jiefeng jiang

Investment Thesis

Advanced Micro Devices, Inc. (NASDAQ:NASDAQ:AMD), it’s a stock I always avoided due to the hype and overvaluation. However, despite the current uncertainty in the market and headwinds in the semiconductor sector, I cannot ignore its impressive growth prospects and very attractive valuation point. As a result, AMD has entered my strong buying zone, but I wouldn’t overweight a position yet. Thus, in the below analysis, we review some of the recent developments and the company’s market outlook.

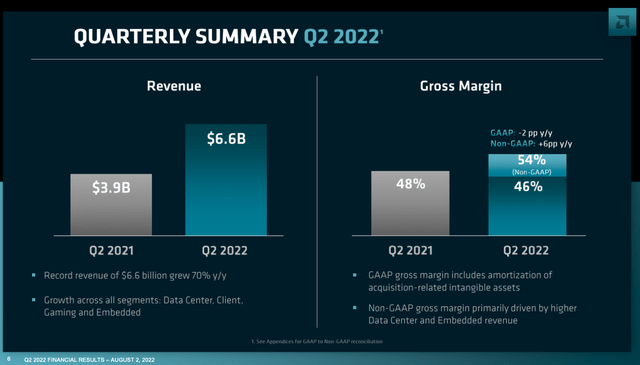

Strong Growth Trajectory

AMD reported a record quarterly revenue of $6.6 billion, up 70% year-over-year, driven by margin expansion and growth across all segments and acquisitions. Data centers remain the company’s fastest-growing segment, reporting an 83% increase in the previous quarter, and with the current momentum, it might overtake the gaming and client segments which are AMD’s largest revenue-producing sources.

Data Center – Xilinx & Pensando

A continued focus on expanding its data-center market share organically and through acquisitions like Xilinx and Pensando can lead to best-in-class growth, offsetting the projected weakness in gaming over the next year. Not surprisingly, gross profit margins have expanded due to higher Xilinx sales, and it is expected for AMD to further leverage FPGAs in the data center segment leading to improved margins.

The recent acquisitions of Xilinx and Pensando will allow the company to expand its data center footprint and market opportunity even further in the cloud, enterprise, and HPC markets. Finally, the company is well-positioned to gain market share in server CPU with its aggressive technology/product roadmap.

Gaining Share In Data Center With EPYC

The management commented in the earnings call that they saw record server CPU revenue in Q2, assisted by more than 60 new AMD-powered instances deployed at AWS (AMZN), Baidu (BIDU), Google (GOOG) (GOOGL), Microsoft (MSFT) Azure, and Oracle (ORCL). In addition, despite macro uncertainty and some matched set issues, enterprise adoption of AMD continues to accelerate at Dell (DELL), HP Enterprise (HPE), Lenovo (OTCPK:LNVGY), Supermicro, and Cisco (CSCO).

JPMorgan recently conducted a survey of 142 CIOs who manage ~$100 billion of annual enterprise IT spending power and revealed that there is a significant increase in intent to adopt AMD’s EPYC server CPUs in both on-prem enterprise and cloud servers. In addition, AMD’s 3rd Gen 7nm EPYC platform launched in 2021 has gained significant traction in the cloud (>500 EPYC-based cloud instances available) and enterprise (>25 large enterprise corporations deploying EPYC-based servers), including Google Cloud.

