Sundry Photography

Palantir (NYSE:PLTR) is scheduled to report its Q3 results before markets open on Monday. With inflation running hot and the Fed rapidly increasing interest rates, investors will be closely watching how Palantir’s revenue is affected during the quarter. But in addition to just tracking its headline financial figures, investors may also want to monitor its customer count, remaining deal value, segment financials and its management’s revenue outlook for Q4. These items will, to a great extent, highlight exactly how the company has been affected by the challenging macroeconomic environment and are likely to influence where its shares may head next. Let’s take a closer look at it all.

Key Operating Metrics

Let me start by saying that Palantir’s management have grown their business at an exceptional pace over the recent years. Its Q2 FY22 revenue, for instance, is up 85% compared to the comparable quarter from 2020 which is a commendable feat and an enviable position to be in. However, now that we’re in a recessionary environment, we need to pay particularly close attention to how the business is being affected operationally and financially.

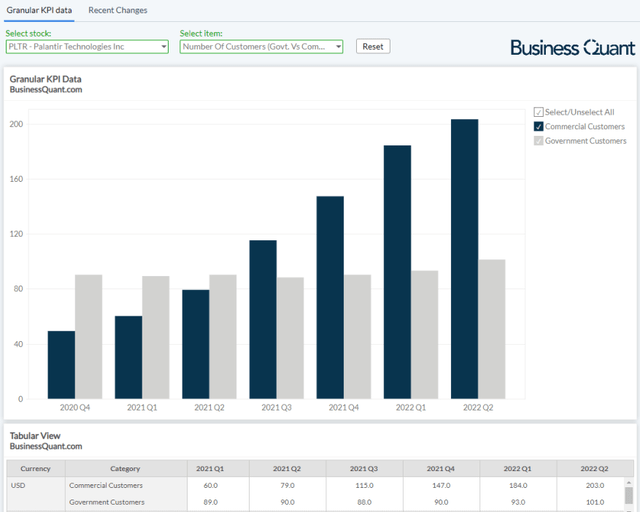

We can start by monitoring Palantir’s customer count. Although the software company has onboarded customers at a rapid rate in the past year, courtesy its ramped-up sales function, the company may experience a slowdown on this front during Q3. I say this because enterprises across the globe are cutting down their discretionary spending to better prepare themselves for a prolonged recession, and Palantir may bear the brunt of it.

I personally estimate that Palantir’s sequential customer growth will slow down from 10% to around 7% during Q3, which means its customer count will amount to somewhere around 325. I think it’s needless to say but a higher reported customer figure will signal that the business is stronger than expected and its platforms are essential for its clients even during tough macroeconomic conditions, which, altogether, are likely to drive Palantir’s shares higher. On the other hand, a dismal customer count figure will suggest that the company is finding it difficult to onboard new customers now.

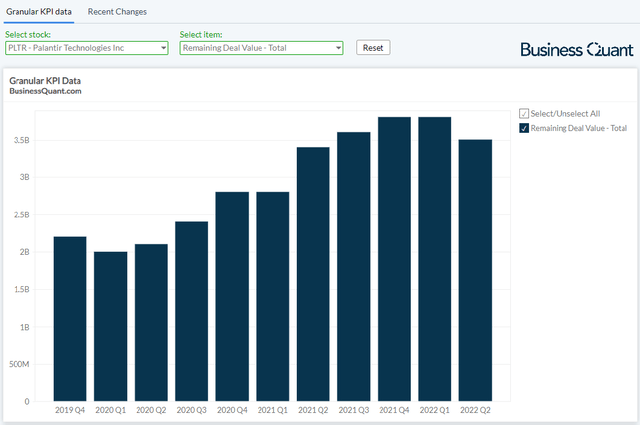

It’s important to note that the customer count figure alone won’t reveal the entire picture. The company may add a large number of customers, but if they have small order values, then these customers are not going to be financially as accretive. So, we must pay close attention to Palantir’s remaining deal value as well. This metric is basically the dollar-value of all the contracts that have been awarded by the company’s government and commercial clients.

Palantir registered a sequential drop in its remaining deal value last quarter as enterprises across the globe cut their discretionary spending. My guesstimate is that Palantir will post another such drop in Q3, with its remaining deal value coming in around $3.3 billion, but only time will tell what the actual figure turns out to be. Having said that, let’s now shift our attention to financial expectations from Palantir’s Q3.

