Athitat Shinagowin/iStock via Getty Images

The Federal Open Market Committee of the Federal Reserve, the maker of monetary policy, meets on July 26 and July 27.

The FOMC is expected to raise the Fed’s policy rate of interest by 75 basis points.

After the most recent statistical release relating to the consumer price index, there was some talk about the Fed moving the policy range by 100 basis points.

However, it is more likely that the rise will only be by the lower number.

This would bring the policy rate range up to 2.25 percent to 2.50 percent.

And, there will be more increases to come in the future.

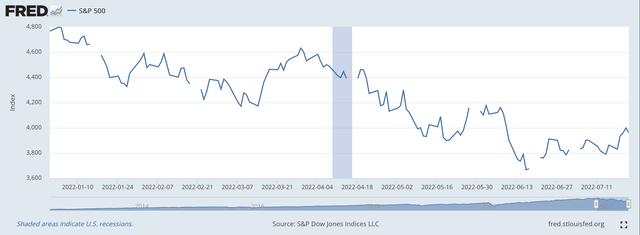

But, many investors believe that most of the future Federal Reserve moves are now incorporated into the stock market and, although a bottom to the stock market decline has not been reached, there will be weeks in which stock prices will actually increase as investors take advantage of some of the lower prices.

For example, Kristina Hooper, chief global market strategist at Invesco, was quoted as saying in the Wall Street Journal,

“Earnings reports earlier this week weren’t terrific, but they also weren’t terrible.”

This led some investors to take advantage of some of the existing prices.

Thus, the markets rose for the week, even though they closed down on Friday.

The S&P 500 Stock Index, for example, rose by 2.5 percent for the week.

Still hanging over the market, however, in addition to the Federal Reserve’s tightening of monetary policy, the market is dealing with the events taking place in Ukraine and the possibility of a world recession, particularly as the news from Europe grows more dim.

Bond Rates

One clear sign that investors are picking up on is the term structure of interest rates.

The yield curve has inverted.

Longer-term yields on government bonds now are lower than short-term yields.

Although the inversion began to take place in the first week of July, this past week saw the inversion increase throughout the yield curve and consistently remain in such a position throughout the whole week.

Heads up!

Historically, when the yield curve inverts and maintains this inversion, a recession always follows.

With the Federal Reserve intent on pushing up the short end of the yield curve, the inversion will most certainly last.

The yield on the 10-year U.S. Treasury note ended the week at 2.763 percent. The week before, this yield was around 3.000 percent. On July 8th, the yield closed at 3.079 percent.

This picture of the term structure seems to be especially true as the longer end of the Treasury’s maturity structure appears to be reluctant to rise.

Pressure to rise on the short end with little or no pressure to rise on the longer end certainly presents the picture of a term structure becoming more and more inverted.

Recession!

The Future

“S&P companies are beating second-quarter earnings estimates by 3.6 percent, which is below the five-year average of 8.8 percent.

“With about a fifth of companies in the index having reported, 10 companies have issued earnings guidance for the third quarter that is below consensus estimates, while one has offered a forecast that is ahead of Wall Street’s projections.”

This is an important guide to the future. This points to investor disappointment.

The environment does not look good.

The Fed is going to continue to tighten up monetary policy.

The Russians are going to push further against Ukraine.

An economic recession is most likely in the United States.

And, for that matter, an economic recession seems to be ahead for the European Union, especially given the political upheaval that has taken place in Italy.

My guess…the S&P 500 is going lower.

Be the first to comment