jiefeng jiang

Investment Thesis

Advanced Micro Devices (NASDAQ:AMD) is a global semiconductor company focused on CPUs, GPUs, server processors, and technology for game consoles. Riding the growth of the semiconductor industry, AMD’s revenue has been skyrocketing in the past several years, and I expect the upward trend to continue for the next several years. Their traditional core business (CPU, GPU, and server processors) will continue to grow, and the expansion into high-margin programmable logic devices via the acquisition of Xilinx will add great revenue growth along with margin expansion. I believe AMD is a superb investment option because:

- AMD’s revenue growth is multifaceted: Computing, graphics, enterprises, and servers. This multifaceted growth will continue for the foreseeable future.

- Acquisition of Xilinx is a great move, and it will bring more revenue growth and margin expansion.

- Superb execution on growth and increasing efficiency is showing in various financial and operational metrics.

Superior Revenue Growth

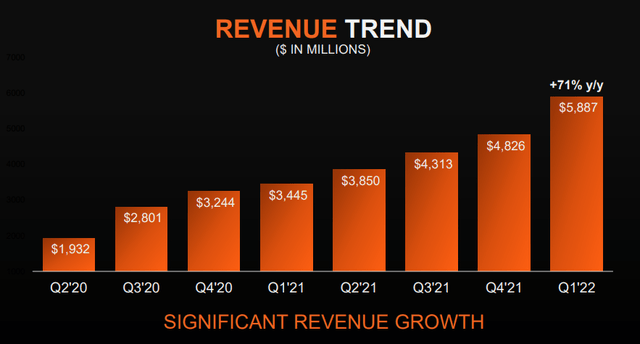

AMD management’s superb execution on their growth plan is clearly working, leading to multifaceted growth across business segments. Last quarter, the Computing and Graphics segment grew 33% YoY led by Ryzen and Radeon, while the Enterprise, Embedded and Semi-Custom segment grew 88% YoY led by EPYC processor. Overall, AMD’s revenue grew 71% YoY and 22% sequentially. This outstanding result is not really surprising given their wide and deep product portfolio that includes data center, gaming, and embedded semiconductors.

Revenue Trend (AMD Investor Relations)