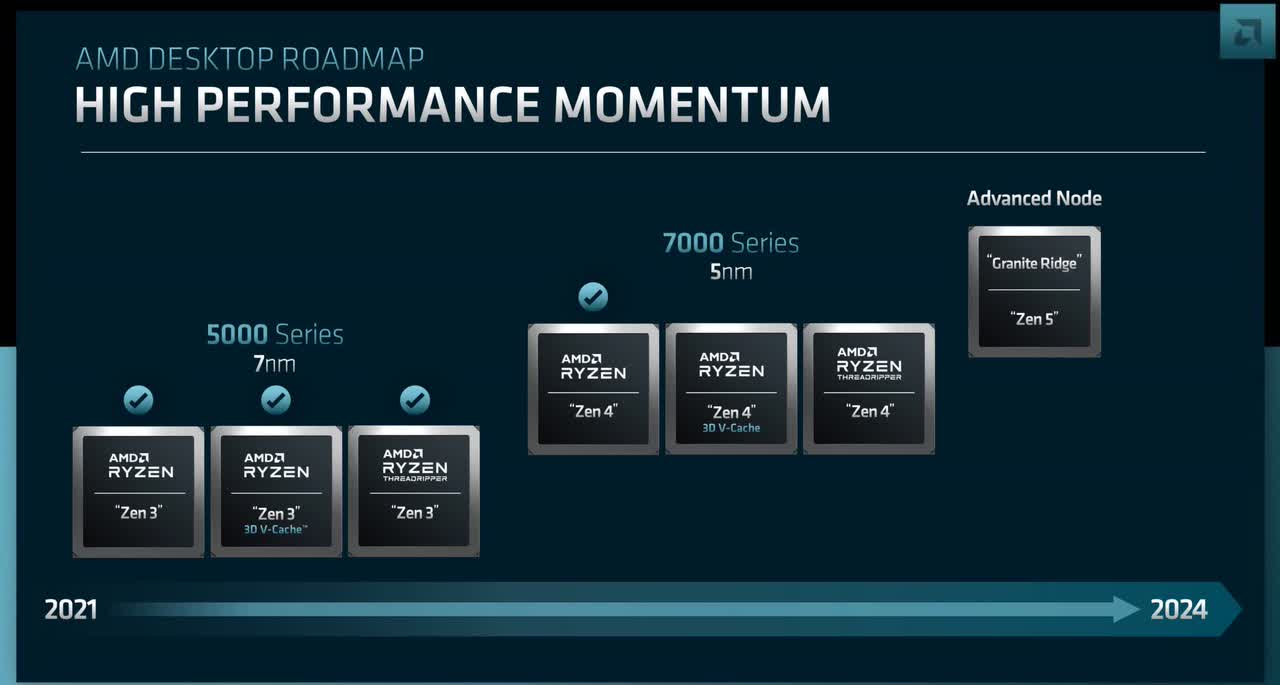

Launch Of New Zen 4-based Ryzen 7000

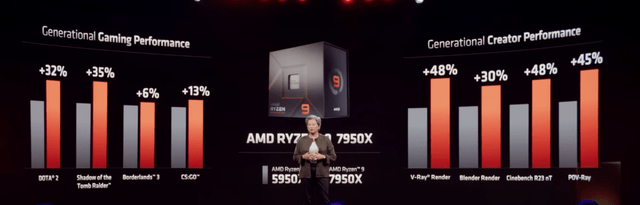

AMD recently announced the Ryzen 7000 Series of client CPUs based on its next-gen Zen 4 architecture built on TSMC’s 5nm process node that features up to 16 cores with support for the latest storage and memory interface technology and boasts significant performance and power improvements relative to the prior Zen 3-based Ryzen 5000 series. In addition, the new series achieves incrementally better benchmarks compared to Intel Corporation’s (INTC) current Alder Lake processors.

AMD introduced four new SKUs for the Ryzen 7000 series, spanning 16 cores at the top end and 6 seats at the low end. Compared to the prior-gen Zen 3-based Ryzen 5000 Series, the Ryzen 7000 Series boasts a 13% average uplift to instruction per clock (IPC) over 22 desktop workloads with a 29% improvement in single-threaded performance and 27% better performance-per-watt.

The new models, which will be available from September 27, are good news for gamers, video editors, and anybody who demands high performance. Built on an optimized, high-performance, TSMC 5nm process node, the Ryzen 7000 Series processors will offer high performance and leading energy efficiency. In addition, the AMD Ryzen 7950X processor enables up to 15% faster gaming performance than the previous generation.

On-time Zen 4 launch sets the stage for continued roadmap execution. The company also indicated that it remains on track on its new product roadmap, with a new desktop CPU supporting 3D V-cache for memory-intensive workloads. In addition, the 4nm-based Zen 4c will be available in server CPUs in 2023. It will deliver the identical functionality of a Zen 4 in half the core area targeted for applications that don’t need to run at the highest frequency. Finally, looking further out, the 4nm-based Zen 5 is on track for 2024, targeting more performance gains with further optimization for AI workloads.

