Ivan-balvan/iStock Editorial via Getty Images

AMD’s (NASDAQ:AMD) last trading week recorded a 10% selloff from $85 to $76 a share. The week corresponded with the disappointing CPI print, leading to broad indices reverting lower by 5-7%.

It seems obvious that the macro environment is driving most investment activity, and is largely responsible for the variance in price action and capital flows across the markets. Equities remain a bruised asset class that has not been favored in recent months, and with it, the semiconductor industry has seen even more pain, as surely it is macro cyclical. Even the mighty NVIDIA (NVDA) has fallen from graces, citing troubles ahead.

For a bottom-up investor, such an environment presents dislocations of value between what a price might imply, and the fundamentals. AMD is one such example, in my opinion.

Separating The Stock From The Industry

An important aspect for investment practitioners is to understand the difference between first-order and second-order effects.

The semiconductor industry selling off disproportionately in reaction to a heavy-handed Fed and anticipated/ongoing recession is a first-order effect. Such a reaction follows through with our basic understanding of the industry. Enterprises, data centers, consumers, console manufacturers, all hold off on upgrades and fresh purchases of semiconductor chips and equipment. A macro downcycle roughly translates to an industry-wide contraction in sales. Therefore, AMD, along with other semiconductor stocks should see deteriorating financials.

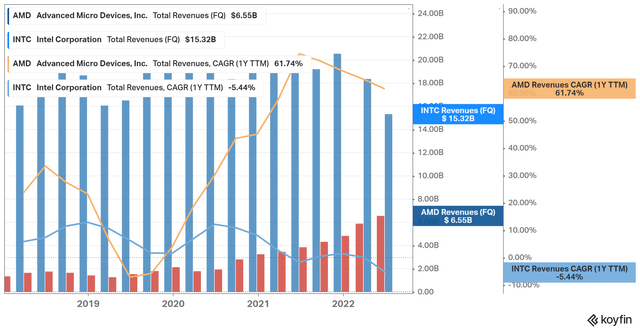

However, a second-order analysis would consider the individuality of a single stock in greater detail. AMD offers extremely competitive (plausibly leading) products on performance and performance per watt across most of their CPU categories. Despite this general understanding, they remain a minority share of the total x86 architecture market – the other and substantially larger in this market is Intel (INTC). Even as of last quarter, AMD still does less than half of Intel in quarterly sales. Excluding AMD’s Xilinx acquisition, and its GPU division, the x86 representation is possibly a third of Intel’s.

Sales growth Intel vs AMD (Koyfin)

Many of us have known that AMD has been gaining share across the broad x86 market for the past few years. It is crucial to understand that Intel controlled the x86 data center-specific opportunity with a virtual monopoly at over 90% share of a slice of the $50B+ category. Intel’s share, by some measures, still represents 70%+ of x86 data centers today. To add, while AMD has been transitioning to big growth, as a fabless company, it has relied on a supply chain that wasn’t entirely available nor elastic to represent its renewed sales demand based on recent engineering leadership. After all, it takes a lot of work to mass-manufacture chips at scale in one of the most highly technical and sophisticated manufacturing industries anywhere. This inference can be drawn upon the host of earnings call transcripts from the past several quarters. To summarize these dynamics, I’d present two broad statements I hold to be true:

- AMD has a tiny fraction of the total share across the data center and server opportunity

- AMD has been historically constrained through supply chain capacity through their partners – TSMC (TSM), etc.

With this backdrop, second-order thinking would result in a conclusion that AMD’s fundamentals are driven by market share gains against Intel, and NOT the entire industry macrocycle. In my mind, the following year would translate to an industry macro downcycle, the entire data center opportunity may contract, Intel gets hit harder as they hold a majority x86 market share, and AMD continues to take share gains against this contracting opportunity.