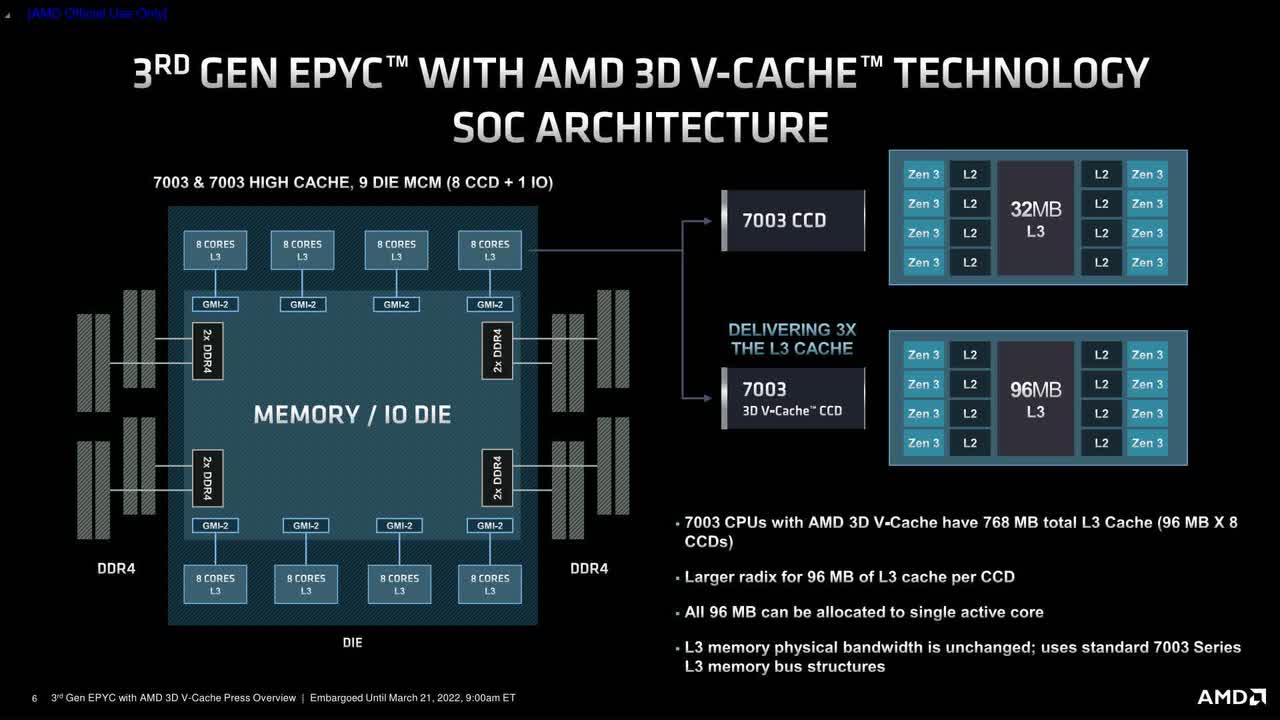

Superior technology is a key contributor to this growth. For example, their new EPYC processors (higher core counts and more PCI Express lanes) with 3D stacked chiplets extend their performance leadership in the technical computing workload field by 66%. Formerly codenamed “Milan-X,” the new processors feature the industry’s largest L3 cash and provide outstanding performance for technical computing like computational fluid dynamics, finite element analysis, and electronic design automation. Industry-leading companies like Cisco (CSCO), Dell (DELL), HPE (HPE), and Lenovo (OTCPK:LNVGY, OTCPK:LNVGF), all launched servers equipped with the new CPUs, and I expect AMD’s footprint to further increase.

3rd Gen EPYC (Video Cardz)

Xilinx Acquisition

Xilinx designs and develops programable logic products for communications, industrial, consumer, automotive, and data processing. Not only do they have a large customer base across multiple sectors, but also their technological strength has led to their systems being chosen at the prestigious CERN European laboratory and United States Air Force Research Laboratory.

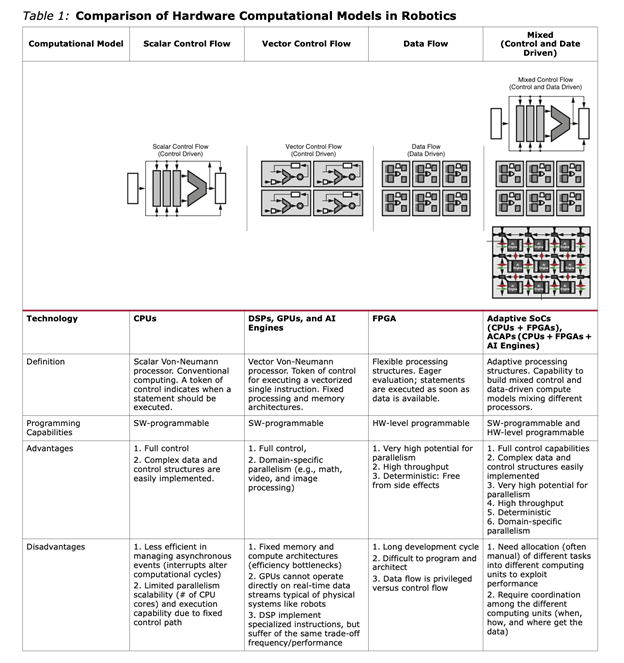

Computational Models in Robotics (TechTalks)

Also, the part that excites me the most about Xilinx technology is their future in the robotics market. There are increasing levels of interest in incorporating more automation within manufacturing to help alleviate labor shortage and safety issues. To produce better and faster robots, a heterogeneous computational model is required: CPUs and GPUs for control-flow computations, and Field Programmable Gate Arrays (FPGA) for data-flow computations. By purchasing FPGA powerhouse Xilinx, AMD, who already held a strong position in CPUs and GPUs, will be in a unique position to deliver great computational packages for robotics. This is a segment with a lot of growth potential.

Mendocino Mainstream Mobile Platform

Late May, AMD unveiled its new mobile platform Mendocino, and this new platform should bring strong revenue growth. The new platform features a Zen 2 4C/8T (4 cores and 8 threads) architecture on TSMC’s (TSM) 6 nm process (that delivers 18 percent higher logic density). With the Mendocino platform, basically AMD is bringing premium features to a more affordable laptop. Intel (INTC) has always dominated the affordable laptops segment, but with Mendocino (high performance at a lower price point), AMD will now be able to challenge Intel in that segment. Mendocino is expected to launch later this year, and I expect the plan to work in AMD’s favor.

