Thomas Barwick

Thesis

Travelzoo (NASDAQ:TZOO) has had poor share price performance over the past year despite recent improvements in its financial performance. Revenue growth is stable, and as costs have improved, earnings have now become positive. Therefore, when comparing multiples to peers, we see that TZOO is undervalued with a potential upside of between 15% and 50%.

Intro

TZOO is a global media company that provides offers travel and entertainment deals on items such as hotels, holidays, cruises, flights, and other related entertainment. The company offers deals across North America, Europe, and Asia Pacific, using channels such as its website, app, and email newsletters, among others. The company was founded in 1998 and is based in New York. The company has more than 30 million members and works with more than 5,000 travel suppliers.

TZOO’s share price has not performed well over the past year, down by more than -55% over the past 12 months, significantly underperforming the broader market, with no sign of resurgence considering they sit at their 52 week low.

(Source: Seeking Alpha)

Financial Analysis

TZOO’s financial performance for the period of the last 3 months ended September, compared to the year prior, has been somewhat ok given the current inflationary environment.

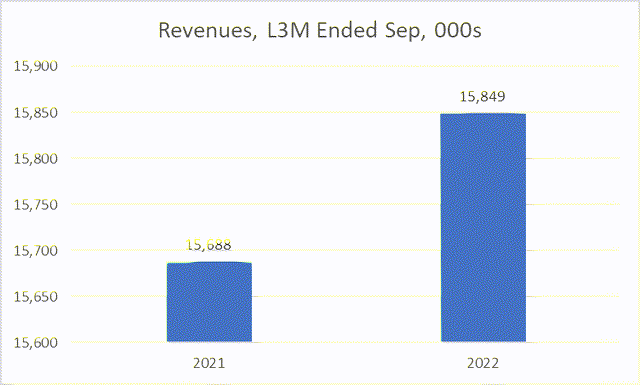

To start, revenues for the last quarter were $15.8m, only 1% higher than the same period a year prior and given that inflation is very high as of now, we can assume this low growth is due to a steep drop in demand. Therefore, sales growth has been poor but remains positive.

(Source: Seeking Alpha)

The growth in revenue was driven by the North American segment, whereas the European segment revenues declined (although a lot of it was due to the negative impact of foreign currency movements to the US dollar – local revenue decrease was marginal).

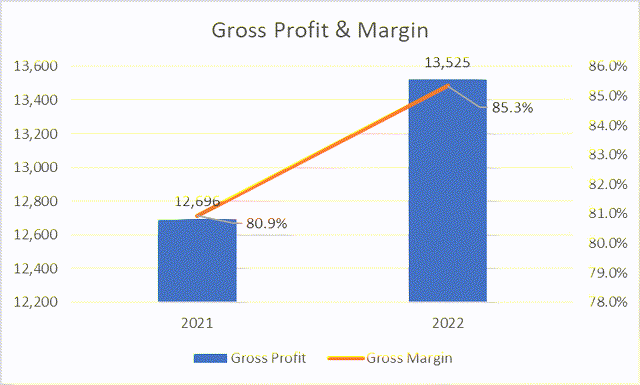

In regard to the cost of revenues, these primarily consist of network expenses. The cost of sales for the last quarterly period declined significantly compared to the year prior, dropping from around $3 million in 2021 to $2.3 million in 2022, a decline of more than 22%. The driver for this decline was due to decreases in credit card fees from decreased voucher sales, as well as a drop in software license expenses.

Due to this, gross profit and margin improved for the period. Gross profit jumped by almost $1m, almost 7%, leading to a jump in the gross margin by almost 5 points, from 80.9% in 2021 to 85.3% in 2022.

(Source: Seeking Alpha)

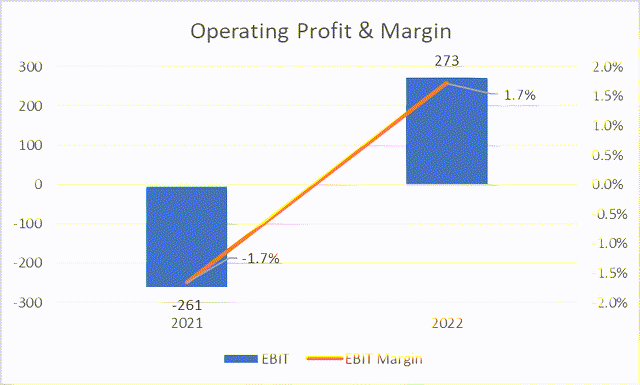

In terms of operating expenses, these are split into three segments, sales and marketing, product development, and G&A. Sales and marketing increased for the period, unfortunately, increasing from around $7.7m in 2021 to $8.5m in 2022, resulting in sales & marketing increasing as a % of sales by 5 points, from 49% to 54%. The drivers for this increase are a rise in both marketing expenses as well as member acquisition costs.

For product development, these costs are marginal but still dropped by almost 30% for the period. Unfortunately, this only contributes around $200k to the bottom line as product development costs are a fraction of total costs, only accounting for around 3% of revenue.

In terms of G&A, these dropped by almost -7%, a $300k decrease. Again, this number is marginal compared to the total size of the business but is an improvement, nonetheless. G&A costs as a % of sales dropped from 29% in 2021 to 27% in 2022 as a result.

Therefore, overall total operating costs, unfortunately, rose by around 2% for the period, driven by the growth in sales and marketing costs.

However, when we look at the bottom line, at an operating profit, we can see an improvement. Despite the meagre revenue growth, the cost of sales dropped significantly which led to a strong improvement in the gross profit, which outpaced the growth in operating costs. Therefore, the operating profit turned from a loss in 2021 (of around $261k) to a profit in 2022 (of around $273k), a much-needed improvement. Despite this, the operating margin is in a very low territory of below 2% and requires a further boost.

(Source: Seeking Alpha)

Valuation

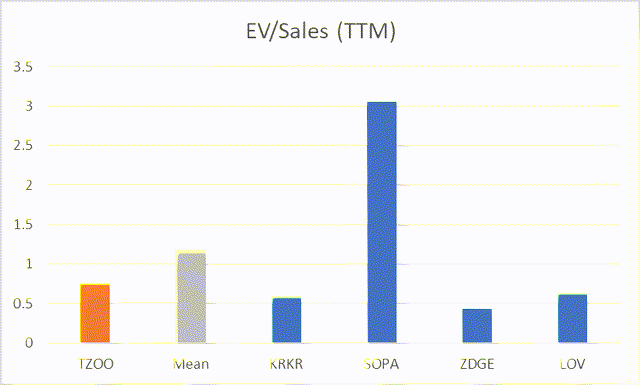

If we collate a set of peer companies that operate in the same sector and have similar market caps, we could potentially see, given the recent financial improvements, if TZOO is overvalued, undervalued, or even fair valued, if we compare multiples.

If we first look at EV/Sales, we can see that TZOO is trading at around 0.75x sales, whereas peers are closer to 1x or even higher, indicating that TZOO is undervalued, with a potential upside of higher than 50%.

(Source: Seeking Alpha)

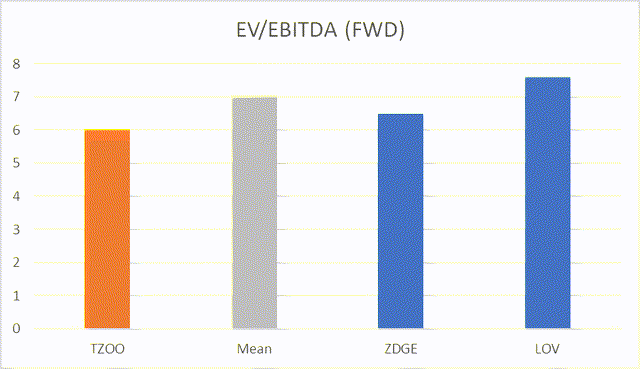

And if we look at EV/EBITDA, we can see that TZOO is trading at around 6x earnings, whereas peers, on average, are trading at around 7x earnings, indicating that, again, TZOO is undervalued compared to peers, albeit at a much lower level this time as the potential upside is only around 15-20%.

(Source: Seeking Alpha)

Risk

- The main risk to this thesis is that cost of sales decline may rebound and grow again, as the reason for the lower costs was due to lower demand (lower fees from voucher sales for example), and this was the core driver to higher earnings for the last period. If the cost of sales were to increase back up to its previous levels, we could potentially see earnings turn negative again. However, this case is unlikely, given that if we see demand return, leading to an increase in fees for voucher sales, this would be because revenue is also growing, and would generally outpace the cost of sales growth.

Conclusion

TZOO’s share price performance has been very poor over the past year, whereas financial performance (in the latest quarter compared to the year prior) has been good given that earnings have now become positive due to a lower cost structure and stable revenue growth, but this improvement has not been reflected in the company’s valuation, resulting in TZOO being undervalued compared to peers with potential upside of between 15% and 50%.

Be the first to comment