imaginima

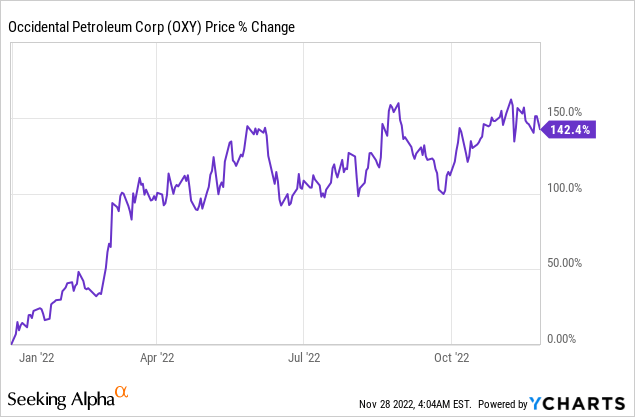

Strong execution and a favorable pricing environment helped Occidental Petroleum (NYSE:OXY)’s shares soar 142% this year. Additionally, an investment in Occidental Petroleum made by investment legend Warren Buffett himself helped stoke interest in the energy producer and put the company on the map for investors. However, since petroleum prices just reached their lowest level in eleven months, I believe the investment environment for petroleum producers is deteriorating, which indicates deteriorating free cash flow prospects for Occidental Petroleum!

Occidental Petroleum: Deteriorating market environment, growing free cash flow risks

Like most producers, Occidental Petroleum benefited greatly from the surge in petroleum and natural gas prices this year which resulted in record free cash flow for the company. Occidental Petroleum’s free cash flow in Q3’22 grew 53.7% year over year to $3.55B, chiefly because of a highly favorable pricing environment for petroleum and natural gas products. The support in pricing is largely attributable due to Russia’s invasion of the Ukraine in February of 2022 and energy supply fears in Europe which have escalated over the summer.

Occidental Petroleum secured an average worldwide realized crude oil price of $94.89 per barrel in the third-quarter, showing an increase of 38% year over year. Natural gas prices also exploded due chiefly to Russia stopping natural gas supplies to Europe this year, with pricing exploding after the Nord Stream pipeline attacks in the Baltic Sea at the end of September. The pipeline attack helped especially natural gas pricing: in the third-quarter, Occidental Petroleum’s average worldwide realized natural gas price was $7.06 per Mcf, showing an increase of 111% year over year.

|

$millions |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Y/Y Growth |

|

Product Net Sales |

$6,792 |

$7,913 |

$8,349 |

$10,676 |

$9,390 |

38.3% |

|

Net cash provided by operating activities |

$2,910 |

$3,231 |

$3,239 |

$5,329 |

$4,267 |

46.6% |

|

Plus: Working Capital/Other |

$57 |

$636 |

$939 |

($181) |

$433 |

659.6% |

|

Less: Purchases of Property and Equipment |

($656) |

($937) |

($858) |

($972) |

($1,147) |

74.8% |

|

Free cash flow |

$2,311 |

$2,930 |

$3,320 |

$4,176 |

$3,553 |

53.7% |

|

Free cash flow margin |

34.0% |

37.0% |

39.8% |

39.1% |

37.8% |

– |

(Source: Author)

Free cash flow growth translates to increased capital returns

Occidental Petroleum’s strong free cash flow and improved liquidity position has allowed the energy producer to return more capital to shareholders. The energy firm increased its quarterly dividend from $0.01 per-share to $0.13 per-share in FY 2022 and Occidental Petroleum initiated a $3.0B stock buyback to return a larger percentage of its free cash flow to shareholders. Occidental Petroleum said in its Q3’22 report that it already completed more than 85% of its $3.0B stock buyback this year… with the remaining 15% to be completed in November and December.