Strong Execution

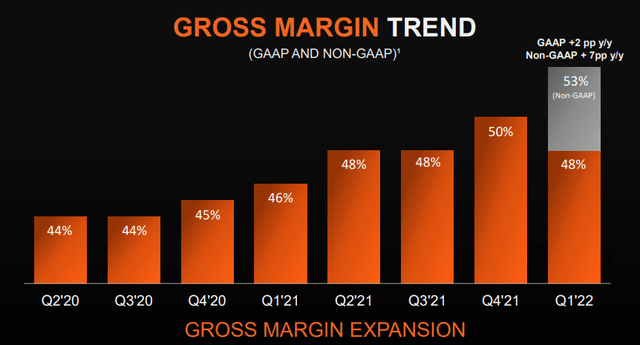

A plan is great, but without good execution, a company cannot be successful. In that regard, AMD is doing an amazing job at executing their growth plan. The aforementioned revenue growth is superb. AMD’s YoY revenue growth (65.26%) is far above their peers: QUALCOMM (QCOM) (33.51%), INTC (0.0%), Micron (MU) (27.08%), and etc. Gross margin keeps on increasing, with GAAP gross margin now at 48% (2% higher than a year ago). Also, their net income margin (17.98%) is far above the sector median (4.76%).

Gross Margin Expansion (AMD Investor Relations)

This strong growth and improvement in operational efficiency results in high operating cash flow ($3.6 B) and EPS growth of 117% YoY. With organic growth already coming from the data center and server sector, combined with the Xilinx acquisition, I expect AMD to keep growing and capture even more synergies through strong execution.

Intrinsic Value Estimation

I used a DCF model to estimate the intrinsic value of AMD. For the estimation, I utilized EBITDA ($4.8 B) and current WACC of 8.0% as the discount rate. For the base case, I assumed EBITDA of 30% (average revenue growth of the past 5 years) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish cases, I assumed cash flow growth of 32% and 35%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price represents 25-30% upside. Given their strong multi-faceted growth trajectory, impressive execution, and the Xilinx acquisition, I expect AMD to achieve this upside in the long run.

|

Price Target |

Upside |

|

|

Base Case |

$104.41 |

18% |

|

Bullish Case |

$111.90 |

26% |

|

Very Bullish Case |

$123.98 |

40% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- EBITDA Growth Rate: 30% (Base Case), 32% (Bullish Case), 35% (Very Bullish Case)

- Current EBITDA: $4.8 B

- Current Stock Price: $88.11 (07/22/2022)

- Tax rate: 20%

Cappuccino Stock Rating

Economic Moat Strength (4/5)

AMD and Intel basically share a duopoly in the CPU market. AMD’s market share has been increasing against Intel. Utilizing their market share and technological advantage, they are able to charge a steep premium on their products. AMD also has a formidable portfolio across data center, gaming, and adaptive SoCs.

Financial Strength (5/5)

Superb profitability and cash generation are allowing AMD to build a strong cash position. AMD has $6.53 B in cash against $2.16 B debt, which gives them a negative net debt position. Also, their liquidity (current ratio at 2.4x and quick ratio at 1.8x) is very strong.

Growth Rate vs. Sector (4/5)

Following the boom in the semiconductor segment and their market-leading position, AMD has been growing far better than the sector. Also, as mentioned before, their growth is multifaceted. I expect them to outpace the overall industry for the foreseeable future.

Margin of Safety (5/5)

The tech sector has been struggling mightily these past several months, and AMD stock is no exception. Its stock dropped from $150 in November 2021 to around $80. Based on the intrinsic value estimation shown above, AMD is easily undervalued by 25-30% at this point.

Sector Outlook (4/5)

The need for semiconductors will only grow in the future, so I would say this segment has a bright future. However, the semiconductor segment is notoriously cyclical, and the margin can swing quite a bit. Therefore, it’s hard to justify a 5.

Risk

Several major banks reported their earnings, and most bank CEOs warned about the risk of a recession later this year. A large portion of AMD’s revenue comes from consumer disposable products like desktops, laptops, and game consoles, so lower consumer spending can negatively impact their revenue.

Even though I believe in the future of the robotics market, it is still a young and growing market. Growth rate (expected to be 16% per year) could certainly be smaller than expectation. Also, installing robotics and automation is a capital-intensive undertaking, so more difficult economic conditions could cause businesses to tighten up their purse strings and push down the capital expenditure on manufacturing sites in the short term, which may negatively impact AMD’s growth trajectory.

Recently, the Senate has been eyeing a $50 B bill to boost U.S. semiconductor production. This bill, if passed as is, will benefit greatly Intel, which is the main competitor of AMD, but not AMD. Companies like AMD and NVIDIA do not manufacture chips in the U.S., so they won’t be qualified for the subsidies. Therefore, the changes in the political climate could impact the competitive landscape of the semiconductor industry.

Conclusion

AMD is riding high on the surge of the semiconductor business, and the usage and demand for semiconductors will only increase in the future. AMD has been executing well and multiple segments are showing growth rates that outpace the overall industry. The acquisition of Xilinx is a great move, and I’m excited to see their growth in the robotics segment. Overall, I expect 25-30% growth in the long run.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment