Massimo Giachetti/iStock Editorial via Getty Images

Theater bears have seemingly been proved right over the last few days as news that Cineworld (OTCPK:CNNWF), the London-based owner of Regal Cinemas, is considering filing a chapter 11 for Regal. Whilst it is likely not going to be the end of the company that has been a part of US moviegoing culture for 33 years, it would be a sobering mark for an industry still recovering from the pandemic. The second-largest theater chain in the United States was acquired by Cineworld in 2017 for $3.2 billion and has actually filed for bankruptcy once before in 2001. Fundamentally, Cineworld was an overleveraged and unnecessarily acquisitory firm facing a $1 billion breach of contract lawsuit payout from its abandoned acquisition of Canada’s Cineplex, overburdened with pandemic-era loans, and facing a soft third quarter film slate.

What does this mean? For AMC Entertainment (NYSE:AMC), it opens up potential acquisition opportunities of prime Regal locations that it is not in direct competition with. This would only happen if Regal’s parent drops a substantial amount of its leases during chapter 11 versus renegotiating debt covenants or even floating Regal on a US stock exchange. The future movie slate looks strong, with Avatar: The Way Of Water and Black Panther: Wakanda Forever set to release in the coming months on the back of a weaker third quarter for moviegoing.

AMC Moves To Buff Up Balance Sheet As Financials Remain Strained

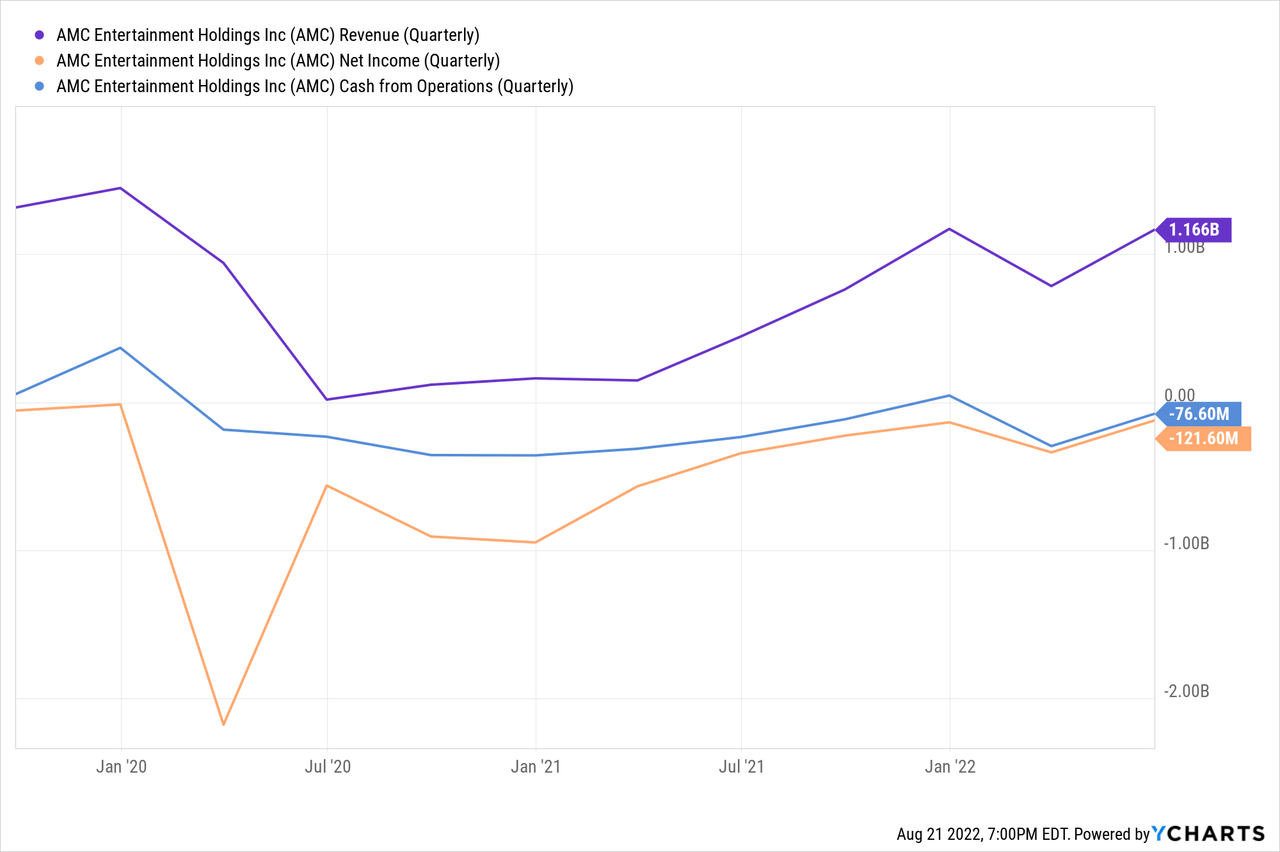

AMC recently reported earnings for its fiscal 2022 second quarter, which saw revenue come in at $1.16 billion, an increase of 162.3% from the year-ago quarter but a miss of around $20 million on consensus estimates. The company benefited from a spring and early summer movie slate that saw plenty of blockbusters like Doctor Strange in the Multiverse of Madness, Top Gun: Maverick, Minions: The Rise of Gru, and Jurassic World Dominion. This meant strong ticket and concession sales, maintaining the recovery from near zero when stay-at-home orders were in place across most of its geographical markets.

The company also realized a net loss of $121.6 million, down materially from $343.6 million in the year-ago quarter. Whilst net income continues to be negative, the recovery is clearly underway and AMC stands to possibly move into positive net income territory in the near term. However, theater bears would argue that AMC can never generate consistent profits if it failed to be profitable in one of the strongest film slates in years.