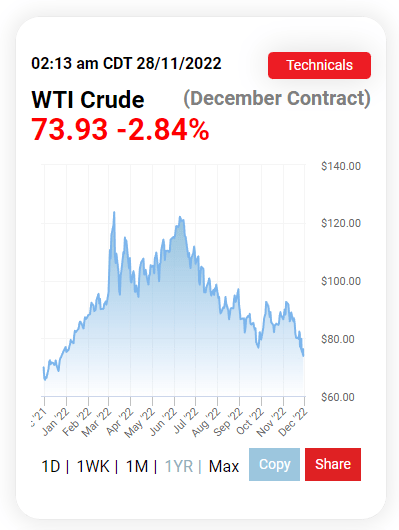

Expect a consolidation

Investors must expect a (continual) consolidation of commodity prices and, as a result, of Occidental Petroleum’s share price. Prices for WTI just fell to $74 a barrel, which is the lowest price in 2022, due to unrest in China over COVID-19 lockdowns as well as growing economic concerns. The onset of a global recession may also be considered a potent catalyst for a new down-leg in petroleum prices.

WTI futures briefly soared above $130 a barrel in March, right after Russia’s invasion of Ukraine, meaning petroleum prices since their 2022 high have dropped approximately 43%. However, Occidental Petroleum’s shares are trading just 9% below their 1-year low of $77.13.

Source: Oilprice.com

Buffett investment likely explains stock’s resilience (for now)

Berkshire Hathaway (BRK.B) (BRK.A) made its first investment in Occidental Petroleum in 2019 and helped finance the acquisition of Anadarko Petroleum at the time. Berkshire Hathaway bought another 6 million shares of Occidental Petroleum in 2022 which resulted in the investment company owning about 21% of the energy producer. Berkshire Hathaway recently also got approval from the Federal Energy Regulatory Commission to buy up to 50% of Occidental Petroleum. I believe it is likely that Buffett’s involvement with Occidental Petroleum has been the key reason why the share price hasn’t dropped as much as the petroleum price. However, since the petroleum pricing environment has started to deteriorate lately, Occidental Petroleum could see a repricing of its free cash flow prospects in the near future.

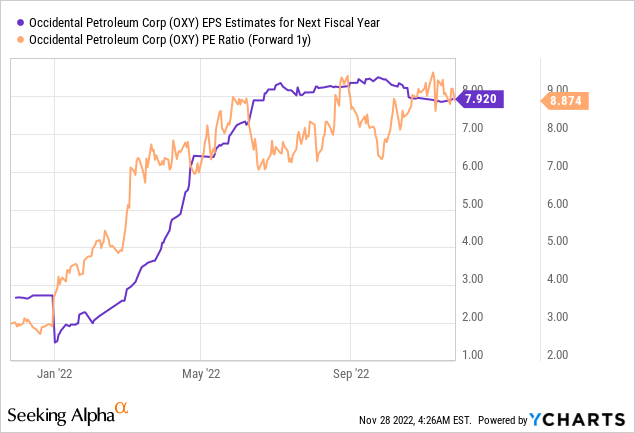

Occidental Petroleum’s valuation, earnings expected to peak in FY 2022

The expectation is for Occidental Petroleum to earn $7.92 in FY 2023, which implies a 21% year-over-year decrease, indicating that earnings are expected to peak this year, before dropping sharply in FY 2022 and beyond. Based off of expected earnings for FY 2023, shares of OXY have a P/E ratio of 8.9 X. Estimates have trended down lately, due to weakening commodity prices, and lower predictions are set to result in a higher P/E ratio going forward.

Risks with Occidental Petroleum

The biggest risk for Occidental Petroleum, as a production-focused energy company, is the commodity price. Petroleum prices have decreased lately and are currently at eleven months lows. For Occidental Petroleum this means diminished free cash flow prospects in the fourth-quarter since the realized petroleum price is set to contract sharply. Faced with lower free cash flow and margins, Occidental Petroleum may decide to reduce the size of its stock buybacks going forward as well.

Final thoughts

Occidental Petroleum had a great third-quarter and it was a fantastic year for the stock which gained 142% from January through November. However, petroleum prices are correcting sharply to the down-side and WTI is now at its lowest price in 2022. At the same time, Occidental Petroleum’s share price has only retreated 9% which indicates that the energy firm likely continues to benefit from the fact that Warren Buffett’s investment company ramped up its investment in Occidental Petroleum in 2022. Given the deteriorating macro environment and growing free cash flow pressure, investors may want to think about selling!

Be the first to comment