Justin Sullivan

What happened to everyone’s favorite chip stocks? I’m talking about Advanced Micro Devices (NASDAQ:AMD) at this time. Last November, I used AMD and several other stocks to highlight the overbought nature of the stock market in my “Epic Drop is Coming” article. Back then, AMD was trading at around $160 and had a nosebleeding high valuation of roughly 60 times 2021 earnings estimates. Well, fast forward about 11 months, and a lot has changed.

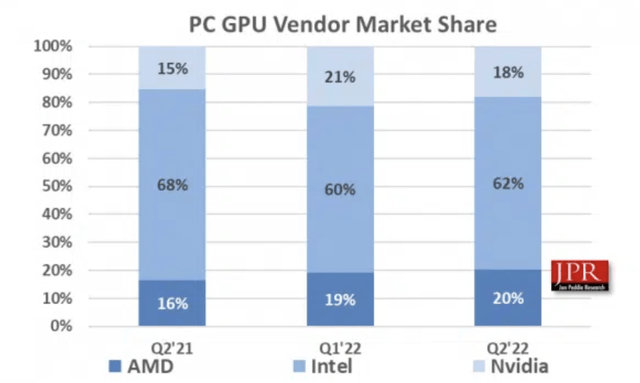

AMD 1-Year Chart

AMD recently dipped below $65 for the first time in over two years. From peak to trough, AMD crashed by a whopping 62%. Now, instead of being epically overbought, the stock is oversold. Moreover, AMD’s valuation has come down dramatically. Forget about that 60 times earnings valuation; AMD is now trading at just 15 times this year’s EPS projections.

Additionally, AMD has plenty of revenue and EPS growth ahead. AMD should continue to lead, grow, and innovate in the CPU and GPU space, allowing the company to continue increasing revenues and profitability potential. AMD’s stock has become remarkably cheap and should go substantially higher as the company advances.

Technical Overview

From a technical perspective, we see that the RSI dipped below 30 recently, illustrating grossly oversold market conditions. Indiscriminate selling has brought AMD down to lows not seen in years. We see the full stochastic and CCI turning higher, demonstrating a shift to positive momentum. While there may be more volatility or modest downside ahead due to the broader bear market in equities, AMD’s stock is in an excellent place to start accumulating or dollar cost average if you are already long shares. In the intermediate and longer term, AMD may be one of the best buys in the tech space.

AMD – A CPU And GPU Leader

There is a reason why AMD was one of the hottest stocks on Wall St. in recent years. AMD is a global CPU and GPU leader, and AMD delivers. Revenues have tripled since 2016, and EPS went from negative to $2.79 last year.

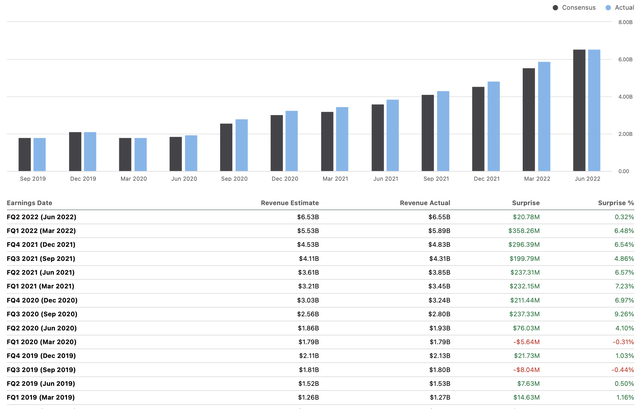

Revenue Growth Surprises

Revenue Surprises (SeekingAlpha.com )

In recent years, AMD has seen quite a bit of revenue growth. The company’s revenues have surged from fewer than $2 billion a quarter to more than $6 billion per quarter. Moreover, AMD has achieved impressive quarterly results, often beating analysts’ estimates by wide margins.

