metamorworks

Elevator Pitch

I assign a Hold investment rating to Lumen Technologies, Inc.’s (NYSE:NYSE:LUMN) shares. In its fiscal 2021 10-K filing, LUMN calls itself one of “the largest providers of communications services to domestic and global enterprise customers” boasting a network of “190,000 on-net buildings and 500,000 route miles of fiber optic cable” worldwide.

In my view, the new CEO appointment and potential changes to LUMN’s dividend and capital allocation priorities are the key factors that will influence the stock’s share price performance in the short term. Lumen Technologies’ shares are likely to trade sideways in the near term, as investors sit on the sideline waiting for new initiatives announced by the new CEO and a confirmation of the company’s future dividend policy. As such, a Hold rating for Lumen Technologies is appropriate.

Management Changes

Lumen Technologies has announced two key management changes in 2022 thus far.

On March 28, 2022, LUMN disclosed that Chris Stansbury will become the company’s new Chief Financial Officer or CFO in early-April; Stansbury was formerly Arrow Electronics, Inc.’s (ARW) CFO, prior to joining Lumen Technologies. It is worthy of note that LUMN’s former CFO, Neel Dev, was only with the company for about three and half years, having taken up the position earlier in November 2018.

Last month, another significant change in management for Lumen Technologies was revealed, as the company’s long-tenured (four decades) CEO, Jeff Storey, plans to retire and make way for Kate Johnson, to be appointed as LUMN’s new CEO with effect from November 7, 2022. According to Lumen Technologies’ September 13, 2022 press release, Kate “held key leadership roles across a variety of Fortune 100 companies”, and she “led Microsoft (MSFT) U.S., the company’s largest business with a remit for all of the company’s sales, services, marketing and operations” before choosing to make the move to LUMN.

In my view, there are three key points to note in relation to Lumen Technologies’ recent management changes.

Firstly, the changes in Lumen Technologies’ leadership team are warranted, taking into account LUMN’s performance in the last couple of years. In the past three years, the S&P 500’s total return (adjusted for dividends) was a reasonably good +28.1%. In contrast, Lumen Technologies’ total return was a negative -25.0% during the same period.

Secondly, Lumen Technologies’ new CEO Kate Johnson is expected to focus more on organic growth, rather than inorganic growth or corporate restructuring.

One factor is that Kate has actual experience running operations at Microsoft, General Electric (GE) and Oracle (ORCL) among other companies; she isn’t an investment banker or one with a private equity background.

Another factor relates to the CFO’s comments at a recent investor conference. At Goldman Sachs’ (GS) 2022 Communacopia + Technology Conference on September 15, 2022, CFO Stansbury commented that “the skill set that Kate brings, which is the way Lumen will monetize what is a very strong network.” This seems to imply that new CEO Kate will work with her colleagues to extract more value from the company’s existing business operations.

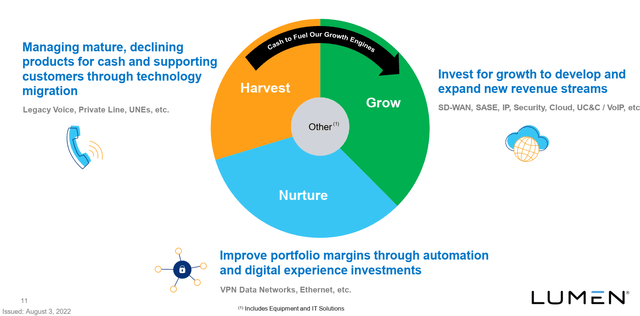

Thirdly, LUMN has already made changes to the company’s financial reporting and disclosures prior to the announcement with regards to the appointment of the new CEO. When Lumen Technologies reported the company’s Q2 2022 earnings in early-August 2022, it revealed a new way of disclosing its revenue by products as highlighted in the chart presented below.

Lumen Technologies’ New Product Revenue Categories

LUMN’s Q2 2022 Results Presentation

LUMN only disclosed the revenue contributed by the various product categories and high-level plans for these different product segments in August 2022. When the new CEO Kate formally comes on board in November 2022, I expect Lumen Technologies to offer more detail on specific actions it will take for the respective product segments and provide more detailed disclosures such as product segment margins. This should act as a key catalyst for Lumen Technologies’ shares.

The changes to Lumen Technologies’ management team are long overdue, and it is encouraging to see this happen. But the proof is in the pudding, and the market will need to see signs of positive change brought about new management, before LUMN’s shares can benefit from a positive re-rating.

Dividend Outlook

LUMN currently offers a consensus forward next twelve months’ dividend yield of 12.6%, based on financial data taken from S&P Capital IQ. It is reasonable to assume that Lumen Technologies’ high dividend yield is a key investment merit for the stock, and that LUMN should have a significant proportion of income- and yield-focused investors among its shareholders.

The market’s consensus is that Lumen Technologies will maintain its generous dividend payouts in the next few years. Wall Street analysts see LUMN’s dividend per share declining from $1.00 in FY 2022 to $0.94 in FY 2023, prior to rising back to $1.00 in FY 2024 again. In other words, investors could be in for a nasty shock and LUMN’s shares might sink, if Lumen Technologies’ future dividends were reduced significantly.

The management’s comments at the mid-September 2022 GS investor conference point to a mixed outlook for the company’s future dividends. At the September 15, 2022 GS Communacopia + Technology Conference, Lumen Technologies stressed that it appreciates “how important the dividend is” for its shareholders, and emphasized that this is “a very clear input to the decisions as we go forward.” On the flip side, LUMN highlighted at the recent conference that the company doesn’t “want to commit” to its future dividend policy right now, and mentioned that “we need a little more time to explore a couple of other (capital allocation) options.”

It is probable that LUMN chooses to reallocate some capital from dividends to deleveraging and capital investments in time to come. Lumen Technologies has considerable financial leverage with its leverage ratio at 3.7 times as of June 30, 2022, and the company might choose to be more aggressive in debt reduction going forward. Separately, funds are also needed to finance new investments with the aim of optimizing the future performance of Lumen Technologies’ three product categories, Harvest, Growth, and Nurture, as mentioned in the previous section.

Bottom Line

Lumen Technologies’ shares are rated as a Hold. I have a Neutral or mixed view of LUMN’s stock, as there is uncertainty over the strategic direction of the company under the leadership of a new CEO, and a possible cut in future dividend payouts. Until there is more clarity on these two key issues, Lumen Technologies’ shares should be range-bound, which supports a Hold investment rating for the stock.

Be the first to comment