Cash from operations remained negative at $76.6 million, albeit lower than net losses but an improvement from an operational cash burn of $234 million in the year-ago quarter. This had an adverse impact on cash and equivalents, which declined to $965.2 million from $1.81 billion in the year-ago period. Long-term debt at $5.36 billion was essentially flat over the same period. This paints a vivid future where the company could essentially go the way of Cineworld, in that a high debt burden and lack of access to liquidity collapse the ability of AMC to remain a going concern. Indeed, with free cash outflow during the period at $134.8 million, the company has 7 quarters of runway left.

AMC’s management has preempted this with the issuance of a special preferred dividend to shareholders. Set to be listed under the ticker symbol APE, the preferred shares are convertible to AMC common shares at a later period. Hence, whilst the initial issuance raises no money for AMC, the company likely hopes to be able to sell shares down the line.

If You Film It, They Will Come

The collapse of Regal has energized bears, who have for a long time warned about the impending collapse of theaters. But the unique conditions around Regal’s collapse call for calm. Moviegoing is still strong, with domestic box office revenue clocking in at an estimated $3.9 billion through July 4, 2022. This is up nearly 250 percent from 2021. The upcoming movie slate will again see a huge surge in ticket sales. Nope, Jordan Peele’s latest film, opened to the biggest original debut of the pandemic era. The next few months will see several blockbusters forecasted for strong domestic and international box office receipts.

AMC’s complicated attempt at raising cash does provide a reason for pause, but is understandable when the alternative is bankruptcy. Current shareholders can either accept partial dilution or their equity going to zero. Cinemas are still resilient and will be around for a long time, but the legacy of the pandemic will require shareholders to be willing to accept some more dilution to help AMC enhance its currently precarious balance sheet.

The pandemic was a material financial shock, and it is quite clear the legacy of lockdowns will stay longer than desired by AMC, whose debt poses the same existential threat that now threatens to eliminate its peer. While I remain bullish on moviegoing, AMC is likely too risky to recommend as a buy.

Be the first to comment