SERCAN ERTÜRK/iStock via Getty Images

Investment Thesis

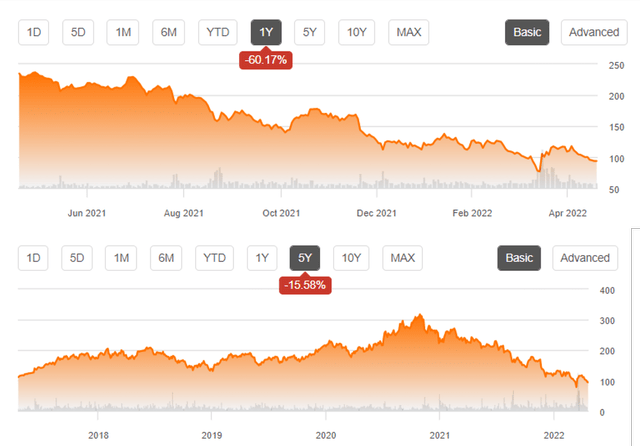

In Alibaba’s (NYSE:BABA) case (and likewise for other Chinese stocks ), the market’s negative sentiment is more pronounced than its fundamentals, given how the stock has shed much of its value in the past year. Despite the rare news of the Chinese government changing its audit rules on overseas listings on 2 April 2022, the needle has barely moved, with BABA still down -60.17% in the past year and, more dramatically, -15.58% in the past five years. Combined with the recent macroeconomics changes and geopolitical uncertainties, we will discuss if BABA can recover from the recent plunge.

BABA’s Decline In Valuation In The Past 1Y and 5Y

In the meantime, we encourage you to read our previous article on BABA, which would help you better understand its position and market opportunities in Cloud Computing.

- Alibaba: Proven Right And Wrong

- Alibaba Stock: Russian Stocks Worth Pennies – Will Chinese Stocks Suffer The Same Fate?

- Alibaba: Cloud Service Will Likely Drive Its Revenue Growth

Negative Sentiment Surrounding Chinese Government’s Policies

Negative Sentiments Surrounding BABA and The Chinese Government

It is evident that many retail investors lacked confidence in the Chinese stock market, given the multitude of negative comments in my previous BABA articles. In addition, certain institutional investors, such as Charlie Munger from Daily Journal Corp. (NASDAQ:DJCO), also cut their exposure to BABA by half in April 2022. But, that wasn’t always the case before ANT IPO’s bubble burst in 2020. At that time, the unicorn company was ‘almost’ the world’s most famous and valuable stock, with a potential market cap of over $313.37B, overtaking the valuations of many US banks, such as Goldman Sachs and Wells Fargo. BABA had also hoped to raise $34.5B through its dual listing in Hong Kong and Shanghai, making it the biggest IPO ever. Obviously, the deal had fallen through, leading BABA’s shares to nosedive by 7% from $310.84 on 2 November 2020.

The uncertainty was further fed, when the Chinese government continued to hammer on various sectors beyond the fintech industry, including the Big Tech crackdowns, to the residential property market, new gaming rules, after-school tutoring services, and cultural clampdown. Though investors were kept on their toes for a while, their confidence in the Chinese government’s actions and future plans gradually eroded, with BABA barely a shadow to its former self at $93.5 on 19 April 2022. Of course, it does not help that the Chinese government has now targeted the live streaming industry, since it only proves that the pain has yet to end.

During the ongoing Ukraine war, many Chinese companies appeared to be walking a thin line between balancing the Chinese government’s close relationship with Russia and succumbing to the global pressures (read: Western powers) to impose sanctions and/or leave behind their Russian operations. However, given the mass exodus of Western companies from Russia, many Chinese companies have indirectly and directly benefited from the gap in the Russian market, with Huawei, Oppo, and Vivo reporting a surge in phone sales by 300% in March 2022. Nonetheless, the Chinese government had also shown an interesting self-preservation stance, by pausing its investments in Russian projects, such as the oil and gas ventures under China’s state-run Sinopec Group and China’s supposed refusal to supply Russia with critical plane parts.

Given the apparent warnings for global sanctions if China were to help Russia, we doubt the former will actually risk its already lagging economic growth ravaged by the COVID-19 pandemic in 2020 and now. However, any Chinese-linked stocks would still be ‘punished’ for the uncertainty, given the “no limits” partnership between China and Russia. As a result, we do not expect the market sentiment for BABA to improve, unless China condemns Russia’s actions in Ukraine, on a day that the sun rises from the West.

China’s Zero-COVID Policy Is Hurting Businesses In General

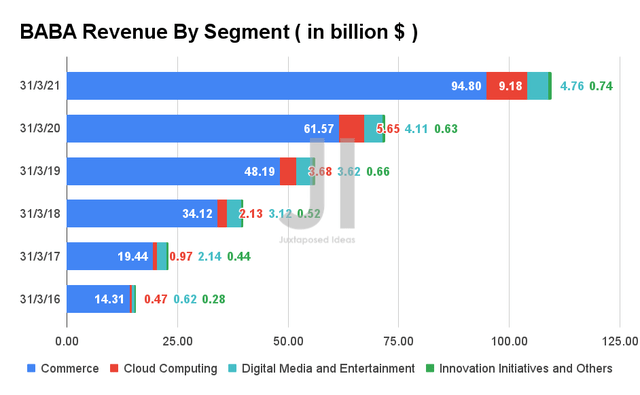

BABA Revenue By Segment

China’s totalitarian rule was also perpetuated in its zero-COVID Policy, when a single positive COVID-19 case will send whole cities into lockdowns. Many Chinese citizens have taken to social media to express their unhappiness, given the suddenness and severity of the lockdowns, often sending food prices skywards with no end in sight. For BABA, the effects may be slightly reduced, given that lockdowns have historically benefited e-commerce platforms like Alibaba’s Taobao and Tmall. The company’s commerce segment has reported massive 27.8% YoY growths in FY2020 and 53.9% in FY2021. Assuming prolonged lockdowns in China, we may see its e-commerce-related revenues continue their exponential growth in FY2022 as well.

