hrui

American Electric Power (NASDAQ:AEP), one of the largest providers of electric service, consisting of generation, transmission, and distribution in the United States, is a buy for the conservative income investor. The management of AEP is good, and it has continued to grow the business by using its cash to expand by adding to its existing facilities and renewable energy sources. The dividend has recently been increased to $0.83/Qtr. from $0.78/Qtr. or an increase of 6.4% for 17 years of increases. American Electric Power is being reviewed using The Good Business Portfolio guidelines, my IRA portfolio of good business companies that are balanced among all styles of investing.

As I have said before in previous articles.

I use a set of guidelines that I codified over the last few years to review the companies in The Good Business Portfolio (my portfolio) and other companies that I am reviewing. For a complete set of guidelines, please see my article “The Good Business Portfolio: Update to Guidelines, March 2020“. These guidelines provide a balanced portfolio of income, defensive, total return, and growing companies that hopefully keep me ahead of the Dow average.

Buy for Conservative Income Growth

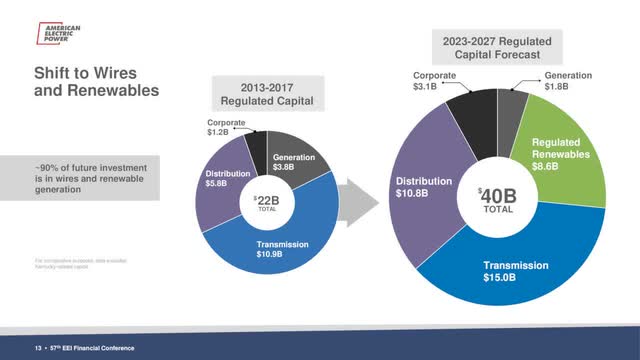

American Electric Power is a great investment for the conservative income investor who also wants steady, moderate earnings growth as a plus. The yearly yield is good at 3.69%. A quote from the third-quarter earnings call by the CEO Nick Akins sums up the good business expansion for the future with a capital five-year investment of $5.0 billion for the development of renewable clean energy projects. The graphic below shows the projected capital expenditures that will drive the company’s growth well into the future.

Percent of renewables over time (57th EEI Financial Conference November 14,2022)

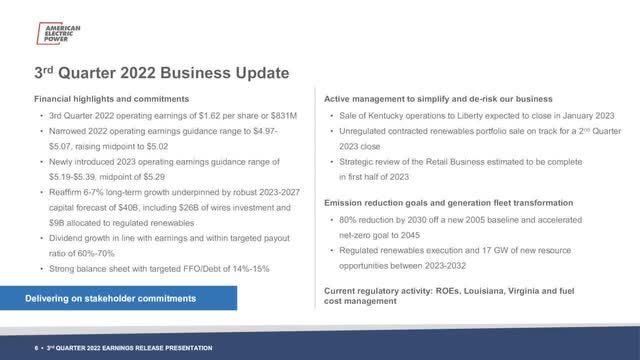

Over the past ten years, we’ve had a great record of consistently exceeding our earnings projections and raising guidance, with this quarter being no exception. Today I’ll provide a brief recap of the key financial highlights for the quarter which are part of our strategy to simplify and derisk our business profile. We continue to build on our momentum, delivering a strong third quarter in 2022, with operating earnings of $1.62 per share or $831 million. Today, we are reaffirming our 2022 narrowed full-year operating guidance range, as well as our newly introduced 2023 operating earnings guidance range. As a reminder, we are guiding to a 2022 range of $4.97 to $5.07, with an increased midpoint of $5.02 per share, and our 2023 guidance range is $5.19 to $5.31, with a $5.29 per share midpoint. Our long-term earnings growth rate guidance of 6% to 7% is underpinned by a robust $40 billion capital investment plan for 2023 to 2027, which includes $26 billion in wires and $9 billion in regulated renewables investments. Moreover, our dividend growth is in line with our long-term growth rate and within our targeted payout ratio of 60% to 70%. Now regarding emission reduction goals, as we mentioned in Analyst Day, AEP remains firmly grounded in our principles of resiliency, reliability, and affordability while recognizing the value of our diverse resource portfolio given today’s world of energy-related volatility. We are undertaking one of the largest clean energy transformations in the country through our regulated renewable strategy. We accelerated our net zero goal by five years from 2050 to 2045. We are confident in our path forward and our ability to hit key milestones in a steady and timely manner. Importantly, these goals are aligned and supported by our latest integrated resource lands that are in various states. We will continue our planned retirement and disposition of select fossil fuel units while adding renewables to our generation portfolio. Our 1.5-gigawatt North Central wind portfolio, which became fully operational in March of this year, represents only the beginning of our clean energy fleet transition. As we look to the long term, we are committed to building a reliable and resilient grid to efficiently deliver clean energy to our customers, and we will continue to monitor new technologies that can help us close the gap of net zero while maintaining the highly reliable and affordable delivery of energy that our customers expect.

