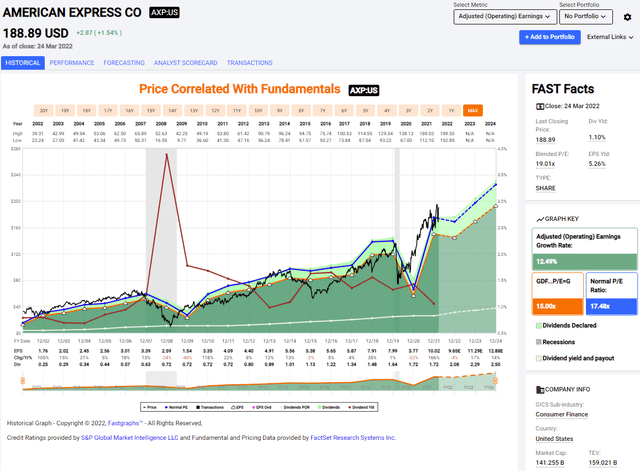

The company’s P/E ratio has recovered over the past twelve years. As the company enjoyed a 160% growth in its EPS in 2021, the share price recovered at an even faster pace. The company’s multiples have expanded, and shares are now trading for 19.5 times the estimated 2022 EPS according to Seeking Alpha’s analysts’ estimates.

The graph below from Fastgraphs.com puts the current valuation in perspective. American Express’s average valuation over the last two years was lower than the current valuation. The company’s average P/E was 17.5 compared to the current 19.5. In addition, the company is also forecasted to grow at a slower rate compared to its historical rates. Therefore, at the current valuation, it is trading for a slight premium.

To conclude, American Express has strong fundamentals when it comes to sales and EPS growth. It is not as impressive as its peers due to different business offerings. Still, American Express is growing and rewarding shareholders with growing dividends and buybacks. The company’s valuation is slightly higher than the average valuation, so the company will have to justify it with significant growth opportunities and limited risks.

Opportunities

Higher rates are the first growth opportunity for American Express. American Express will be able to charge more interest when rates are higher. The Federal Reserve has already raised the interest rate in March and is aiming for additional increases. The European Central Bank is more reluctant to follow due to war in Europe and the lower inflation, but it will eventually have to follow as the inflation is already eroding savings across the continent.

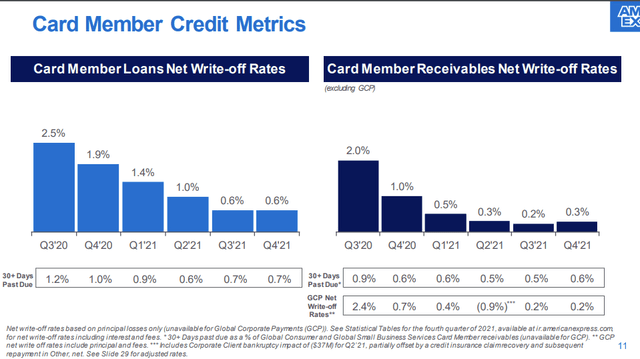

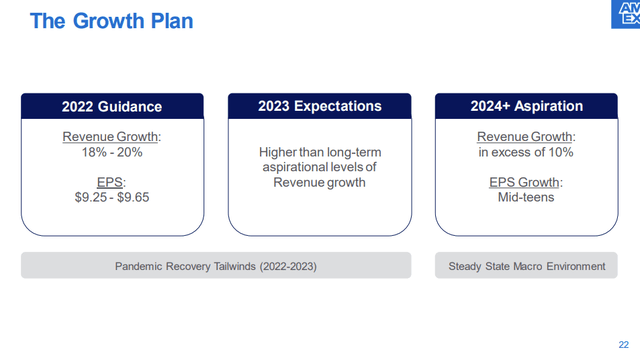

American Express is enjoying loans growth due to the strong return from the pandemic recession. Therefore, the company showed significant growth in 2021. The company also expects 2022 and 2023 to be extremely strong due to the return from the pandemic. The company is not only growing loans, but it also enjoys a significant decrease in write-offs which improves the company’s bottom line significantly.

Customer satisfaction is another clear growth opportunity. Credit card companies and financial services companies in general, do not tend to have good publicity. The company is enjoying high customer satisfaction which leads to high retention in a business that is very competitive in nature. The good customers who pay their bills on time, and use the loans are willing to keep their American Express credit card.

Customer retention and satisfaction continue to be very strong and remained above pre-pandemic levels. For example, retention rates in global consumers are above 98%, and for the second year in a row and the 11th time in 15 years, we ranked first in J.D. Power’s Annual Credit Card Satisfaction Study of U.S. consumers.

(Stephen Squeri – Chairman and CEO, Q4 Results)

Risks

Inflation is a significant risk for American Express. The company’s interest rates are affected by the rates decided by central banks. With inflation being much higher than the interest rate, the company may struggle to maintain its current profitability when taking inflation into account. American Express will suffer from eroding real income as long as the rates remain as low as they’re.

The geopolitical situation is another challenge. First of all, it intensifies inflation. We already see basic materials like oil and wheat becoming more expensive. The central banks around the world are struggling to react to the inflationary pressures as they need to support the economy during the war, especially in Europe. Moreover, the war may result in a recession in addition to inflation.

A recession in Europe and later in the United States will affect American Express’s profitability. The recession will affect it in two ways. Firstly, consumers will consume less thus buying less and traveling less. Second, if the recession is significant we may see an increase in late payment and delinquent accounts, and it will have an effect on the company’s top and bottom line as expenses will increase while clients struggle to pay their debt.

Conclusion

American Express is a great company. It is not a coincidence that 20% of the shares are owned by Warren Buffett’s Berkshire. The company has grown consistently over the last several decades, and it has several significant growth prospects that will fuel long-term growth thanks to its vast access to clients and worldwide network.

However, the company is also facing some short-term headwinds. The inflation, the risk of recession, and the tensions in Europe will make it harder for American Express to execute in the next 1-2 years. The current valuation doesn’t reflect it in my opinion, and therefore at the current price, American Express is a hold. It would be attractive at a forward P/E around 16 which implies a stock price of around $160 based on the current 2022 estimates, as it will offer some margin of safety for investors.

Be the first to comment