georgeclerk/iStock Unreleased via Getty Images

Investment Thesis

Amazon (NASDAQ:AMZN) stock has languished for almost two years since it had a spectacular rally from the COVID-19 bottom. However, the stock has failed to break its critical resistance level of $3,500. Momentum buyers have tried several times over the last two years to break that crucial level but to no avail. There were just too many headwinds impacting e-commerce stocks over the past year.

Even though Amazon has a well-diversified business model, its FQ4 earnings card demonstrated it was not immune to these headwinds. The culmination of surging costs, and higher inflation, has also exacerbated its labor shortages. Coupled with moderation in online spending as the world emerges from the pandemic, e-commerce players have had their work cut out.

Furthermore, the Russia-Ukraine conflict is expected to have worsened the near-term profitability outlook for Amazon since its FQ4 card. As a result, we believe Amazon long-term holders need to brace themselves for what could be a highly challenging FQ1 report, to be announced on April 28.

However, if the company could issue better than expected guidance over what seems like pretty gloomy consensus estimates, AMZN stock could outperform in H2’22.

Amazon CEO Andy Jassy also shared meaningful insights in his first Annual Letter as its #1 executive. We remain confident of Jassy & Team’s long-term execution. As such, we reiterate our Buy rating on AMZN stock heading into its pivotal FQ1 card.

Can Amazon’s Q1 Earnings Be The Inflection Point?

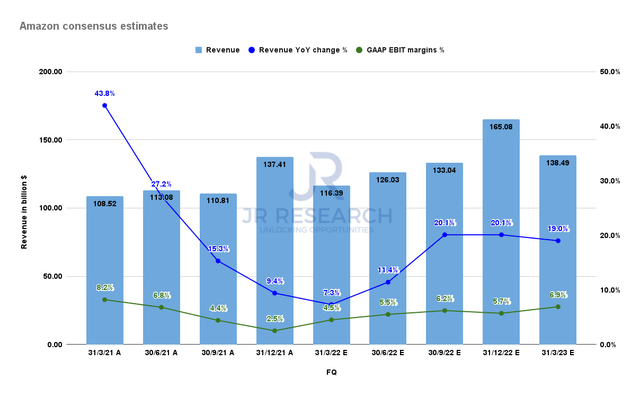

Amazon consensus estimates (S&P Capital IQ)

It’s clear that the market has been digesting Amazon’s massive growth acceleration from the pandemic. But, investors should not consider it a “slow down” but rather a healthy normalization. Jassy was also upfront in his letter, as he accentuated the company grew its revenue at a 2-year CAGR of 29%. He undoubtedly wanted to put things in the proper perspective for long-term shareholders to deliberate.

Notably, Jassy also emphasized the substantial supply chain and logistical challenges Amazon has faced over the past two years. He enunciated that the “supply chains were disrupted in ways none of us had seen previously.” Therefore, we believe management is keenly aware of the struggles that Amazon’s long-term holders have been going through over the past year. Despite that, it’s hard to ignore the near-term challenges that impacted Amazon’s ability to execute. Jassy emphasized (edited):

This growth also created short-term logistics and cost challenges. Supply chains were disrupted in ways none of us had seen previously. As we were bringing this new capacity online, the labor market tightened considerably.

Combined with ocean, air, and trucking capacity becoming scarcer and more expensive, this created extra transportation and productivity costs. We hoped that the major impact from COVID-19 would recede as 2021 drew to a close, but then Omicron reared its head in December, which had worldwide ramifications, including impacting people’s ability to work.

And then in late February, with Russia’s invasion of Ukraine, fuel costs and inflation became bigger issues with which to contend. (Amazon’s 2021 Letter to Shareholders)

Nevertheless, the updated consensus estimates suggest that Amazon’s revenue and profitability normalization could reach an inflection point in FQ1. Therefore, the Street remains optimistic about Amazon’s ability to navigate these challenges. Moreover, we think it’s credible that the Street has already priced in the expected weakness in Amazon’s P&L for Q1.

For instance, despite the recent headwinds, Morgan Stanley (MS) remains confident of the company’s outperformance through FY23. It added (edited): “We are lowering FY22/23 EBIT by ~$5.6bn/$1.1bn (15%/2%). We still expect revenue acceleration and margin expansion (even through higher fuel costs) to drive outperformance.”

However, BNP Paribas (OTCQX:BNPQF) earned the ire of bullish Amazon holders as it issued Amazon stock’s “first sell rating since 2020.” It highlighted (edited): “Amazon’s capital spending is going to be much higher than the market expects, while profit margins will be hurt by inflation shocks. The stock has been underperforming big tech peers and we expect that to continue.”

Therefore, we believe investors will keenly watch Amazon’s Q1 card for its ability to manage through these headwinds. However, we are cautiously optimistic as we think the consensus estimates seem to have reflected the recent pessimism. Also, we believe that Amazon’s quarterly performance will be a barometer for the rest of its e-commerce and retail peers.

AMZN Stock Valuation Seems Well-Balanced

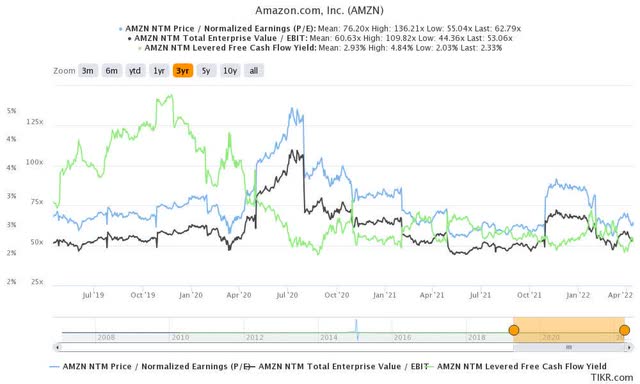

AMZN stock valuation metrics (TIKR)

AMZN stock trades at a premium against the market and its peers. There’s no doubt about that. For instance, AMZN stock’s NTM normalized P/E of 62.8x is way ahead of the market’s median P/E of 16.9x. Moreover, it’s also ahead of the online retail median P/E of 16.4x.

However, Trefis SOTP estimates suggest a significant portion of AMZN stock valuation is attributed to AWS (44%). Given AWS’ hyperscaler leadership, the market has been willing to accord the premium to AMZN stock over time. Furthermore, AMZN stock has also normalized (53.1x) below its NTM EBIT multiples 3Y mean (60.6x).

Therefore, we think AMZN stock valuation seems quite well balanced heading into Q1 earnings on April 28. Therefore, if management could guide more favorably through FY22, the stock could be due for a re-rating.

As such, we reiterate our Buy rating on AMZN stock.

Be the first to comment