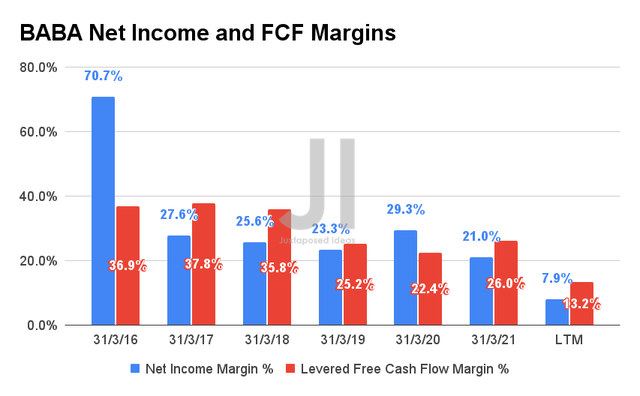

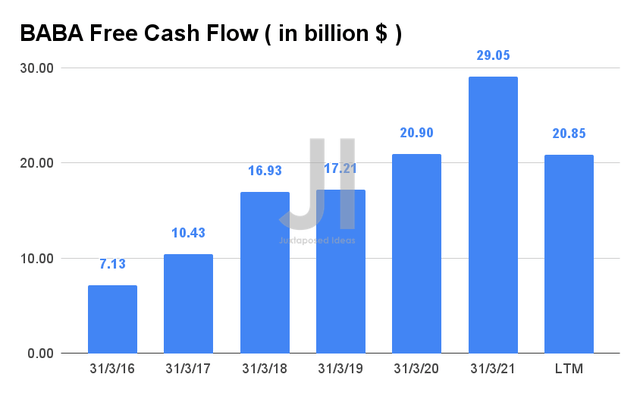

BABA Net Income and FCF Margins

However, in general, businesses within China have been massively impacted, given the zero-COVID policy in China. As a result, we expect BABA to continue the subsidies for its merchants, leading to a further decline in its margins for FY2022. The company’s net income margins have fallen from 21% in FY2021 to 7.9% in the last twelve months (LTM). In addition, BABA’s Free Cash Flow margins have also suffered from 26% in FY2021 to 13.2% in the LTM. Nonetheless, given that the company reported $20.85B worth of FCF in the LTM, investors should still be assured of its execution and business model.

BABA Free Cash Flow

Nonetheless, China’s prolonged zero-COVID Policy is putting even more pressure on the already overstretched global supply chain, further impacting multiple industries, including automotive, energy, and semiconductor. For example, Tesla (TSLA), one of the biggest EV manufacturers globally, is expected to report reduced deliveries of at least 40K vehicles in FY2022, after a three-week shutdown for its Shanghai Gigafactory.

Given that the Shanghai lockdowns are expected to extend through May, its reverberating effects would definitely be felt worldwide, given China’s central role in the global productions and logistics segments. Jon Monroe, a supply-chain expert from Jon Monroe Consulting, said that “once lockdowns end, there will be an overwhelming movement of goods that cripples supply chains. It’s probably worse than Wuhan. You’re going to have a lot of pent-up orders.”

We might just see another recession happening again, if we add the ongoing Ukraine war, inflation, rising interest rates, and slowing market growth into the equation. And when that happens, the market would turn bearish again, post-COVID19-pandemic. Consequently, we may see protracted stock market volatility, especially for stocks with much uncertainty, such as BABA. Despite its robust FCF, profitability, and excellent business execution, I suppose the market is not ready to look past BABA’s currently self-made predicament from its busted ANT IPO in 2020 and the almost draconian Chinese government regulations.

So, Is BABA Stock A Buy, Sell, Or Hold?

Though we are still optimistic about BABA with its stellar business model, retracement is almost etched in stone, with recovery written in the sand. As a result of the factors discussed above, we may see BABA trading sideways for a while longer if we are lucky. Otherwise, the stock is expected to continue its downwards slide, potentially nearing its 10Y lows in the range of $60s as of September 2015. When that happens, BABA’s valuations would have truly hit rock bottom.

Though BABA is currently trading at an EV/NTM Revenue of 1.52x, the lowest it has been in the past ten years, its valuations obviously do not matter anymore in the current macro market conditions. Nonetheless, we still encourage speculative and aggressive long-term investors to add to their portfolios as the stock continues to decline to reduce their cost averaging while waiting for the Chinese stock market to recover and stabilize in the next few years. However, risk intolerant investors should cash out and, finally, sleep better at night.

Therefore, we rate BABA stock as a Buy only for speculative long-term investors.

Be the first to comment