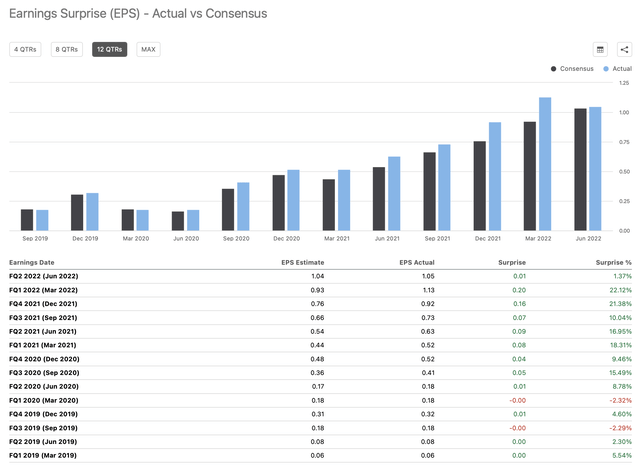

EPS Growth Surprises

We see a similar dynamic with AMD’s EPS growth. The company’s EPS has exploded from just several cents per quarter to more than $1. Additionally, we have seen many EPS beats and double-digit outperformance in recent quarters. There is no indication that AMD is slowing down (beyond the general economic slowdown). Therefore, AMD should continue outperforming as the economy straightens out in the coming quarters.

AMD’s Market Dynamics

AMD primarily competes in the CPU and GPU markets, and AMD’s primary competitors are Intel (INTC) and Nvidia (NVDA). Despite some transitory macroeconomic challenges in its markets, AMD remains well-positioned to capitalize in the future.

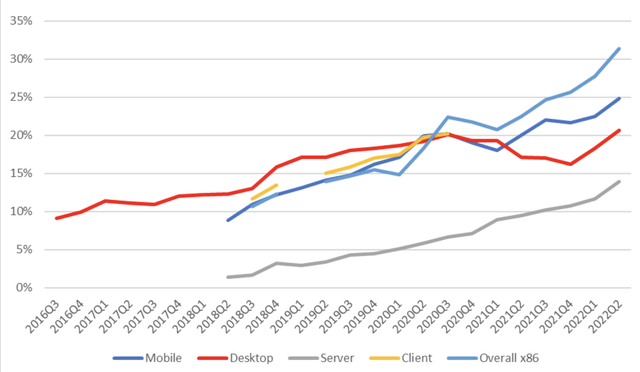

AMD Market Share Growth

AMD’s market share growth remains phenomenal as the company continues expanding across multiple segments. The company’s overall X86 market share recently crossed the 30% mark and is likely to increase as we advance.

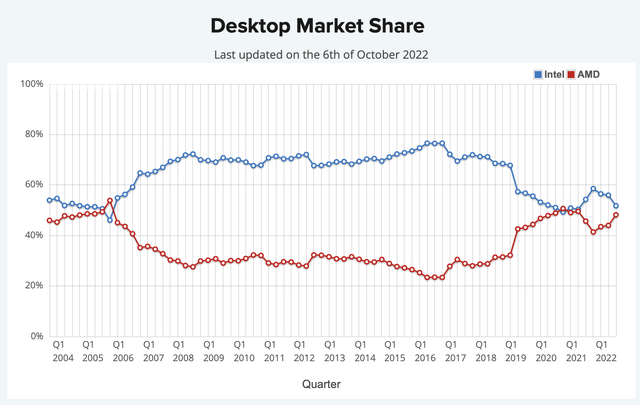

AMD Vs. Intel Desktop Market Share

Desktop Market Share (cpubenchmark.net )

We see that AMD’s desktop market share is approaching 50%. We saw a similar dynamic in 2020, but Intel clawed back market share in 2021. As Intel continues struggling, we could see AMD take over the majority of its market share in the desktop market for a prolonged period this time. AMD’s Ryzen 7000 is the gold standard in desktop CPUs, and it is unclear when or how Intel will catch up.

