Justin Sullivan

This story was originally published for subscribers of Reading The Markets, an SA Marketplace service on October 11. The story has been updated on the afternoon of October 18.

AMD’s (NASDAQ:AMD) shares have slid more than 60% since peaking nearly a year ago, and the outlook doesn’t appear to have improved. The company recently slashed its revenue guidance for the third quarter to $5.6 billion from $6.7 billion. Additionally, the company now sees non-GAAP gross margins of 50%, down from a prior view of 54%.

While all the bad news seems to be out of the way, it may not be. Analysts haven’t completely adjusted their earnings and revenue estimates for the third quarter yet, so there are likely to be further downward revisions to come, which will also impact the 2023 estimates.

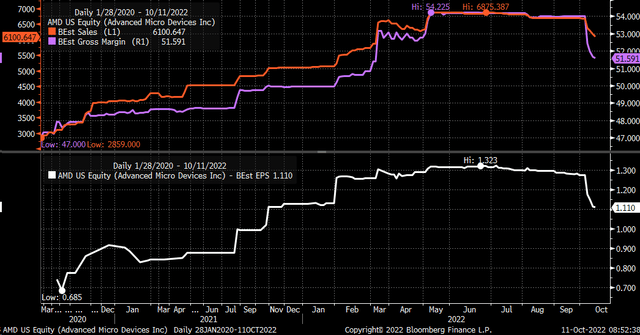

Analysts have only partially adjusted their revenue estimates for AMD for the third quarter, lowering them to $6.1 billion from a prior $6.7 billion. Meanwhile, gross margin estimates have fallen to 51.6% from 54.2%. As a result, earnings estimates for AMD are down to $1.11 per share from $1.32 per share.

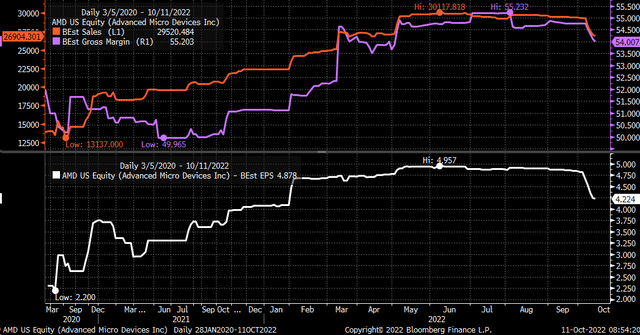

Yes, analysts have lowered their revenue estimates, but it also implies that analysts haven’t completely updated their models yet to reflect AMD’s new guidance, which probably means that forecasts for 2023 are too high. To this point, earnings estimates for next year have only fallen $4.22 per share from $4.96 per share. Meanwhile, revenue estimates have dipped to $26.9 billion from $30.1 billion, as gross margin has fallen to 54% from 55.2%.

The company noted in the press release that it saw weakness in its PC business and an inventory correction. These inventory corrections can take a few quarters to work through, making the outlook for the stock over the next 3 to 4 quarters challenging to predict. It did mention that the data center business performed as expected.

A Drop Below $55

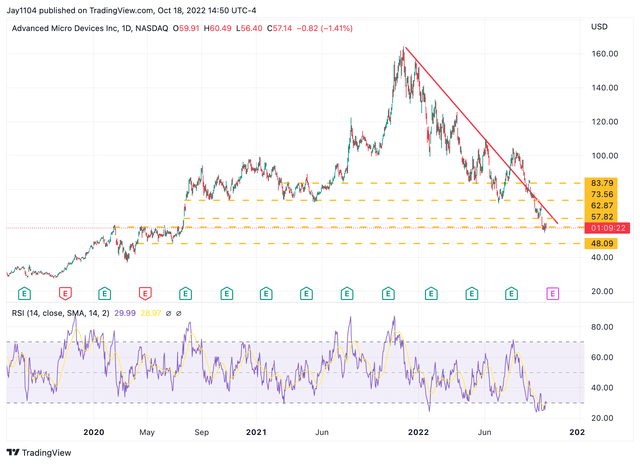

A trader is betting the stock drops even further. The open interest for November 18 $55 calls and puts rose by around 42,000 contracts each on October 11. The data shows that most calls were sold for between $6.30 and $6.50 per contract. Meanwhile, the data also shows that most of the puts were bought for between $3.80 to $3.90 per share. Overall, this is a bearish bet and indicates that the stock will be trading below $55 by mid-November.

Big Downtrend

The technical chart shows that AMD has been trending lower in a trading channel since November 2021. The stock briefly moved above the trading channel in July but moved back into that range starting in October. The shares are currently trading around a minor level of support at $57, but the real risk is for the shares to fall to around $49. Yes, the stock is flirting with oversold levels from a relative strength standpoint, but when stocks are in a prolonged downtrend, they can remain oversold for some time.

Despite the significant decline, there will be plenty of questions about the stock until the earnings call on November 1. Until then, the stock is likely to face downward pressure as analysts continue to reset their expectations.

Be the first to comment