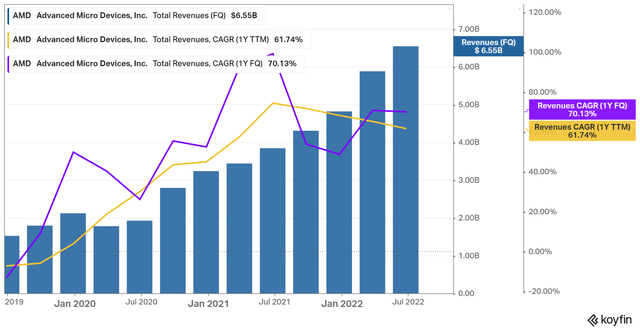

So in conclusion: Yes, the semiconductor pie is contracting and will contract in a recession, but trends point to AMD taking a larger slice of this smaller pie. When it comes to the net result looking out a year from now, that larger slice should outweigh the macro downturn. Why do I say that? Well, look at the business momentum AMD has been growing with. A 61% YoY TTM sales growth is impressive, which is still at 45%+ YoY, excluding the inorganic Xilinx acquisition.

Sales have outperformed the total x86 market growth, and there’s little reason to see why this will dramatically change in the near future. To add, perhaps the most important near-term industry view comes from Intel’s own CEO, Pat Gelsinger:

“Competition just has too much momentum, and we haven’t executed well enough. So we expect that bottoming. The business will be growing, but we do expect that there continues to be some share losses. We’re not keeping up with the overall TAM growth until we get later into ’25 and ’26 when we start regaining share, material share gains,…”

– CEO Pat Gelsinger, Evercore ISI Conference

There you have it. The above response was specifically to an analyst question on AMD and the data center business. I don’t have a strong opinion on Intel’s stock and for what it’s worth but it looks like a strong value opportunity by itself. I really like Pat Gelsinger who brings both technical engineering experience and proven public-company leadership as CEO of VMWare. Even if there’s a turnaround, it’s not going to happen soon. AMD’s rapid PC/Desktop adoption in 2019, for instance, preceded Enterprise and Semi-Custom expansion by a good 12-18 months. The non-consumer verticals take time to switch ship as they have to plan with non-chip infrastructure and highly complex systems in mind.

The Value Dislocation

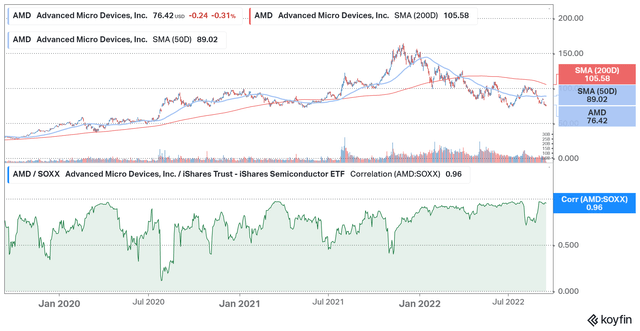

Now, my bullish theory is hard to quantify given the macro uncertainty ahead, but I do think the market has been predominantly in first-order macro thought since the start of this year. To make my point, let’s just look at price action vs correlation for SOXX (semiconductor industry ETF) and AMD.

Correlation (AMD vs SOXX) (Koyfin)

Point your eyes to the green highlighted chart at the bottom. AMD’s fundamentals have been driven by business execution and the growth of market share in the previous years. Before 2022, AMD’s 21-day correlation with the semiconductor industry (the SOXX ETF) oscillated between 0.5 and 1, averaging a 0.7 correlation.

As macro became most of the dominating story in 2022, the correlation between AMD and SOXX substantially increased, averaging in the 0.9+ range. This leads me to believe that market participants and the money that ought to move the stocks aren’t being influenced by single-stock fundamentals as much as they used to. As a result, we have a dislocation – one that presents a good opportunity for long-term investors.

US-China Tensions

The recent US sanctions against China on Artificial Intelligence chip sales from NVIDIA and AMD are likely a sizeable contributor to recent selloffs. Most AI workloads rely on parallel-processing computations, those primarily facilitated by GPUs. That said, CPUs play an important complementary role, with use-case designed architecture that syncs with GPUs in order to extract optimal AI performance.

NVIDIA logically should take harder hits on such restrictions, which they remarked as a $400m hit to annual sales, while AMD mentioned that their impact from recent restrictions would be minimal. Regardless, increasing US-China tensions amidst a difficult geopolitical climate will remain a heightened downside risk for the entire semi-industry, with AMD’s key partner TSMC in contested territory.

To make any forecasts on geopolitics or Taiwan in this regard would be unhelpful given my lack of understanding of these nuanced matters. Investors in the industry should nevertheless be highly cognizant of the geopolitics. AMD potentially losing more of its China sales is understandable, but the greater risk comes from events resulting in significant supply chain disruption that may impact Taiwan and therefore TSMC. If anything, Russia’s Ukraine invasion is widely considered a significant miscalculation on Russia’s strategic part, and this may reduce the probability of a China-Taiwan invasion in the coming years.

