JHVEPhoto

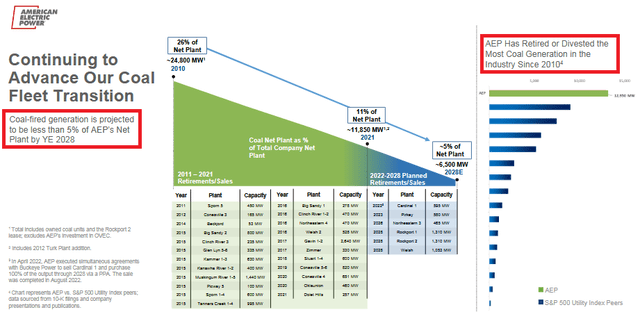

In 2010, 26% (24.8 GW) of American Electric Power’s (NASDAQ:AEP) net plant power generation came from coal. As a result of plant retirements and sales, at year-end 2021 AEP’s coal-based power generation was down to only 11% (11.85 GW). Indeed, no other U.S. utility company has reduced its coal generation as drastically as AEP has and, by 2028, coal is expected to account for less than 5% of AEP’s mix (see below). Going forward, the company is in a perfect position to benefit from the Biden administration’s infrastructure and clean-tech legislation and accelerate the pivot toward renewables. Meantime, AEP continues to deliver strong financial results that has enabled it to reward investors with a recent 6.4% boost in the quarterly dividend to $0.83/share. The equates to an annual dividend obligation of $3.32 and a yield of 3.5%.

AEP

Investment Thesis

As you can see from the graphic above, AEP has done a fantastic job of closing down high-cost and dirty-coal plants over the past decade. Indeed, even during the previous administration’s rather idiotic “make coal great again” failed “strategy,” AEP shut-down many coal plants during the 2016-2020 time frame. Going forward, that trend will continue with another 5.3 GW of coal plant capacity planned to be shut down over the next six years.

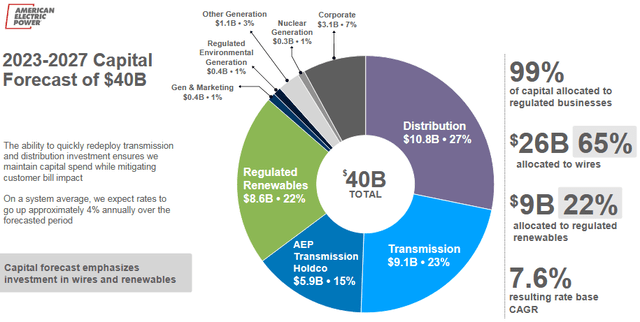

Meantime, AEP has pivoted to renewable energy, with ~20% of its planned capital budget going toward clean-energy during the 2023-2027 time frame. That equates to practically all of the company’s investment in increment power generation capacity (slide taken from AEP’s recent 57th EEI Financial Conference Presentation):

AEP

Given the Biden administration’s ability to pass a bipartisan Infrastructure Plan, as well as the IRA Act (which I prefer to call the “Clean-Tech Act“), that’s a smart strategy. Going forward, AEP’s capital allocation to Transmission Lines expansion should also benefit from these government tailwinds.

Earnings

Meanwhile, despite the “pro-coal” naysayers, AEP has continued to deliver strong financial results for income-oriented investors. The Q3 earnings report was very strong. Highlights including:

- Non-GAAP EPS of $1.62 was a $0.06 beat.

- Revenue of $5.5 billion (+19.6% yoy) beat by $750 million.

- The midpoint of FY22 operating income guidance was raised to $5.02/share vs consensus of $5.01, and its long-term growth rate is expected to be in the 6-7% range.

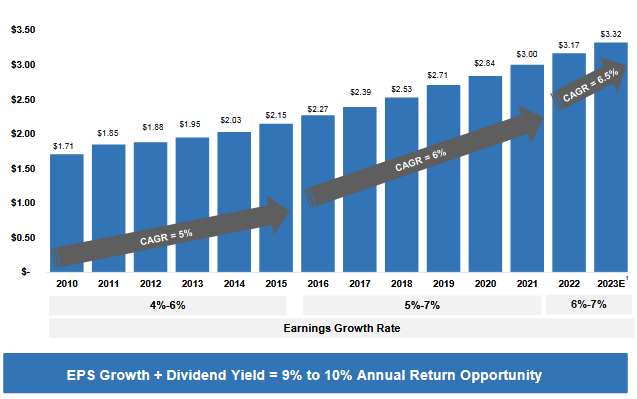

As mentioned earlier, AEP’s strong financial performance enabled it to raise the quarterly dividend 6.4% to $0.83/share, or $3.32 on an annual basis (3.5% yield). The point here is that CEO Nick Akins has proved the “pro-coal” naysayers wrong: I say that because AEP has actually been able to accelerate dividend growth while shutting down the expensive coal power generation that had been holding the company back for so long:

AEP

AEP has a very shareholder friendly management team and expects dividend growth to remain “in-line with earnings growth” and the company’s targeted payout ratio of 60%-70%. And it’s important to note that investors have a relatively clear line-of-sight into AEP’s expected 6%-7% earnings growth rate given the company’s high exposure to regulated utility assets.

Going Forward

Going forward, AEP is going to continue on this track: Shutting down expensive coal-powered generation, investing heavily in renewable clean-energy projects, and investing heavily in transmission line projects to get that clean energy to market and prepare for the era of higher electric power demand due to the EV transition.

Exhibit No. 1 is, as reported last week by UtilityDive.com, AEP’s Oklahoma subsidiary announced an application to invest $2.5 billion to acquire three planned wind and three solar plants totaling 995.5 MW from Invenergy. Importantly, the AEP subsidiary said the planned projects in Kansas and Texas are expected to produce $1 billion in federal tax credits and are expected to go in-service by January 2026. Indeed, in September, Morgan Stanley included AEP in its list of utility companies expected to benefit from the transition to renewables. With AEP’s large transmission line business (40,000 miles – the largest transmission system in the country), it’s in a great position to leverage its strength in power transmission infrastructure.

Valuation

The following table compares the relative valuation metrics of AEP versus the SPDR Utility ETF (XLU), competitor NextEra Energy (NEE), and the S&P500:

| TTM P/E | Forward P/E | Yield | |

| AEP | 19.7x | 19.0x | 3.48% |

| NEE | 43.6x | 29.6x | 1.99% |

| XLU ETF | 7.0x | 19.8x | 3.04% |

| S&P500 | 20.8x | 19.5x | 1.64% |

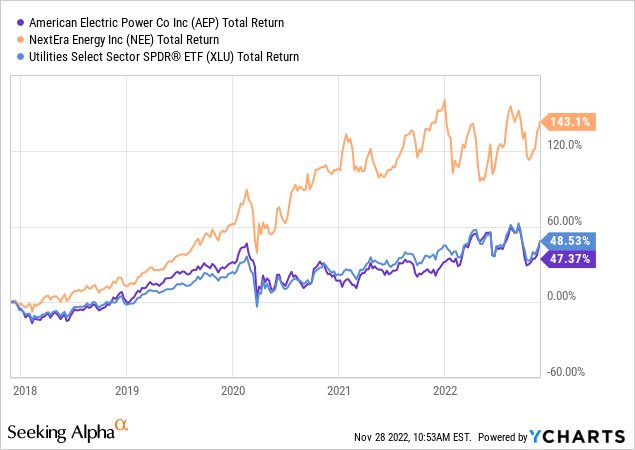

In my opinion, AEP looks relatively fairly valued in terms of its relationship with the S&P 500 and the XLU ETF. NextEra is obviously trading at a significant premium, but many would argue NEE is in an even better position than AEP to benefit from the clean-energy transition considering it was a very early adopter and has much bigger portfolio of renewable wind, solar, and battery backup projects already in operation and in the pipeline going forward.

Risks for AEP include slowing consumer and industrial demand for electric power due to the high-inflation, higher-interest rate environment that could slow domestic economic growth. And, as with all U.S. utility companies, adverse regulatory outcomes can affect earnings and distributions.

The graphic below shows the five-year total returns performance of APE versus the XLU and NEE. Clearly, NEE has left both eating its dust:

Summary and Conclusion

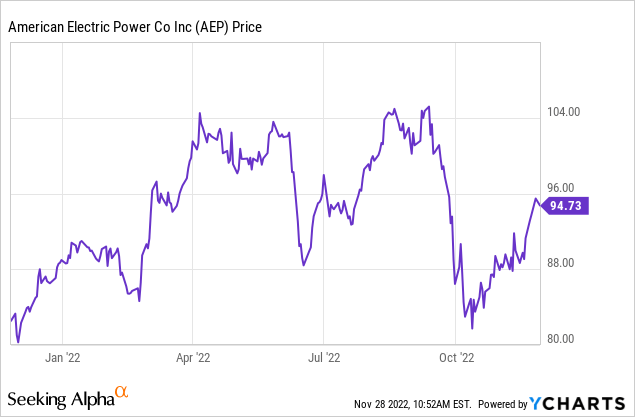

AEP is a very solid utility that continues to deliver for income-oriented utility sector investors. Despite the “pro-coal” narrative that “making coal great again” was “the ticket,” AEP has been able to accelerate dividend growth while closing down a great number of coal-based capacity and pivoting toward renewable energy. The result has been more dividend income for its shareholders. I currently rate AEP a HOLD, but if market volatility drove the stock back down into the low $80s (last seen in October, see below), I’d be a buyer.

Be the first to comment