Last but not least, following on the heels of its 4th generation Zen 4-based 5nm “Genoa” general-purpose server CPU in Q4 2022, which promises 75%+ higher performance than the Zen 3 version, the AMD team is planning to ramp a Zen 4c-based “Bergamo” cloud-native server CPU with 2x cloud container density vs. the Zen 3 version in 2023. AMD has achieved meaningful progress within 2022, and with the current momentum, its roadmap seems highly attainable.

AMD’s Roadmap (AnandTech)

Zen 4 Ryzen 7000 Vs. Intel Alder & Raptor Lake

While AMD’s new Ryzen 7000 series client CPU platform certainly raises the performance standards, the lead will likely be short-lived given Intel’s competing Raptor Lake, just around the corner, which is expected to launch as early as October of this year.

Based on early reviews, the generation-to-generation performance gains in Intel Raptor Lake will likely be on par with AMD’s Zen 4, which would mean the two companies will again be head-to-head with each other after Intel regained parity in client CPU with Alder Lake late last year. As for pricing, AMD priced the flagship Ryzen 9 7950X at $699, $100 less than the top-of-the-line 5950X of the prior Ryzen 5000 Series, which could be in anticipation of the competitive environment ahead with the upcoming Raptor Lake launch.

Worsening Macro Environment; Headwinds

AMD typically derives ~50% of its revenue from the core PC end market, which is highly correlated with macroeconomic conditions. Therefore, if the PC end market is weaker/stronger than expected, then this could lead to a decrease/increase in microprocessor and GPU shipments, which could result in a downward/upward revision of our revenue and EPS estimates for AMD.

Despite AMD’s positive outlook on the H2 of the year, I anticipate a global demand slowdown which will pose headwinds to both PC and server TAM. Over the last month, several chipmakers, including Micron (MU), Intel, AMD, and Nvidia (NVDA), warned of a worsening outlook for the second half of this year and have warned of weaker export orders. Moreover, shrinking tech demand highlights a gloomier outlook for the sector as Russia’s conflict with Ukraine and increasing interest rates dampen economic activity.

Although AMD continues to gain processor market share, which should help it offset some of the potential demand weakness, the growth rates are starting to get challenged as macro headwinds begin to strengthen heading into the latter part of the year and next year.

Escalating US-China Tension, A Structural Risk For Chipmakers

Along with a bleak economic environment, the cold war between US and China is intensifying with each passing day and presenting a new challenge for chipmakers as the US government continues with its strategic objective of weakening China’s semiconductor industry. Recently, the US dealt a heavy blow to Chinese tech by asking NVIDIA Corporation and AMD not to sell their high-end graphics processors and AI accelerators to China over concerns that the Chinese military may use them.

This would be a massive setback for NVDA, which holds nearly a 95% share of that market, while the rest is accounted for by AMD. Although AMD has stated that there isn’t a material impact on the company of the directive as of now, and its MI100 accelerator product isn’t affected, the structural risk of the US government expanding its restrictions on more chips and other server-related products looms over the semiconductor industry.

Concluding Thoughts

AMD is improving its competitiveness across CPU and GPU products with Ryzen, EPYC, and Radeon Vega platforms, and it’s on track to strengthen its market share and drive meaningful revenue growth in the near term. In addition, the Ryzen 7000 series processors for desktop offers significant improvements compared to INTC’s Alder Lake CPUs. With that said, it will be interesting to see how the competitive landscape will evolve again when INTC launches its 13th gen in the coming months.

Overall, I believe this launch will help reaccelerate AMD’s gains in the desktop CPU segment. However, the duration of this reacceleration will be highly dependent upon the timing and performance of INTC’s upcoming Raptor Lake launch, as well as the general health of the PC environment. Even though the future for the semiconductor sector remains uncertain amidst a slowing macro environment and escalating tensions between US and China, AMD is a strong buy due to its solid financials, persisting growth prospects, and very attractive valuation.

Be the first to comment