4kodiak/iStock Unreleased via Getty Images

It is only natural to expect things to get better when you are in pain. Amazon.com, Inc. (NASDAQ:AMZN) investors know quite a bit about pain, as the stock is nearly down 50% YTD. Just because a mega-cap is down so much doesn’t mean things will only get better. Just ask Meta Platforms (META) investors, as that stock is down 75% YTD.

As holders of both stocks, it hurts us, too. But just because we feel the pain, it doesn’t mean a cure is ready. At least not yet. We present a few reasons why the worst may not be over for Amazon investors, and a trade we are interested in as a result.

Still in Denial But Technicals Say Otherwise

Amazon investors are in the “Denial” phase of the famous market cycles graph. News items like Amazon losing trillion-dollar market cap and Apple (AAPL) being more valuable than three other mega-companies combined are gathering steam. Such headlines and the ensuing comments make you think it is almost a sacrilege this has happened to Amazon. Apple being a fundamentally stronger company has nothing to do with Amazon’s or Meta’s weakness. Not to mention, Apple was never overvalued in their territories, although one can argue Apple is fair to a bit overvalued right now due to its relative safety. We don’t believe Amazon has yet seen the panic selling. Even the post-earnings selloff faced resistance, with analysts rushing to the stock’s aid.

Granted, it is hard to time the exact bottom but Mr. Market has a very emotional, impulsive “love-hate” relationship with darling stocks. That means, there will be clearer clues about a top or a bottom for these stocks than the average stock in the index. For us, a panic selloff in Amazon will be a random 5% down day on no stock-specific news. But that is not all there is. Beyond panic, there needs to be a consolidation phase where investors are plain angry and depressed, but not much action takes place on either the buy or sell side.

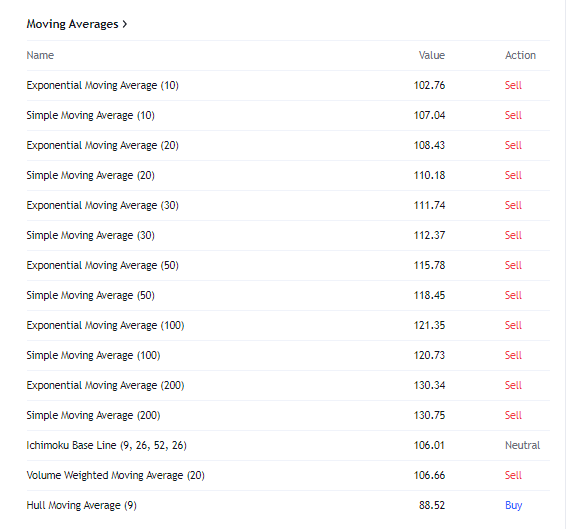

Right now, Amazon’s stock has no life from a technical perspective, as shown below. The stock is a sell by almost every single moving average method, which means it keeps making lower lows with no end in sight yet. Please note, we are not recommending you sell here, though.

AMZN Moving Averages (tradingview.com)

Expectations are Still High

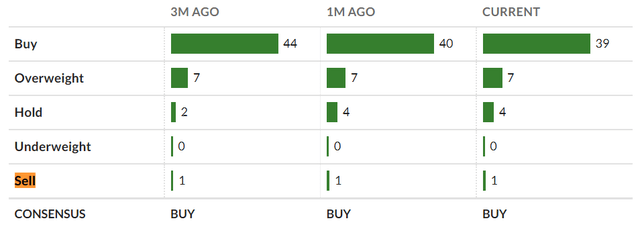

This goes in parallel with the section above. Investors are in denial still because expectations of a turnaround are still too high. Earnings estimates are still holding up fairly well compared to those of other beaten-down names like Meta, especially in the wake of recent earnings and the guidance that we cover below. Out of the 51 analysts covering the stock, only one has a sell rating. Even Apple has more sell ratings than that.

