Justin Sullivan

By The Valuentum Team

Advanced Micro Devices, Inc. (NASDAQ:NASDAQ:AMD) is a stellar cash flow generator backed up by a strong balance sheet and a bright growth runway. Various secular tailwinds, from the proliferation of cloud computing to the Internet of Things [‘IoT’] trend to the rise of autonomous vehicles and more, are all driving up demand for semiconductor components and should continue to do so over the coming decades. In turn, that is driving up demand for AMD’s offerings and supports its pricing power. Through our enterprise cash flow analysis process, which we will cover in detail in this article, we assign AMD a fair value estimate of $120 per share, well above where shares of AMD are trading at as of this writing. AMD represents a nice capital appreciation opportunity for investors.

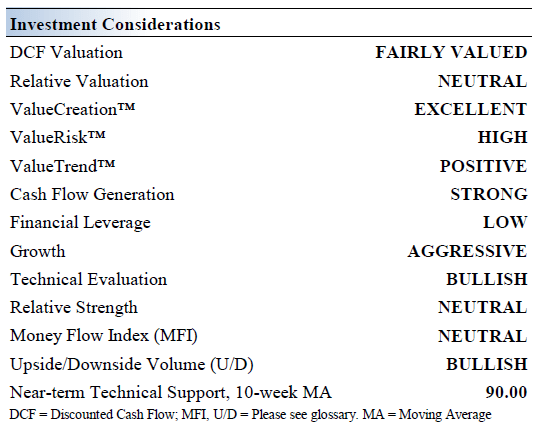

Advanced Micro Devices’ Key Investment Considerations

Image Source: Valuentum

AMD is a global semiconductor company. The firm makes x86 microprocessors as well as graphics, video, and multimedia products for desktops, data centers, and mobile devices. Its solutions, for example, power the newest gaming and entertainment consoles from Microsoft Corporation (MSFT) and Sony Group Corporation (SONY). The company was founded in 1969 and is headquartered in Sunnyvale, California.

In February 2022, AMD acquired Xilinx through an all-stock transaction worth ~$35 billion. Xilinx’s offerings include field-programmable gate arrays, or FPGAs, that can be configured by the customer after the manufacturing process is complete. This deal better positions AMD to capture the ~$135 billion market opportunity it sees “across cloud, edge, and intelligent devices” according to the press release announcing the close of the acquisition.

While Intel Corporation (INTC) has dominated the microprocessor market for years, holding a commanding market share position, AMD has made some share gains against Intel in PCs and CPUs of late. Going forward, AMD has an opportunity to take additional share as a few missteps at Intel have opened the door at AMD. Though technology changes fast, AMD is well-positioned in the near term.

Earnings Update

On August 2, AMD reported second quarter earnings for fiscal 2022 (period ended June 25, 2022) that beat both consensus top- and bottom-line estimates. Its GAAP revenue surged higher by 70% year-over-year in the second quarter to reach $6.6 billion, aided by the uplift provided by its acquisition of Xilinx. AMD’s GAAP operating income dropped by 37% year-over-year in the second quarter primarily due to special items relating to its Xilinx acquisition. Its non-GAAP adjusted operating income more than doubled year-over-year in the second quarter to reach $2.0 billion, aided by robust demand for AMD’s offerings along with the company’s ample pricing power. AMD’s non-GAAP adjusted diluted EPS was up 67% year-over-year in the second quarter, reaching $1.05, with strong net income growth offsetting a significant increase in AMD’s outstanding diluted share count (due to the all-stock nature of its Xilinx acquisition).

As of June 25, 2022, AMD had a $3.2 billion net cash position on hand (inclusive of short-term debt). We are big fans of AMD’s pristine balance sheet as that puts the firm in a prime position to ride out various exogenous shocks seen of late (supply chain hurdles, inflationary pressures, geopolitical tensions, and a potential global recession).

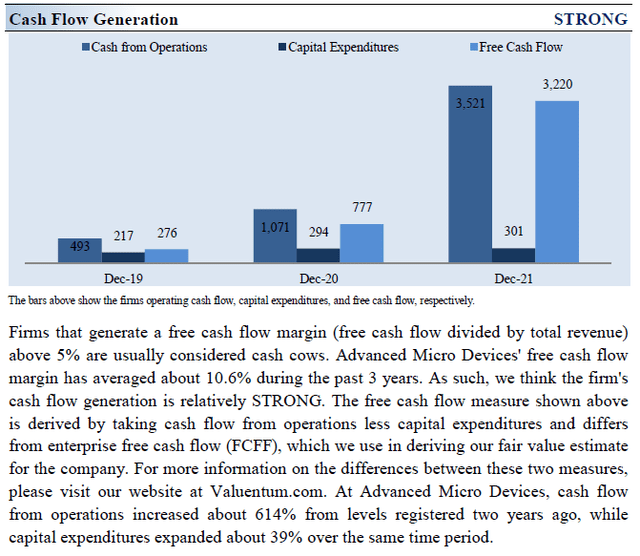

During the first half of fiscal 2022, AMD generated $1.8 billion in free cash flow (defined as net operating cash flow less capital expenditures) and spent $2.8 billion buying back its stock via its repurchase program (excluding purchases made for tax withholding purposes). AMD does not pay out a common dividend at this time. The company has an asset-light business model that requires relatively modest capital expenditures to maintain a given level of revenues, enhancing its free cash flow-generating abilities. We expect that AMD will remain a free cash flow cow going forward.