Bifurcated Financials

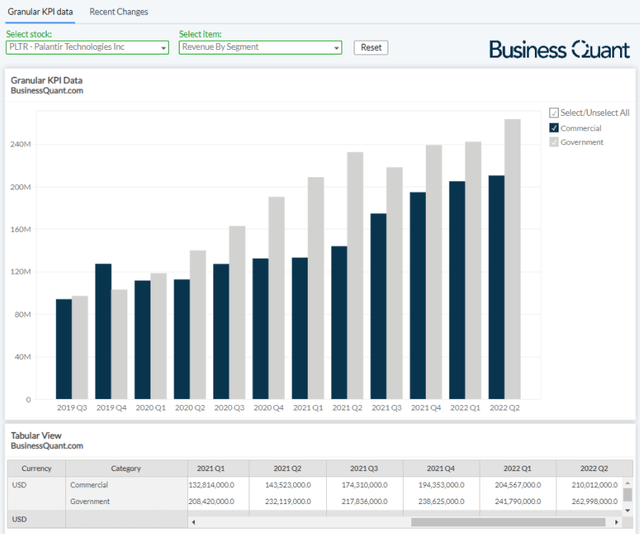

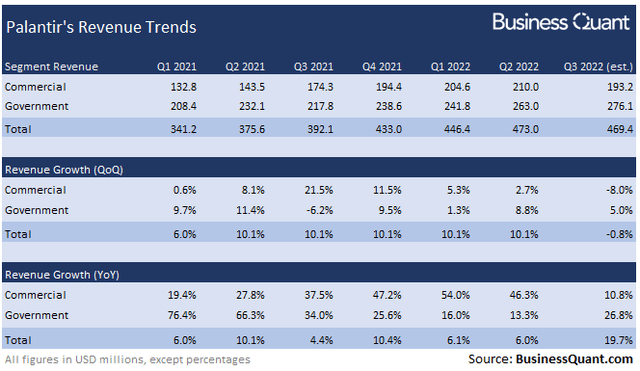

Palantir classifies its revenue in two reporting segments, namely government and commercial. Its commercial segment has generally been growing at a relatively faster pace and it accounted for over 44% of the company’s total revenue last quarter. This segment caters to commercial enterprises across the globe and it has particularly benefited from Palantir’s switch to a recurring payment model and its revamped sales effort.

However, given that enterprises across the globe are currently in cost-cutting mode to better equip themselves for a prolonged recession, Palantir’s commercial segment may report dismal results. I’m estimating that the segment’s revenue will decline sequentially by high single digits (~8%) and amount to roughly $193 million.

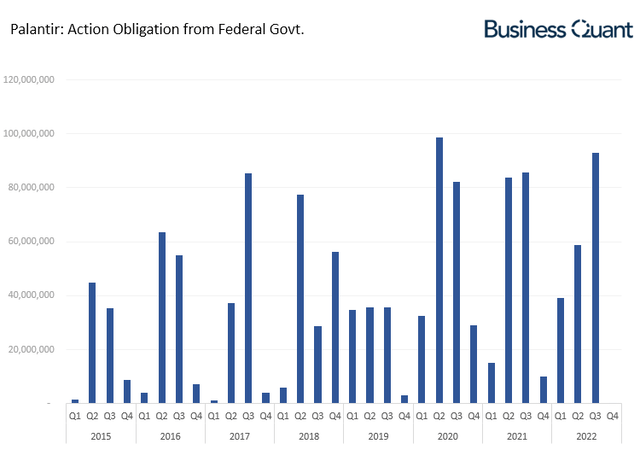

On the other hand, I believe Palantir’s government segment will surprise investors. It’s evident from the chart above that the company’s growth on the government side has slowed down in recent quarters and consequently, the company’s shares have tanked to price-in this slowdown. But things won’t necessarily stay the same during its Q3 earnings report.

Latest data reveals that Palantir has secured $92 million worth of orders from US government agencies alone. This is the second highest figure in the company’s last 30 quarters which marks a substantial sales acceleration in what’s considered a slowing down segment. More important, this sales acceleration quashes bearish narratives that Palantir is losing out to competitors when it comes to securing government orders.

Since the terms of these orders are rarely made public, we cannot reliably predict the dollar-impact on Palantir’s financials for the ongoing quarter. However, as far as guesstimates go, I believe Palantir’s government revenue will grow 5% sequentially and the dollar-figure will come in approximately $276 million for Q3.

This brings us to a company-wide revenue estimate of $469.4 million for the said quarter. This figure is coincidentally within the Street’s estimates that are spanning from $437.8 million to $475.15 million at the time of this writing. But having said that, we must also listen on Palantir management’s revenue outlook for Q4. Specifically speaking, are they seeing commercial clients canceling or deferring their orders due to challenging macroeconomic conditions or is it business as usual for them?

Final Thoughts

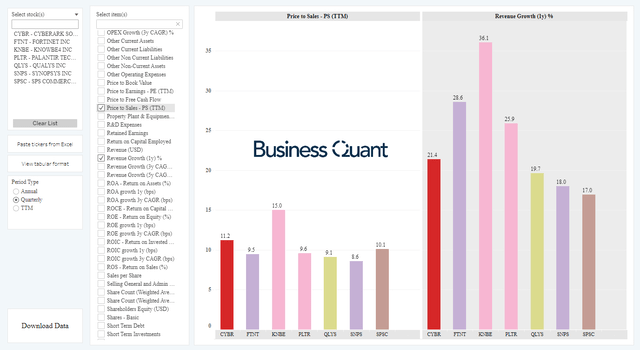

Palantir’s shares are trading at 9-times their trailing twelve-month sales. This may seem like a lot in isolation but it’s actually at par with many of the other rapidly growing software stocks. So, in essence, Palantir’s shares are fairly valued at current levels and any correction from here onwards can be construed as a buying opportunity.

But as far as its Q3 is concerned, there’s a bit of ambiguity about the extent of its slowdown. So, investors may want to keep a close eye on its customer count, remaining deal value, bifurcated financials and its management’s outlook for Q4. These items will reveal how adversely the company is affected by the ongoing recession, and will likely impact where its shares head next. I remain bullish on the stock as detailed here, here and here. Good Luck!

Be the first to comment