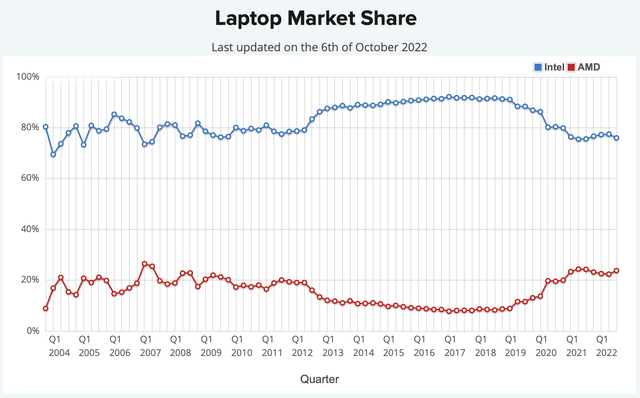

AMD Vs. Intel Laptop Market Share

Laptop Market Share (cpubenchmark.net)

While AMD’s laptop market share is limited to about 24%, it is around the highest percentage AMD has had in nearly 15 years. Also, due to the relatively low market share in the lucrative laptop segment, AMD has plenty of room to grow and acquire more market share from Intel as the company advances.

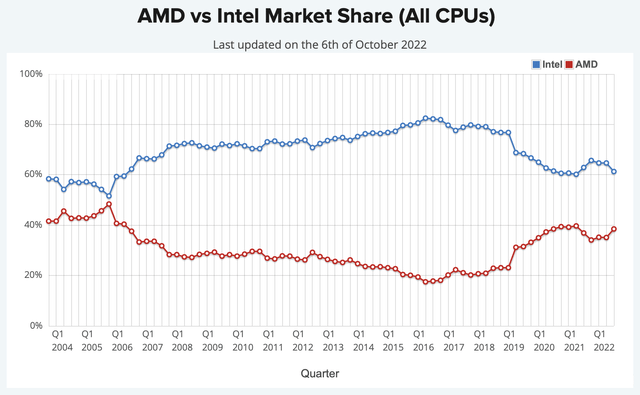

AMD vs. Intel All CPUs

All CPUs Market Share (cpubenchmark.com )

AMD’s market share is only around 38.5% among all CPUs. As AMD continues innovating, it could grow its CPU market share beyond 40% and higher in the coming years. Therefore, we can probably continue seeing AMD’s CPU market share increase and its stock price grow as the company advances in the coming years.

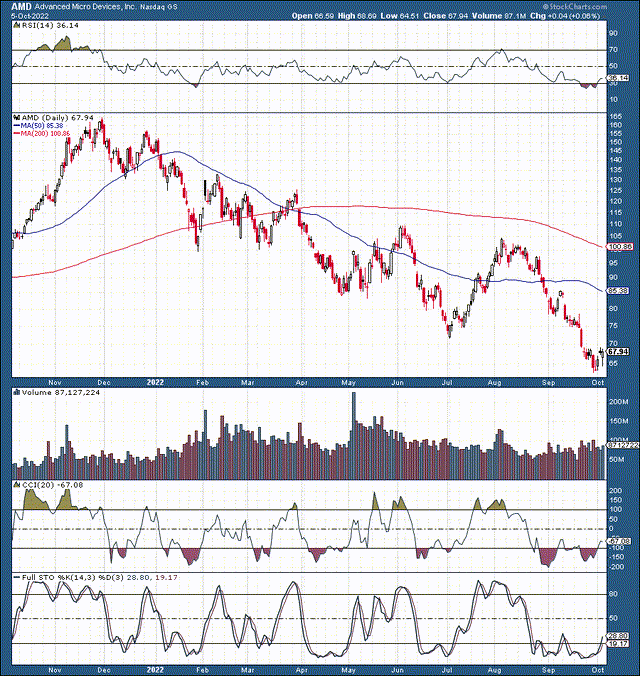

The GPU Market

GPU Market (Hardwaretimes.com )

We see that there are essentially three players in the GPU market. Intel is the undisputed leader in the integrated GPU market, while AMD and Nvidia lead in the discrete GPU space. Now, while Nvidia is experiencing difficulties, it is giving up some market share recently, and AMD is advancing, now controlling around 20% of the GPU market space. It’s difficult to say which discrete GPUs are better, but AMD has always been the more affordable option. With the economy going through rocky times, we could see AMD’s market share continue increasing in this space. However, both companies, AMD and Nvidia, can continue thriving in the discrete GPU market space.

