David Tran/iStock Editorial via Getty Images

Software stocks have been absolutely hideous so far this year. The group is highly correlated to investors’ collective willingness to pay high multiples for high growth stocks, and of course, that willingness waned essentially immediately in early-2022. Most of the group has been decimated, and former leader Adobe Inc. (NASDAQ:ADBE) is no different. The stock has lost almost 40% of its value just since December, but I think the selloff is overdone.

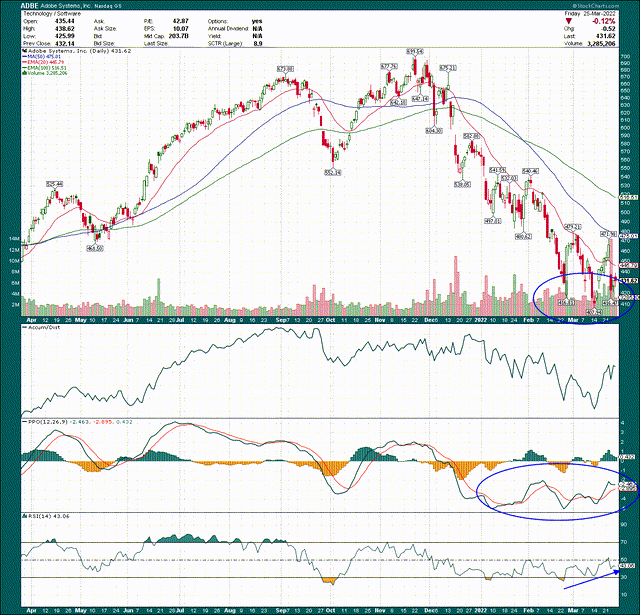

Let’s begin with the chart, and straightway, we can see there was a deep and sustained downtrend that I believe is breaking. Shares plummeted in more-or-less a straight line from $700 to $415, and has bounced around that level for the past few weeks. Importantly, this behavior looks like bottoming, and if we look at the momentum indicators, we see more evidence we may be bottoming.

The accumulation/distribution line is weak, so that’s not necessarily supportive of a bottom. However, the momentum indicators look quite good.

The PPO bottomed back in January, which is well ahead of the stock bottoming. That’s a positive divergence, and this sort of thing can often portend the end of a downtrend. To my eye, that’s exactly what this positive divergence is doing, and we can see it’s still very much in play three months later. The stock has continued to decline while momentum has improved, and that’s a good sign.

We see similar behavior from the 14-day RSI, as it bottomed some time ago, and well ahead of the stock bottoming. The combination of these factors make me think we’ve got a bottoming process in place, but we’ll need price action to eventually confirm this.

Let’s now take a look at relative strength from both the software group as a whole, and Adobe’s strength against the group.

As you might expect from a stock that’s lost ~40% of its value, Adobe’s relative strength has been awful. Software stocks have been destroyed since the start of the year, and Adobe has managed to underperform the weak group. This is not what you want from a stock, but in this case, I think the combination of the positive divergences in momentum, and the price action that looks like it’s trying to bottom are able to offset this weakness.

Now, let’s take a look at the fundamental case for Adobe.

Leverage to the cloud mega-trend

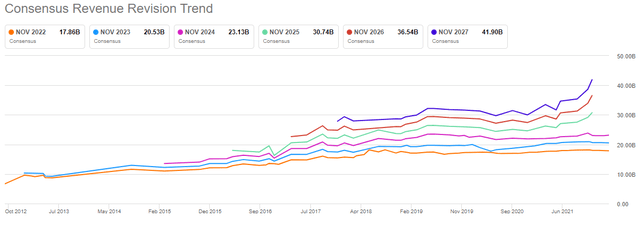

Let’s begin with an overall look at revenue revisions, which gives you not only a look at the company’s year-over-year growth, but the ability of analysts to keep pace with the company’s actual performance. In both cases, I think Adobe looks just fine.

This has the look of a bullish long-term story, in that revenue moves up and to the right, and there are meaningful gaps between the years, indicating year-over-year growth. For instance, 2027 estimates have moved from $28 billion to $42 billion in the past three years, which is the kind of move you can get on the out years for a company that is absolutely crushing it. The short-term oscillations in revisions can cause the stock to move up or down, but over time, I fully expect we’ll see stronger and stronger revenue estimates for Adobe.

Adobe’s growth has come from a variety of sources, and that’s part of the reason why I think the selloff is overdone. Software and other growth stocks have been crushed for a variety of reasons this year, but long-term fundamental performance isn’t one of them, in my view.

Adobe’s most recent quarter showed continued strength in revenue, with the adjusted top line at +17% year-over-year. But apart from that, the company’s remaining performance obligations grew 19% to nearly $14 billion. That’s about three quarters’ worth of revenue and it portends great things for Adobe’s continued revenue growth.

The Creative Cloud segment continues to show robust growth as its flagship offerings such as Photoshop, Illustrator, and Premiere continue to attract higher subscription revenue. That’s one of the reasons Adobe and other software stocks are so attractive, because subscription revenue has extremely high margins, and is recurring. Adobe isn’t getting paid each time someone uses Photoshop; it is getting paid all the time whether they use it or not.

In addition, the company notes newer products like Frame.io, which was acquired last year, continue to ramp and benefit from Adobe’s brand name recognition and massive scale.

