Buda Mendes/Getty Images News

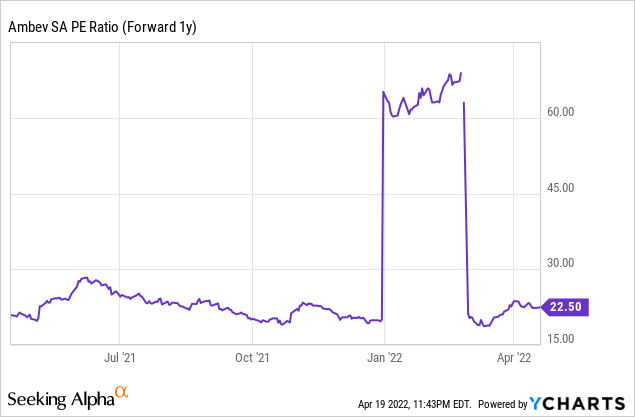

Ambev S.A. (NYSE:ABEV), the world’s largest brewer formed following InBev’s purchase of Anheuser-Busch in 2008 and subsequently SABMiller in 2016, houses brands such as Budweiser, Stella Artois, and Corona in its portfolio. After years at the top, it is encouraging to see that Ambev’s capacity to reinvent itself has not faded – as last week’s investor update showed, the company’s innovation platform continues to fire on all cylinders. While the tone of the digital narratives and the long-term growth opportunities laid out by management is compelling, it is hard to ignore the short to medium-term challenges in the core beer business. With the new value pockets Ambev is targeting still comparatively small (relative to weakness in the core beer segment), and the stock valuation at a premium ~23x P/E, I would hold off for now.

Addressing Issues In RGB/On-Trade

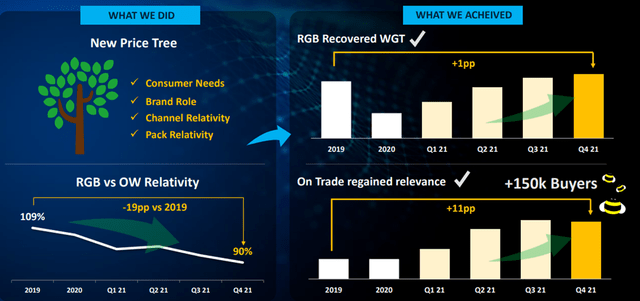

Pre-2019, Ambev had “over-earned” by taking excessive pricing on its higher-margin returnable glass bottle (RGB) packs, resulting in a ~10% premium to the lower margin one-way packs. Post-2019, however, this led to a parallel channel problem for the company, as customers opted to purchase one-way packs from on-trade channels (mainly cash & carry) at a lower price than RGB directly from Ambev. As a result, the proportion of lower margin one-way packs grew within Ambev’s mix relative to RGBs, which fell by ~14%pts – the negative mix shift has since weighed on profitability and market share.

In part, this “mea culpa” explains why pricing hasn’t improved in recent months despite the strong post-COVID market share recovery. That said, management has adjusted its pricing tree, and thus, RGB pricing has moved to ~90% of one-way presentations (down from 109% in 2019). This should drive a positive mix change going forward and, perhaps more importantly, some margin relief given that higher RGB penetration entails lower exposure to rising aluminum costs. Over the long run, however, it remains unclear if the favorable mix shift can sustain, as the emergence of cash & carry stores could lead to a structural change in one-way presentation price points. Thus, execution in the RBG/on-trade channel will be crucial if Ambev is to maintain its stronghold within this channel and continue capturing higher margins and retain customer loyalty going forward.

Ambev S.A. (Ambev Brazil Beer Investor Deck)

Beyond Beer Presents Long-Term Growth Opportunities Amid Mainstream Weakness

Crucially, Ambev has struggled with the erosion of its brand equity in the mainstream beer category over the years. Per management, the core segment share saw a steep decline to 48% of the market (from 61%) over the 2018 to 2021 period, while premium and core-plus expanded to 33% (from 15%). Thus, it makes sense to focus on elevating the portfolio through innovations and marketing initiatives to regain revenue growth and unlock pricing power.

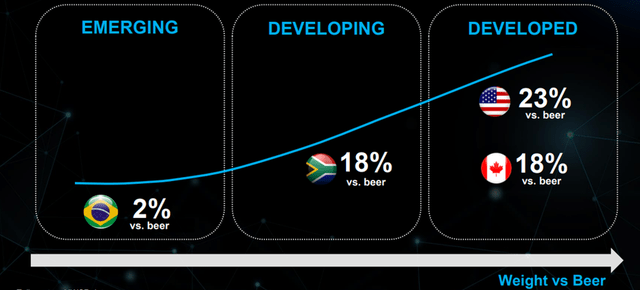

A key component of the consumer-centric and innovative mentality is Ambev’s push to lead the beyond beer category expansion in Brazil. Given the growth runway, this could prove to be a major long-term bet – the category currently represents an ~2% share of beer volumes in Brazil, well behind the levels of penetration in developing markets (e.g., South Africa at ~18%) and developed markets (e.g., the US at ~23%). Growth in beyond beer volumes should also be accretive to the overall profile – ~75% of volumes are incremental, while the category also generates a 2.5x higher gross margin relative to the core beer category. By over-indexing to younger, female consumers, Beyond Beer is guided to attract 10m new consumers, although there could be further upside if Ambev successfully leverages the full extent of its distribution reach and digital capabilities.

Ambev S.A. (Ambev Beyond Beer Investor Deck)

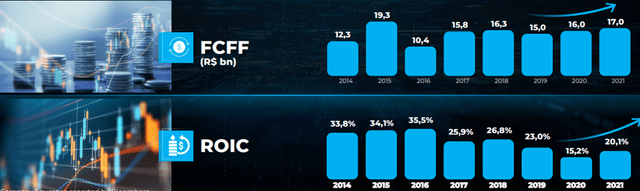

Reigniting ROIC Momentum

While the underlying NOPAT margin erosion, led by Brazil, has been a concern, Ambev’s asset turnover has moved higher, driving a higher return on invested capital (ROIC) in the last year. With Ambev now focused on building out its tech stack, this should drive structurally higher ROICs, and economic value added (EVA). Hence, Ambev’s focus on ROIC (vs. margins) as the key metric to evaluate the business going forward. The shift toward economic value makes sense, in my view – many of the new tech initiatives are significantly more capital-light and, thus, more accretive to the P&L profile than Ambev’s core operations. The BEES’ ordering platform is a prime example – not only does it require limited capital investment, but it also sustains negative working capital and adds incremental profit as the revenue base grows over time. Ambev’s ROIC remains well below the previous cycle peak of >35% in 2016, and thus, the recent recovery of 2021 ROIC to ~20% still leaves ample room for upside to shareholder value creation.

Still Richly Valued Despite Near-Term Headwinds

Management has done an excellent job drumming up positivity around the core business and the multiple growth opportunities Ambev is tapping into, including a tech-enabled platform and a promising pipeline of innovation in the premium and core-plus segments. That said, Brazil beer consumption is slowing and seeing more intense competition, while the higher commodity costs (and lower margins) could weigh on the earnings outlook. Long-term, however, it’s hard to see Ambev igniting a large enough growth momentum to move the needle relative to its >R$200bn market cap. Plus, the stock is richly valued at ~23x – a premium to its historical P/E.

Be the first to comment