Palantir (PLTR) CEO Alex Karp and Stanley Druckenmiller, for instance, both agreed that the Trump presidency era despite the trade war, was likely the best US-China relations were going to be in recent times, and they expect it to deteriorate substantially from here on out. Karp offers notoriously unfiltered viewpoints and happens to be at the helm of a major military software vendor, while Druckenmiller is probably the most accomplished macro investor alive. The pessimistic conclusion they’ve come to holds some weight in my book. A geopolitical event is a risk that can’t be ignored and may seriously undermine my thesis.

Valuation

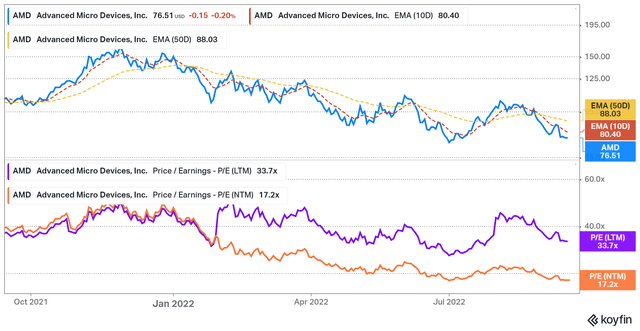

AMD looks very cheap on forward valuation metrics. Particularly, a next twelve months P/E of 17.2x and PEG of 1.08x.

I don’t think the market is just pricing in this analyst-consensus P/E but is likely pricing relatively excessive deterioration of earnings over the coming year. If the earnings simply stick with the consensus, I’d consider it a strong recipe for some 1-year alpha.

Let’s forget analysts for now, and the typical lagging indicator price targets (which are at $120+). The basis for the argument I present relies on high market share gains, in a contracting overall opportunity, with the tail risk of a geopolitical event. Importantly, those market share gains should negate macro to score 20%+ YoY in sales growth in 2023 given my thesis. I certainly don’t see it heading down to the single digits and flattening out with the business momentum AMD has recently displayed. Should this be the case, AMD ought to trade in the 25-30x NTM P/E range at least for its potential over the next 2-3 years. The macro-influenced price seems to be entirely ignoring the long-term growth and business execution against Lisa Su’s exceptional leadership. It’s still a growth stock in my books – that is not an outrageous statement with a sales trend that looks like this:

AMD Sales Growth Trend (Koyfin)

Factor out the Xilinx acquisition, and we’re still left with 45%+ YoY organic growth. One should definitely expect macro headwinds to mute this trend, but not to an extent where the company’s sales stagnate or plateau in my view. Expect consumer segment or consumer-related chip weakness. But at the end of the day, the amount of data and the need for processing power is always increasing – a recession isn’t going to reverse such a trend.

Risks

- Geopolitics: discussed above

- Macro: Data centers and data are on a secular growth trend, but a truly terribly macro may lead to a worse slowdown for AMD than anticipated.

- Competition: Intel gets its act together faster than anticipated, or offers releases that compete head-on with more pricing power to reverse AMD’s share gains faster. ARM chips leapfrog on technology, and their modern architectures enable them to take market share gains against x86.

- Merger: The Xilinx merger may lead to internal friction and influence business execution or financials inside the company. No signs of this yet, but it is a possibility.

- Systematic risks: Expect higher volatility and potential drawdowns for AMD compared with the rest of the market. This factors into all growth-oriented stocks.

Conclusion

The thesis I’ve presented right now is a contrarian one. In the face of deteriorating macro conditions, I argue that AMD’s individual characteristics and business execution are sufficient to fight industry-wide weakness to deliver strong fundamentals. This should come from market-share gains in the x86 opportunity against Intel, with a particular focus on the data center market where the company is still seriously under-represented. To add, the markets have been influenced by macro/industry views, with the price action of AMD, closely matching that of the SOXX. Fundamentals seem to be ignored, and the stock appears to be dislocated against its first-principle derived business drivers. At $76 a share and a 17.2x NTM P/E, I think AMD is excellently priced for long-term investors on risk-reward. The Abstract Portfolio is long AMD.

Be the first to comment