This shows the feelings of the CEO for the continued growth of the American Electric Power business and shareholder return via increased earnings and dividends. American Electric Power has good growth long term and will continue as the workforce returns as the COVID virus is reasonably controlled. American Electric Power’s S&P CFRA one-year price target is $93.00 with a hold rating, giving you a possible gain of 7% in a year and making it a good buy at this time. The projected one-year PE is moderate at 18, which shows that AEP is almost undervalued compared with the CEO’s 6-7%% CAGR projected growth. American Electric Power has a business that will grow from year to year as the need for more electricity as the United States economy grows. American Electric Power is a large-cap company with a capitalization of $46 billion, well above my guideline target of at least $10 billion. American Electric Power’s 2023 projected increase of 7% in operating revenue is good, allowing the company to have the means for company growth and increased dividends. The graphic below shows 2022 Q3 good results.

Q3 Business parameters (Q3 Earnings call slides)

One method I use to compare companies is to look at the total return compared to the market. The lower American Electric Power total return for five years of 50.78% compared to the Dow base of 59.87% over the same period makes AEP a poor investment for the total return investor but provides a steady growing income for the conservative income investor. Looking back five years, $10,000 invested five years ago would now be worth over $14,300 today. This gain makes American Electric Power a fair investment for the total return investor looking back, which has future growth with increased earnings as the economy gets back to normal after COVID.

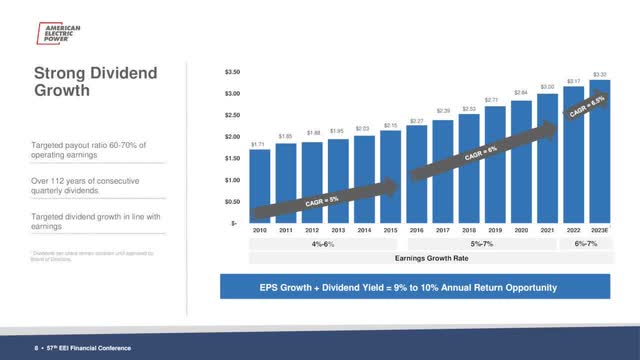

One of the major reasons to own American Electric Power is to have a company with increasing growth as the need for more renewable electricity generation is required by EV cars and a growing population. American Electric Power has an above-average dividend yield of 3.69% and has had increases for seventeen years. This makes American Electric Power a good choice for the dividend growth investor that wants growing yearly income. The dividend was just increased in October 2022 for an increase from $0.78/year to $0.83/year or a 6.4% increase, a steady increase that is typical from the previous years looking back. The five-year average payout ratio is moderate at 62%, which allows cash to remain for increasing the business of the company by increasing the capacity of existing facilities, adding new renewable plants, and increasing the dividend that provides company growth that brings value to the stockholder. The graphic below shows the constant growth of the dividends looking back.

Dividend growth (Q3 Earnings call slides)

I look for the earnings of my positions to consistently beat their quarterly estimates. For the last quarter, on October 27, 2022, American Electric Power reported earnings that beat expectations at $1.62 by $0.06, compared to last year at $1.02. Total revenues were up 19.6% at $5.5 billion compared to last year and beat total revenue by $750 million. This was a good report with a bottom-line beating expected and the top line up compared to last year. The next earnings report, Q4, will be out in January 2023 and is expected to be $0.97 compared to the previous year at $0.98. The graphic below shows a summary of the projected return for 2022 and beyond.

Proposed Return (57th EEI Financial Conference November 14,2022)

One of my guidelines is whether I would buy the whole company if I could. The answer is yes. The total return is fair, and the above-average growing dividend makes American Electric Power a good business to own for yearly income and moderate growth. The Good Business Portfolio likes to embrace all kinds of investment styles but concentrates on buying businesses that can be understood, makes a fair profit, invests profits back into the business, and also generates a good income stream. Most of all, what makes American Electric Power interesting is the long-term growth of its business as the need for more electricity with the growing economy.

Risks and Negatives of the business

The obvious risk for American Electric Power is that a new COVID virus will hurt the business. American Electric Power has great service, and they keep adding renewable energy facilities that increase their sales. American Electric Power’s revenue will continue to grow, but revenues and earnings may be volatile if COVID or a recession occurs. As more businesses and people get back to work, AEP’s earnings should return to their normal steady growth. There is also always the risk of government regulation that could hurt American Electric Power’s rate increases and cause a decrease in earnings.

Conclusions

American Electric Power is a great investment choice for the dividend income growth investor with its well-above-average dividend yield and a fair investment for total return investors. The Good Business Portfolio will add AEP to my income buy list and buy if cash is ever available. If you want a steadily growing good dividend income in the electric utility business, American Electric Power may be the right investment for you, and it’s fairly priced with a projected 7% gain for 2023.

The Good Business Portfolio’s total return is behind of the Dow average from 1/1/2022 to December 2 by 2%, which is a loss below the market loss of 5.25% for a total portfolio loss of 7.25%. Each quarter after the earnings season is over, I write an article giving a complete portfolio list and performance. The latest article is titled “The Good Business Portfolio: 2022 2 nd Quarter Earnings and Performance Review and Select Company Reviews”. The third-quarter report is being worked on and should go out soon.

Be the first to comment