AMZN Ratings (marketwatch.com)

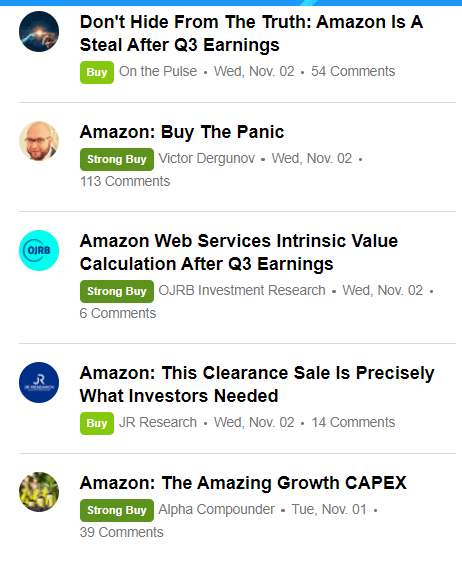

As another example, the last 11 Amazon articles on Seeking Alpha have either a “Buy” or “Strong Buy” tag. As much as it hurts to be an Amazon long at this point, these constant buy and strong buy ratings may be a case of “misery loves company” more than “great minds think alike.” Things don’t generally turn around when the mass expects them to.

SA AMZN Articles (seekingalpha.com)

Fundamental Weakness

Beyond technicals and the current trend, Amazon has finally acknowledged that things are slowing down by pausing corporate hires. The pause was in effect for the slowing retail business, but is now largely in effect, with few exceptions in targeted places. While Amazon Web Services (“AWS”) is still showing strength, it is natural for things to at least grow at a lesser pace there when the rest of the world that sends in the money to AWS is slowing down too. One clear difference in the last two years for AWS is that the pandemic played a major role in many businesses starting up and/or going online. With the economic downturn, such starts ups and small businesses are almost guaranteed to not show up in masses, with most existing ones fighting to survive.

Competitors like Walmart (WMT) are sensing that the time may be right to challenge the king while he is at his weakest shape in years. As Amazon Prime users, we’ve so far been quite happy with our access to Prime Video, Music, and the shipping benefits. But since 2014, the cost has gone up from $79 to $139. This may seem justifiable with added benefits over the years and the recent general inflation, but at some point, customers are going to feel the pinch, especially if Walmart and the likes are showering with better deals.

Speaking of fundamentals, the stock is still overvalued after a 50% fall. Even if the company meets the current lofty EPS expectations of $1.67 in 2023, the stock has a forward multiple of almost 54, which is excessively overvalued from any fundamental standpoint. Even accounting for the projected five-year growth rate of 26%. Free cash flow was a disaster in the most recent quarter. Things were so bad for the overall company that it erased AWS’s net income of $5.4 billion.

A Trade-off Trade

Honestly, it is too tempting to let go off a 50% selloff in a name like Amazon. At the same time, the worst is likely not over as described above. Hence, we are considering selling cash-secured puts that will allow us to buy Amazon lower should it reach our strike price. In return for this “risk,” we get a premium for parking our money aside.

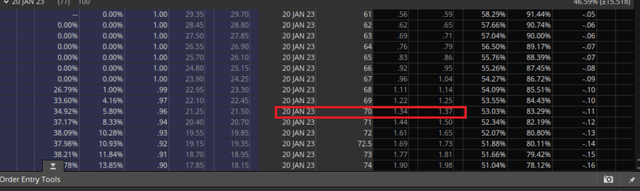

- The chain in contention is the January 20th, 2023 chain at a strike price of $70. The option seller would need to set aside $7,000 to be able to buy 100 shares of Amazon at $70 should the stock go below $70 by the date in question. For this risk, the market immediately pays a premium of $1.37 per share for a total of $137 for each $7,000 you are willing to park. The 2% return for 2 months or so may not sound too appealing for some, but it is a better bargain than seeing your share price go from $90 to $70 should you buy here outright. At the same time, this gives you some skin in the game where you don’t wait for the bottom but never get one on time.

- This chain will expire a week before Amazon’s next earnings date, so that gives you the chance to exit the option chain if needed.

- Assuming the forward EPS estimates holds, $70 would represent a multiple of about 40. This is still a bit high for our liking but at twice the current S&P multiple, it is a reasonable buy given Amazon’s higher (inevitable, although delayed) growth rate from here.

Conclusion

While an AWS spin-off remains an enticing possibility, Amazon’s brand, distribution, and overall synergy help AWS offset other typical expenses a standalone company may have. We don’t see the AWS spinoff happening quite yet. Till that time, Amazon, the conglomerate, has a major task on hand. It is astounding to think that despite operating for 25 years as a public company, Amazon is still getting the benefit of the doubt when it comes to the fine balance between valuation, showing profits, and investing in the future.

We remain long here but aren’t expecting things to turn around too quickly. What do you think about Amazon here? Is a 50% haircut too much, or do you believe more pain is in store?

Be the first to comment