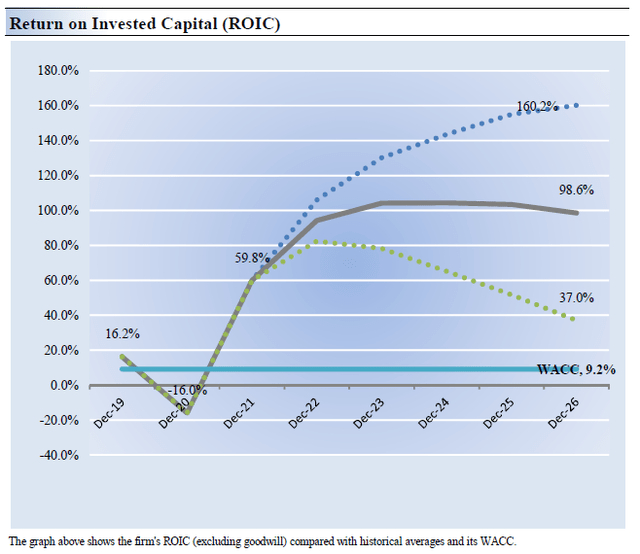

Advanced Micro Devices’ Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. AMD’s 3-year historical return on invested capital (without goodwill) is 20%, which is above the estimate of its cost of capital of 9.2%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. We forecast that AMD will be a stellar generator of shareholder value going forward.

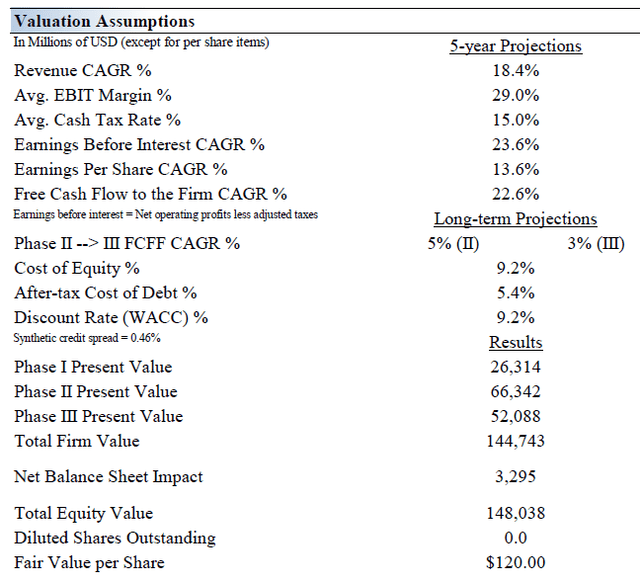

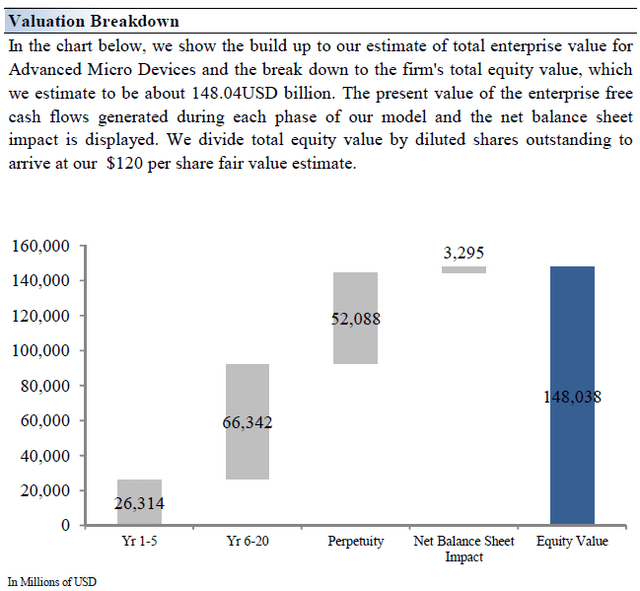

Advanced Micro Devices’ Cash Flow Valuation Analysis

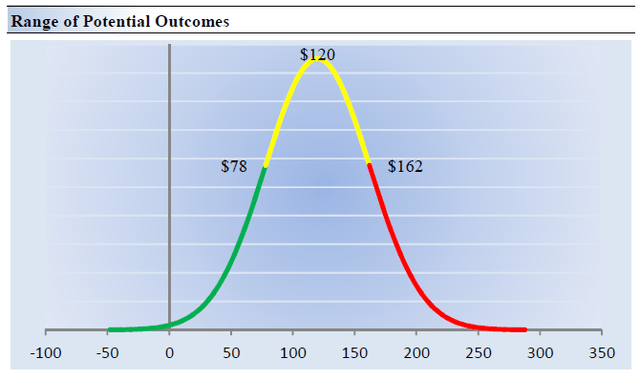

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think AMD is worth $120 per share with a fair value range of $78.00 – $162.00. Please be aware that our enterprise cash flow model assumes AMD posts double-digit annual revenue growth and significant operating margin expansion over the coming fiscal years. Should AMD stumble for any reason, its intrinsic value would face material headwinds.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 18.4% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 36.4%. Our model reflects a 5-year projected average operating margin of 29%, which is above AMD’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 5% for the next 15 years and 3% in perpetuity. For AMD, we use a 9.2% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

Advanced Micro Devices’ Margin of Safety Analysis

Although we estimate AMD’s fair value at about $120 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graph up above, we show this probable range of fair values for AMD. We think the firm is attractive below $78 per share (the green line), but quite expensive above $162 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

AMD’s underlying performance has held up well so far in fiscal 2022. During AMD’s fiscal second quarter earnings call, management issued out guidance for the fiscal third quarter that called for AMD’s revenue to grow by 55% year-over-year at the midpoint. We appreciate AMD’s strong financial standing and view the firm’s capital appreciation upside potential favorably.

Be the first to comment