The Valuation Perspective

So, we discussed that AMD’s valuation of 60 times forward earnings was expensive last fall, and it was time to sell the stock. However, now that the stock has crashed by 60%, its valuation (current year P/E) has been cut by 75% to just 15.

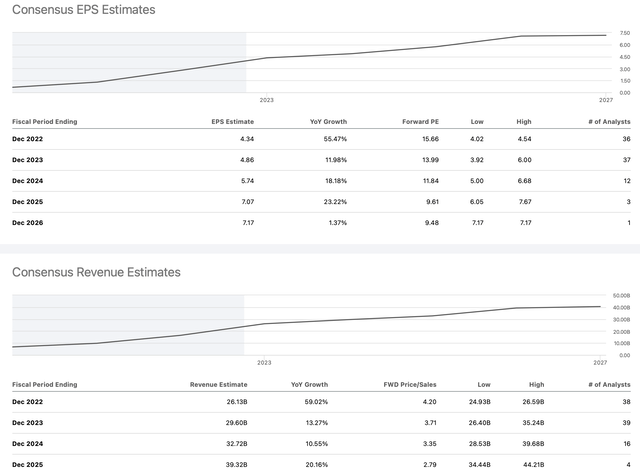

EPS and Revenue Estimates

EPS and revenue estimates (SeekingAlpha.com )

This year’s consensus EPS estimate is $4.34, placing AMD’s P/E ratio at just 15. Moreover, if we look ahead at future years, AMD’s EPS should be around $5-6, putting its forward P/E ratio at just 10-13. This valuation is remarkably cheap for a company in AMD’s position. We should also see substantial revenue growth, with double-digit growth persisting in future years. Amazingly, AMD is a growth company trading at a valuation suited for a mature value company. We should see significant multiple expansion when the market normalizes and starts to assign AMD a reasonable valuation.

Therefore, now is probably a good time to buy AMD’s stock. Also, I am not talking about buying this stock for the next few months. I am talking about a buy for the following several (3-5 or more) years. As the bear market continues, we may see more volatility, and AMD may get sold down to $60 or $50. However, even if the stock heads lower in the near term, it will not stay there for long, making AMD an excellent intermediate and long-term buy. My one-year price target range for AMD is $100-120, roughly 50-80% higher than current levels.

Here is what AMD’s financials could look like in the coming years

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $26.1 | $30 | $34 | $40 | $46 | $52 | $58 |

| Revenue growth | 59% | 15% | 13% | 17% | 15% | 13% | 12% |

| EPS | $4.34 | $5 | $6 | $7.20 | $8.50 | $10 | $12 |

| Forward P/E ratio | 13 | 18 | 20 | 22 | 23 | 25 | 24 |

| Stock price | $65 | $108 | $144 | $187 | $230 | $300 | $350 |

Source: The Financial Prophet

AMD’s stock price can appreciate considerably, provided several elements. First, the company must maintain its revenue growth, providing modest double-digit growth in the coming years. AMD also needs to expand earnings by growing its EPS by roughly 15-20% annually as the company advances. Additionally, we need to see mild multiple expansion. AMD’s forward P/E ratio is dirt cheap right now, and I don’t expect it to be stuck down here for long. Therefore, we will probably see AMD’s multiple expand to the high teens and low twenties in the coming years. We could see AMD’s forward P/E multiple peaks at 25 or higher in future years, and my projections have it peaking at 25 in around 2027. As the following fundamental factors materialize, we will likely see AMD’s stock price rise substantially in the coming years.

Be the first to comment