Adobe also has a strong position in the much smaller Document Cloud segment, but is a segment that really took off higher following the start of the pandemic. Digital signatures and document collaboration is something that I believe is here to stay, whether offices reopen fully or not, and Adobe is squarely in the middle of that market with its Acrobat suite. With PDF for mobile and other similar products, this market should be another long-term tailwind for Adobe.

Adobe’s second quarter guidance reflects this in that the company expects $440 million in net new annual recurring revenue in Digital Media, and $4.34 billion in total. Growth rates are expected to be in the mid-teens on an adjusted basis, so in that vein, it’s hard to see why the stock is at a 52-week low.

Margins in focus

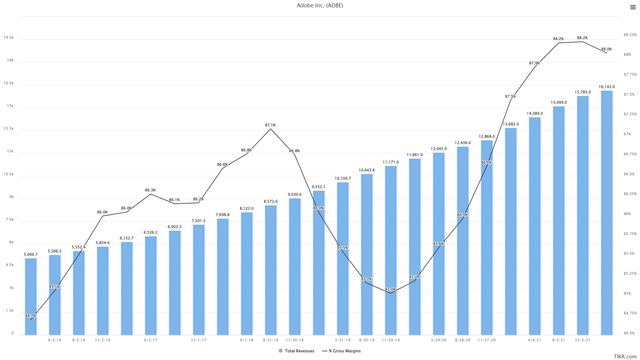

As a software stock, Adobe has outstanding margins. That doesn’t mark it aside from others in the group, but I think there’s a very strong margin growth story at play here, which just might mark it aside.

This first view is trailing-twelve-months revenue against gross margins. This gives us an idea of margin leverage from higher revenue, which is something you’d expect from a software company. We can see in the past three years, Adobe has seen very strong gross margin expansion, with the most recent values in the area of 88%. That’s extremely high, and it leaves little room for potential improvement, simply because the value is already outstanding.

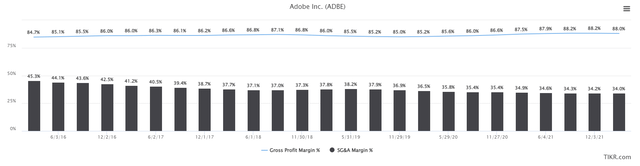

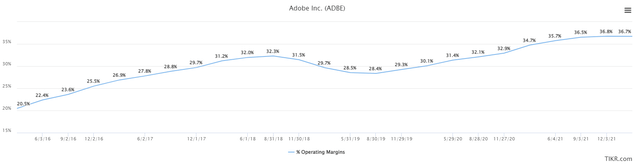

However, operating margin is a different story, as the elevated revenue value allows Adobe to generate leverage on its SG&A costs; that’s charted below.

The difference between these two numbers, more or less, is operating margin. You can see SG&A has declined over time, and there’s no reason this shouldn’t continue to occur in the years to come. This is mostly a function of higher revenue leveraging down costs like salaries, office space, etc. As gross margins rise, this leverage is supercharged and creates higher profits.

Here’s a look at what I’m on about, and we can see operating margin has risen from 28% to 36% in the past three years, which has done wonders for the company’s profitability. It is entirely possible – and perhaps even likely – that we’ll see Adobe produce higher revenue, which will drive operating margins higher, all else equal. All of these things – revenue growth, SG&A leverage, and operating margin improvements – drive EPS higher over time. All else equal, that means a higher share price, and that’s what I believe we’ll see.

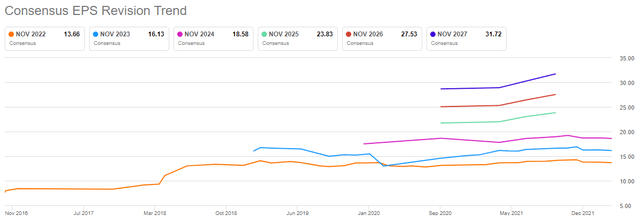

Over time, Adobe has certainly produced higher estimates with EPS. However, we can see the most recent revisions have been lower, and that’s certainly a factor in why the stock is down.

If you have a longer horizon, however, these short-term oscillations can present opportunities, as I believe this selloff is today. Adobe has enormous brand recognition in the areas it competes, and the pandemic accelerated the adoption of certain tools Adobe offers. The odds are Adobe is going to see more and more strength in the years to come, downward revisions notwithstanding at the moment.

Final thoughts

I like the look of the bottoming action we’re seeing in Adobe, but I also very much think this company will remain a leader for years to come. It is acquiring and growing organically to fuel top line expansion in the years to come, and its margins are outstanding. The last piece is the valuation, and as we’ll see, that’s very attractive as well.

Shares go for just 30X forward earnings today, which is very near the valuation it traded for at the worst of the pandemic selling. The stock peaked over 50X earnings last year, so the valuation is pricing in a lot of negativity. I believe the stock is being priced like Adobe cannot reach its growth estimates, but all indications are that it will. If I’m right, we could easily see 40X earnings, in addition to the ample growth that should be ahead. With all that in mind, I think we’ll see Adobe much higher into the later part of this year. Given it’s in the middle of a bottoming process, it will take some patience, but that patience is likely to be handsomely rewarded.

Be the first to comment